Life insurance is a financial product designed to provide financial security for individuals and their families in the event of death. However, there are several criticisms and concerns associated with life insurance that have sparked debates among consumers and industry experts. Some argue that life insurance policies can be overly complex, with intricate terms and conditions that may be difficult for the average consumer to fully understand. Others point out that the high costs of insurance premiums can be a burden, especially for those on a tight budget. Additionally, there are concerns about the potential for insurance companies to engage in misleading or aggressive sales tactics, which can lead to customers being sold policies that are not suitable for their needs. These issues have led to calls for better regulation and transparency in the life insurance industry to ensure that consumers are protected and informed about their choices.

What You'll Learn

- High Costs: Premiums can be expensive, especially for older individuals, making it unaffordable for many

- Limited Coverage: Policies may not provide comprehensive coverage for all life stages and needs

- Misleading Sales Practices: Some agents may use aggressive tactics or misrepresent policy details

- Complexity: Understanding the fine print and policy intricacies can be challenging for the average consumer

- Lack of Transparency: Hidden fees and complex terms may lead to unexpected costs and dissatisfaction

High Costs: Premiums can be expensive, especially for older individuals, making it unaffordable for many

Life insurance, while a valuable tool for financial planning, has several drawbacks that are worth considering. One of the most significant issues is the high cost of premiums, which can make it financially burdensome for many individuals, especially those in their later years. As people age, their health and life expectancy become riskier factors for insurance companies, leading to increased premium rates. This can result in older adults finding it nearly impossible to afford the necessary coverage, leaving them vulnerable in the event of unexpected death.

The expense of life insurance premiums is often a significant barrier to entry. For younger individuals, the cost might be manageable, but as time passes and life events occur, the financial commitment can become overwhelming. For instance, a young family with a mortgage, children's education, and other financial obligations may struggle to allocate a substantial portion of their income to insurance premiums. This is further exacerbated for older individuals who might have limited disposable income and are more likely to face health issues that could increase their insurance costs.

The affordability issue is not just limited to individuals but also extends to families. In many cases, life insurance is a crucial component of a family's financial strategy, providing a safety net for loved ones. However, the high premiums can make it challenging for families to afford the coverage they need. This can lead to difficult decisions, such as choosing between adequate insurance and other essential expenses like healthcare, education, or retirement savings.

