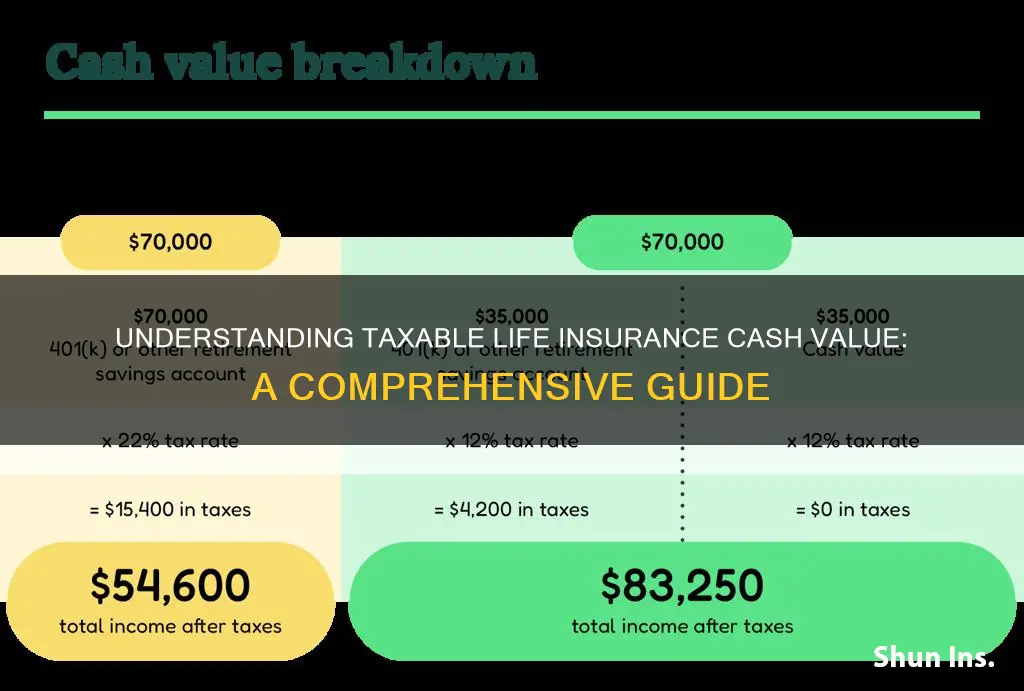

When it comes to life insurance, understanding the tax implications of its cash value is crucial for policyholders. The cash value of a life insurance policy can be a significant financial asset, but it's important to know how much of this value is taxable. This knowledge is essential for making informed financial decisions and maximizing the benefits of your life insurance policy. In this article, we will explore the specific portion of life insurance cash value that is taxable and how it can impact your financial planning.

| Characteristics | Values |

|---|---|

| Taxability of Life Insurance Cash Value | Generally, the cash value of a life insurance policy is not taxable when it is accumulated. However, there are some exceptions and considerations. |

| Taxable Event | The cash value becomes taxable when it is surrendered, borrowed against, or taken as a withdrawal. These actions can trigger income tax on the amount exceeding the policy's basis. |

| Basis of the Policy | The basis is the amount paid in premiums plus any prior loan payments. This basis is used to determine the taxable gain or loss when the policy is surrendered or borrowed against. |

| Tax Treatment of Withdrawals | If the cash value is withdrawn, the amount exceeding the policy's basis may be taxable as ordinary income. The policyholder can choose to treat the withdrawal as a loan, which avoids immediate taxation. |

| Loan Interest | Any interest charged on a policy loan is typically taxable as ordinary income. The loan must be repaid with interest to avoid penalties. |

| Surrender Charge | Some policies have surrender charges, which are fees deducted from the cash value if the policy is surrendered early. These charges are generally not taxable. |

| Tax-Deferred Growth | The cash value grows tax-deferred, meaning it can accumulate without being taxed annually. This allows the policy to build a substantial value over time. |

| Tax Implications of Policy Lapse | If a policy lapses (premiums are not paid), the cash value may be subject to income tax if it exceeds the policy's basis. |

| Tax-Free Borrowing | Borrowing against the cash value is generally tax-free, provided the loan is repaid with interest. |

| Estate Tax | Life insurance proceeds paid out upon death are typically exempt from estate tax, but the cash value may be included in the estate's taxable value. |

