Transamerica offers a range of life insurance products, including term life insurance and whole life insurance. Their term life insurance includes the Trendsetter Super Series policy, which offers a minimum of $25,000 in coverage for terms of 10 to 30 years, and the Trendsetter LB policy, which provides similar coverage amounts and terms but with the addition of health-based riders. Transamerica's whole life insurance provides coverage ranging from $25,000 to $2 million, with a guaranteed death benefit, a guaranteed minimum rate of return on cash value, and fixed premiums. While Transamerica's policies offer excellent rates and coverage amounts, the company has received a higher-than-average number of complaints, particularly regarding delays in paying claims.

| Characteristics | Values |

|---|---|

| Type of Insurance | Term life insurance |

| Coverage | $25,000 to $2 million |

| Term | 10, 15, 20, 25 or 30 years |

| Riders | Terminal illness accelerated death benefit, children's benefit, income protection |

| Application Process | Work with an agent |

| Policy Illustrations | Reliable |

| Policy Costs | Low internal policy costs for permanent policies |

| Trendsetter Super Policy | Competitive rates |

What You'll Learn

Term life insurance policies

Transamerica offers two term life insurance policies: the Trendsetter Super Series and the Trendsetter LB policy. The Trendsetter Super Series policy offers a minimum coverage of $25,000 for terms of 10, 15, 20, 25, or 30 years. The coverage can go up to $2 million without a medical exam, provided you qualify. This policy also includes an automatic terminal illness accelerated death benefit endorsement and can be further customized with one of four available riders.

The Trendsetter LB policy offers coverage ranging from $25,000 to $2 million for the same term lengths as the Super Series. This policy allows you to lock in your rate, and if you qualify, you may be able to forgo a medical exam if you are purchasing coverage of $2 million or less. Additionally, the Trendsetter LB policy automatically includes three health-based riders that provide a portion of the death benefit if the insured becomes terminally, chronically, or critically ill.

One of the key advantages of term life insurance is its simplicity and cost-effectiveness. Policyholders know exactly how much coverage they have and for how long, making it easy to plan and ensure financial security during the policy's duration. Additionally, term life insurance policies offer flexibility, allowing policyholders to adjust their coverage or term length if their circumstances change.

When considering a term life insurance policy, it is essential to review the policy's specifics, including the coverage amount, term length, and any included riders or benefits. It is also worth noting that term life insurance policies do not build cash value over time, unlike some permanent life insurance policies. However, term life insurance can be an excellent option for those seeking straightforward and affordable financial protection for their loved ones.

Easy Ways to Complete a Telephone App Life Insurance

You may want to see also

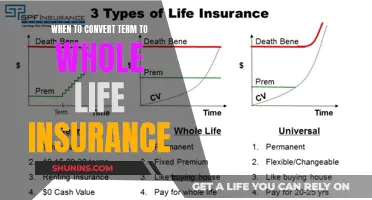

Permanent life insurance policies

Transamerica offers both term and permanent life insurance policies. Permanent life insurance policies, also known as whole life insurance, offer a guaranteed death benefit, a guaranteed minimum rate of return on cash value, and fixed premiums. Transamerica's permanent life insurance policies are notable for their highly reliable policy illustrations, which provide confidence in the expected gains in cash value. The company's internal policy costs for permanent policies are also relatively low.

Transamerica Lifetime whole life insurance offers coverage ranging from $25,000 to $2 million. All policies include a terminal illness accelerated death benefit rider, which provides a payout if the insured is diagnosed with a terminal illness. Additionally, there are nine other riders available for customization, including a children's benefit rider and an income protection option that allows beneficiaries to control how and when they receive their death benefit.

While Transamerica's permanent life insurance policies offer stability and guaranteed benefits, it's important to consider the company's above-average complaint level. For the past three years, Transamerica's complaint level has been higher than the industry average, with delays in paying claims being the most common issue. However, the cash value generally builds well in the early years of their cash value policies.

In contrast to permanent life insurance, Transamerica also offers term life insurance policies, such as the Trendsetter Super Series and the Trendsetter LB. These policies provide coverage for a specified term, such as 10, 15, or 30 years, and offer competitive rates and coverage amounts. The Trendsetter Super Series policy includes an automatic terminal illness accelerated death benefit endorsement, and both policies offer additional customization through riders.