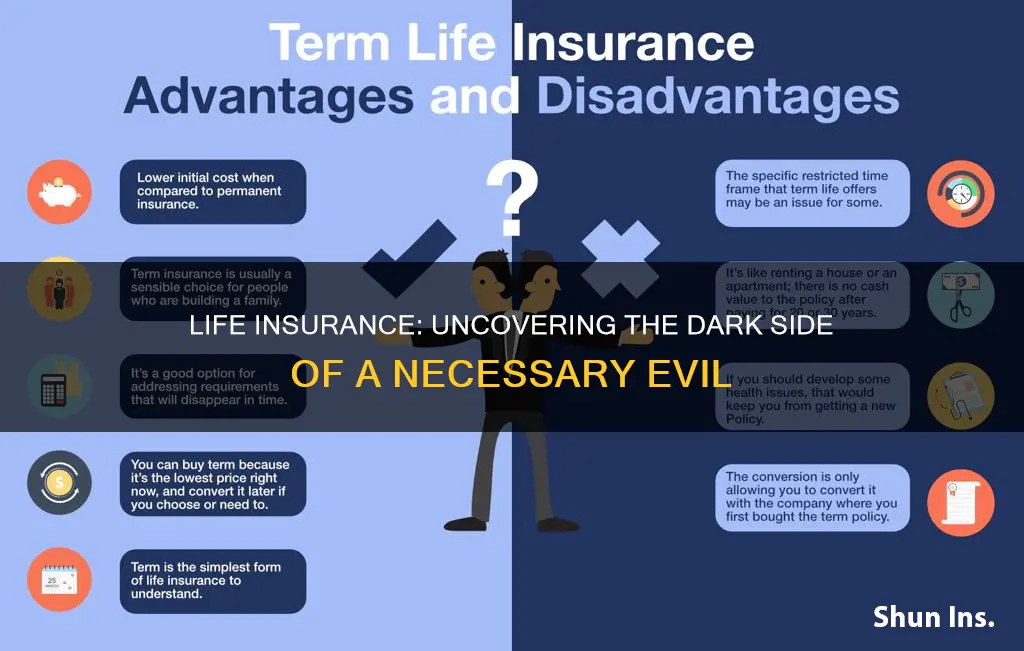

To address this problem, some insurance companies offer various solutions. These include term life insurance, which provides coverage for a specified period, allowing individuals to secure their family's financial future without the long-term commitment of a permanent policy. Additionally, some insurers provide discounts for non-smokers, those with healthy lifestyles, or individuals with no family history of certain medical conditions, making the product more accessible and cost-effective.

In conclusion, the high costs associated with life insurance premiums, especially for older individuals, can be a significant deterrent. It is essential for consumers to carefully consider their financial situation and explore different insurance options to find a suitable and affordable plan. By understanding the potential drawbacks and taking proactive steps, individuals can make informed decisions about their life insurance coverage, ensuring they are adequately protected without breaking the bank.

Texas Life Insurance: A Comprehensive Guide to Coverage

You may want to see also

Limited Coverage: Policies may not provide comprehensive coverage for all life stages and needs

Life insurance is a financial product designed to provide financial security and protection for individuals and their families. However, it is important to recognize that life insurance policies may have certain limitations that can impact their effectiveness in meeting all of an individual's life stage and need requirements. One of the primary concerns is the potential for limited coverage, which can leave individuals and their beneficiaries vulnerable in various life circumstances.

Many life insurance policies offer a fixed amount of coverage, often determined by the policyholder's age, health, and lifestyle factors. While this coverage can be adequate for certain life stages, such as providing financial support for a young family or covering funeral expenses, it may fall short when it comes to more complex and evolving needs. For instance, as individuals progress through different life stages, their financial obligations and goals can change significantly. During their working years, life insurance might be sufficient to cover mortgage payments, car loans, and daily living expenses. However, as they approach retirement, the policy's coverage might not be enough to sustain their desired standard of living, especially if they plan to retire early or have specific retirement goals.

Furthermore, life insurance policies often have limitations in terms of the types of risks they cover. Standard policies typically provide coverage for death due to natural causes or accidents. However, they may exclude coverage for specific conditions or causes of death, such as suicide, self-inflicted injuries, or certain pre-existing medical conditions. This exclusion can leave individuals and their families without the intended financial protection during critical times. For example, a person with a history of mental health issues might find that their life insurance policy does not cover death by suicide, leaving their loved ones without the financial support they need.

To address the issue of limited coverage, individuals should carefully review and understand the terms and conditions of their life insurance policies. It is essential to assess whether the coverage amount is sufficient to meet current and future financial obligations. Policyholders should also consider the possibility of increasing their coverage over time to account for changing circumstances. Additionally, exploring supplementary policies or riders that offer additional benefits, such as critical illness coverage or long-term disability insurance, can help fill the gaps in standard life insurance policies.

In summary, while life insurance is a valuable tool for financial protection, it is crucial to recognize its limitations in providing comprehensive coverage for all life stages and needs. By being aware of these potential shortcomings, individuals can make informed decisions about their insurance choices, ensuring that they have adequate protection throughout their lives. Regularly reviewing and adjusting policies can help individuals adapt to changing circumstances and ensure that their financial security is adequately addressed.

