Veterans Life Insurance, also known as the Veterans Affairs (VA) Life Insurance, is a program offered by the U.S. Department of Veterans Affairs to eligible veterans and their families. This insurance provides financial protection and peace of mind, offering coverage options such as term life insurance and permanent life insurance. It is designed to assist veterans in securing their financial future and that of their loved ones, ensuring they receive the support they have earned through their service. The program is a valuable resource for veterans, helping them navigate the complexities of life insurance and providing a safety net for their families.

What You'll Learn

- Eligibility: Veterans meet specific criteria for enrollment

- Benefits: Coverage includes death and disability protection

- Premiums: Rates vary based on age and coverage amount

- Claims Process: Simplified procedures for policyholders and beneficiaries

- Support Services: Assistance with policy management and claims

Eligibility: Veterans meet specific criteria for enrollment

Veterans Life Insurance is a unique and valuable benefit offered to eligible U.S. military veterans and their families. This insurance program is designed to provide financial protection and peace of mind to those who have served our country. To be eligible for enrollment, veterans must meet specific criteria set by the U.S. Department of Veterans Affairs (VA).

Firstly, the veteran must have an honorable discharge from active military service. This is a fundamental requirement, as it ensures that the individual has completed their military obligations and is entitled to the benefits associated with veterans' status. The discharge must be characterized as "honorable," indicating a successful and honorable completion of their service. This criterion ensures that the insurance is provided to those who have contributed significantly to their country's defense.

Secondly, veterans must have served a minimum period of active duty. The VA sets this duration, which may vary depending on the branch of service and the individual's specific circumstances. For example, veterans who served in the Army or Air Force typically need to have completed at least 2 years of active duty, while Navy and Coast Guard veterans may have different requirements. This eligibility criterion ensures that the insurance program supports those who have dedicated a substantial portion of their lives to military service.

Additionally, veterans must be in good health to be eligible for enrollment. The VA requires a medical examination to assess the veteran's overall health and determine if they meet the necessary standards. This step is crucial to ensure that the insurance is accessible to those who can benefit from it and to manage potential risks associated with providing coverage to individuals with pre-existing conditions. The VA's medical guidelines provide a fair and standardized approach to evaluating veterans' health.

Furthermore, veterans must be a U.S. citizen or a resident alien with a permanent residence in the United States. This criterion ensures that the insurance benefit is extended to those who have made the United States their home and are entitled to the rights and privileges associated with citizenship or legal residency. It also helps in managing the administrative aspects of the program.

Meeting these eligibility criteria is essential for veterans to access the Veterans Life Insurance program. It ensures that the insurance is provided to those who have served their country honorably and have contributed to the protection and security of the United States. By adhering to these specific requirements, the VA can efficiently manage the program and provide financial security to eligible veterans and their families.

Term Life Insurance: Can It Be Denied for Renewal?

You may want to see also

Benefits: Coverage includes death and disability protection

Veterans Life Insurance is a program designed to provide financial security and peace of mind to military veterans and their families. This insurance policy offers a range of benefits, with a primary focus on death and disability coverage, ensuring that veterans and their loved ones are protected during challenging times.

The death benefit is a crucial aspect of this insurance. When a veteran passes away, the designated beneficiaries receive a lump sum payment. This financial support can help cover various expenses, such as funeral costs, outstanding debts, or provide financial stability for the family, especially if the veteran was the primary breadwinner. It ensures that the family's financial situation is not further burdened during a difficult period.

In addition to the death benefit, the policy also provides disability protection. This coverage is designed to support veterans who become permanently disabled due to an illness or injury sustained during their military service. Disability benefits can be crucial as they provide a regular income to cover living expenses and medical costs associated with the disability. It ensures that veterans can maintain their standard of living and access necessary healthcare services without financial strain.

The disability coverage is particularly valuable as it offers long-term financial security. Veterans may face challenges in finding employment or adapting to civilian life after their military service, and this insurance provides a safety net during such transitions. It allows veterans to focus on their recovery and rehabilitation, knowing that their financial needs are being met.

Furthermore, the Veterans Life Insurance policy often includes additional benefits tailored to the unique needs of military personnel. These may include accelerated death benefits, which allow for faster access to funds in the event of a terminal illness, and waiver of premiums, ensuring that the policy remains active even if the veteran is unable to make payments due to disability. These features showcase the comprehensive nature of the insurance, catering specifically to the veteran community.

Life Insurance for Incarcerated Individuals: Is It Possible?

