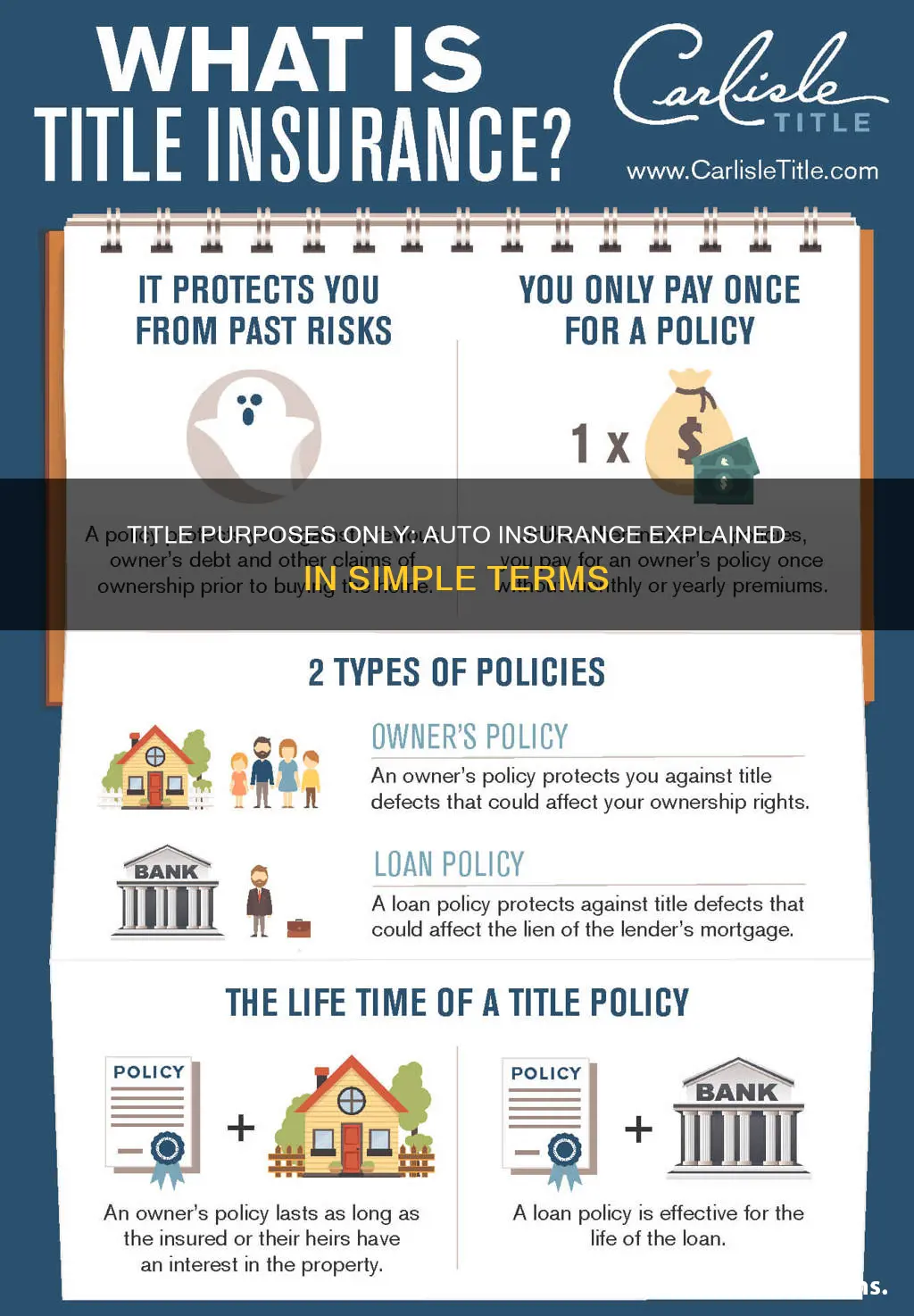

Title insurance is a form of indemnity insurance that protects homebuyers and mortgage lenders from financial loss due to defects in a property's title. It is a one-time fee that covers administrative fees for deep searches of title data to protect against claims for past occurrences. There are two types of title insurance: owner's title insurance and lender's title insurance. Owner's title insurance is optional and protects the homebuyer, while lender's title insurance is required and protects the lender. Title insurance is important because it protects homebuyers and lenders from unforeseen financial losses and gives peace of mind when purchasing a property.

| Characteristics | Values |

|---|---|

| Type | Owner's title insurance and lender's title insurance |

| Who does it protect? | Homebuyers and mortgage lenders |

| What does it protect against? | Financial loss due to defects in the title to a property, including back taxes, liens, and conflicting wills |

| When is it purchased? | When buying a home |

| How often is it paid? | One-time fee |

| Who pays? | The buyer or the seller, depending on the situation and region |

| How much does it cost? | $500 to $3,500, depending on the state, insurance provider, and property price |

What You'll Learn

- Title insurance protects homebuyers and lenders from financial loss due to defects in a title to a property

- There are two types of title insurance: owner's title insurance and lender's title insurance

- A clear title is necessary for any real estate transaction

- Title insurance is a one-time fee and is not an ongoing expense

- Title insurance protects your ownership of the property, unlike homeowner's insurance, which protects you from losses due to fire, weather, and theft

Title insurance protects homebuyers and lenders from financial loss due to defects in a title to a property

There are two types of title insurance: lender's title insurance and owner's title insurance. Lender's title insurance is the most common type and is typically required for a mortgage loan. It protects the lender from financial loss in the event of defects in the property title, such as liens, ownership disputes, or conflicting wills. The cost of lender's title insurance is based on the size of the loan and is usually paid by the buyer as part of their closing costs.