What You'll Learn

- Taxable Income: Life insurance cash value can be considered taxable income if it exceeds a certain threshold

- Policy Loans: Loans taken against the policy may be taxable as ordinary income

- Surrender Charges: Penalties for early policy surrender can be taxable as ordinary income

- Dividend Distributions: Dividends paid out of the policy's cash value may be taxable as ordinary income

- Tax-Free Growth: Portions of cash value growth can be tax-free if certain conditions are met

Taxable Income: Life insurance cash value can be considered taxable income if it exceeds a certain threshold

When it comes to life insurance, understanding the tax implications of its cash value is crucial for policyholders. The cash value of a life insurance policy, often built up over time through regular premiums, can be a significant financial asset. However, it's important to know that this cash value may be subject to taxation if it surpasses a specific threshold.

The Internal Revenue Service (IRS) has set a threshold for the cash value of life insurance policies, beyond which it can be considered taxable income. This threshold is typically much lower than the total cash value of the policy, ensuring that only a portion of the accumulated value is taxable. For instance, if the cash value of your life insurance policy exceeds $1,000, you may be required to report it as taxable income. It's essential to monitor the growth of your policy's cash value to ensure compliance with IRS regulations.

The tax treatment of life insurance cash value is designed to encourage long-term savings and provide financial security. When the cash value is below the threshold, it is often treated as a non-taxable investment, allowing policyholders to build wealth tax-free. However, once the threshold is crossed, the excess cash value becomes taxable income, and you may be required to pay taxes on the amount exceeding the limit.

To avoid any surprises, it is advisable to consult with a tax professional or financial advisor who can provide personalized guidance based on your specific circumstances. They can help you understand the tax implications of your life insurance policy and ensure that you are aware of any reporting requirements. Additionally, staying informed about the IRS guidelines and keeping accurate records of your policy's cash value can help you navigate the tax landscape effectively.

In summary, while the cash value of a life insurance policy can be a valuable asset, it's important to be aware of the potential tax consequences. By understanding the threshold set by the IRS and seeking professional advice, you can ensure that you manage your life insurance policy's cash value in a way that minimizes tax liabilities and maximizes financial benefits.

Life Insurance Payouts: Taxable or Not?

You may want to see also

Policy Loans: Loans taken against the policy may be taxable as ordinary income

When it comes to life insurance, understanding the tax implications of various aspects, including policy loans, is crucial for policyholders. One important consideration is that loans taken against a life insurance policy can be taxable as ordinary income. This means that the amount borrowed from the policy may be subject to taxation, which can impact the overall financial benefits of the policy.

Policy loans are a way for policyholders to access a portion of the cash value of their life insurance policy. These loans typically allow individuals to borrow money against the policy's value, providing immediate access to funds. However, it's essential to recognize that this convenience comes with potential tax consequences.

The taxability of policy loans arises from the Internal Revenue Service (IRS) regulations. When a loan is taken against a life insurance policy, the amount borrowed is considered a distribution of cash value. According to IRS rules, these distributions are generally taxable as ordinary income. This means that the policyholder will have to pay taxes on the loan amount, which can be a significant financial burden. The tax liability is typically due when the loan is taken, and the policyholder may have to pay estimated taxes on the borrowed amount.

To illustrate, let's consider an example. Suppose a policyholder takes out a loan of $50,000 against their life insurance policy. If the policy has a cash value of $100,000, the loan would be considered a distribution of $50,000. The IRS may classify this distribution as taxable income, and the policyholder would need to report this amount on their tax return. As a result, the individual's taxable income for that year would increase, potentially leading to higher tax obligations.

