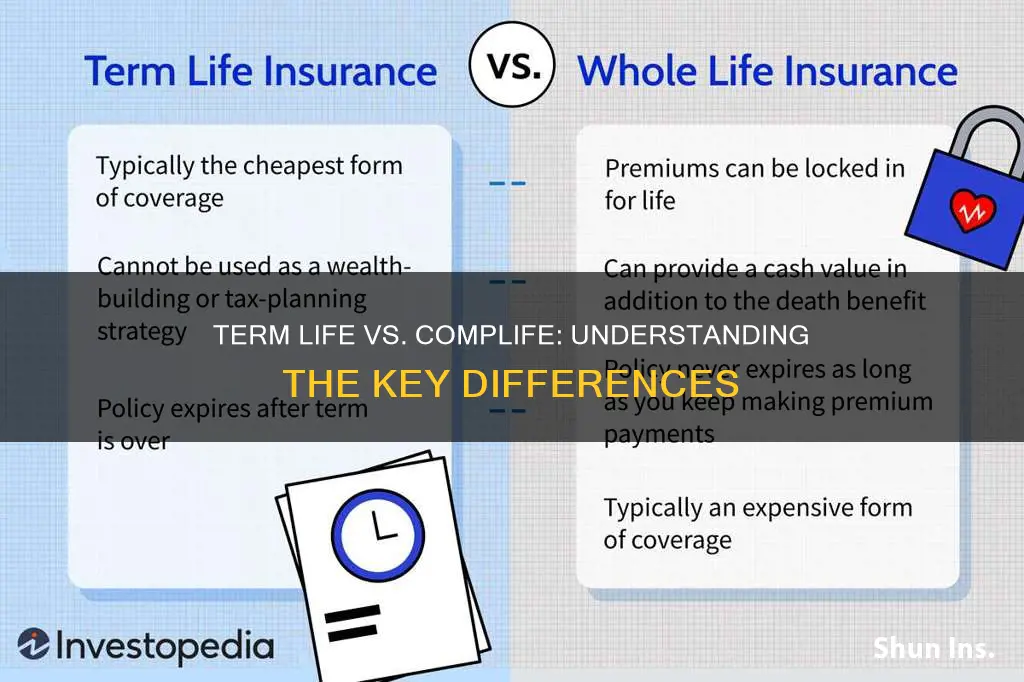

Term life insurance and whole life insurance, also known as complife, are two distinct types of life insurance policies. Term life insurance provides coverage for a specific period, or term, typically ranging from 10 to 30 years. It offers a straightforward policy with a set premium and a death benefit that pays out if the insured individual passes away during the term. On the other hand, whole life insurance is a permanent policy that provides lifelong coverage. It features an investment component, allowing the policyholder to build cash value over time, which can be borrowed against or withdrawn. While term life insurance is ideal for temporary needs and offers simplicity and affordability, whole life insurance provides long-term financial security and a guaranteed death benefit.

What You'll Learn

- Coverage Duration: Term life insurance offers fixed coverage for a set period, while Complife may have a longer-term or permanent policy

- Cost: Term life is generally more affordable due to its shorter duration, whereas Complife can be more expensive

- Flexibility: Complife provides more customization options, allowing for adjustments to coverage over time

- Conversion Option: Complife often includes a conversion feature, allowing term policyholders to convert to permanent insurance

- Features: Complife may offer additional benefits like cash value accumulation or investment components

Coverage Duration: Term life insurance offers fixed coverage for a set period, while Complife may have a longer-term or permanent policy

When it comes to life insurance, understanding the coverage duration is crucial as it determines the length of time your beneficiaries will receive financial protection. Term life insurance provides a straightforward approach, offering coverage for a specified period, often ranging from 10 to 30 years. This type of policy is ideal for individuals who need coverage for a particular period, such as covering mortgage payments or providing financial security for dependent children. During this term, the policyholder pays regular premiums, and in return, the insurance company promises to pay out a death benefit if the insured individual passes away within the agreed-upon period. Once the term ends, the coverage expires, and further coverage may need to be obtained, which can be more expensive or challenging to secure.

On the other hand, Complife, which is likely a play on the word 'permanent,' offers a different approach to life insurance. Complife policies are designed to provide coverage for the entire lifetime of the insured individual, often referred to as 'whole life' insurance. This type of policy offers a guaranteed death benefit and accumulates cash value over time, which can be borrowed against or withdrawn. Complife insurance is permanent and remains in force as long as the premiums are paid, providing long-term financial security. The coverage duration with Complife is not limited to a set period, making it a more comprehensive and permanent solution for long-term financial planning.

The key difference in coverage duration is that term life insurance is temporary and provides protection for a specific time frame, while Complife offers lifelong coverage. Term life is suitable for those who need coverage for a defined period, ensuring financial security during specific life events. In contrast, Complife is more appropriate for individuals seeking long-term financial protection and the potential for cash value accumulation. Understanding these coverage duration differences is essential when choosing the right life insurance policy to meet your specific needs and financial goals.

