Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their families. However, there may be times when policyholders consider changing their life insurance plans. This could be due to various reasons, such as a significant life event like marriage, the birth of a child, or a career change, which may require adjusting coverage levels or types. Additionally, individuals might seek to optimize their insurance policies to align with their evolving financial goals, risk tolerance, or personal circumstances. Understanding the motivations behind these changes is essential to ensure that life insurance remains a valuable asset that adapts to the policyholder's needs over time.

What You'll Learn

- Financial Security: Ensure your family's financial stability in the event of your passing

- Coverage Gaps: Address gaps in existing policies to better protect your loved ones

- Cost-Effectiveness: Explore more affordable options without compromising on coverage

- Policy Flexibility: Adapt your insurance to changing life circumstances and needs

- Peace of Mind: Obtain reassurance that your family is protected, reducing stress and anxiety

Financial Security: Ensure your family's financial stability in the event of your passing

Life insurance is a critical tool for providing financial security and peace of mind for your loved ones. It ensures that your family is protected financially in the event of your untimely passing, offering a safety net to cover various expenses and maintain their standard of living. When considering a change in your life insurance policy, it's essential to focus on the long-term benefits it can provide to your family's financial stability.

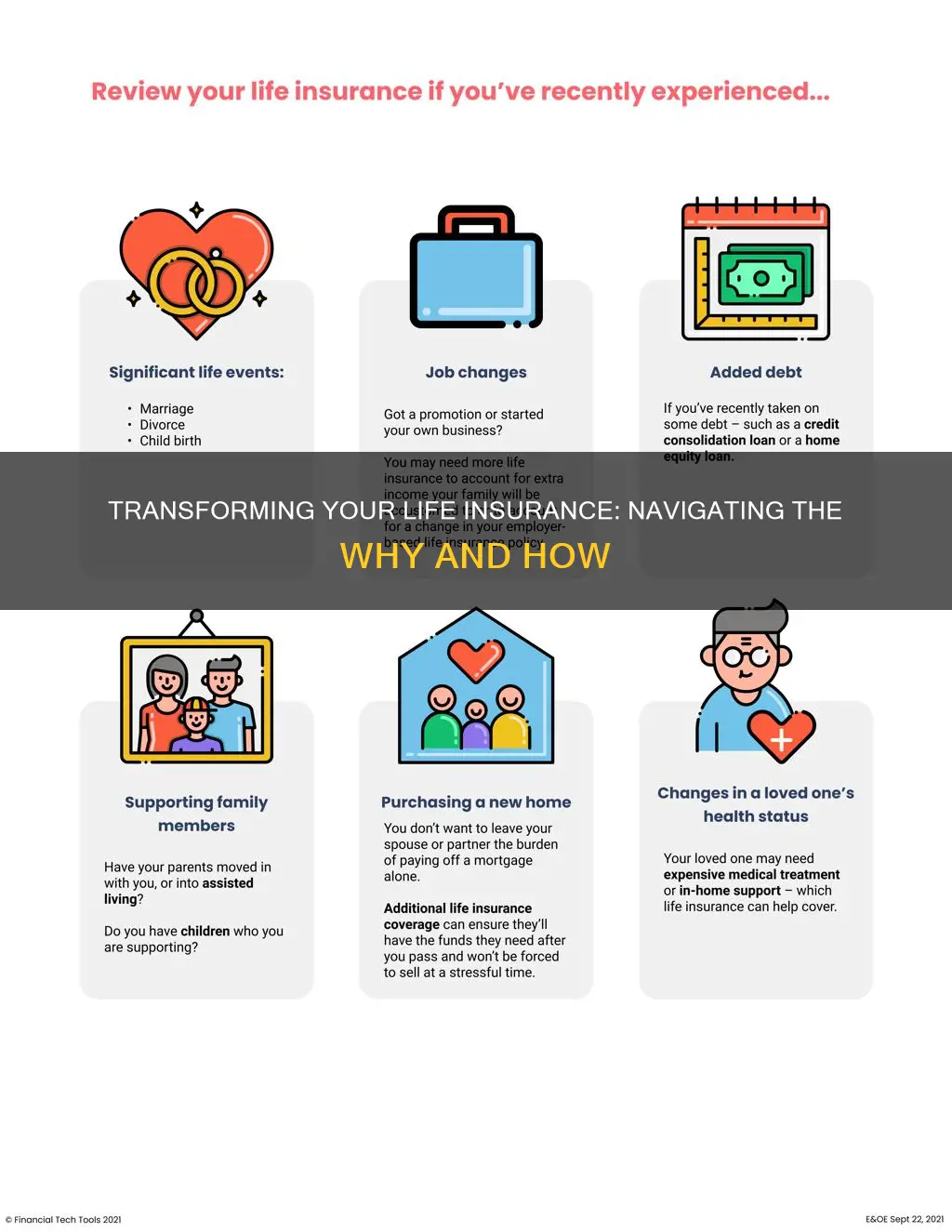

One of the primary reasons to review and potentially change your life insurance is to ensure that the coverage adequately addresses your family's current and future financial needs. As your family's circumstances evolve, so should your insurance policy. For instance, if you have recently started a new job with a higher income, you might want to increase your insurance coverage to match this new financial reality. Similarly, if you have taken on additional responsibilities, such as a mortgage or a growing family, your insurance should reflect the increased potential financial burden.

The primary purpose of life insurance is to provide financial support to your dependents in the event of your death. This support can cover various expenses, including mortgage payments, school fees, daily living costs, and even the cost of funeral arrangements. By regularly reviewing and adjusting your policy, you can ensure that the coverage amount is sufficient to cover these essential expenses, providing your family with the financial security they need during a challenging time.

Moreover, life insurance can also be a valuable tool for long-term financial planning. It can help build a substantial cash value over time, which can be borrowed against or withdrawn to fund significant life events, such as your child's education or a business venture. By changing your policy to include a higher cash value component, you can maximize the potential benefits of your insurance, ensuring that your family has access to funds when needed.