It is important to note that the tax implications can vary depending on individual circumstances and the specific policies in place. Some policies may offer loan options with different tax treatments, so it's advisable to consult with a financial advisor or tax professional to understand the potential tax consequences in your particular situation. Being aware of these tax considerations can help policyholders make informed decisions regarding their life insurance policies and ensure they are well-prepared for any financial obligations.

Group Life Insurance Basics: What You Need to Know

You may want to see also

Surrender Charges: Penalties for early policy surrender can be taxable as ordinary income

When considering the tax implications of life insurance cash values, it's important to understand the potential impact of surrender charges. These charges are fees imposed by insurance companies for early policy surrender, and they can have significant financial consequences for policyholders. Here's a detailed breakdown of how surrender charges can be taxable as ordinary income:

Surrender charges are typically applied when a policyholder exits their life insurance policy before reaching a certain point in its term. This early termination often occurs due to financial difficulties, policy dissatisfaction, or other reasons. The insurance company incurs a loss when a policy is surrendered early, as they have already invested a portion of the premiums in various investment options. To compensate for this loss, they charge a surrender fee, which can be a percentage of the policy's cash value or a flat fee.

The tax treatment of surrender charges is an essential aspect to consider. When a policyholder surrenders the policy, the insurance company may treat the surrender charge as a taxable distribution. This means that the amount of the surrender charge could be subject to ordinary income tax. Ordinary income tax rates vary depending on the policyholder's income and tax bracket, and they can be relatively high, making this a significant financial consideration.

The tax rules surrounding surrender charges can be complex. In some cases, the entire surrender charge may be taxable as ordinary income. However, there might be exceptions or specific conditions under which only a portion of the charge is taxable. For instance, if the policyholder has held the policy for a certain period (e.g., five years) and the surrender charge is a result of a financial hardship, there could be tax relief options available. It is crucial to consult tax professionals or insurance experts to understand the specific regulations applicable to your situation.

To minimize the tax impact of surrender charges, policyholders should carefully review their insurance policies and consider the potential consequences before making early surrender decisions. Some insurance companies may offer grace periods or options to reduce surrender charges, allowing policyholders to make more informed choices. Additionally, exploring alternative strategies, such as policy loans or partial surrenders, might provide more tax-efficient ways to access the cash value without incurring significant penalties.

In summary, surrender charges for early policy surrender can have tax implications as ordinary income. Policyholders should be aware of these potential costs and carefully evaluate their options to make informed decisions regarding their life insurance policies. Understanding the tax rules and seeking professional advice can help individuals navigate the complexities of surrender charges and their tax consequences.

Overweight and Uninsurable: What You Can Do

You may want to see also

Dividend Distributions: Dividends paid out of the policy's cash value may be taxable as ordinary income

When it comes to life insurance, understanding the tax implications of cash value is crucial, especially when it comes to dividend distributions. Dividends paid out of the policy's cash value can be subject to taxation as ordinary income, which is an important consideration for policyholders. This is a key aspect of the tax treatment of life insurance cash value, and it's essential to grasp the details to ensure you're managing your policy effectively.

Dividends from life insurance cash value are typically paid out as a result of the policy's investment performance. These dividends can be a significant source of income for policyholders, but they are not always tax-free. The tax treatment of these dividends is based on the ordinary income tax rate, which can vary depending on the individual's tax bracket. This means that the amount of tax owed on these dividends can be substantial, especially for those in higher income brackets.

The taxation of dividend distributions from life insurance cash value is an important factor to consider when evaluating the overall tax efficiency of your policy. It's a complex area, and the rules can vary, so seeking professional advice is recommended. Tax laws and regulations are subject to change, and staying informed about these changes is essential to ensure compliance and optimize your tax strategy.

