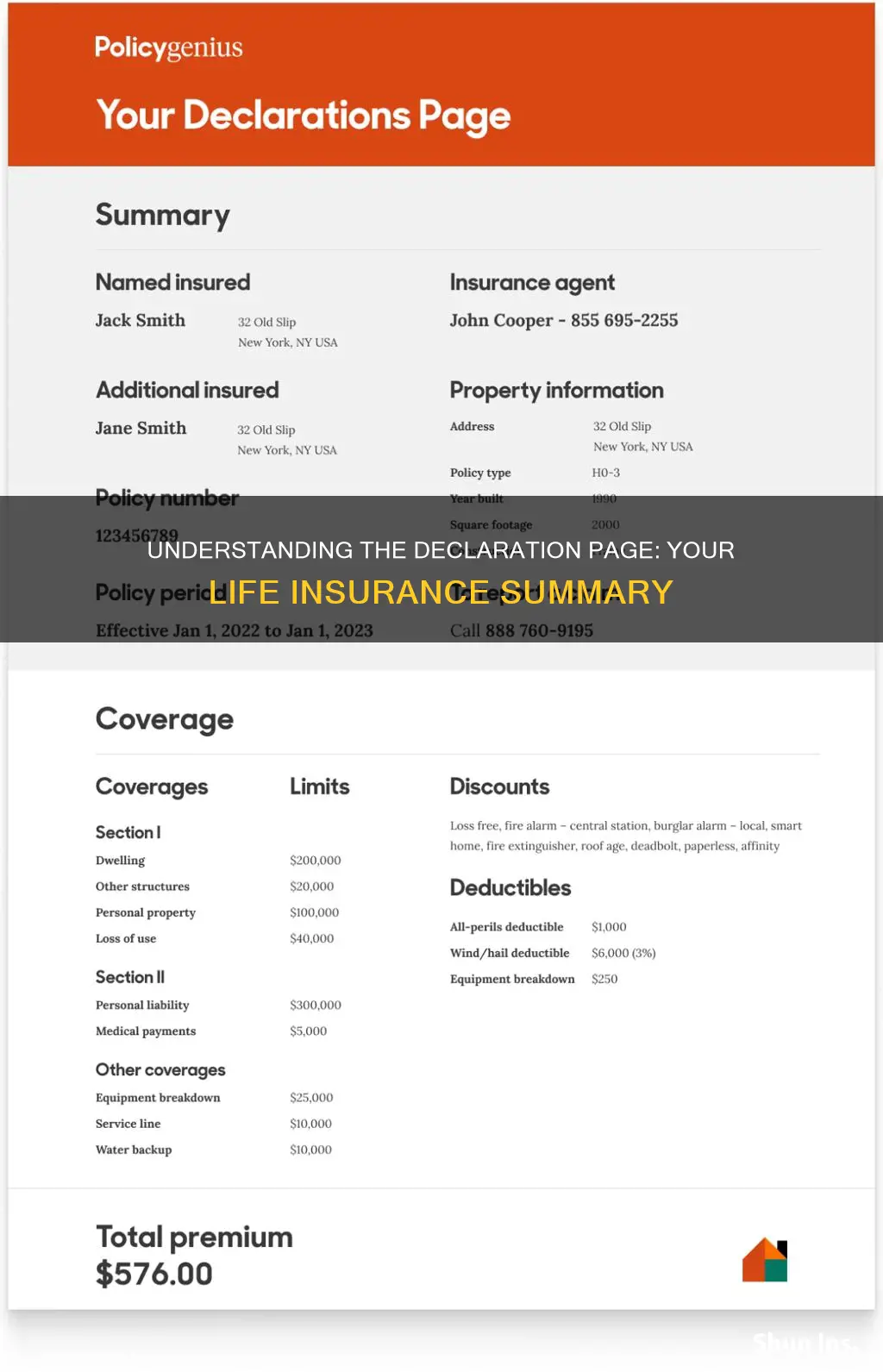

The declaration page of life insurance is a crucial document that provides an overview of the insurance policyholder's coverage. It serves as a summary of the key details, including the policy number, the insured's personal information, the insurance company's contact information, and a breakdown of the coverage amounts for death benefits, accidental death benefits, and any additional riders or endorsements. This page is essential for the policyholder to understand the specifics of their insurance policy and is often used as a reference point for future claims and policy management.

What You'll Learn

- Definition: The declaration page is a summary of your life insurance policy, outlining key details

- Key Information: It includes policy number, coverage amount, and beneficiary details

- Policy Details: This page provides an overview of your insurance coverage and terms

- Benefits: It highlights the benefits and protections offered by your life insurance policy

- Policy Summary: A concise summary of your policy's key features and coverage

Definition: The declaration page is a summary of your life insurance policy, outlining key details

The declaration page of a life insurance policy is a crucial document that provides a comprehensive overview of the insurance coverage and its terms. It serves as a summary of the entire policy, ensuring that both the insurance company and the policyholder have a clear understanding of the coverage details. This page is an essential reference point for all the critical information related to the life insurance policy.