Owner's title insurance, on the other hand, is optional but recommended. It protects the homebuyer's investment in the property and covers the costs of any future title disputes. The cost of owner's title insurance is based on the purchase price of the home and can range from $500 to $3,500 depending on the state and insurance provider. It is typically paid for by the seller to protect the buyer's equity in the property.

Auto Insurance: To Buy or Not to Buy Before Your Car Purchase?

You may want to see also

There are two types of title insurance: owner's title insurance and lender's title insurance

Lender's title insurance, on the other hand, is meant to protect the lender. It is purchased by the borrower to protect the lender from financial loss in the event of defects in the title. Lenders almost always require the borrower to buy lender's title insurance as it is too great a risk to be without this type of coverage.

Both types of title insurance policies pay valid claims and legal fees to defend against hidden title issues, and also help to decrease ownership risks by providing a thorough title search prior to the issuance of either policy. While lender's title insurance is almost always required, owner's title insurance is optional but highly recommended to protect your investment.

Joint Custody Teen Auto Insurance: What You Need to Know

You may want to see also

A clear title is necessary for any real estate transaction

If you can't prove insurable interest, your options for getting insurance are more limited. You can be added to the existing policy of the vehicle owner, especially if you live together, or you can ask them to add you to their policy. Alternatively, you can purchase a non-owner car insurance policy, which provides minimum liability coverage. However, insurance companies are unlikely to sell you this type of policy if you share an address with the vehicle owner and have regular access to the car.

A clear title is a title to a property that is free from any liens, levies, or other claims that could call the ownership into question. It firmly establishes the sole and undisputed legal ownership of the property, ensuring that no other party can make any kind of legal claim to it. A clear title is also known as a "clean title," "just title," "absolute title," or "free and clear" title.

A clear title is essential for any real estate transaction to take place. Title companies must conduct a thorough title search to identify any liens, claims, or other issues before the title can be deemed clear. This process typically takes between 10 to 14 days but can take longer for older properties with more complex ownership histories. Erroneous surveys, unresolved building code violations, undisclosed divorces, and unpaid taxes are all examples of issues that can make a title "dirty."

If a property doesn't have a clear title, it will be challenging to buy or sell it, obtain a mortgage, or get homeowners insurance. In some cases, the buyer could be held responsible for resolving any outstanding liens or issues, which could result in significant costs. At worst, the buyer could lose the property entirely. Therefore, it is crucial to establish a clear title before any real estate transaction to ensure a smooth and secure process.

Auto Insurance: Personal vs Commercial

You may want to see also

Title insurance is a one-time fee and is not an ongoing expense

There are two types of title insurance: lender's title insurance and owner's title insurance. Lender's title insurance is purchased by the borrower to protect the lender from claims, whereas owner's title insurance is bought by the seller to protect the buyer against defects in the title. Lender's title insurance is almost always required, whereas owner's title insurance is optional.

The cost of title insurance varies depending on the state and the insurance provider, typically ranging from $500 to $3,500. The policy covers administrative fees for deep searches of title data to protect against claims for past occurrences.

Auto Insurance: The Future of Protection and Coverage

You may want to see also

Title insurance protects your ownership of the property, unlike homeowner's insurance, which protects you from losses due to fire, weather, and theft

There are two main types of title insurance: lender's title insurance and owner's title insurance. Lender's title insurance is typically required by mortgage lenders to protect their investment in the event of ownership disputes. On the other hand, owner's title insurance is optional but highly recommended by attorneys for added protection and peace of mind. It safeguards homebuyers from financial loss and legal issues arising from defects in the property title that may have occurred before they purchased the property.

The cost of title insurance varies depending on the state, the insurance provider, and the purchase price of the home. It is typically paid as a one-time fee at closing and can range from $500 to $3,500. While owner's title insurance is optional, it offers valuable protection for homebuyers, especially those planning to stay in their homes for an extended period.

In summary, title insurance is an essential aspect of the home-buying process, providing peace of mind and financial protection against potential ownership disputes. By understanding the differences between title insurance and homeowners insurance, homebuyers can make informed decisions about their property and ensure their investment is safeguarded.

Primary Location's Impact: Unraveling the Auto Insurance Location Conundrum

You may want to see also

Frequently asked questions

Title insurance is a form of indemnity insurance that protects lenders and homebuyers from financial loss sustained from defects in a title to a property.

There are two types of title insurance: lender's title insurance and owner's title insurance. Lender's title insurance is purchased by the borrower to protect the lender from claims, whereas owner's title insurance is usually bought by the seller to protect the buyer against defects in the title.

Title insurance covers underlying issues with a property's title that might have been missed before the property was bought, including property survey errors, errors on the property deed, building code violations by a previous owner, claims by an ex-spouse who didn't sign off on the sale, and liens from contractors, taxing entities, or previous lenders.

Title insurance does not protect against issues created after the property is purchased, such as failing to pay property taxes or contractors, or against eminent domain, where the government seizes private property for public use.

The cost of title insurance varies depending on the state, insurance provider, and the purchase price of the home. An owner's policy is typically based on the home's purchase price, while a lender's policy is based on the loan amount. Together, the policies usually cost around 0.5% to 1.0% of the home's purchase price.