In summary, when dividends are paid out of the cash value of a life insurance policy, they may be taxable as ordinary income. This is a critical aspect of understanding the tax implications of life insurance cash value. Policyholders should be aware of this potential tax liability and consider it when making financial decisions related to their life insurance policies. Proper planning and consultation with tax professionals can help individuals navigate this aspect of their financial planning effectively.

Term vs. Full Life Insurance: Which is Right for You?

You may want to see also

Tax-Free Growth: Portions of cash value growth can be tax-free if certain conditions are met

When it comes to life insurance, understanding the tax implications of cash value growth is crucial for maximizing the benefits of your policy. While the entire cash value of a life insurance policy is not typically taxable, there are specific conditions under which a portion of the growth can be tax-free. This is particularly advantageous for those seeking to grow their wealth while also ensuring a tax-efficient approach.

The key to tax-free growth lies in the concept of "basis" in the life insurance policy. The basis is the initial amount invested in the policy, and any subsequent growth is added to this basis. If the policy is owned for a sufficient period, the growth can be considered tax-free. This is because the IRS allows for the tax-free treatment of gains on investments held for a certain period, typically one year or more. When the policyholder takes out a loan against the cash value or makes a withdrawal, the basis is adjusted, and any subsequent growth is taxed accordingly.

To qualify for tax-free growth, the policy must meet specific criteria. Firstly, the policy should be a permanent life insurance policy, meaning it is designed to last for the policyholder's lifetime. These policies often have a cash value component that accumulates over time. Secondly, the policy should have been owned for at least two years, and the policyholder must have paid premiums for a continuous period of at least two years. This ensures that the policy has had sufficient time to grow and mature.

Additionally, the policyholder must not have taken any substantial loans against the cash value or made any substantial withdrawals that would significantly reduce the policy's value. If the policy is surrendered or the cash value is withdrawn, the basis may be adjusted, and any subsequent growth could be taxable. It is essential to maintain the policy's integrity and ensure that the cash value growth remains untaxed.

In summary, tax-free growth in life insurance cash value is achievable under certain conditions. By understanding the concept of basis and meeting the requirements of policy ownership and maturity, individuals can take advantage of tax-efficient wealth accumulation. Consulting with a financial advisor or tax professional is recommended to ensure compliance with tax laws and to make informed decisions regarding life insurance policies and their cash value components.

Insurable Interest: When Life Insurance Becomes Legally Binding

You may want to see also

Frequently asked questions

No, only a portion of the cash value is taxable. When you surrender or withdraw money from a life insurance policy, the tax treatment depends on the policy type and the time of the distribution. Generally, the cash value accumulation in a life insurance policy is not taxable until it is taken out or surrendered. However, if the policyholder takes a withdrawal, the amount exceeding the policy's basis (the cost basis of the policy plus any previous withdrawals) is taxable as ordinary income.

The taxable amount is calculated based on the policy's basis and the withdrawal amount. The basis is typically the total premiums paid plus any previous withdrawals. If the withdrawal exceeds the basis, the excess is taxable. For example, if a policy has a basis of $10,000 and the policyholder withdraws $15,000, the $5,000 excess is taxable.

Yes, for tax-deferred life insurance policies, such as whole life or universal life, the cash value accumulation is generally not taxable until the death of the insured or the surrender of the policy. However, if the policyholder takes a loan against the cash value, the interest on the loan may be taxable as ordinary income. Additionally, any investment gains or interest credited to the policy's cash value are typically tax-deferred until they are withdrawn.

Yes, there are strategies to minimize the tax impact. One common approach is to allow the cash value to grow tax-deferred until needed. By keeping the policy in force, the cash value can accumulate tax-free. Additionally, policyholders can consider taking partial withdrawals, which may reduce the taxable amount. Consulting a tax advisor or financial professional is recommended to understand the specific tax implications and explore suitable strategies for managing the cash value of a life insurance policy.