Suze Orman, a renowned personal finance expert, has dedicated her career to helping individuals make informed financial decisions. When it comes to life insurance, Orman emphasizes the importance of understanding your needs and choosing the right type of coverage. She recommends term life insurance for those seeking affordable and straightforward protection, especially for young families or individuals with financial dependents. This type of policy provides a death benefit for a specified term, offering peace of mind without the complexity of permanent insurance. Orman also highlights the value of whole life insurance for long-term financial planning, as it combines insurance with a savings component, allowing for potential investment growth over time. Her advice focuses on finding the best fit for individual circumstances, ensuring that life insurance aligns with one's financial goals and priorities.

| Characteristics | Values |

|---|---|

| Term Life Insurance | Suze Orman recommends term life insurance, which provides coverage for a specific period, typically 10, 20, or 30 years. This type of policy is often more affordable and suitable for those who want coverage for a particular period, such as until a child is financially independent or a mortgage is paid off. |

| Permanent Life Insurance | She also suggests permanent life insurance, which offers lifelong coverage and includes a cash value component that can be invested. This type of policy provides both insurance and a savings element, allowing individuals to build wealth over time. |

| Universal Life Insurance | Universal life insurance is another option, offering flexible premiums and potential for higher returns on the cash value. It provides permanent coverage and allows policyholders to adjust their premiums and death benefit over time. |

| Needs-Based Approach | Orman emphasizes a needs-based approach, suggesting that individuals calculate their potential future expenses and ensure their life insurance coverage matches those needs. This includes considering future education costs, retirement expenses, and other financial obligations. |

| Adequate Coverage | She advises individuals to determine their "needs-based death benefit," which is the amount needed to cover their financial obligations and provide for their dependents. This amount should be regularly reviewed and adjusted as circumstances change. |

| Avoid Over-Insuring | Orman warns against over-insuring, as it can lead to unnecessary financial burden. She suggests that individuals should not buy more life insurance than they need, as the primary goal is to provide for loved ones, not to leave a large estate. |

| Review and Adjust | Regularly reviewing and adjusting life insurance policies is essential. Orman recommends reevaluating coverage at least once a year or when significant life events occur, such as marriage, the birth of a child, or a major purchase. |

| Compare Options | She encourages consumers to compare different life insurance policies and providers to find the best fit. This includes understanding the policy's features, costs, and any associated fees. |

| Seek Professional Advice | Orman advises seeking professional advice from a financial advisor or insurance specialist to ensure individuals choose the right type of life insurance for their specific needs and financial situation. |

What You'll Learn

- Term Life: Suze Orman suggests term life insurance for temporary coverage

- Whole Life: She recommends whole life for long-term financial security

- Needs-Based: Orman advises on life insurance tailored to individual financial needs

- Cost-Effective: She emphasizes the importance of affordable and accessible life insurance

- Review and Adjust: Regularly review and adjust life insurance policies

Term Life: Suze Orman suggests term life insurance for temporary coverage

Suze Orman, a renowned personal finance expert, often emphasizes the importance of term life insurance as a practical and cost-effective solution for individuals seeking temporary coverage. This type of insurance provides a safety net for a specific period, ensuring financial security for loved ones during that time. Orman's recommendation for term life insurance is particularly appealing due to its straightforward nature and ability to offer peace of mind without unnecessary complications.

Term life insurance is designed to cover a predetermined period, typically ranging from 10 to 30 years. During this term, the policy provides a death benefit to the designated beneficiaries if the insured individual passes away. The simplicity of this arrangement is a key advantage, as it allows individuals to focus on their financial goals and priorities without the added complexity of permanent insurance policies. Orman suggests that term life insurance is ideal for those who want coverage for a specific period, such as covering mortgage payments, providing for children's education, or ensuring financial stability for a particular life stage.

One of the primary benefits of term life insurance is its affordability. Since the coverage is limited to a specific duration, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for individuals who require insurance for a temporary period but may not have the financial resources to commit to a more expensive long-term policy. Orman's advice often includes encouraging people to consider the duration of their financial obligations when deciding on the term length of their life insurance.

When choosing a term life insurance policy, Orman recommends considering the following factors. Firstly, evaluate your current financial obligations and determine the coverage amount needed to secure your loved ones' financial future during the specified term. Secondly, assess your financial situation and choose a term length that aligns with your ability to afford the premiums. Longer terms may provide more comprehensive coverage but could also result in higher costs. Lastly, ensure that the policy includes a conversion option, allowing you to convert the term life insurance into a permanent policy if desired, providing flexibility and long-term security.

In summary, Suze Orman's recommendation for term life insurance highlights its suitability for temporary coverage and its ability to offer financial protection without unnecessary complexity. By understanding the duration of one's financial responsibilities and assessing personal financial capabilities, individuals can make informed decisions about term life insurance, ensuring they have the right coverage at the right price for their specific needs. This approach empowers individuals to take control of their financial future and provide for their loved ones with confidence.