When you purchase a life insurance policy, the declaration page is typically the first document you receive, often after the initial application process. It is a concise yet informative document that highlights the key aspects of your insurance coverage. This page is designed to be a quick reference guide, making it easier for you to understand the policy's specifics without delving into the entire policy document.

The content of the declaration page includes essential details such as the policy number, the name of the insured individual, the type of life insurance (term, whole life, etc.), the coverage amount, and the policy term. It also outlines the premium amount, payment frequency, and the name of the insurance company providing the coverage. Additionally, it may include information about any additional benefits or riders attached to the policy.

This page is particularly useful for policyholders as it provides a quick reference to their coverage details. It allows individuals to verify their personal information, the amount of coverage they have, and any specific terms or conditions associated with their policy. In the event of a claim, the declaration page can be a vital document to facilitate the claims process, ensuring that the insurance company has all the necessary information readily available.

Furthermore, the declaration page is an essential tool for policyholders to understand their rights and obligations under the insurance contract. It outlines the policy's duration, any conversion options, and the process for making changes or updates to the policy. By providing a summary of the key terms, it empowers policyholders to make informed decisions and take appropriate actions regarding their life insurance coverage.

AARP Life Insurance: Legit or a Scam?

You may want to see also

Key Information: It includes policy number, coverage amount, and beneficiary details

The declaration page of a life insurance policy is a crucial document that provides essential details about the insurance coverage. It serves as a summary of the policy's key information, ensuring that both the insured and the insurance company have a clear understanding of the terms and conditions. This page is typically included in the policy package and is an important reference point for the policyholder.

One of the primary pieces of information on the declaration page is the policy number. This unique identifier is assigned to each individual policy and is used to track and manage the specific insurance coverage. It is a critical reference point for the insurance company to locate and access the policy's details, and it also helps the policyholder keep track of their insurance information.

In addition to the policy number, the declaration page will specify the coverage amount. This figure represents the financial benefit that will be paid out to the policy's beneficiary(ies) in the event of the insured's death. The coverage amount is a key factor in determining the value of the life insurance policy and is often used to assess the adequacy of the coverage for the insured's needs.

Another critical piece of information on this page is the beneficiary details. The beneficiary is the person or entity who will receive the death benefit upon the insured's passing. The declaration page will list the names and contact information of the primary and secondary beneficiaries, ensuring that the insurance company knows who should receive the payout. This information is vital for the smooth processing of claims and provides clarity on the distribution of the insurance proceeds.

Furthermore, the declaration page may also include other relevant details such as the policy term, premium payment information, and any applicable riders or endorsements. These additional details ensure that the policyholder has a comprehensive understanding of their coverage and can make informed decisions regarding their insurance needs. By providing a concise yet comprehensive overview, the declaration page becomes an indispensable tool for both the insured and the insurance provider.

Whole Life Insurance: Cash Value Accumulation Explained

You may want to see also

Policy Details: This page provides an overview of your insurance coverage and terms

The Declaration Page of a life insurance policy is a crucial document that serves as a comprehensive summary of the insurance coverage and the terms and conditions agreed upon between the insurance company and the policyholder. This page is often the first document that the policyholder receives after purchasing the insurance policy and is essential for understanding the details of the coverage. It is a detailed and informative document that outlines the specific terms and conditions of the insurance policy, ensuring that both the policyholder and the insurance company are on the same page regarding the coverage provided.

This page typically includes a variety of important information. Firstly, it provides a clear and concise description of the type of life insurance policy, such as term life, whole life, or universal life. It specifies the coverage amount or the death benefit, which is the amount of money the insurance company will pay to the beneficiaries upon the insured individual's death. The declaration page also outlines the policy period, which is the duration for which the insurance coverage is valid. For example, it might state that the policy is valid for a term of 10 years, 20 years, or until a certain age.

In addition to the coverage details, the Policy Details page also includes information about the policyholder and the insured individual. It provides the personal details of the policyholder, such as their name, address, and contact information. It also lists the insured person's basic information, including their name, birthdate, and any relevant health or lifestyle factors that may impact the insurance premium or coverage. This section ensures that the insurance company has all the necessary details to process the policy and provide the appropriate coverage.

Furthermore, this page is where you will find the premium payment details. It specifies the amount of premium the policyholder is required to pay and the frequency of these payments. It also outlines the grace period, which is the time the policyholder has after the due date to pay the premium without losing coverage. The declaration page might also include information about any additional benefits or riders that can be added to the policy, such as critical illness coverage or accidental death benefits.

In summary, the Declaration Page of a life insurance policy is a vital document that offers a comprehensive overview of the insurance coverage, terms, and conditions. It ensures that the policyholder has a clear understanding of their insurance policy and provides essential details for both parties involved. This page is a key reference point for policyholders to review and ensure they have the coverage they expected and to take any necessary actions to manage their policy effectively.

