MetLife offers a range of whole life insurance policies designed to provide long-term financial security and peace of mind. These policies offer a combination of death benefit protection and a cash value component that grows over time. Whole life insurance from MetLife can be tailored to individual needs, offering a permanent coverage solution with guaranteed death benefits and a flexible investment component. With various policy options, including different premium payment terms and riders, MetLife's whole life insurance can be a comprehensive financial tool for those seeking a stable and reliable insurance solution.

What You'll Learn

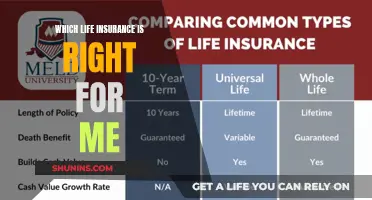

- Term Life: MetLife offers term life insurance, providing coverage for a set period

- Whole Life: Whole life insurance offers lifelong coverage with a guaranteed death benefit

- Universal Life: This type allows policyholders to adjust premiums and death benefits over time

- Variable Life: Variable life insurance offers investment options and potential higher returns

- Guaranteed Issue: MetLife provides guaranteed issue whole life, accessible without medical exams

Term Life: MetLife offers term life insurance, providing coverage for a set period

MetLife, a well-known insurance provider, offers a range of life insurance products, including term life insurance, which is a popular choice for individuals seeking coverage for a specific period. This type of insurance provides financial protection for a predetermined duration, offering peace of mind and security to policyholders and their loved ones.

Term life insurance from MetLife is designed to be straightforward and flexible. It offers coverage for a set term, typically ranging from 10 to 30 years, depending on the policyholder's needs and preferences. During this period, the insurance company guarantees a death benefit if the insured individual passes away. This benefit is paid out to the designated beneficiaries, providing them with a financial safety net. The simplicity of term life insurance lies in its focus on a defined period, making it an excellent option for those who want coverage for a specific milestone or goal, such as paying off a mortgage or funding a child's education.

One of the advantages of MetLife's term life insurance is the potential for cost-effectiveness. Since the coverage is limited to a set term, the premiums are generally lower compared to permanent life insurance policies. This affordability makes it accessible to a wide range of individuals, allowing them to secure their loved ones' financial future without incurring high insurance costs. Moreover, term life insurance can be easily adjusted or renewed at the end of the term, providing flexibility as your life circumstances change.

When considering MetLife's term life insurance, it is essential to evaluate your specific needs. The insurance company offers various policy options, allowing you to choose the coverage amount and term length that best suit your requirements. You can also explore additional riders or optional benefits to customize the policy further and ensure comprehensive protection.

In summary, MetLife's term life insurance provides a practical and affordable solution for individuals seeking coverage for a defined period. With its flexibility, cost-effectiveness, and customizable options, this type of insurance empowers policyholders to make informed decisions about their financial security and the well-being of their loved ones.

Understanding Life Insurance: Criteria, Benefits, and Coverage

You may want to see also

Whole Life: Whole life insurance offers lifelong coverage with a guaranteed death benefit

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, hence the name. It is a popular choice for those seeking long-term financial security and peace of mind. One of the key advantages of whole life insurance is the guaranteed death benefit, which means that the insurance company promises to pay out a specific amount to the policyholder's beneficiaries upon the insured's death. This guarantee is a significant feature, ensuring that the financial needs of the family or beneficiaries are met, regardless of when the insured passes away.

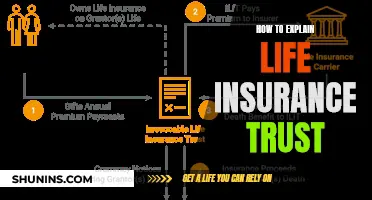

MetLife, a well-known insurance provider, offers various whole life insurance policies tailored to meet different financial needs and goals. When considering whole life insurance from MetLife, it's essential to understand the different options available. The company provides two main types of whole life insurance: traditional whole life and universal whole life. Traditional whole life insurance offers a fixed premium and a guaranteed death benefit, ensuring that the policyholder's beneficiaries receive the specified amount at the time of death. This type of policy is ideal for those seeking long-term financial protection and a stable investment component.