In summary, changing your life insurance policy to focus on financial security is a proactive approach to protecting your loved ones. It ensures that your family is prepared for any financial challenges that may arise due to your passing. By regularly reviewing and adjusting your policy, you can provide the necessary financial support and peace of mind, knowing that your family's well-being is secure.

How to Add Decreasing Life Insurance to Your Mortgage

You may want to see also

Coverage Gaps: Address gaps in existing policies to better protect your loved ones

When reviewing your life insurance policy, it's crucial to identify and address any coverage gaps that may exist. These gaps can leave your loved ones vulnerable and financially exposed in the event of your passing. Here's a detailed guide on how to tackle this important aspect of life insurance planning:

Assess Current Coverage: Begin by carefully examining your existing life insurance policy. Understand the coverage amount, the type of policy (term or permanent), and the duration of the policy. Identify the beneficiaries and ensure they are up-to-date with your wishes. This initial assessment will provide a baseline for understanding your current protection and any potential shortcomings.

Identify Gaps: Coverage gaps can arise due to various factors. Common reasons include an increase in family size, changes in financial obligations, or the accumulation of new assets. For instance, if you've recently started a family or taken on additional mortgage payments, your existing policy may not adequately cover these new responsibilities. Similarly, the value of your assets, such as a growing business or valuable possessions, might not be fully protected. Identify these gaps by comparing your current coverage to your family's current and future needs.

Analyze Needs: To address coverage gaps, you must first understand your family's unique needs. Consider the financial impact of your death on your loved ones. This includes daily living expenses, mortgage or rent payments, education costs for children, and any other long-term financial commitments. Additionally, think about the emotional and practical support your family might require during this difficult time. By quantifying these needs, you can determine the additional coverage required to ensure your family's financial security.

Adjust Policy Limits: Once you've identified the gaps and assessed your family's needs, it's time to adjust your policy limits. You may need to increase the death benefit to cover the identified financial obligations and support your loved ones. Work closely with your insurance advisor to explore options such as increasing the policy amount, converting a term policy to a permanent one, or adding riders to enhance coverage. Remember, the goal is to ensure that your family has the necessary financial resources to maintain their standard of living and cover any unexpected expenses.

