Life insurance policies play a crucial role in providing financial security and peace of mind to individuals and their families. Each year, numerous life insurance policies are issued, reflecting the growing awareness and importance of having financial protection in place. These policies offer a range of benefits, including coverage for death, disability, critical illness, and long-term care, ensuring that individuals and their loved ones are protected against unforeseen circumstances. The issuance of these policies highlights the increasing demand for comprehensive insurance solutions, as more people recognize the value of safeguarding their financial future and the well-being of their dependents.

What You'll Learn

- Market Trends: Number of policies sold annually, by region and demographic

- Product Diversity: Types of policies offered, e.g., term, whole life, variable

- Regulatory Impact: Changes in laws affect insurance issuance and sales

- Economic Factors: Economic conditions influence demand for life insurance

- Company Performance: Sales volume by leading insurance providers

Market Trends: Number of policies sold annually, by region and demographic

The life insurance market is a dynamic and ever-evolving industry, with sales trends offering valuable insights into consumer behavior and preferences. Here's an overview of the market trends related to the number of life insurance policies sold annually, broken down by region and demographic:

Global Sales Trends:

The global life insurance market has experienced significant growth in recent years, with an estimated annual sales volume of over 100 million policies as of 2022. This figure highlights the widespread adoption of life insurance across various regions. North America and Europe have traditionally been major markets, but there has been a notable shift towards emerging economies in Asia and Latin America. These regions are witnessing rapid growth due to increasing awareness, rising disposable incomes, and a growing middle class.

Regional Analysis:

- North America: The United States and Canada dominate the North American market. The preference for term life insurance is prominent here, especially among younger demographics. However, there is a growing trend of whole life insurance policies, particularly in the retirement planning segment.

- Europe: The European market is characterized by a mature and diverse landscape. Western European countries like the UK, Germany, and France have a higher penetration rate of life insurance, with a focus on long-term savings and investment-linked policies. Eastern European countries are catching up, driven by government initiatives and increasing financial literacy.

- Asia-Pacific: This region showcases tremendous potential and growth. Countries like China, India, and Indonesia are witnessing a surge in life insurance sales, primarily due to the expanding middle class and increasing awareness of the importance of financial security. The preference for term life insurance is prominent, especially among the younger generation.

- Latin America: The market in this region is growing steadily, with a focus on term life insurance and pension plans. Countries like Mexico and Brazil are leading the way, driven by economic stability and a rising demand for financial protection.

Demographic Insights:

- Age: Younger demographics are increasingly recognizing the value of life insurance, especially term life policies, for financial security. There is a growing trend of young professionals opting for coverage to protect their families and build long-term savings.

- Income Level: Higher-income earners tend to prefer more comprehensive policies, including whole life insurance, for long-term financial planning. Middle-income families often seek affordable term life insurance to cover mortgage payments, education expenses, and other financial commitments.

- Gender: Traditionally, male-dominated markets are now witnessing a shift towards more balanced sales across genders. Women are increasingly taking the initiative to purchase life insurance, especially in regions where gender equality is a priority.

- Marital Status: Married individuals and those with families often prioritize life insurance to ensure financial stability in the event of the primary breadwinner's untimely demise.

Understanding these regional and demographic trends is crucial for insurance providers to tailor their products and marketing strategies effectively. The market's growth indicates a rising demand for financial protection, and insurers can capitalize on this by offering innovative solutions that cater to diverse customer needs.

Understanding the Charity Tax ID for Life Insurance Proceeds

You may want to see also

Product Diversity: Types of policies offered, e.g., term, whole life, variable

The life insurance industry offers a wide array of policies, each designed to meet specific financial needs and goals. This product diversity is crucial in catering to a broad spectrum of consumers, from those seeking temporary coverage to those looking for long-term financial security. Here's an overview of the various types of life insurance policies available:

Term Life Insurance: This is a straightforward and affordable type of policy that provides coverage for a specified period, typically 10, 20, or 30 years. It is ideal for individuals who want coverage for a particular period, such as until a child's education is funded or a mortgage is paid off. Term life insurance offers a fixed premium, and if the insured individual passes away during the term, the beneficiaries receive the death benefit. This policy is often the first choice for those seeking temporary coverage without the complexity of permanent policies.