Understanding Voluntary Term Life Insurance: A Comprehensive Guide

You may want to see also

Misleading Sales Practices: Some agents may use aggressive tactics or misrepresent policy details

The life insurance industry, while generally reputable, has faced criticism for certain misleading sales practices employed by some agents and brokers. These tactics can often lead to consumers making uninformed decisions, resulting in potential financial losses and disappointment. Here's an overview of this issue:

Aggressive Sales Techniques: Some insurance agents may adopt aggressive sales approaches, which can be off-putting to potential customers. This includes high-pressure sales pitches, frequent follow-ups, and even door-to-door visits, especially in residential areas. Such tactics may make individuals feel uncomfortable and pressured to make quick decisions without fully understanding the implications. For instance, an agent might claim that a policy is time-sensitive and that the offer won't be available for long, creating a sense of urgency that could cloud judgment.

Misrepresentation of Policy Details: Misrepresenting the terms and conditions of a life insurance policy is another concerning practice. Agents might simplify complex policy language or omit crucial information, making it difficult for customers to comprehend the full scope of their commitment. For example, they may downplay the policy's limitations, exclusions, or the process of claiming benefits, which could lead to unexpected issues when the policyholder needs to make a claim. Misrepresenting the financial implications, such as hidden fees or the potential for policy lapses, can also be detrimental to the consumer.

In some cases, agents might also encourage customers to purchase unnecessary add-ons or riders, which can significantly increase the cost of the policy without providing substantial benefits. This practice can result in policyholders paying more than they initially anticipated, often without fully understanding the added value.

To protect themselves, consumers should always request detailed explanations and written information about the policies they are considering. They should also be cautious of agents who make unrealistic promises or use fear-mongering tactics to push their products. It is essential to compare policies from multiple providers and seek independent financial advice to ensure that the chosen life insurance policy aligns with one's needs and budget.

Being aware of these misleading sales practices can empower individuals to make more informed choices when purchasing life insurance, ensuring they receive the coverage they need without falling victim to aggressive or deceptive tactics.

Join Kotak Life Insurance: Steps to Become an Agent

You may want to see also

Complexity: Understanding the fine print and policy intricacies can be challenging for the average consumer

The life insurance industry, while providing a crucial safety net for families and individuals, often presents a complex web of policies and fine print that can be daunting for the average consumer. Understanding the intricacies of life insurance policies is a challenging task, and many people may find themselves in a position where they are not fully aware of the terms and conditions they are agreeing to. This lack of transparency can lead to several issues and potential problems for policyholders.

One of the primary concerns is the complexity of the language used in life insurance policies. These documents are often filled with technical jargon and legalese, making it difficult for non-experts to comprehend. The fine print may include clauses that are not immediately obvious, such as exclusions, limitations, and conditions that could significantly impact the policyholder's benefits. For instance, some policies might exclude certain pre-existing medical conditions or have waiting periods before coverage begins, which could leave individuals vulnerable in the event of an unforeseen tragedy.

Furthermore, the various types of life insurance policies available, such as term life, whole life, and universal life, each have their own unique features and benefits. Navigating through these options and understanding the differences can be a complex task. Consumers might mistakenly choose a policy that does not suit their needs, leaving them with inadequate coverage or unnecessary expenses. The pressure to make quick decisions during times of grief or financial strain can further complicate matters, leading to hasty choices without a thorough understanding of the policy's long-term implications.

To address this complexity, it is essential for consumers to take the time to carefully review and understand their policies. Seeking professional advice from independent financial advisors or insurance brokers can provide valuable insights and ensure that individuals make informed decisions. These experts can help simplify the process, explain the intricacies, and offer tailored advice based on the consumer's specific circumstances. Additionally, regulatory bodies and consumer protection agencies should continue to work towards improving transparency and providing clear, accessible information to the public.

In summary, the complexity of life insurance policies can be a significant issue, leaving consumers vulnerable to potential pitfalls. By encouraging a more thorough understanding of the fine print and providing accessible resources, individuals can make more informed choices. It is crucial for the industry to prioritize transparency and for consumers to take an active role in educating themselves to ensure they receive the appropriate coverage and protection for their loved ones.