In summary, term life insurance provides fixed coverage for a set period, making it a practical choice for short-term financial security. Complife, or permanent life insurance, offers lifelong coverage, ensuring protection and potential cash value benefits for the long term. Evaluating your financial goals and the specific duration of coverage needed will help you decide between these two insurance options.

Life and Health Insurance: Changing Residency, Changing Coverage

You may want to see also

Cost: Term life is generally more affordable due to its shorter duration, whereas Complife can be more expensive

When considering life insurance options, understanding the cost implications of different policies is crucial. Term life insurance and Complife (a combination of term life and permanent life insurance) offer distinct advantages, and their costs reflect these differences. One of the primary factors influencing the cost is the duration of coverage.

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. This shorter-term nature makes it more affordable compared to Complife. With term life, you pay premiums for the chosen duration, ensuring financial protection during that specific period. The lower cost is attributed to the reduced risk for the insurer, as they only need to cover potential claims within the defined term.

In contrast, Complife offers a longer-term commitment, often with a permanent life insurance component. This type of policy provides coverage for the entire lifetime of the insured individual. As a result, Complife policies tend to be more expensive. The insurer assumes a higher risk since the coverage is guaranteed for life, and the premiums reflect this extended commitment. The cost of Complife can vary based on factors such as the insured's age, health, and the specific features of the policy.

The affordability of term life insurance is particularly beneficial for those seeking temporary coverage, such as individuals with specific needs during a particular phase of life, like starting a family or owning a home. For these situations, term life provides a cost-effective solution without the long-term financial commitment. On the other hand, Complife might be more suitable for individuals who desire lifelong coverage and are willing to invest in a more comprehensive policy.

Understanding the cost structure of these insurance options allows individuals to make informed decisions based on their financial goals and circumstances. While term life insurance offers affordability and flexibility, Complife provides comprehensive coverage for life. The choice between the two depends on the specific needs and preferences of the policyholder.

Life Insurance Agents: Financial Consultants or Not?

You may want to see also

Flexibility: Complife provides more customization options, allowing for adjustments to coverage over time

When it comes to life insurance, understanding the differences between various policies is crucial to making an informed decision. One key aspect that sets Complife apart from traditional term life insurance is its flexibility and customization options. This flexibility is a game-changer for those seeking a tailored insurance plan that can adapt to their changing needs over time.

Complife offers a unique advantage in that it allows policyholders to adjust their coverage as their circumstances evolve. Unlike term life insurance, which provides a fixed amount of coverage for a specified period, Complife empowers individuals to modify their policy's terms and conditions. This means that if your financial situation changes, you can increase or decrease your coverage accordingly. For instance, if you start a new high-paying job, you might want to boost your insurance coverage to protect your loved ones. Conversely, if you've paid off your mortgage or reduced your family's financial obligations, you can opt to lower your insurance premium by adjusting the coverage.

The customization options provided by Complife are particularly beneficial for those who prefer a more personalized approach to insurance. It allows individuals to create a policy that aligns perfectly with their unique requirements. Whether you're a young professional starting your career or an entrepreneur with a dynamic business, Complife's flexibility ensures that your insurance plan can grow with you. You can choose to add or remove riders, adjust the death benefit, or even convert your term policy into a permanent one as your needs change.

This level of customization is a significant advantage, especially for those who want to ensure their insurance remains relevant and effective throughout their lives. With Complife, you're not locked into a one-size-fits-all approach, but instead, you have the freedom to make changes that reflect your evolving financial goals and priorities. This flexibility is a powerful tool, allowing you to optimize your insurance coverage and make the most of your premium payments.

In summary, Complife's flexibility and customization options set it apart from term life insurance. It empowers individuals to take control of their insurance needs, ensuring that their coverage remains relevant and effective as their lives change. This level of adaptability is a valuable feature for anyone seeking a long-term insurance solution that can grow with them.

Life Insurance Payouts: Are They Taxable?

You may want to see also

Conversion Option: Complife often includes a conversion feature, allowing term policyholders to convert to permanent insurance

The term life insurance is a straightforward product, offering coverage for a specified period, typically 10, 20, or 30 years. It provides a death benefit to the policyholder's beneficiaries if the insured individual passes away during the term. Once the term ends, the policy typically expires, and the coverage ceases unless the policyholder renews it. This type of insurance is generally more affordable and is suitable for individuals who want coverage for a specific period, such as those with temporary financial responsibilities or those who want to provide for their families during a particular stage of life.