Universal whole life insurance, on the other hand, offers more flexibility and potential for long-term savings. With this type of policy, the policyholder can adjust the premium payments and even take out loans against the cash value of the policy. Over time, the cash value can accumulate, providing a valuable financial asset. MetLife's universal whole life insurance allows policyholders to build a substantial cash value, which can be used for various purposes, such as funding education, starting a business, or supplementing retirement income.

The benefits of whole life insurance from MetLife extend beyond the guaranteed death benefit. Policyholders can also access the cash value of the policy, which grows tax-deferred. This feature allows individuals to build a substantial financial reserve that can be borrowed against or withdrawn to meet various financial needs. Additionally, whole life insurance policies typically have an investment component, allowing the policy to grow over time, providing potential for higher returns compared to other investment vehicles.

In summary, MetLife offers a comprehensive range of whole life insurance options to suit different financial objectives. Whether it's the traditional whole life policy for long-term coverage or the universal whole life option for added flexibility and savings potential, individuals can choose the plan that best aligns with their needs. Whole life insurance provides a reliable and secure way to protect loved ones and build a financial safety net for the future.

Ace Your Life Insurance Agent Interview: Tips for Success

You may want to see also

Universal Life: This type allows policyholders to adjust premiums and death benefits over time

Universal Life Insurance: A Flexible Option

MetLife offers a unique and flexible type of whole life insurance known as Universal Life. This policy provides policyholders with the ability to customize and adjust their insurance coverage according to their changing needs and financial goals. One of the key advantages of Universal Life is the flexibility it offers in terms of premium payments and death benefits.

With Universal Life, policyholders can choose to pay a fixed premium or adjust the amount they contribute over time. This flexibility allows individuals to manage their insurance costs more effectively, especially during periods of financial fluctuation. For instance, during times of financial prosperity, a policyholder might opt for higher premium payments, building up a substantial cash value in the policy. Conversely, when financial circumstances change, they can lower the premiums, ensuring that the insurance remains affordable.

The death benefit, which is the amount paid out upon the insured's passing, is also adjustable in Universal Life policies. Policyholders can increase or decrease the death benefit to align with their evolving financial objectives. This feature is particularly beneficial for those who want to ensure their loved ones are adequately protected, especially if their financial situation changes over time. For example, a policyholder might initially set a higher death benefit to cover significant expenses, such as a mortgage or children's education, and then adjust it downward as these financial obligations are met.

Furthermore, the cash value component of Universal Life policies can be a valuable asset. The cash value grows tax-deferred and can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various purposes, such as investing, starting a business, or funding retirement. This aspect of Universal Life offers a level of financial flexibility that is not typically found in other types of life insurance.

In summary, MetLife's Universal Life insurance provides a highly customizable and adaptable solution for individuals seeking whole life insurance. The ability to adjust premiums and death benefits, along with the potential for cash value accumulation, makes Universal Life a versatile and attractive option for those who want to tailor their insurance coverage to their specific needs and financial circumstances.

Life Insurance: TSP's Offer and Your Options

You may want to see also

Variable Life: Variable life insurance offers investment options and potential higher returns

Variable life insurance, offered by MetLife, is a unique type of whole life insurance that provides policyholders with a dual benefit. Firstly, it offers the guarantee of lifelong coverage, ensuring financial protection for your loved ones. Secondly, it presents an opportunity to grow your money through investment options. This combination of security and potential growth is what sets variable life insurance apart from traditional whole life policies.

One of the key advantages of variable life insurance is the flexibility it provides in terms of investment. Policyholders can choose from a range of investment options, allowing them to potentially increase the value of their policy over time. These investment options can include stocks, bonds, and mutual funds, among others. By allocating a portion of your policy's cash value to these investments, you can take advantage of market growth and potentially earn higher returns compared to more conservative investment vehicles.