You may want to see also

Premiums: Rates vary based on age and coverage amount

Veterans Life Insurance is a unique and valuable benefit offered to eligible U.S. military veterans and their families. This insurance is provided by the Department of Veterans Affairs (VA) and is designed to offer financial protection and peace of mind to veterans and their loved ones. One of the key aspects of this insurance is the premium structure, which is directly tied to the age of the veteran and the coverage amount they choose.

The premium rates for Veterans Life Insurance are determined by several factors, with age being the most significant. As with any insurance policy, younger individuals typically pay lower premiums compared to older individuals. This is because younger people are generally considered less risky to insure, and insurance companies often offer more competitive rates to attract younger customers. For veterans, this means that the younger they are when they apply for the policy, the lower their monthly premium will be. This is a significant advantage, as it allows veterans to secure a policy at a more affordable rate, which can be crucial for long-term financial planning.

Additionally, the coverage amount selected by the veteran also plays a role in premium calculation. The coverage amount refers to the death benefit that will be paid out upon the insured veteran's passing. Higher coverage amounts result in higher premiums, as the insurance company is taking on a larger financial risk. This is a standard practice in the insurance industry, where the level of coverage directly influences the cost of the policy. Veterans should carefully consider their financial goals and the level of protection they need when deciding on the coverage amount.

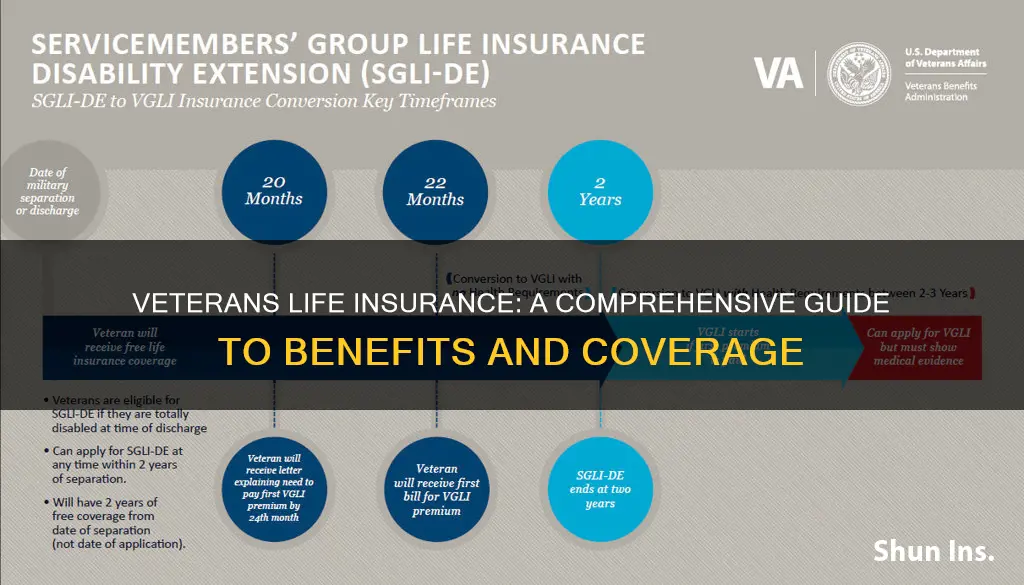

It's important to note that the VA offers different types of Veterans Life Insurance policies, each with its own set of benefits and premium structures. For instance, the Service-Disabled Veterans Insurance (SDVI) and the Veterans' Group Life Insurance (VGLI) have distinct premium rates and eligibility criteria. Understanding these variations is essential for veterans to make informed decisions about the type of policy that best suits their needs.

In summary, the premiums for Veterans Life Insurance are tailored to the individual's age and the chosen coverage amount. Younger veterans and those opting for lower coverage amounts can expect more favorable premium rates. This insurance provides a critical safety net for veterans and their families, ensuring financial security during challenging times. By understanding the premium structure, veterans can make the right choices to protect themselves and their loved ones effectively.

Dave Ramsey's Take on Adjustable Comp Life Insurance

You may want to see also

Claims Process: Simplified procedures for policyholders and beneficiaries

The Veterans Life Insurance (VLI) program offers a comprehensive financial safety net to eligible U.S. veterans and their families. When a covered veteran passes away, the VLI policy can provide a tax-free death benefit to designated beneficiaries, offering financial security during a difficult time. Understanding the claims process is crucial for policyholders and beneficiaries to ensure a smooth and efficient experience.

Step 1: Notify the Insurance Provider

The first step is to notify the VLI provider, the Department of Veterans Affairs (VA), about the veteran's passing. This can be done by contacting the VA's National Cemetery Administration or the appropriate VA regional office. Provide them with the necessary information, including the veteran's full name, date of birth, Social Security number, and the policy number. The VA will then initiate the claims process and guide you through the necessary steps.

