When you become a parent, it's natural to want to protect your family's future. Life insurance can be a crucial part of your financial plan, especially when you have a baby. It provides financial security for your loved ones in the event of your untimely passing, ensuring they have the resources to cover expenses like mortgage payments, education costs, and daily living expenses. When considering life insurance for a new baby, it's important to evaluate your current financial situation, future goals, and the specific needs of your growing family. This will help you determine the appropriate coverage amount and type of policy to ensure your baby's well-being and the financial stability of your family.

What You'll Learn

- Newborn Basics: Understand essential coverage for your baby's early years

- Long-Term Needs: Plan for future expenses like education and healthcare

- Financial Security: Ensure your family's financial stability in case of your absence

- Child-Specific Policies: Explore options tailored for children's unique needs

- Review and Adjust: Regularly assess and adjust coverage as your baby grows

Newborn Basics: Understand essential coverage for your baby's early years

When it comes to your newborn's well-being, life insurance is an important consideration that can provide financial security for your growing family. While it might seem like a daunting task, especially during the early years when your baby's needs are most immediate, understanding the essential coverage options can help you make informed decisions. Here's a breakdown of the basics to ensure you're prepared:

- Term Life Insurance: This is often the go-to choice for new parents. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. During this term, it offers a death benefit to your beneficiaries if you were to pass away. For newborns, term life insurance is ideal as it allows you to secure their future without the long-term financial burden. You can choose a policy with a higher death benefit to ensure your baby's needs are met during their early years.

