Whole life insurance, also known as permanent life insurance, is a long-term financial product that provides both life coverage and a savings component. It offers a range of benefits, including a guaranteed death benefit, which pays out a fixed amount to your beneficiaries upon your passing. Additionally, whole life insurance builds cash value over time, allowing policyholders to accumulate savings that can be borrowed against or withdrawn. This type of insurance is a popular choice for those seeking lifelong coverage and a way to build wealth, as it provides financial security and a sense of assurance for the future.

What You'll Learn

- Definition: Whole life insurance is a permanent policy offering lifelong coverage and a guaranteed death benefit

- Premiums: It involves fixed monthly/annual payments, ensuring consistent costs over time

- Cash Value: Policies accumulate cash value, which can be borrowed against or withdrawn

- Death Benefit: A predetermined payout is paid to beneficiaries upon the insured's death

- Long-Term Savings: It provides tax-advantaged savings, allowing policyholders to build wealth over time

Definition: Whole life insurance is a permanent policy offering lifelong coverage and a guaranteed death benefit

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers several unique benefits and features. This insurance policy is designed to provide financial security and peace of mind to policyholders and their beneficiaries.

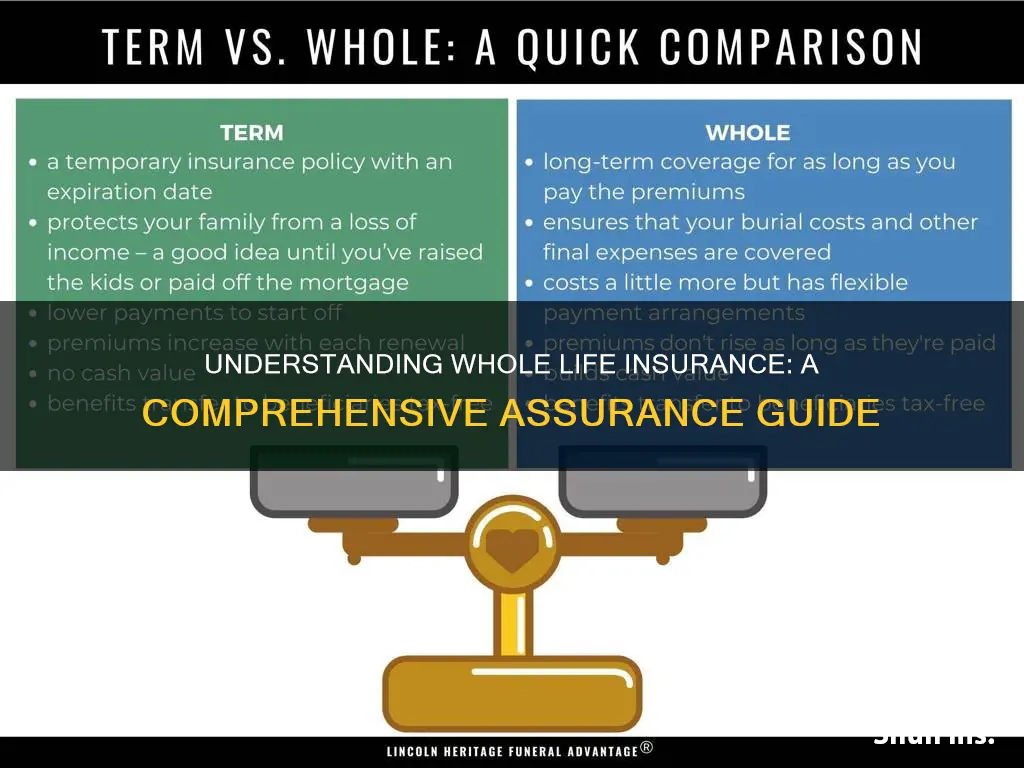

The key characteristic of whole life insurance is its permanence. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for as long as the policyholder pays the premiums. This means that once the policy is in effect, the coverage is guaranteed to be there for the rest of the insured's life. As a result, policyholders can have the assurance that their loved ones will be financially protected even if they outlive the initial term of coverage.

One of the most significant advantages of whole life insurance is the guaranteed death benefit. When the insured person passes away, the insurance company pays out a predetermined amount to the designated beneficiary. This guaranteed benefit is a fixed amount, which is determined at the time of policy inception and remains the same throughout the life of the policy. The death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, or to provide financial support to dependents.

In addition to the death benefit, whole life insurance also accumulates cash value over time. A portion of the premium payments goes towards building a cash reserve, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various financial needs, such as education expenses or business ventures. The cash value also increases the overall value of the policy, making it a valuable asset that can be passed on to beneficiaries or used for estate planning.