Step 2: Gather Required Documents

The VA will request specific documents to process the claim. These typically include:

- A completed VA Form 29-537, "Application for Insurance Benefits."

- A certified copy of the veteran's death certificate.

- Proof of the veteran's military service, such as a DD-214 discharge paper or a military ID card.

- Identification and contact information for the designated beneficiary(ies).

- Any additional documentation the VA may require, such as a will or trust documents if there are disputes regarding the beneficiary.

Step 3: Submit the Claim

Once you have gathered all the necessary documents, submit them to the VA along with the completed application form. You can choose to submit them online, by mail, or in person at a VA regional office. The VA will review the application and supporting documents to verify the veteran's eligibility and the beneficiary's status.

Step 4: Claim Review and Payment

The VA will conduct a thorough review of the claim, which may involve contacting the veteran's next of kin or other relevant parties for additional information. If the claim is approved, the VA will process the payment of the death benefit to the designated beneficiary. The payment is typically made in a lump sum, and the amount depends on the policy's coverage and the veteran's age at the time of enrollment.

Step 5: Beneficiary Communication

The VA will notify the beneficiary(ies) of the claim decision and provide instructions on how to receive the death benefit. This communication will outline the steps the beneficiary needs to take to access the funds, which may involve providing additional documentation or opening a designated bank account.

Simplifying the claims process is essential to ensure that veterans' families receive the financial support they are entitled to. By following these steps and providing the necessary documentation, policyholders and beneficiaries can navigate the VLI claims process with clarity and efficiency, allowing them to focus on honoring the veteran's memory during this challenging period.

Life Insurance Basics: Core Life Insurance Explained

You may want to see also

Support Services: Assistance with policy management and claims

Veterans Life Insurance is a program designed to provide financial protection and peace of mind to veterans and their families. It offers a range of benefits, including death benefits, which can help cover funeral expenses and provide financial support to beneficiaries. One of the key support services associated with this insurance is the assistance with policy management and claims, ensuring that veterans and their families can navigate the process with ease and confidence.

When it comes to policy management, the VA (Department of Veterans Affairs) offers dedicated support to help veterans understand and manage their insurance policies effectively. This includes providing resources and guidance on various aspects of the policy, such as premium payments, policy terms, and coverage options. Veterans can reach out to the VA's customer service team or utilize online portals to update their personal information, make changes to their policy, or inquire about any policy-related matters. The VA's goal is to empower veterans to take control of their insurance and ensure that their policies are tailored to their specific needs.

Assistance with claims is another crucial aspect of the support services offered. When a veteran or their beneficiary needs to file a claim, the VA provides a streamlined process to facilitate the process. This includes helping with the necessary documentation, such as death certificates, medical reports, and proof of military service. The VA's claims team is trained to handle various scenarios, ensuring that the claims process is efficient and fair. They can provide guidance on the specific requirements for different types of claims, ensuring that veterans and their families receive the benefits they are entitled to.

In addition to the VA's support, many non-profit organizations and veteran service organizations also offer assistance with policy management and claims. These organizations often provide resources, educational materials, and guidance to help veterans navigate the complexities of life insurance. They may offer workshops, online tutorials, or personalized consultations to ensure that veterans make informed decisions and understand their rights as policyholders.

By offering comprehensive support services, the VA and these supporting organizations aim to simplify the process of managing and claiming benefits from Veterans Life Insurance. This assistance is particularly valuable for veterans who may have limited access to financial advisors or insurance experts, ensuring that they can make the most of their insurance policies and receive the support they need during challenging times.

Life Insurance: What Employers Offer Permanently to Employees?

You may want to see also

Frequently asked questions

The Veterans Life Insurance (VLI) is a program offered by the U.S. Department of Veterans Affairs (VA) to provide financial protection and peace of mind to veterans and their families. It is a term life insurance policy that offers coverage for 10, 15, 20, or 30 years, with the option to convert to a permanent policy after the initial term.

Eligibility for VLI is available to all honorably discharged veterans, members of the National Guard or Reserves who have completed at least six consecutive months of active duty, and certain former prisoners of war. Spouses and dependents of eligible veterans can also apply for coverage. The VA has specific guidelines and requirements for eligibility, which can be found on their official website.

The VLI provides a death benefit to the veteran's designated beneficiary(ies) if the insured veteran passes away during the term of the policy. The benefit amount is determined by the coverage selected and the premium paid. Premiums are typically low and competitive, and the policy offers level death benefits, meaning the amount remains the same throughout the term. After the initial term, the policy can be converted to a permanent life insurance plan, providing long-term coverage.