Regular Review: Life insurance needs are not static; they evolve over time. It's essential to schedule regular reviews of your policy, especially when significant life events occur, such as marriages, births, or substantial financial changes. By periodically assessing your coverage, you can proactively address any new gaps that may arise, ensuring that your loved ones remain protected.

Canceling Life Insurance: Understanding Termination and Its Implications

You may want to see also

Cost-Effectiveness: Explore more affordable options without compromising on coverage

When considering a change in life insurance, one of the primary motivations is often the desire to find more cost-effective solutions without sacrificing the essential coverage you need. Life insurance is a crucial financial tool, providing financial security for your loved ones in the event of your passing. However, the cost of this coverage can vary significantly, and many individuals seek alternatives that offer better value for their money.

The insurance market offers a wide range of options, and exploring these alternatives can lead to substantial savings. One approach is to review your current policy and assess if there are any adjustments or add-ons that can enhance coverage while reducing expenses. For instance, you might consider increasing the term length, which often results in lower premiums per year, or adding riders to your policy to customize the coverage to your specific needs. These adjustments can provide a more tailored and cost-efficient solution.

Another strategy is to shop around and compare different insurance providers. Insurance companies often have varying pricing structures, and some may offer more competitive rates without compromising on the quality of coverage. Obtaining quotes from multiple insurers allows you to make an informed decision and choose a policy that aligns with your budget and requirements. Additionally, consider the policy's features, such as the flexibility to adjust coverage over time or the option to convert term life insurance to a permanent policy, which can offer long-term savings.

Furthermore, term life insurance is generally more affordable than permanent life insurance, especially for younger individuals. Term policies provide coverage for a specified period, such as 10, 20, or 30 years, and they can be an excellent short-term solution while keeping costs low. As you age, you may then consider converting to a permanent policy, which offers lifelong coverage and potential cash value accumulation. This approach ensures that you have comprehensive protection without the long-term financial burden.

In summary, exploring cost-effective options in life insurance is about finding the right balance between coverage and affordability. By reviewing your current policy, comparing providers, and understanding the different types of insurance available, you can make a well-informed decision. This process empowers you to secure the necessary financial protection for your loved ones while managing your insurance expenses effectively.

Understanding Life Insurance: Exploring the Major Classes

You may want to see also

Policy Flexibility: Adapt your insurance to changing life circumstances and needs

Life insurance is a crucial financial tool that provides security and peace of mind, but it's not a one-size-fits-all solution. As your life circumstances and needs evolve, so should your insurance policies. Policy flexibility is a key aspect of adapting your life insurance to ensure it remains relevant and beneficial throughout your journey. Here's how you can leverage this flexibility:

Review and Adjust Regularly: Life insurance policies often offer the option to review and adjust coverage periodically. This is a strategic move to ensure your policy aligns with your current situation. For instance, if you've recently started a new job with an excellent benefits package, you might consider reducing the amount of life insurance you need. Conversely, if you've started a family or purchased a home, increasing your coverage to protect your loved ones and assets becomes more critical. Regular reviews allow you to make informed decisions and ensure your policy is not over or under-insured.

Convert Term to Permanent: Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. If you've outlived the term and still need coverage, converting it to a permanent policy is a smart move. Permanent life insurance, such as whole life or universal life, offers lifelong coverage and additional benefits like cash value accumulation. This conversion ensures that your insurance remains a long-term solution, providing financial security for your entire life, not just a specific period.

Increase or Decrease Coverage: Life events often prompt a re-evaluation of coverage needs. For example, getting married or starting a business might require increasing your life insurance to protect your spouse and business partners. Similarly, if you've paid off your mortgage or downsized your lifestyle, you may consider reducing the coverage amount. Policy flexibility allows you to make these adjustments without starting the entire process from scratch, ensuring your insurance remains tailored to your evolving circumstances.