Whole life insurance is an attractive option for those seeking long-term financial protection and a sense of security. It provides a guaranteed death benefit and offers a way to build a valuable asset. Policyholders can enjoy the peace of mind that comes with knowing their loved ones will be financially secure, even in the event of their passing. This type of insurance is particularly beneficial for individuals who want to ensure their family's financial well-being and leave a lasting legacy.

Disclosing VA Disability: Life Insurance Requirements and You

You may want to see also

Premiums: It involves fixed monthly/annual payments, ensuring consistent costs over time

Whole life insurance, often referred to as 'assurance' in certain regions, is a long-term financial commitment that provides coverage for the entire lifetime of the insured individual. One of the key features that sets it apart from other insurance types is its structured and predictable premium structure. When you opt for whole life insurance, you agree to make regular payments, typically on a monthly or annual basis, to the insurance company. These premiums are a fundamental aspect of the policy and are designed to ensure that the insurance provider can fulfill its commitment to pay out the death benefit when the insured person passes away.

The beauty of this premium structure lies in its consistency. Unlike some other insurance products, whole life insurance premiums remain fixed throughout the life of the policy. This means that the amount you pay each month or year will not increase or fluctuate based on market conditions or the insured's health changes. For instance, if you take out a $100,000 whole life insurance policy and pay a fixed premium of $50 per month, that $50 will remain the same for the entire duration of the policy, providing stability and predictability in your financial planning.

This fixed premium structure is particularly advantageous for long-term financial planning. It allows individuals to budget effectively, knowing exactly how much they need to set aside each month or year to maintain their coverage. Moreover, the consistency of premiums ensures that the insurance company can accurately predict its future obligations, enabling it to offer competitive rates and maintain the financial stability of the policy over time.

For those considering whole life insurance, understanding the premium structure is crucial. It empowers individuals to make informed decisions about their financial commitments and ensures they are aware of the long-term costs associated with the policy. With fixed premiums, policyholders can rest assured that their insurance coverage will remain intact, providing financial security for their loved ones, regardless of economic fluctuations or changes in personal circumstances.

In summary, the concept of 'Premiums: It involves fixed monthly/annual payments' is a cornerstone of whole life insurance assurance. This structured approach to premiums ensures that policyholders have consistent costs, providing financial stability and peace of mind. By understanding this aspect, individuals can make well-informed choices when selecting a long-term insurance solution that suits their needs and offers reliable coverage.

Missing 1099 Form: Annuity Life Insurance Tax Return Woes

You may want to see also

Cash Value: Policies accumulate cash value, which can be borrowed against or withdrawn

Whole life insurance, often referred to as permanent life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. One of its key features is the accumulation of cash value, which is a significant benefit that sets it apart from other insurance products. This cash value is essentially the investment component of the policy, and it grows over time, providing a range of financial options for the policyholder.

As the policyholder pays premiums, a portion of each payment goes towards covering the cost of insurance and the other expenses associated with the policy, while the remaining amount is invested. This investment component is what builds up the cash value. The cash value grows at a fixed rate, which is typically guaranteed by the insurance company, and it can be used in various ways.

One of the primary advantages of the cash value in whole life insurance is the ability to borrow against it. Policyholders can take out loans against the accumulated cash value, allowing them to access funds without selling the policy or disrupting their insurance coverage. These loans are typically interest-free, as they are secured by the policy itself, and they can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses.

Additionally, the cash value can be withdrawn as needed. Policyholders have the option to withdraw a portion of the accumulated cash value in the form of a lump sum. This provides financial flexibility, allowing individuals to access their funds when required, such as during retirement or for other significant life events. Withdrawals may be subject to certain restrictions and fees, and it's important to understand the policy's terms regarding withdrawals to ensure it aligns with the policyholder's financial goals.

The accumulation of cash value in whole life insurance policies offers a unique financial advantage, providing policyholders with a growing asset that can be utilized in multiple ways. This feature makes whole life insurance an attractive option for those seeking long-term financial security and the potential for tax-advantaged savings. It is a powerful tool that allows individuals to build wealth while also ensuring their loved ones are protected with a permanent insurance policy.

AICPA Life Insurance: Understanding Dependent Child Definition

You may want to see also

Death Benefit: A predetermined payout is paid to beneficiaries upon the insured's death

Whole life insurance, often referred to as permanent life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. One of its key features is the death benefit, which is a crucial aspect of the policy's value and purpose. When the insured person passes away, the death benefit is paid out to the designated beneficiaries, ensuring financial security and peace of mind for the loved ones left behind.

The death benefit is a predetermined amount agreed upon between the insurance company and the policyholder. This amount is typically based on the insured's age, health, and other factors considered by the insurer. It serves as a financial safety net, providing a lump sum payment to cover various expenses and financial obligations that may arise after the insured's death. These expenses can include funeral costs, outstanding debts, mortgage payments, or any other financial responsibilities the deceased had.