Adding Minors to Life Insurance: Executors and You

You may want to see also

Benefits: It highlights the benefits and protections offered by your life insurance policy

The Declaration Page of a life insurance policy is a crucial document that outlines the specific details and coverage provided by your insurance plan. It serves as a comprehensive summary, ensuring that both the policyholder and the insurance company are on the same page regarding the terms and benefits. This page is an essential reference tool, offering a clear understanding of the financial protection and support you can expect in the event of a covered loss.

When reviewing the Declaration Page, you'll find a detailed breakdown of the policy's coverage, including the amount of insurance provided, the premium payments, and the duration of the policy. It specifies the type of life insurance you have, such as term life or permanent life, and the benefits associated with each. For instance, it might detail the death benefit, which is the amount paid out to your beneficiaries upon your passing, and the policy's cash value, if applicable. Understanding these aspects is vital as it directly impacts the financial security of your loved ones.

The Declaration Page also highlights any additional benefits and riders that can be added to your policy. These riders provide extra protection and customization options, such as an accidental death benefit rider, which increases the payout if your death is caused by an accident, or a critical illness rider, which offers financial assistance if you're diagnosed with a critical illness. These riders can significantly enhance the value of your life insurance policy, ensuring that you receive comprehensive coverage tailored to your specific needs.

Moreover, this page provides information about the policy's conversion options, allowing you to change the type of insurance or increase the coverage amount at a later date. It also outlines the policy's surrender or termination options, which are essential to understand if you decide to cancel the policy. By reviewing these details, you can make informed decisions about your insurance coverage and ensure that it aligns with your long-term financial goals.

In summary, the Declaration Page is an indispensable resource for understanding the full scope of your life insurance policy. It empowers you to make informed choices, ensuring that you receive the benefits and protections you need. By carefully reviewing this document, you can have confidence in your insurance coverage and its ability to provide financial security for your loved ones.

Life Insurance for Children: Is it Possible in the UK?

You may want to see also

Policy Summary: A concise summary of your policy's key features and coverage

The Declaration Page of a life insurance policy is a crucial document that provides a comprehensive overview of the policy's essential details. It serves as a summary of the insurance contract between the policyholder and the insurance company, outlining the specific terms and conditions of the coverage. This page is often referred to as the "policy summary" and is designed to offer a quick reference guide for the insured individual.

When reviewing the Declaration Page, you will find a wealth of information that is essential to understanding your life insurance policy. It typically includes the policy number, which is a unique identifier for your specific insurance contract. This number is crucial for any future claims or inquiries related to your policy. The page also displays the policyholder's name, the insured individual's details, and the insurance company's contact information.

One of the critical aspects covered in this summary is the policy's coverage amount or death benefit. This is the financial payout that the insurance company will provide to the policyholder's beneficiaries upon the insured individual's death. It is a key feature that determines the value of the policy and the potential financial support it offers to the policyholder's loved ones. Additionally, the Declaration Page specifies the policy's term, which could be a specific period, such as 10 or 20 years, or it might be a permanent policy with lifelong coverage.

Another important section is the list of policy riders or endorsements. These are additional benefits or modifications that can be added to the base policy to customize the coverage. For example, riders might include options for critical illness coverage, accidental death benefits, or long-term care insurance. Understanding these riders is essential as they can significantly enhance the policy's value and provide additional financial protection.

Furthermore, the Declaration Page outlines the policy's premium payment terms. It specifies the amount and frequency of payments, whether they are due annually, semi-annually, or monthly. It also mentions the due dates for these payments and any late payment penalties or grace periods. This information is vital for policyholders to manage their finances effectively and ensure timely premium payments to maintain the policy's validity.

In summary, the Declaration Page of a life insurance policy is a comprehensive document that provides a concise yet detailed summary of the policy's key features and coverage. It empowers policyholders to understand their insurance contract, including the death benefit, policy term, riders, and premium payment terms. Reviewing this page regularly is essential to ensure that the policy meets the policyholder's needs and to make any necessary adjustments as their circumstances change over time.

Joint Life Insurance: Cheaper Option for Couples?

You may want to see also

Frequently asked questions

The declaration page is a crucial document in life insurance policies, often referred to as the "dec page." It is a summary of the policy's key details, including the insured person's information, the policyholder's details, the insurance amount, the policy term, and the premium payment schedule. This page serves as a quick reference for the policyholder and provides an overview of the coverage and terms.

Typically, the declaration page is provided to the policyholder when the life insurance policy is issued. It can be found in the initial policy documents or package. If you have lost your policy documents, you can usually request a copy of the declaration page from your insurance company. They may ask for your personal details and policy information to verify your identity and provide the necessary document.

The declaration page includes essential details such as the policy number, insured person's name, birthdate, and any relevant medical information (if applicable). It also outlines the policy's coverage amount, premium payment frequency, and the duration of the policy term. Additionally, it may include important dates like the policy start and end dates, as well as any applicable conversion options or riders.