Understanding Top-Up: Enhancing Your Life Insurance Coverage

You may want to see also

Whole Life: She recommends whole life for long-term financial security

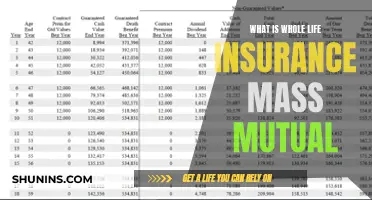

Suze Orman, a renowned personal finance expert, often emphasizes the importance of whole life insurance for individuals seeking long-term financial security. This type of insurance provides a comprehensive solution to various financial needs, offering both an insurance component and an investment element.

Whole life insurance is a permanent policy, meaning it remains in force for the entire life of the insured individual. One of its key advantages is the guaranteed death benefit, ensuring that the beneficiaries receive a specified amount upon the insured's passing. This aspect provides a sense of financial security and peace of mind, knowing that your loved ones will be taken care of regardless of life's uncertainties.

In addition to the death benefit, whole life insurance accumulates cash value over time. This cash value grows tax-deferred and can be borrowed against or withdrawn, providing financial flexibility. Orman suggests that this feature is particularly beneficial for long-term financial goals, such as funding education, starting a business, or planning for retirement. The cash value can be utilized to meet these needs without disrupting the insurance coverage.

Another advantage of whole life insurance is its stability and predictability. Unlike term life insurance, which has a specific period of coverage, whole life insurance remains constant throughout the insured's life. This predictability allows individuals to plan and budget effectively, knowing that their financial obligations are covered for the long term.

Orman's recommendation of whole life insurance highlights its ability to provide financial security and flexibility. By combining insurance and investment elements, whole life policies offer a comprehensive solution for individuals seeking to protect their loved ones and achieve their long-term financial goals. It is a powerful tool in an individual's financial arsenal, ensuring a stable and secure future.

Life Insurance: Can They Access Private Lab Results?

You may want to see also

Needs-Based: Orman advises on life insurance tailored to individual financial needs

Suze Orman, a renowned personal finance expert, emphasizes the importance of needs-based life insurance, which is designed to provide financial security based on an individual's unique circumstances and goals. This approach ensures that the insurance coverage is tailored to meet specific needs, offering a more personalized and effective solution compared to one-size-fits-all policies.

When determining the appropriate life insurance, Orman suggests considering several key factors. Firstly, the insurance should cover the expenses associated with raising a family, including education costs, extracurricular activities, and general living expenses. For individuals with dependents, this coverage is crucial to ensure their financial well-being in the event of the insured's passing. Secondly, it should account for any outstanding debts, such as mortgages, car loans, or personal debts. By covering these liabilities, the policy helps to alleviate the financial burden on the beneficiaries and ensures a smoother transition to a new financial reality.

The needs-based approach also takes into account the individual's income and earning potential. Orman recommends that the life insurance policy should be sufficient to replace a significant portion of the insured's income, allowing the beneficiaries to maintain their standard of living and cover essential expenses. This is particularly important for those with primary earners in the household, as the loss of income could have a devastating impact on the family's financial stability.

Additionally, Orman encourages individuals to consider their long-term financial goals. For instance, those planning to start a business or save for retirement may require a different level of coverage compared to someone who is debt-free and has no immediate financial obligations. By assessing these goals, individuals can ensure that their life insurance policy aligns with their future aspirations and provides the necessary support.

In summary, Suze Orman's recommendation for life insurance is a needs-based approach, which involves customizing the policy to address individual financial responsibilities, income, and long-term objectives. This personalized strategy ensures that the insurance coverage is both comprehensive and relevant, providing peace of mind and financial security for individuals and their families.

Cholesterol and Life Insurance: How Are They Classified Together?

You may want to see also

Cost-Effective: She emphasizes the importance of affordable and accessible life insurance

Suze Orman, a renowned personal finance expert, strongly advocates for the importance of cost-effective life insurance. She believes that life insurance should be accessible and affordable to everyone, not just a luxury for the wealthy. Orman emphasizes that having a life insurance policy is a crucial aspect of financial planning, as it provides financial security for your loved ones in the event of your untimely demise.

When it comes to cost-effectiveness, Orman suggests that individuals should focus on term life insurance. Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years, and it is generally more affordable than permanent life insurance. This type of policy is ideal for those who want to ensure their family's financial stability during the years when they are most dependent on the primary income earner. By choosing a term policy, you can get the necessary coverage without breaking the bank.

One of the key strategies Orman recommends is to shop around and compare quotes from different insurance providers. The insurance industry is highly competitive, and prices can vary significantly. By obtaining multiple quotes, you can find the most competitive rates and choose a policy that fits your budget without compromising on coverage. Additionally, Orman suggests considering the option of increasing your policy's coverage over time as your financial situation improves.

