Lab slip, also known as a medical examination report, is a crucial document in the life insurance process. It provides a detailed assessment of an individual's health and medical history, which is essential for insurers to determine the risk associated with insuring a person. This report typically includes information about pre-existing conditions, lifestyle factors, and any recent medical events or treatments. Understanding lab slips is vital for both insurance applicants and providers, as it helps in making informed decisions regarding coverage and premiums, ensuring a fair and transparent process for all parties involved.

What You'll Learn

- Definition: Lab slip is a policy change request, often for premium adjustments

- Process: It involves submitting a request to the insurance company for policy modifications

- Documentation: Required documents include proof of changes and personal details

- Timelines: Processing times vary, typically taking a few days to a week

- Impact: Lab slips can affect policy coverage and premiums

Definition: Lab slip is a policy change request, often for premium adjustments

A lab slip, in the context of life insurance, is a formal document or request that initiates a process of policy modification or adjustment. It is a crucial step when an insurance policyholder or their representative wants to make changes to their existing life insurance policy, particularly regarding premium payments. This process is often initiated when the policyholder's circumstances change, and they need to update their insurance coverage accordingly.

When an individual purchases a life insurance policy, the terms and conditions are agreed upon, including the premium amount to be paid regularly. Over time, various life events can occur, such as a significant increase in income, a change in marital status, the birth of a child, or a major health improvement. These events may prompt the policyholder to request a change in their insurance policy to ensure it remains appropriate and adequate.

The lab slip is a formal request to the insurance company, detailing the proposed changes. It typically includes information such as the policy number, the current premium amount, and the proposed new premium, along with the reasons for the change. For example, if a policyholder's income has increased substantially, they might request a premium adjustment to reflect this new financial status. Similarly, if a policyholder gets married or has a child, they may want to increase the coverage amount, and the lab slip would outline this desired modification.

This process is essential as it ensures that the insurance policy remains relevant and beneficial to the policyholder. It also allows the insurance company to review and approve the changes, ensuring that the policy is still valid and meets the requirements. The lab slip is a standardized form that streamlines the process, making it efficient and organized.

In summary, a lab slip is a critical document in life insurance, facilitating policy adjustments to reflect the policyholder's evolving life circumstances. It is a formal request that initiates the necessary changes, ensuring the policy remains appropriate and up-to-date. This process is a standard practice in the insurance industry, providing a structured approach to policy modifications.

Farmers New World Life Insurance: Legit or a Scam?

You may want to see also

Process: It involves submitting a request to the insurance company for policy modifications

The process of requesting policy modifications for a life insurance policy is a straightforward yet crucial step for policyholders who wish to adapt their coverage to changing circumstances. Here's a detailed breakdown of how to initiate this process:

- Identify the Need for Modification: Before taking any action, policyholders should carefully assess their current insurance coverage and determine if modifications are necessary. This could be due to various reasons such as a change in marital status, the birth of a child, a significant career advancement, or a desire to increase/decrease coverage amount. Understanding the specific need is the first step towards a successful modification.

- Gather Required Information: Once the decision to modify is made, the next step is to compile all the necessary documents and details. This includes personal and financial information such as updated contact details, income/expense statements, medical records (if applicable), and any other relevant documentation that supports the need for the change. Having this information readily available will streamline the process.

- Contact the Insurance Company: Policyholders should reach out to their insurance provider directly. This can typically be done through various channels such as a dedicated customer service line, online chat, or email. When contacting, it's essential to clearly state the purpose of the call or communication, i.e., requesting policy modifications. Providing a concise summary of the required changes is vital.

- Submit the Request: After the initial contact, the insurance company will guide you through the specific steps to submit your request. This might involve filling out an application form, providing additional documentation, or scheduling a meeting with a representative. Ensure that you adhere to any deadlines or requirements set by the insurance company to avoid delays.

- Review and Approve: Once the request is submitted, the insurance company will review the provided information. They may conduct a background check, assess the policyholder's financial situation, and consider any new medical information. If the request is approved, the company will proceed with the modifications, and the policyholder will receive updated documentation reflecting the changes. If not, the company will provide a reason for the rejection and may suggest alternative solutions.

This process ensures that policyholders can adapt their life insurance policies to better suit their evolving needs and circumstances. It's a standard procedure that allows for flexibility and ensures that the insurance coverage remains relevant and beneficial to the policyholder.