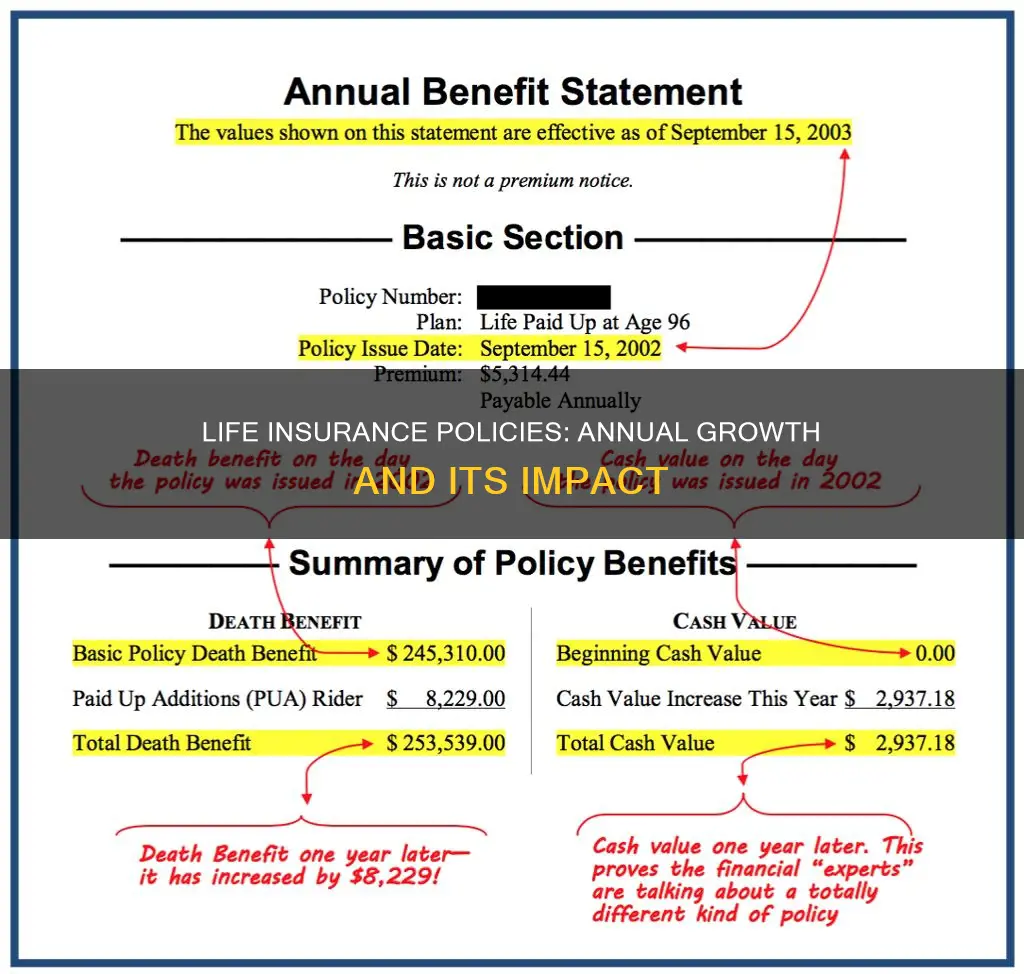

Whole Life Insurance: In contrast to term life, whole life insurance provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a fixed premium that remains the same throughout the policy's duration. The primary difference lies in the investment component; whole life policies accumulate cash value over time, which can be borrowed against or withdrawn. This type of policy is suitable for those seeking long-term financial security and the peace of mind that comes with knowing their beneficiaries will receive a payout regardless of when the insured passes away.

Variable Life Insurance: This policy combines the death benefit of whole life insurance with an investment component, allowing policyholders to allocate their premiums between guaranteed and variable components. The variable portion can be invested in various sub-accounts, similar to mutual funds, offering the potential for higher returns. Policyholders have the flexibility to adjust their investment strategy over time. Variable life insurance is attractive to those who want both the security of a death benefit and the potential for investment growth.

Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefit within certain limits, providing a level of customization. Universal life insurance also accumulates cash value, which can be used to pay premiums or taken out as a loan. It is suitable for individuals who want the flexibility to adapt their policy as their financial situation changes.