Another aspect of cost-effectiveness that Orman highlights is the importance of understanding the various factors that influence insurance premiums. Age, health, smoking status, and the amount of coverage desired are all factors that can impact the cost. For instance, younger individuals often qualify for lower premiums, and non-smokers or those with a healthy lifestyle may also benefit from reduced rates. By being aware of these factors, you can make informed decisions to keep your insurance costs as low as possible.

In summary, Suze Orman's recommendation for cost-effective life insurance is centered around term life policies, shopping around for quotes, and understanding the factors that influence premiums. By following her advice, individuals can ensure they have the necessary financial protection without incurring excessive costs, making life insurance a more accessible and affordable option for everyone.

Stranger-Owned Life Insurance: A Unique Financial Strategy Explained

You may want to see also

Review and Adjust: Regularly review and adjust life insurance policies

Life insurance is a crucial financial tool, and regular reviews and adjustments are essential to ensure it remains suitable and effective. Suze Orman, a renowned personal finance expert, emphasizes the importance of periodically assessing and modifying life insurance policies to align with changing circumstances and goals. Here's a detailed guide on why and how to review and adjust your life insurance:

Understanding the Need for Review: Life insurance is not a one-time purchase; it's a long-term commitment. Over time, your life, finances, and goals evolve. What was once an adequate policy might no longer meet your needs. Reviewing your life insurance regularly allows you to make necessary adjustments to ensure you have the right coverage at the right time. This process is particularly important when significant life events occur, such as marriage, the birth of a child, purchasing a home, or major career changes. These events can impact your risk profile and the amount of coverage you require.

Reviewing Policy Details: When reviewing your life insurance, start by examining the policy's terms and conditions. Check the coverage amount, which should ideally be a multiple of your annual income to provide a safety net for your family. Assess the policy's duration and ensure it aligns with your long-term goals. For term life insurance, consider the length of the term, as this determines how long the coverage will last. If you have permanent life insurance, review the death benefit and ensure it is sufficient to cover your family's needs. Also, check for any additional benefits or riders that might be worth keeping or modifying.

Assessing Your Current Situation: Evaluate your current financial and personal circumstances. Calculate your family's living expenses and consider any future financial goals, such as funding your child's education or paying off a mortgage. If your income has increased, you might need to increase your life insurance coverage to ensure your family can maintain their standard of living. Conversely, if you've paid off debts or downsized, you may have less reliance on the death benefit, allowing for potential adjustments to lower costs.

Adjusting for Changing Needs: Based on your review, make the necessary adjustments to your policy. If you've had a significant life event, such as a new baby or a career advancement, you might need to increase your coverage. For instance, a new parent might consider a larger policy to provide for their child's future. Conversely, if you've experienced a major life change that reduces your risk, like paying off a large debt, you can explore options to decrease your insurance costs. Adjustments can include increasing or decreasing the coverage amount, extending or shortening the term, or adding or removing riders.

Seeking Professional Advice: When reviewing and adjusting your life insurance, consider consulting a financial advisor or insurance professional. They can provide valuable insights and help you navigate the complexities of policy adjustments. These experts can ensure that any changes you make are aligned with your overall financial strategy and goals. Additionally, they can assist in finding the best options to suit your needs, whether it's term life, whole life, or universal life insurance.

Regularly reviewing and adjusting your life insurance is a proactive approach to financial planning. It ensures that your policy remains relevant and effective, providing the necessary protection for your loved ones when it matters the most. By following Suze Orman's recommendations and staying vigilant about your insurance needs, you can make informed decisions that contribute to a secure financial future.

Life Insurance: Haven Life's Gender Gap Study

You may want to see also

Frequently asked questions

Suze Orman often advocates for term life insurance, which provides coverage for a specific period, usually 10, 20, or 30 years. This type of policy offers a straightforward and cost-effective way to secure financial protection for loved ones during the years when they are most dependent on the income.

Term life insurance is generally more affordable than permanent life insurance (whole life or universal life) because it has no cash value accumulation and focuses solely on providing a death benefit. Orman believes that the primary goal is to ensure financial security for a defined period, and term insurance meets this need efficiently.

Orman often highlights the importance of shopping around and comparing policies from different insurers. She suggests that individuals should look for policies with no-lapse guarantees, which ensure that the policy remains in force even if premiums are missed, and she recommends getting quotes from multiple providers to find the best rates and coverage.

A no-lapse guarantee protects policyholders from policy lapsation, which can occur if they miss premium payments. With this guarantee, the policy remains in force even if the insured individual becomes unable to pay premiums, ensuring that the intended beneficiaries receive the death benefit as planned.

Orman advises that the term length should align with the specific needs of the individual and their family. For example, if the primary goal is to cover mortgage payments and children's education for the next 20 years, a 20-year term policy would be appropriate. She emphasizes the importance of regularly reviewing and adjusting policies as life circumstances change.