Employment Status and Life Insurance: What's the Connection?

You may want to see also

Documentation: Required documents include proof of changes and personal details

When it comes to life insurance, understanding the concept of a 'lab slip' is crucial, especially if you're undergoing any changes that might impact your policy. A lab slip, in this context, refers to a document that provides proof of changes in your personal circumstances or medical conditions. This could include any modifications to your lifestyle, health, or other factors that are relevant to your insurance coverage. The primary purpose of providing such documentation is to ensure that your insurance policy remains accurate and up-to-date, reflecting your current situation.

The required documents for this process typically include proof of changes and personal details. For instance, if you've recently started a new, more physically demanding job, you would need to provide evidence of this change. This could be in the form of a job offer letter, employment contract, or even a pay stub to demonstrate the new income level. Similarly, if you've made significant lifestyle changes, such as quitting smoking or starting a new exercise regimen, you should provide documentation to support these changes. This might include medical certificates, fitness tracker data, or even a written statement from your doctor.

In the case of medical changes, such as a new diagnosis or a change in existing health conditions, medical records and reports become essential. These documents should detail the new or updated medical information, including any test results, diagnoses, and treatment plans. It's important to ensure that these records are accurate and up-to-date, as they will be used to assess the impact of these changes on your insurance policy.

Personal details that might require documentation include changes in address, contact information, or family status. For instance, if you've recently moved to a new city, you should provide proof of your new address, such as a utility bill or a lease agreement. Similarly, if you've gotten married or divorced, you would need to provide legal documents or certificates to update your personal details in the insurance policy.

In summary, the documentation process for life insurance, particularly when changes occur, involves providing proof of these changes and personal details. This ensures that your insurance policy remains relevant and accurate, reflecting your current circumstances. It's a crucial step to ensure that you receive the appropriate coverage and that your insurance provider can make informed decisions regarding your policy.

Tata AIA Life Insurance: Comprehensive Coverage, Peace of Mind

You may want to see also

Timelines: Processing times vary, typically taking a few days to a week

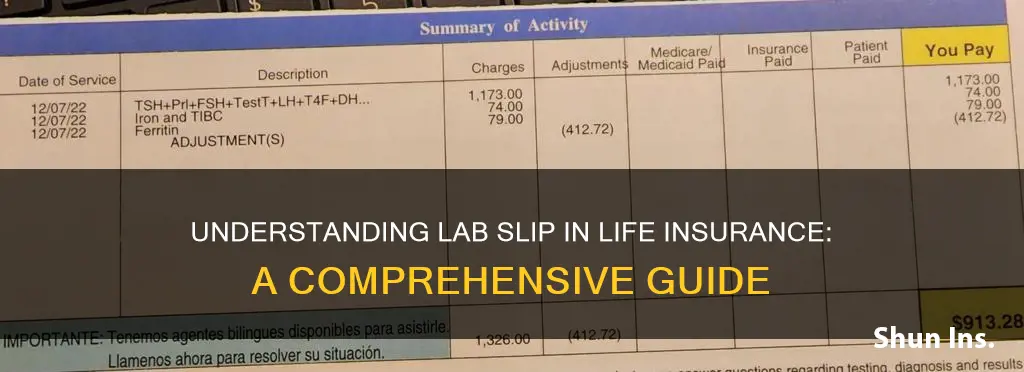

When it comes to life insurance, understanding the process and timeline of a lab slip is crucial. A lab slip, in this context, refers to a medical report or a laboratory test result that is required by the insurance company to assess an individual's health and eligibility for coverage. This document is an essential part of the underwriting process, as it provides valuable information about the applicant's medical history and current health status.

The processing time for a lab slip can vary depending on several factors. Typically, it takes a few days to a week for the insurance company to receive and review the medical report. This timeline is standard and ensures that the insurance provider has sufficient time to analyze the information and make an informed decision. It is important to note that the duration may differ based on the complexity of the case and the specific insurance company's procedures.

During this processing period, the insurance underwriter will carefully examine the lab slip to assess the applicant's health risks. They will look for any pre-existing conditions, recent medical procedures, or unusual test results that may impact the insurance coverage. This thorough review is necessary to ensure that the insurance company can provide appropriate coverage while managing potential risks.