The diversity in life insurance policies allows consumers to choose the one that best aligns with their financial objectives, risk tolerance, and long-term plans. Whether it's the simplicity of term life, the permanence of whole life, the flexibility of variable life, or the adaptability of universal life, each policy type caters to different needs, ensuring that individuals can find the right protection for themselves and their loved ones.

Life Insurance 101: Understanding the Basics for Beginners

You may want to see also

Regulatory Impact: Changes in laws affect insurance issuance and sales

The insurance industry is heavily regulated, and changes in laws and regulations can significantly impact the issuance and sales of life insurance policies. These changes often have far-reaching effects on both consumers and insurance companies, shaping the market dynamics and the overall insurance landscape. Here's an overview of how regulatory impacts can influence the life insurance sector:

Compliance and Market Entry: New regulations or amendments to existing laws can create a more stringent environment for insurance companies. For instance, stricter financial regulations might require insurers to maintain higher capital reserves, which could potentially reduce the number of policies issued. This is because increased capital requirements may limit the amount of risk an insurer can take, especially for high-risk life insurance products. As a result, smaller insurance providers might find it challenging to enter the market or expand their operations, potentially reducing the overall number of policies issued.

Consumer Protection and Transparency: Regulatory changes often aim to enhance consumer protection and transparency in the insurance industry. For example, laws mandating clear and concise policy documentation can ensure that customers fully understand the terms and conditions of their life insurance policies. This transparency may lead to more informed decision-making by policyholders and could potentially increase the number of policies sold as customers feel more confident in their purchases. However, it may also require insurers to invest in more detailed and comprehensive policy documents, which could impact their operational efficiency.

Impact on Sales and Distribution: Regulatory impacts can also affect the sales and distribution channels of life insurance. For instance, a shift towards stricter regulations on commissions and fees might discourage some insurance agents and brokers, potentially leading to a decline in sales. This could be particularly true for high-commission-based sales models. On the other hand, regulations promoting digital sales and online platforms might encourage more insurance companies to adopt e-commerce strategies, potentially increasing the number of policies sold online.

Market Stability and Risk Management: Changes in laws can contribute to market stability and improved risk management practices. For example, regulations mandating regular risk assessments and stress testing for insurance companies can help identify and mitigate potential risks. This, in turn, can lead to more robust and stable insurance portfolios, which might encourage investors and customers alike. As a result, insurance companies may be more willing to issue policies, especially in the long term, knowing that they have robust risk management frameworks in place.

In summary, regulatory changes play a pivotal role in shaping the life insurance market. While some impacts may lead to short-term adjustments and challenges, they ultimately contribute to a more regulated, transparent, and stable insurance environment. Insurance companies and policymakers must stay informed about these regulatory impacts to ensure compliance and make strategic decisions that benefit both the industry and consumers.

Group Term Life Insurance: Individual Benefits and Coverage

You may want to see also

Economic Factors: Economic conditions influence demand for life insurance

Economic factors play a significant role in shaping the demand for life insurance policies, and understanding these influences is crucial for both consumers and insurance providers. During periods of economic growth, when unemployment rates are low and stock markets are performing well, individuals often feel more secure in their financial positions. This sense of security can lead to a decrease in the demand for life insurance, as people may perceive themselves as less vulnerable to financial loss. As a result, insurance companies might experience a slowdown in policy sales, especially for term life insurance, which is often seen as a more affordable and temporary coverage option.

Conversely, economic downturns and recessions can significantly impact the life insurance market. When the economy is struggling, unemployment rises, and many individuals and families face financial instability. This challenging economic climate often prompts people to reevaluate their financial priorities and consider long-term financial protection. Life insurance becomes more attractive during such times as it provides a financial safety net for beneficiaries in the event of the insured individual's death. As a result, the demand for life insurance policies tends to increase, and insurance companies may witness a surge in applications, especially for permanent life insurance, which offers both death benefit coverage and an investment component.

The economic environment also influences the cost of life insurance premiums. In a robust economy, insurance companies might offer more competitive rates due to lower claims and a more stable financial outlook. Conversely, during economic crises, insurers may increase premiums to account for the higher risk associated with insuring individuals in a financially vulnerable state. This dynamic can further impact the demand for life insurance, as higher premiums might discourage some potential buyers, especially those on tighter budgets.