On the other hand, Complife, a type of life insurance, often comes with additional features and benefits. One of the key advantages of Complife is the conversion option it offers. This feature is particularly beneficial for term life insurance holders who want to ensure long-term financial protection. When purchasing a term life policy, the conversion option allows the policyholder to convert it into a permanent life insurance policy without the need for a medical examination or additional underwriting. This conversion process can be advantageous as it provides a seamless transition to a more comprehensive insurance plan.

The conversion option is especially valuable for those who initially opt for term life due to its cost-effectiveness but later realize the need for lifelong coverage. By converting to Complife, policyholders can secure permanent insurance without the typical delays and additional costs associated with a new application. This flexibility ensures that individuals can adapt their insurance needs as their life circumstances change. For instance, a young professional might start with a 10-year term policy to cover their family's immediate needs and then convert it to Complife as they approach a stage in life where long-term financial security becomes more critical.

When considering the conversion option, it's essential to understand the terms and conditions set by the insurance provider. Typically, the conversion process involves notifying the insurance company and paying any additional premiums required for the new permanent policy. The insurance company will then assess the policyholder's health and financial situation to determine the new premium rate. This process ensures that the policyholder receives the appropriate coverage and benefits for their specific needs.

In summary, Complife's conversion feature is a valuable addition to term life insurance, offering policyholders the flexibility to adapt their coverage as their life progresses. This option allows individuals to start with a cost-effective term policy and seamlessly transition to permanent insurance when the need arises, ensuring they have comprehensive protection throughout their lives. Understanding the conversion process and its implications is crucial for making informed decisions about life insurance coverage.

American Income Life: Persistent Insurance Calls Explained

You may want to see also

Features: Complife may offer additional benefits like cash value accumulation or investment components

When considering life insurance, it's important to understand the various types available, such as term life insurance and whole life insurance, which includes the specific type known as Complife. One key aspect that sets Complife apart is its potential to offer additional financial benefits beyond basic life coverage.

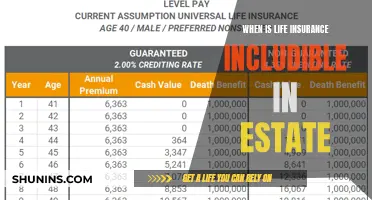

Complife, a type of permanent life insurance, is designed to provide long-term financial security. One of its unique features is the ability to accumulate cash value over time. This means that, in addition to the death benefit, the policyholder can build up a cash reserve within the policy. This cash value can be used for various purposes, such as taking out loans, paying for college tuition, or even as a source of emergency funds. The accumulation of cash value is a significant advantage, especially for those who want a more flexible and permanent insurance solution.

In addition to cash value accumulation, Complife policies often include investment components. These investment options allow policyholders to allocate a portion of their premiums into various investment vehicles, such as stocks, bonds, or mutual funds. By doing so, the policy's cash value can grow at a potentially higher rate than traditional savings accounts. This investment aspect provides an opportunity for policyholders to benefit from market growth while also ensuring that their insurance coverage remains in place.

The investment component of Complife can be particularly attractive to those seeking to grow their wealth while also protecting their loved ones. It offers a way to potentially increase the overall value of the policy, providing both insurance coverage and an investment opportunity. However, it's essential to carefully review the investment options and associated risks before making any decisions, as these can vary between different insurance providers.

In summary, Complife's additional benefits, such as cash value accumulation and investment components, set it apart from term life insurance. These features provide policyholders with financial flexibility, potential for wealth growth, and a more comprehensive approach to long-term financial planning. Understanding these advantages can help individuals make informed decisions when choosing the right life insurance policy to suit their specific needs and goals.

Life Insurance: Income Protection and Its Coverage

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specified period, known as the 'term', such as 10, 20, or 30 years. It is a pure insurance product, meaning it offers no investment or savings component. On the other hand, whole life insurance is a permanent policy that provides lifelong coverage, as long as premiums are paid. It includes an investment component, allowing the policy to accumulate cash value over time.

Term life insurance is generally more affordable, especially for younger individuals, as it does not have the additional costs associated with building cash value. The premiums are typically lower because the coverage is only valid for a specific period. Whole life insurance, with its investment aspect, tends to be more expensive, as it provides coverage for the entire life of the insured and offers a guaranteed death benefit.

Yes, many term life insurance policies offer an option to convert to a whole life policy at a later date. This conversion privilege allows policyholders to switch to a permanent policy without a medical examination, as long as they meet the insurer's requirements. It provides flexibility, allowing individuals to start with a simpler, more affordable term policy and then upgrade to a whole life policy as their needs and financial situation change.

Term life insurance does not accumulate cash value, so there are no tax advantages or deductions. However, the death benefit paid out to beneficiaries is generally tax-free. Whole life insurance, due to its investment component, may offer tax advantages. The cash value in the policy can grow tax-deferred, and policyholders can borrow against this value tax-free. Additionally, the death benefit may be partially tax-free, depending on the policy's structure.