The investment aspect of variable life insurance is what makes it a popular choice for those seeking both insurance coverage and investment opportunities. It provides a way to potentially enhance your financial portfolio while still having the peace of mind that comes with knowing your loved ones are protected. However, it's important to note that the investment component of variable life insurance is not guaranteed and can be subject to market fluctuations. Therefore, it's crucial to carefully consider your risk tolerance and consult with a financial advisor before making any investment decisions.

In addition to the investment options, variable life insurance also offers the advantage of permanent coverage. Unlike term life insurance, which provides coverage for a specified period, whole life insurance, including variable life, offers lifelong protection. This means that as long as you continue to pay the premiums, your loved ones will receive a death benefit when you pass away. The cash value accumulated in the policy can also be borrowed against or withdrawn, providing additional financial flexibility.

When considering variable life insurance from MetLife, it is essential to understand the various investment strategies and associated risks. Policyholders can work closely with their financial advisor to tailor the investment options to their specific goals and risk profile. This personalized approach ensures that the policy aligns with the individual's financial objectives, providing both insurance and investment benefits that can be customized to suit their needs.

Life Insurance Payment: AARP's Missed Payment Policy and You

You may want to see also

Guaranteed Issue: MetLife provides guaranteed issue whole life, accessible without medical exams

MetLife, a well-known insurance company, offers a range of whole life insurance policies, including a unique and appealing option called "Guaranteed Issue." This type of whole life insurance is designed to provide individuals with a guaranteed acceptance process, making it accessible to those who may have difficulty obtaining traditional life insurance due to health concerns or other factors.

The Guaranteed Issue policy from MetLife is an attractive choice for several reasons. Firstly, it is issued without the need for a medical exam, which is a significant advantage for individuals who might be considered high-risk candidates for traditional life insurance. This process simplifies the application and ensures that everyone has access to a whole life insurance policy, regardless of their health status. By eliminating the medical exam requirement, MetLife streamlines the underwriting process, making it more efficient and convenient for customers.

This type of insurance is particularly beneficial for older individuals or those with pre-existing health conditions who may find it challenging to qualify for standard life insurance. It provides a safety net and financial security for individuals who want to ensure their loved ones are protected, even if they have been turned down by other insurance providers. The guaranteed acceptance aspect of this policy means that the insurance company will not deny coverage based on health factors, making it an inclusive option.

When considering a Guaranteed Issue policy, it's essential to understand the terms and conditions. These policies typically have certain limitations and may come with higher premiums compared to standard whole life insurance. The coverage amount and other features might also differ, so it's crucial to review the policy details carefully. MetLife's website or a licensed insurance agent can provide comprehensive information to help individuals make informed decisions about their insurance needs.

In summary, MetLife's Guaranteed Issue whole life insurance offers a valuable solution for those seeking accessible and inclusive life insurance coverage. This policy type ensures that individuals can obtain whole life insurance without the typical medical exam requirements, providing financial security and peace of mind. As with any insurance decision, thorough research and understanding of the policy terms are essential to ensure the chosen plan meets individual needs.

Is Triple-A Life Insurance Worth the Cost?

You may want to see also

Frequently asked questions

MetLife provides various whole life insurance options, including permanent life insurance and universal life insurance. Permanent life insurance offers lifelong coverage and a cash value component, ensuring a guaranteed death benefit. Universal life insurance provides flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change.

Whole life insurance and term life insurance serve different purposes. Whole life insurance provides permanent coverage, meaning it remains in force for the entire life of the insured individual. It offers a fixed death benefit and a cash value account that grows over time. In contrast, term life insurance is designed for a specific period, typically 10, 20, or 30 years, and provides coverage only during that time frame. Term life is generally more affordable but does not accumulate cash value.

Yes, MetLife offers conversion options for term life insurance policyholders. If you own a term life policy and wish to switch to a whole life policy, you can typically convert it without a medical examination. This process allows you to lock in permanent coverage and build cash value from the start. However, conversion terms and conditions may vary, so it's essential to review the specific details of your policy and consult with a MetLife representative for guidance.