In some cases, the insurance company might request additional information or clarification from the applicant or their medical provider. This could further extend the processing time, but it is a standard step to ensure accuracy and completeness in the underwriting process. It is advisable for applicants to be patient and provide any necessary details promptly to facilitate a smoother and faster processing experience.

Understanding the timeline for lab slip processing is essential for applicants to manage their expectations and plan accordingly. While a few days to a week is the typical range, it is always beneficial to stay in communication with the insurance company to ensure a timely resolution. This awareness can help individuals navigate the life insurance application process with more confidence and efficiency.

Understanding Life Insurance Solicitation Rules: Purpose and Impact

You may want to see also

Impact: Lab slips can affect policy coverage and premiums

A lab slip, in the context of life insurance, refers to a document or report generated by a medical laboratory that provides detailed information about an individual's health status, including any medical conditions or treatments they have undergone. These slips are crucial in the underwriting process, as insurance companies use them to assess the risk associated with insuring a particular individual. The content of a lab slip can significantly impact the terms and conditions of a life insurance policy, as well as the premiums that the insured person will have to pay.

When a lab slip reveals pre-existing medical conditions or treatments, it can directly influence the coverage provided by the insurance policy. Insurance companies often have specific clauses in their policies that address pre-existing conditions. If a policyholder has a condition that was not disclosed or was misrepresented during the application process, the insurance company may deny coverage for that particular condition or even cancel the policy altogether. For instance, if a person has a history of heart disease and this was not mentioned during the application, the insurance company might not cover any claims related to heart-related issues.

Furthermore, the presence of certain medical conditions or treatments on a lab slip can lead to adjustments in the policy's coverage limits. Insurance companies may impose higher premiums or restrict coverage for individuals with specific health risks. For example, a person with a history of cancer might be charged higher premiums, and the policy may exclude coverage for cancer-related treatments or complications. The impact of lab slips on premiums is significant, as it can result in increased financial obligations for the policyholder, especially if they require medical attention in the future.

In some cases, lab slips can also affect the overall cost of life insurance. Insurance companies may offer different premium rates based on the information provided in these reports. For instance, a person with a healthy blood pressure reading might be offered a lower premium rate compared to someone with hypertension. The underwriting process takes into account various health factors, and lab slips play a vital role in determining the risk profile of the applicant. This can lead to a more accurate assessment of the insurance company's potential losses, which, in turn, influences the final premium amount.

In summary, lab slips are essential documents that provide critical health information to insurance companies during the underwriting process. The impact of this information can be far-reaching, affecting policy coverage, premiums, and the overall cost of life insurance. It is crucial for individuals to disclose all relevant medical details accurately to ensure they receive appropriate coverage and to avoid any potential issues with their insurance claims. Understanding the implications of lab slips is essential for making informed decisions when purchasing life insurance.

California Life Insurance Test: Challenging or a Breeze?

You may want to see also

Frequently asked questions

A lab slip, also known as a medical examination report or lab results, is a document that provides details of a policyholder's medical tests and health assessments. When applying for life insurance, insurers often require applicants to undergo a medical examination, which may include blood tests, urine analysis, and other health checks. The lab slip summarizes these test results, allowing insurers to assess the applicant's health and determine the terms of insurance coverage.

Lab slips are crucial as they offer a comprehensive view of an individual's health status. Insurers use this information to evaluate the risk associated with insuring a particular individual. By reviewing lab results, insurers can identify any potential health concerns or pre-existing conditions that may impact the policy's terms, premiums, or even eligibility for coverage.

The information provided in lab slips can significantly influence the cost of life insurance premiums. If the lab results indicate good health or low-risk factors, the insurer may offer more favorable rates. Conversely, if there are health concerns or pre-existing conditions, the premiums might be higher or the insurer may require additional coverage or exclusions.

Yes, lab slips can be a factor in policy adjustments. If a policyholder's health status changes significantly, as indicated by updated lab results, the insurer may require a policy review. This could lead to changes in premium rates, coverage amounts, or even policy cancellations if the insurer deems the risk too high.

Lab slip information is typically confidential and protected under privacy laws. Insurers are required to handle and store this data securely. The confidentiality of lab slips ensures that personal health information remains private and is only shared with the policyholder and the insurer as necessary for the application process and policy management.