Life Insurance Premium Payment Options: Credit Card Eligibility

You may want to see also

Lack of Transparency: Hidden fees and complex terms may lead to unexpected costs and dissatisfaction

The life insurance industry has often been criticized for a lack of transparency, which can lead to significant issues for policyholders. One of the primary concerns is the presence of hidden fees and complex terms that are not always clearly communicated. When individuals purchase life insurance, they expect a straightforward agreement with defined benefits and costs. However, the reality is often far from transparent, leaving policyholders vulnerable to unexpected financial burdens.

Hidden fees are a common issue, with insurance companies employing various tactics to generate additional revenue. These fees can include administrative charges, rider fees for optional benefits, and even commissions that are not disclosed upfront. For instance, a policyholder might be charged a monthly fee for a critical illness rider, only to discover that the rider's benefits are not as comprehensive as promised or that the fees are significantly higher than expected. Such hidden costs can accumulate over time, impacting the overall value and affordability of the policy.

Complex terms and conditions in life insurance policies are another significant source of dissatisfaction. These policies often contain intricate language and legal jargon, making it challenging for the average consumer to fully understand the coverage and exclusions. For example, a policy might exclude certain pre-existing conditions or specific causes of death, which are not immediately apparent to the policyholder. When a claim is made, the complexity of the policy terms can lead to disputes, with insurance companies sometimes denying claims based on technicalities that the policyholder was unaware of.

The lack of transparency can have severe consequences. Policyholders may find themselves with policies that do not meet their needs or expectations, leading to financial strain when they need the coverage the most. Moreover, the complexity and hidden fees can create a sense of distrust and dissatisfaction, damaging the relationship between the insurance company and the policyholder. It is essential for insurance providers to ensure that their policies are clear, concise, and easily understandable, allowing customers to make informed decisions without hidden surprises.

To address this issue, regulatory bodies and consumer protection organizations should implement stricter guidelines and transparency standards for the life insurance industry. This includes requiring clear and concise policy documentation, mandatory disclosure of all fees and charges, and regular reviews of policy terms to ensure they are fair and equitable. By promoting transparency, the industry can build trust with consumers and ensure that life insurance remains a reliable and beneficial financial product.

Life Coaching and Insurance: Exploring the Possibilities

You may want to see also

Frequently asked questions

While life insurance is a valuable financial tool, it is not without its potential downsides. One common concern is the cost, as life insurance premiums can be expensive, especially for older individuals or those with health issues. Additionally, some people might find the process of obtaining a policy too complex or time-consuming. Another issue could be the potential for over-insurance, where the coverage amount exceeds the actual needs of the individual and their family.

Yes, in some cases, life insurance can create challenges for beneficiaries. If the policyholder dies, the beneficiary must go through a claims process, which can be lengthy and stressful. Miscommunication or administrative errors might lead to delays in receiving the death benefit. Furthermore, if the policy has a loan or surrender value, beneficiaries might face financial complications if they need to access those funds.

Absolutely. Life insurance policies often come with various fees and charges that are not always transparent. These can include surrender charges, policy fees, and administrative costs. Some policies might also have riders or optional benefits that increase the premium but provide additional coverage. It's essential for policyholders to carefully review the policy documents and understand all the associated costs to make informed decisions.

Pre-existing medical conditions or a poor health history can significantly affect life insurance rates and eligibility. Insurers often require medical exams or ask for detailed medical records to assess the risk associated with insuring an individual. Chronic illnesses, smoking habits, obesity, and family medical history can all influence the premium and coverage terms. It's advisable for individuals with health concerns to disclose their medical information accurately to get the best possible policy.

There are several alternatives to consider if traditional life insurance doesn't fit one's needs. Term life insurance, for instance, provides coverage for a specific period, offering a more affordable option for temporary needs. Universal life insurance combines permanent coverage with an investment component, allowing policyholders to build cash value over time. Additionally, whole life insurance offers lifelong coverage and a guaranteed death benefit, but with higher premiums. Other options include annuities and long-term care insurance, which provide different forms of financial protection.