Overall, Transamerica's permanent life insurance policies may be a good choice for individuals seeking stable and guaranteed benefits. However, it is essential to weigh the pros and cons, considering the company's higher-than-average complaint level and delays in paying claims.

Life Insurance: What Can Void Your Policy?

You may want to see also

Trendsetter Super Series policy

Transamerica offers two term life insurance policies, one of which is the Trendsetter Super Series policy. This policy provides a minimum coverage of $25,000 for terms of 10, 15, 20, 25, or 30 years. The coverage can go up to $2 million without a medical exam, provided the insured qualifies. The Trendsetter Super Series policy includes an automatic terminal illness accelerated death benefit endorsement, which means that a portion of the death benefit is made available if the insured becomes terminally ill. This policy can be further customized with one of four available riders. Some of the riders include a children's benefit rider and an income protection option that allows control over how and when beneficiaries receive their death benefit.

The Trendsetter Super Series policy is best suited for shoppers seeking term coverage with some optional riders. It offers competitive rates and the flexibility to choose from a range of coverage amounts and terms. The policy also provides reliable policy illustrations, giving customers confidence in the expected gains in cash value. Additionally, Transamerica's internal policy costs for permanent policies are relatively low.

However, it is important to note that Transamerica has received a higher-than-average number of complaints in recent years, particularly regarding delays in paying claims. When considering this policy, it is essential to weigh the benefits against the potential drawbacks and decide if it aligns with your specific needs and requirements.

Overall, the Trendsetter Super Series policy offered by Transamerica provides a solid option for those seeking term life insurance with customizable features and competitive rates. It allows individuals to secure financial protection for their loved ones, with the added benefit of optional riders to enhance the coverage.

Whole Life Insurance: Comprehensive Cover, Explained

You may want to see also

Whole life insurance

Transamerica offers both term and whole life insurance policies. Whole life insurance is a policy with a guaranteed death benefit, a guaranteed minimum rate of return on cash value, and fixed premiums. Transamerica's whole life insurance, Transamerica Lifetime, offers coverage ranging from $25,000 to $2 million. All policies include a terminal illness accelerated death benefit rider, which pays out a portion of the death benefit if the insured is diagnosed with a terminal illness. There are nine additional riders available, including a children's benefit rider and an income protection option that allows beneficiaries to control how and when they receive their death benefit.

One of the key features of whole life insurance is the guaranteed death benefit. This means that the insurance company guarantees a payout to the beneficiaries upon the insured's death, as long as the policy is in force. The death benefit can provide financial support to loved ones, cover final expenses, or be used to continue the insured's legacy.

When considering whole life insurance, it is important to weigh the benefits against the costs and potential drawbacks. Whole life insurance policies tend to have higher premiums than term life insurance policies, and the cash value component may not perform as well as other investment options. Additionally, it is important to carefully review the terms and conditions of the policy, including any riders or add-ons, to ensure that it meets your specific needs and requirements.

Universal Life Insurance: An Asset or a Liability?

You may want to see also

Riders and customisation options

Transamerica offers a range of riders and customisation options for its life insurance policies. The specific options available depend on the type of policy chosen.

The Trendsetter Super Series policy includes an automatic terminal illness accelerated death benefit endorsement and can be customised with one of four riders. However, the exact nature of these four riders is not specified.

The Trendsetter LB policy automatically includes three health-based riders that make a portion of the death benefit available if the insured becomes terminally, chronically, or critically ill.

Transamerica's whole life insurance policies also come with a terminal illness accelerated death benefit rider. Additionally, they can be customised with one or more of the nine riders currently available, including a children's benefit rider and an income protection option that allows beneficiaries to control how and when they receive their death benefit.

Ghetto Residents' Guide to Getting Life Insurance

You may want to see also

Frequently asked questions

Transamerica is a company that offers life insurance policies. They have two term life insurance policies and one whole life insurance policy.

The Trendsetter Super Series policy and the Trendsetter LB policy. The former offers a minimum of $25,000 in coverage for terms of 10, 15, 20, 25 or 30 years, with the option to get up to $2 million in coverage without a medical exam if you qualify. The latter offers the same amount of coverage and terms, but with the added benefit of locking in your rate.

The Transamerica Lifetime whole life insurance policy offers coverage ranging from $25,000 to $2 million. It includes a terminal illness accelerated death benefit rider and the option to add additional riders for further customization.

Transamerica offers highly reliable policy illustrations, giving customers confidence in expected cash value gains. Their internal policy costs for permanent policies are also low.