Add or Remove Riders: Life insurance policies often come with optional riders that provide additional benefits. For instance, a waiver of premium rider can suspend premium payments if you become disabled, ensuring your policy remains in force. You can also add riders to enhance coverage, such as a critical illness rider, which provides a lump sum payment if you're diagnosed with a critical illness. The ability to add or remove riders allows you to customize your policy to address specific concerns or changing priorities.

In summary, policy flexibility is a powerful tool that enables you to adapt your life insurance to your life's changing circumstances. By regularly reviewing and adjusting your policies, you can ensure that your insurance remains a reliable source of financial protection and peace of mind. It empowers you to make informed decisions, protect your loved ones, and secure your future with confidence.

Uncovering Your Mom's Legacy: Life Insurance Discovery

You may want to see also

Peace of Mind: Obtain reassurance that your family is protected, reducing stress and anxiety

Changing your life insurance policy can provide a sense of peace of mind and security for your loved ones, which is an invaluable benefit. Here's how it can help:

Financial Security for Your Family: Life insurance is a crucial tool to ensure your family's financial well-being in the event of your passing. By reviewing and potentially updating your policy, you can confirm that your beneficiaries are adequately protected. This process involves assessing your current coverage, income, and expenses to determine the appropriate death benefit. Adequate coverage will provide a financial safety net, allowing your family to maintain their standard of living, cover essential expenses, and achieve their long-term financial goals without the added stress of uncertainty.

Reduced Financial Burden: Life insurance can also help alleviate the financial burden on your loved ones by covering various expenses that may arise after your passing. These expenses could include funeral costs, outstanding debts, mortgage payments, or even the daily living expenses of your dependents. By having a comprehensive policy, you can ensure that your family is not left with overwhelming financial obligations, providing them with the freedom to grieve and move forward without the added pressure of financial strain.

Long-Term Peace of Mind: Regularly reviewing and updating your life insurance policy offers long-term peace of mind. As your life circumstances change, so should your insurance coverage. This could include significant life events such as marriage, the birth of a child, purchasing a home, or starting a business. By staying proactive and adapting your policy, you can ensure that your family's protection remains relevant and sufficient throughout your life's journey. This ongoing review process allows you to make informed decisions and provides reassurance that your family's security is always a priority.

Customized Protection: Life insurance policies offer various coverage options and riders, allowing you to tailor the protection to your specific needs. You can choose the term length, death benefit amount, and additional benefits like critical illness or accidental death coverage. By customizing your policy, you can address any gaps in coverage and ensure that your family receives the financial support they deserve. This level of personalization provides a sense of control and reassurance, knowing that your policy is designed with your family's best interests in mind.

In summary, changing your life insurance policy is a proactive step towards securing your family's future. It provides financial protection, reduces stress, and offers peace of mind, knowing that your loved ones are taken care of. By staying informed and making necessary adjustments, you can ensure that your life insurance policy remains a reliable safety net, allowing your family to focus on what matters most during challenging times.

Term Life Insurance: Living Benefits and Their Impact

You may want to see also

Frequently asked questions

There are several reasons why someone might consider changing their life insurance policy. Firstly, life circumstances can change significantly over time, and your current policy might no longer align with your current needs. For example, if you've recently started a new job with better benefits, you may no longer require the same level of coverage. Additionally, life events like marriage, the birth of a child, or purchasing a home can influence your insurance requirements. It's essential to regularly review and adjust your policy to ensure it provides adequate protection for your loved ones.

It is generally recommended to review your life insurance policy at least once a year or whenever there are significant life changes. Annual reviews allow you to assess your current coverage and make necessary adjustments. Major life events like getting married, having a child, buying a house, or experiencing a career change are crucial moments to re-evaluate your insurance needs. Regular reviews ensure that your policy remains relevant and effective in providing financial security for your family.

Increasing your life insurance coverage can offer several advantages. Firstly, it provides enhanced financial protection for your loved ones in the event of your passing. Higher coverage amounts can ensure that your family has sufficient funds to cover essential expenses, such as mortgage payments, education costs, or daily living expenses. Moreover, increased coverage can provide peace of mind, knowing that your family is well-protected. It also allows you to plan for long-term financial goals and ensures that your beneficiaries receive a substantial payout to support their future needs.