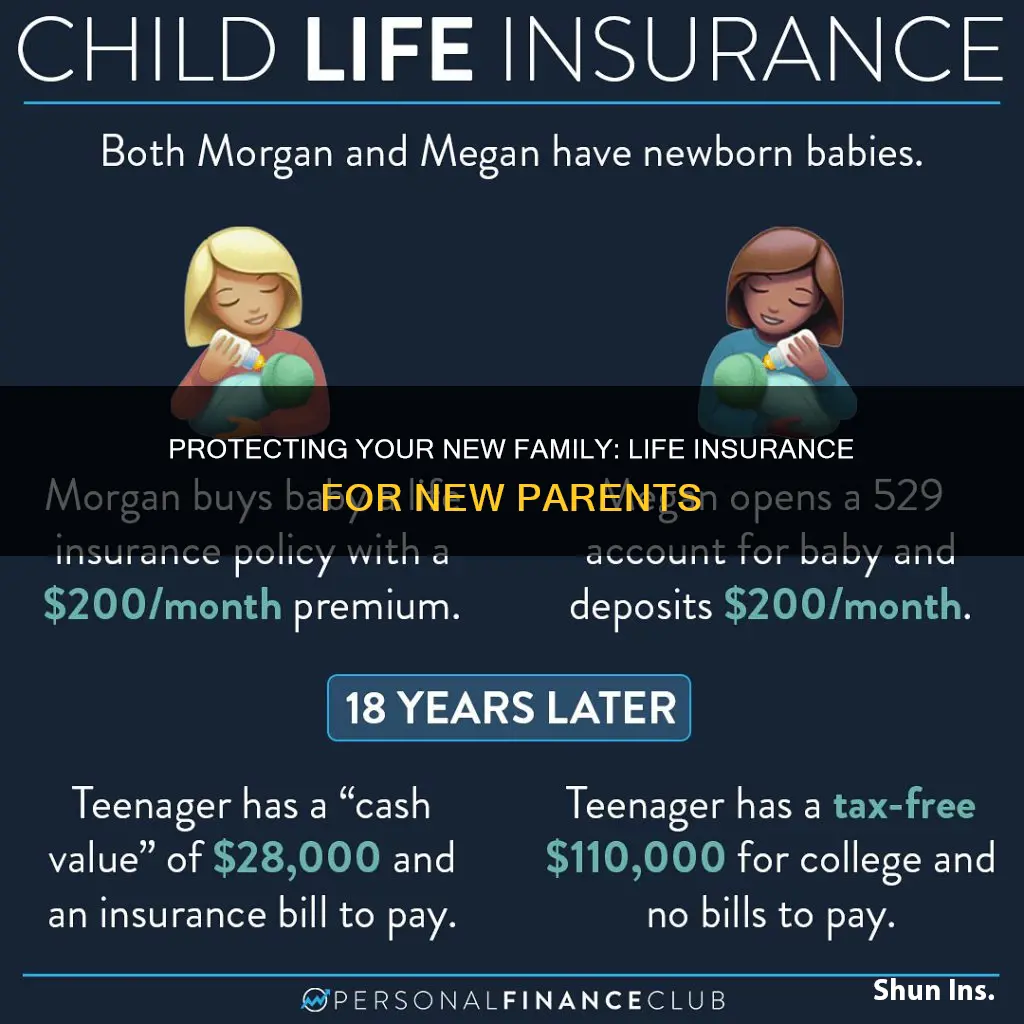

- Permanent Life Insurance: Unlike term life, permanent life insurance offers coverage for your entire lifetime. It provides a cash value accumulation and a death benefit. While it's more expensive, permanent life insurance can be a valuable asset for your family. You can use the cash value to pay for your baby's education, future expenses, or even as a tax-efficient savings plan. This type of insurance is a long-term commitment, ensuring your baby's financial security throughout their life.

- Universal Life Insurance: This policy offers flexibility and adaptability. With universal life, you can adjust the death benefit and premium payments as your financial situation changes. It provides a death benefit and a cash value component, similar to permanent life insurance. For new parents, this option allows you to customize the policy to fit your baby's evolving needs and your family's financial goals.

- Understanding Your Needs: When considering life insurance for your baby, it's crucial to assess your family's unique circumstances. Evaluate your income, expenses, and long-term financial goals. Do you have sufficient savings to cover your baby's immediate needs and future expenses? If not, life insurance can act as a safety net, ensuring your baby's well-being even in your absence. Additionally, consider the potential impact of inflation on future costs, such as education expenses, which may require a higher death benefit.

- Review and Adjust: Life insurance needs may change over time as your baby grows and your financial situation evolves. Regularly review your policy to ensure it still aligns with your family's goals. As your baby gets older, you might consider converting a term policy to a permanent one to provide long-term financial security. Stay informed about the various types of life insurance and their benefits to make the best choices for your newborn's future.

Putting Life Insurance in Trust: A Guide

You may want to see also

Long-Term Needs: Plan for future expenses like education and healthcare

When it comes to planning for your baby's future, considering long-term needs is essential. One crucial aspect to address is the financial security of their education and healthcare. Here's a detailed guide on how to approach these long-term expenses:

Education Planning:

The cost of education can be a significant financial burden, and it's never too early to start planning. Here are some steps to ensure your baby's educational goals are financially secure:

- Determine Education Goals: Begin by discussing your family's educational aspirations with your partner. Consider the type of education you envision for your child, whether it's a private school, college, or university. Research the average costs associated with these institutions and create a realistic budget.

- Start Early Savings: Open a dedicated savings account specifically for your child's education. You can contribute regularly, even with a small amount, and watch it grow over time. Consider setting up automatic transfers from your paycheck or monthly income to make saving effortless.

- Explore Investment Options: Explore various investment vehicles like education savings plans (ESPs), 529 plans, or other tax-advantaged accounts. These options often offer tax benefits and can help your savings grow faster. Research the rules and tax implications of each plan to make an informed decision.

- Consider College Funding Strategies: As your child approaches school age, research and compare different college funding strategies. This may include scholarships, grants, work-study programs, or loans. Understanding these options will help you make informed choices to minimize the financial impact.

Healthcare Considerations:

Ensuring your baby's health and well-being is a top priority, and here's how you can plan for potential healthcare expenses:

- Health Insurance: Obtain comprehensive health insurance coverage for your family. Look for plans that offer coverage for routine check-ups, immunizations, and potential medical emergencies. Review the policy details to understand what is covered and any exclusions.

- Save for Unexpected Expenses: Set aside a portion of your savings to cover unexpected medical costs. This emergency fund will provide a safety net in case of unforeseen illnesses or accidents. Aim to save enough to cover at least six months' worth of living expenses.

- Explore Healthcare Savings Accounts: Consider opening a Health Savings Account (HSA) or a Flexible Spending Account (FSA). These accounts allow you to set aside pre-tax dollars for qualified medical expenses, offering tax advantages. Educate yourself on the rules and benefits of these accounts to maximize their potential.