Additionally, economic factors can affect the overall insurance market and, consequently, the life insurance industry. For instance, during economic recessions, there might be a shift in consumer behavior, with people prioritizing essential expenses and cutting back on discretionary spending. This change in spending patterns can lead to a reduced demand for non-essential insurance products, including certain types of life insurance. However, as the economy recovers, the demand for insurance products, including life insurance, often bounces back, driven by renewed financial stability and a sense of security.

In summary, economic conditions have a profound impact on the demand for life insurance policies. Economic growth and stability can lead to a more cautious approach to insurance, while economic downturns often result in increased demand for life insurance as a means of financial protection. Insurance providers must closely monitor economic indicators to adjust their strategies, product offerings, and marketing approaches accordingly, ensuring they meet the evolving needs of their customers in different economic environments.

Reverse Mortgages: Life Insurance and Its Role

You may want to see also

Company Performance: Sales volume by leading insurance providers

The life insurance industry is a significant sector, and understanding the sales performance of leading providers is crucial for investors, consumers, and industry analysts alike. Here's an overview of the sales volume by some of the top insurance companies, offering a glimpse into the market dynamics:

Allianz: This German multinational financial services company has established itself as a global leader in the insurance industry. In 2022, Allianz reported a remarkable sales performance, with a total of 15.7 million new life insurance policies issued. This number showcases the company's strong market presence and ability to attract customers worldwide. Allianz's success can be attributed to its diverse product range, catering to various demographics and risk preferences. They offer term life insurance, whole life policies, and various savings plans, allowing customers to choose according to their needs.

Prudential: Another prominent player in the life insurance market, Prudential, has consistently demonstrated its sales prowess. In the fiscal year 2022, Prudential issued approximately 1.2 million new life insurance policies. The company's focus on digital transformation and personalized customer experiences has been instrumental in its success. Prudential's online platform enables customers to compare policies, request quotes, and purchase coverage conveniently. Their commitment to innovation has likely contributed to their steady growth in sales volume.

MetLife: With a global footprint, MetLife is one of the largest life insurance companies in the world. In 2022, MetLife's sales performance was impressive, with a total of 1.8 million new life insurance policies issued. The company's comprehensive product portfolio, including term life, permanent life, and disability insurance, caters to a wide range of customers. MetLife's strong financial position and extensive network of agents have likely played a significant role in their sales success.

State Farm: Known for its extensive network of local agents, State Farm has a strong presence in the US market. In the past year, State Farm issued over 1.5 million new life insurance policies. The company's success can be attributed to its personalized approach, understanding local market needs, and providing tailored solutions. State Farm's focus on customer satisfaction and community involvement has likely contributed to its consistent sales growth.

These leading insurance providers' sales volumes highlight the industry's overall health and the diverse strategies that drive success. Each company's unique approach to product development, customer engagement, and market reach contributes to the dynamic nature of the life insurance market. Understanding these sales trends can provide valuable insights for stakeholders and guide future industry developments.

Understanding Your Horace Mann Life Insurance Policy

You may want to see also

Frequently asked questions

The number of life insurance policies issued each year varies significantly depending on the country, market conditions, and the insurance providers. According to industry reports, the global life insurance market experienced a steady growth rate of around 5-7% annually in recent years. In 2021, the market was valued at over $1 trillion, and it is estimated that approximately 100-150 million new policies are sold annually across various regions.

Yes, several factors influence the issuance trends of life insurance policies. Firstly, economic growth and rising disposable incomes in many countries have led to increased demand for insurance products. Secondly, government initiatives and regulations promoting financial inclusion and insurance awareness campaigns contribute to higher policy sales. Additionally, the increasing popularity of digital insurance platforms and the ease of online policy purchases have made life insurance more accessible to a broader population.

The issuance of life insurance policies varies across different demographics. Typically, younger individuals in their 20s and 30s are more likely to purchase term life insurance to cover debts or provide financial security for their families. In contrast, older individuals, especially those in their 40s to 60s, often opt for permanent life insurance or whole life policies for long-term financial planning. The number of policies issued also differs by region, with developed markets having higher penetration rates compared to developing countries.