Upon the insured's death, the beneficiaries named in the policy will receive the death benefit. These beneficiaries can be family members, such as a spouse, children, or parents, or even charitable organizations. The process of claiming the death benefit involves providing the insurance company with the necessary documentation, including proof of death and identification of the beneficiaries. Once the claim is verified, the insurance company will disburse the predetermined amount to the beneficiaries, ensuring a swift and efficient process.

It is essential to understand that the death benefit is a guaranteed payment, provided the premiums are paid as required. Unlike term life insurance, which offers coverage for a specific period, whole life insurance provides lifelong coverage. This means that as long as the premiums are up-to-date, the death benefit will be paid out regardless of the timing of the insured's passing. The policyholder has the flexibility to choose the beneficiaries and can even change them over time, ensuring that the financial protection is tailored to their evolving needs.

In summary, the death benefit is a critical component of whole life insurance assurance, offering financial security and peace of mind. It provides a predetermined payout to beneficiaries upon the insured's death, covering various expenses and ensuring the loved ones are taken care of. With whole life insurance, individuals can have the assurance that their family's financial well-being will be protected, even in the face of unforeseen circumstances.

Borrowing Against Renewable Term Life Insurance: Is It Possible?

You may want to see also

Long-Term Savings: It provides tax-advantaged savings, allowing policyholders to build wealth over time

Whole life insurance, often referred to as 'assurance' in certain regions, is a long-term financial commitment that offers a range of benefits, including a significant focus on long-term savings and wealth accumulation. This type of insurance is designed to provide financial security and peace of mind to policyholders and their beneficiaries over an extended period. One of its key advantages is the potential for tax-advantaged savings, which can be a powerful tool for those looking to build a substantial financial nest egg.

When it comes to long-term savings, whole life insurance offers a structured approach. Policyholders make regular premium payments, which are typically higher than those for term life insurance. These premiums are invested in a variety of assets, including stocks, bonds, and real estate, depending on the insurance company's investment strategy. The beauty of this arrangement is that the earnings from these investments grow tax-free, allowing the policy's cash value to accumulate steadily over time. This tax-advantaged status is a significant benefit, as it enables policyholders to save more efficiently compared to traditional savings accounts or investment vehicles.

As the policyholder, you have the option to borrow against the cash value of your policy, providing access to funds without the need for additional paperwork or interest charges that might be associated with loans. This feature can be particularly useful for major purchases or investments, allowing you to leverage your policy's value. Additionally, the death benefit, which is a guaranteed amount paid to the beneficiary upon your passing, is also tax-free, ensuring that your loved ones receive the full benefit of your policy's value.

The long-term savings aspect of whole life insurance is ideal for those who want to secure their financial future and that of their family. It provides a consistent and reliable way to build wealth, especially when compared to other investment options that may offer less stability and higher risks. With regular contributions and the power of compound interest, policyholders can watch their savings grow, providing a sense of financial security and achievement.

In summary, whole life insurance assurance offers a comprehensive approach to long-term savings, providing tax-advantaged growth and the potential for substantial wealth accumulation. It is a commitment that can pay off in the long run, ensuring financial security and peace of mind for policyholders and their beneficiaries. Understanding the tax benefits and investment strategies associated with this type of insurance is essential for anyone considering it as a long-term financial strategy.

Group Life Insurance: Cashing Out and Claiming Benefits

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers both death benefit protection and a cash value component. The death benefit is a fixed amount paid to the policy's beneficiaries upon the insured's passing. The cash value, on the other hand, accumulates over time and can be borrowed against or withdrawn, providing financial flexibility.

The premium for whole life insurance is determined by various factors, including the insured's age, health, gender, and the desired death benefit amount. Younger and healthier individuals typically pay lower premiums. The premium structure is designed to ensure that the policy remains in force for the entire life of the insured, providing a guaranteed death benefit and cash value accumulation.

Whole life insurance offers several advantages. Firstly, it provides guaranteed coverage for life, ensuring that beneficiaries receive the promised death benefit. Secondly, the cash value component allows policyholders to build a savings element, which can be used for various financial goals. Additionally, whole life insurance offers a fixed premium, providing long-term financial security and predictability.

Yes, one of the key features of whole life insurance is the ability to access the cash value. Policyholders can borrow against the cash value by taking out a loan, which is typically interest-free. Withdrawals can also be made, but it's important to note that excessive withdrawals may reduce the policy's death benefit. It's recommended to consult the policy's terms and conditions or seek professional advice to understand the impact on the policy.

Whole life insurance can be a valuable financial tool for many individuals, but it may not be the best fit for everyone. The cost of a whole life policy can be higher compared to term life insurance, especially for older individuals. It's essential to assess your financial goals, risk tolerance, and long-term financial needs before deciding on a life insurance policy. Consulting with a financial advisor can help determine the most suitable type of insurance coverage.