- Regular Health Check-ups: Schedule regular health check-ups for your baby and ensure they receive all recommended vaccinations. Staying proactive in their healthcare can help prevent minor issues from becoming major expenses.

By proactively addressing these long-term needs, you can provide a secure foundation for your baby's future. It's a thoughtful approach that ensures they have the resources they need for education and healthcare, setting them up for success as they grow. Remember, starting early and regularly reviewing your plans will contribute to a more financially stable future for your child.

Life Insurance and Doctor Visits: What's the Connection?

You may want to see also

Financial Security: Ensure your family's financial stability in case of your absence

When you become a parent, ensuring the financial security of your family becomes even more crucial. Life insurance is a powerful tool to provide that essential safety net for your loved ones in the event of your untimely passing. Here's a guide to help you navigate the process of choosing the right life insurance coverage for your new baby:

Assess Your Family's Needs: Start by evaluating your family's current and future financial obligations. Consider the cost of raising your child, including expenses like education, healthcare, and daily living costs. Also, factor in any long-term financial goals you may have for your child's future, such as a college fund or a trust for their inheritance. Understanding these needs will help determine the amount of coverage you require.

Choose the Right Type of Policy: There are two primary types of life insurance policies relevant to your situation: Term Life Insurance and Permanent Life Insurance. Term life insurance provides coverage for a specific period, often 10, 20, or 30 years. It is typically more affordable and offers a straightforward way to cover your family's immediate financial needs. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes a savings component, allowing you to build a cash value over time. Consider your family's long-term goals and choose a policy that aligns with your preferences and budget.

Determine the Coverage Amount: The coverage amount should be sufficient to replace the income your family would have lost due to your absence. Multiply your annual income by the number of years you expect to provide financial support to your family. This calculation will give you a rough estimate of the coverage needed. Additionally, consider any other sources of income your spouse or partner might have and ensure the policy covers the remaining gap.

Review and Adjust Regularly: Life insurance needs can change over time as your family's circumstances evolve. It's essential to review your policy periodically and adjust the coverage as necessary. Major life events like marriages, births, or significant financial milestones should prompt a policy review. As your child grows and their needs change, you may want to increase or decrease the coverage amount accordingly.

Consider Additional Benefits: Some life insurance policies offer additional features that can provide extra peace of mind. For instance, some policies include an accelerated death benefit, allowing you to access a portion of the death benefit if you are diagnosed with a terminal illness. Others may offer critical illness insurance, providing financial support if you are diagnosed with a critical illness. These add-ons can enhance the overall value of your policy.

Remember, the goal is to provide financial security and peace of mind for your family. By carefully assessing your needs, choosing the right policy, and regularly reviewing your coverage, you can ensure that your loved ones are protected, even when you're not there to provide directly.

Life Insurance Agreements: What's Discoverable?

You may want to see also

Child-Specific Policies: Explore options tailored for children's unique needs

When it comes to ensuring your child's future, considering child-specific life insurance policies is a wise decision. These policies are designed to provide financial protection and peace of mind tailored to your child's unique needs. Here's why exploring these options is essential:

Child-specific life insurance policies are customized to cater to the particular vulnerabilities and requirements of children. Unlike traditional life insurance, these policies often offer lower coverage amounts, ensuring that the premium remains affordable for young individuals. This affordability factor is crucial, as it allows you to provide financial security without straining your budget. Additionally, child-focused policies may include unique features such as accelerated death benefits, which can provide financial assistance if your child faces a critical illness or injury, ensuring they receive the necessary care without financial hardship.

One of the key advantages of these policies is the flexibility they offer. As your child grows, their needs evolve, and a child-specific policy can adapt to these changes. For instance, you can initially secure a basic level of coverage and then increase it as your child gets older and their financial responsibilities expand. This flexibility ensures that the insurance remains relevant and effective throughout your child's life. Moreover, some policies offer the option to convert the coverage into a different type of policy in the future, providing long-term financial protection as your child becomes an adult.

When exploring child-specific policies, it's essential to consider the various options available. Term life insurance, for instance, provides coverage for a specified period, which can be particularly useful during your child's formative years. Permanent life insurance, on the other hand, offers lifelong coverage and a cash value component, which can accumulate over time. Understanding the differences between these options will help you make an informed decision based on your child's long-term financial goals.

