When it comes to auto insurance, it's important to understand the different types of coverage and the associated numbers to ensure you have adequate protection. The three key numbers in an auto insurance policy represent coverage limits for bodily injury per person, bodily injury per accident, and property damage. For example, a policy with limits of 25/50/10 indicates maximum coverage of $25,000 for bodily injury per person, $50,000 for all injuries in an accident, and $10,000 for property damage. These numbers are crucial as they define the financial limits of your liability coverage.

Additionally, it's essential to know your state's minimum insurance requirements, as they vary across the country. While most states mandate liability insurance, the specific coverage amounts differ. Understanding these requirements is vital to ensure compliance with the law and adequate protection in case of an accident.

When deciding on the appropriate coverage limits, consider factors such as your state's minimums, your financial situation, and the value of your assets. It's generally recommended to have sufficient liability coverage to protect yourself and your assets.

| Characteristics | Values |

|---|---|

| Number of digits in a policy number | 8 to 10 |

| Purpose of a policy number | Uniquely identify your coverage |

| Where to find a policy number | Declarations page, auto insurance ID card, billing invoices |

| What the first number in a split coverage limit represents | Bodily injury per person |

| What the second number in a split coverage limit represents | Bodily injury per accident |

| What the third number in a split coverage limit represents | Property damage per accident |

What You'll Learn

Understanding liability insurance numbers

- The first number refers to the maximum coverage for bodily injury liability for a single person injured in an accident. For instance, in a 25/50/10 policy, the insurer will pay up to $25,000 for injuries to one person.

- The second number represents the maximum coverage for bodily injury liability for all individuals injured in a single accident. Using the same example, the insurer will pay a total of up to $50,000 for injuries in that accident.

- The third number denotes the limit of coverage for property damage liability per accident. In the case of a 25/50/10 policy, the insurer will cover property damage expenses up to $10,000.

These numbers are crucial in understanding your level of protection. If the cost of a claim exceeds your policy limits, you may be held personally responsible for the remaining amount. Therefore, it is generally recommended to purchase as much liability insurance as you can reasonably afford to protect your finances in case of a severe accident.

Additionally, these liability coverage limits are mandatory in most states, and every state except New Hampshire requires drivers to have minimum liability coverage before operating a vehicle.

When shopping for auto insurance, it's essential to compare quotes with the same coverages and limits to make an informed decision. You can use a car insurance calculator to determine the most suitable coverage for your needs, considering factors such as your state's minimum requirements, your assets, and your risk tolerance.

Missouri Auto Insurance Rates: Higher or Lower?

You may want to see also

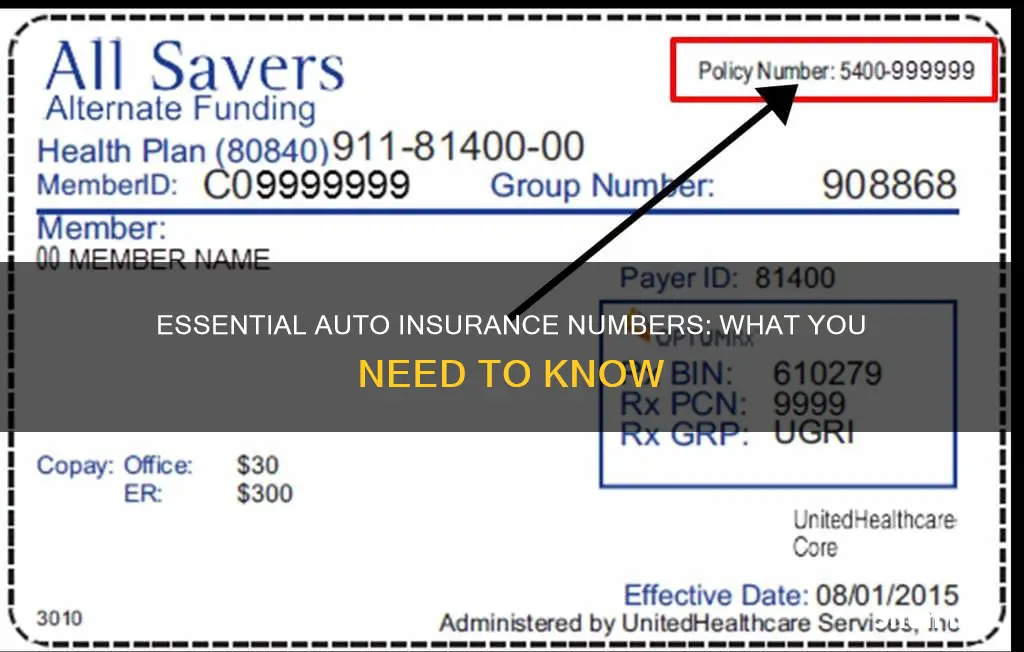

What is a policy number?

An auto insurance policy number is a unique identifier that links you directly to your insurance coverage. This number is crucial for managing claims and billing efficiently and streamlining your interactions with insurers. It is usually 8 to 10 digits long but can be longer, depending on the insurer's system.

Your policy number is typically found on your insurance card, billing statements, and the policy declaration page. It is essential to have this number readily available in case of an accident, when filing a claim, or during a traffic stop. You may also need it when contacting your insurance company to make changes to your policy or for verification purposes.