Furthermore, child-specific policies often provide valuable benefits that go beyond financial protection. Some insurers offer features like education benefits, which can help cover the costs of higher education. Others may include disability income benefits, ensuring that your child has a financial safety net if they become unable to work due to an illness or injury. These additional benefits showcase the comprehensive nature of child-specific life insurance, making it a valuable tool for long-term financial planning.

In conclusion, considering child-specific life insurance policies is a proactive approach to safeguarding your child's future. These policies offer tailored coverage, flexibility, and additional benefits that cater to your child's unique needs. By exploring these options, you can provide financial security and peace of mind, ensuring that your child is protected and prepared for whatever life may bring. Remember, starting early and choosing the right policy can have a significant impact on your child's financial well-being in the long term.

Choosing the Right Life Insurance: A Comprehensive Guide

You may want to see also

Review and Adjust: Regularly assess and adjust coverage as your baby grows

As your baby enters the world, it's a time of joy and celebration, but it's also a crucial moment to ensure that your life insurance coverage is appropriate and comprehensive. The needs of a new family can change rapidly, and it's essential to periodically review and adjust your insurance policies to reflect these changes. Here's a guide on how to approach this important task:

Understand Your Initial Coverage: When you first purchase life insurance with a baby, it's likely that you've chosen a policy that provides financial security for your growing family. This initial coverage is a vital foundation, offering protection during the early years of parenthood. Take the time to thoroughly understand the terms and benefits of your policy. Know the coverage amount, the duration of the policy, and any specific provisions related to your baby's birth and well-being. This knowledge will be your starting point for future adjustments.

Regularly Review and Assess: Life insurance needs can evolve significantly over time, especially with the arrival of a child. Schedule regular reviews of your policy, perhaps annually or every few years. As your baby grows, their needs and your financial obligations will likely change. For instance, you might need to consider increased coverage to account for the rising costs of education, healthcare, and other future expenses. Reviewing your policy regularly allows you to stay proactive and ensures that your insurance remains a reliable safety net.

Adjust for Life Changes: Life events often trigger the need for policy adjustments. For example, if you and your partner decide to expand your family through adoption or another pregnancy, your insurance should reflect this new development. Similarly, significant life changes like a career advancement, a business venture, or a move to a different location might require an update to your policy. These adjustments ensure that your insurance accurately represents your current circumstances and provides the necessary financial protection.

Consider Long-Term Goals: As your baby grows, it's an excellent opportunity to align your insurance with long-term financial goals. You might want to explore options like increasing the coverage amount to secure your family's future, or you may consider adding riders or additional policies to address specific needs, such as critical illness or disability insurance. Regularly reviewing your policy with a financial advisor can help you make informed decisions that align with your family's best interests.

Stay Informed and Seek Professional Advice: Insurance policies can be complex, and understanding the nuances of your coverage is essential. Stay informed about any changes in your policy and be aware of the options available to you. Additionally, consult with a financial advisor or insurance specialist who can provide tailored advice based on your unique circumstances. They can guide you through the process of reviewing and adjusting your policy, ensuring that your baby's needs are always met.

By actively reviewing and adjusting your life insurance coverage, you can ensure that your baby's future is protected, and your family's financial security is maintained as you navigate the joys and challenges of parenthood. It's a responsible step towards providing a stable and prosperous life for your growing family.

Term Life Insurance: Understanding Its Characterization

You may want to see also

Frequently asked questions

For new parents, term life insurance is often a popular choice. This type of policy provides coverage for a specific period, typically 10, 20, or 30 years, and offers a death benefit if the insured parent passes away during that time. It is generally more affordable and provides adequate coverage for the initial years of a baby's life, ensuring financial security for the family.

The amount of life insurance needed for a baby depends on various factors, including your family's financial goals and circumstances. It is essential to consider the potential long-term expenses, such as education costs, future inheritance tax, or any specific financial goals you may have for your child's future. Typically, a policy with a death benefit of $100,000 to $500,000 could be a starting point, but consulting with an insurance advisor can help tailor the coverage to your unique needs.

While life insurance is typically designed for adults, some insurance companies offer dependent or child life insurance policies. These policies are usually taken out by parents to cover their child's life. The coverage amount can vary, and the policy may have different terms and conditions. It is advisable to explore options with insurance providers that offer child-specific plans, ensuring that the coverage aligns with your baby's needs and your family's financial objectives.