In addition to your policy number, your insurance card includes other important information such as your name and contact information, the insured vehicle's make and model, the vehicle identification number (VIN), and the effective dates of your insurance policy.

It is important to keep a physical copy of your insurance card in your vehicle and have a digital copy on your phone. This ensures that you can easily access your policy number and provide proof of insurance when needed.

California Allows Electronic Proof of Auto Insurance

You may want to see also

How much liability insurance do I need?

Liability insurance is a requirement in almost every state. It covers the cost of damage and injuries you cause to others in an accident. It does not cover your own medical bills or car repairs.

The minimum amount of liability insurance you need is specified by your state or lender. The most commonly required liability limits are $25,000 for bodily injury per person, $50,000 in total bodily injury per accident, and $25,000 for property damage per accident. However, individual state requirements vary, and your state may mandate higher or lower limits.

It's a good idea to carry more liability coverage than the legal minimum to avoid being left with a large bill. For example, if you cause an accident that totals another car and injures four people, you could be facing almost $500,000 in medical bills and car repairs. If your liability limits aren't high enough, you could be held personally responsible for anything above those limits.

As a general rule, you should aim to have enough liability insurance to cover your net worth. To calculate your net worth, add up the value of your home, vehicles, savings, and investments, and subtract your debts. If your net worth is high, you may want to consider an umbrella policy, which can provide additional liability coverage above your auto insurance limits.

When deciding how much liability insurance to buy, it's important to consider your state's requirements, your net worth, and the potential costs of an accident. By choosing adequate liability coverage, you can protect yourself financially and ensure you have the necessary funds to cover any damage or injuries you may cause.

Auto Insurance: States with the Cheapest Rates

You may want to see also

What is uninsured motorist coverage?

Uninsured motorist coverage is an optional insurance policy that protects you if you're hit by a driver with no auto insurance or insufficient insurance to cover the damages. This type of coverage is especially important because nearly 13% of drivers countrywide don't have auto insurance, and that number rises above 20% in some states. If you don't have uninsured motorist coverage, you could end up paying out of pocket for medical bills or vehicle repairs after an accident with an uninsured or underinsured driver.

Uninsured motorist coverage is typically divided into four types:

- Uninsured motorist bodily injury (UMBI) covers medical bills for you and your passengers.

- Uninsured motorist property damage (UMPD) covers damage to your vehicle.

- Underinsured motorist bodily injury (UIMBI) covers medical bills when the other driver's insurance isn't enough.

- Underinsured motorist property damage (UIMPD) covers vehicle damage when the other driver's insurance isn't enough.

While not all states mandate uninsured motorist coverage, it is highly recommended for all drivers. In some states, you may be required to purchase a certain level of uninsured motorist coverage or reject it in writing.

Managing Risk: Strategies of Auto Insurance Companies

You may want to see also

How much collision and comprehensive insurance should I buy?

Collision and comprehensive insurance are not required by law, but they are valuable types of insurance that shouldn't be overlooked. They are usually required if you have a car loan or lease. Collision insurance pays to repair or replace your car if you accidentally collide with something, such as a car, guardrail, pole or tree. Comprehensive insurance pays to repair or replace your car if it's stolen or damaged by something other than collision, such as fire, flood, striking an animal, falling objects or vandalism.

When deciding how much collision and comprehensive insurance to buy, consider the following:

- Your vehicle's value: The value of your vehicle will play a significant role in determining whether you can opt out of comprehensive and collision coverage. If you have a high-value car, getting these coverage types is a good option. If you have a low-value or older vehicle, it may be better to drop them to save money on monthly premiums.

- Your insurance costs: If your insurance premiums are more than 10% of your car's cash value, it is best not to get comprehensive and collision insurance.

- Your finances: If you can afford to pay out-of-pocket for a new vehicle, you can opt not to carry comprehensive and collision coverage.

- Your location: If you live in an area with high occurrences of natural disasters, crime or animal collisions, it may be a good idea to have comprehensive coverage. Consider getting collision insurance if you frequently drive in heavy traffic or crash-prone areas.

- Your driving record and history: If you are a cautious driver or don’t drive often and your car usually stays in your garage, you may not need collision insurance.

You can drop comprehensive and collision coverage at any time, but you can’t drop liability insurance. Liability insurance covers the cost of damage to other people or their property if you are in a crash, and it is required by law in all states except for New Hampshire.

Auto Insurance: Understanding the Most Common Coverage Options

You may want to see also

Frequently asked questions

The three numbers on your auto insurance policy refer to the coverage limits in terms of liability coverage. For instance, in a policy with limits of "25/50/10", the first number represents the bodily injury liability limit per person, the second number represents the bodily injury liability limit per accident, and the third number represents the property damage liability limit.

Your auto insurance policy number can typically be found on various documents related to your insurance policy, including your insurance ID card, policy declarations page, insurance policy documents, and correspondence from your insurance company.

The policy number refers to the specific contract of insurance, while the account number may refer to the policyholder's overall account with the insurance company, which can include multiple policies.

If you lose your auto insurance policy number, contact your insurance provider immediately. They can verify your identity and provide you with the correct policy number. It is always a good idea to keep a backup of your insurance information in a safe place to avoid such issues.