When your term life insurance policy comes to an end, it's important to consider your financial goals and make a plan for the future. Many people choose to renew their term life insurance for another period, but others may want to explore alternative options such as converting to a permanent life insurance policy or reviewing their overall insurance needs. Understanding your options and making informed decisions can help ensure that you and your loved ones are protected financially, even after your initial term insurance coverage has expired.

| Characteristics | Values |

|---|---|

| Review Your Financial Situation | Assess your current financial needs, including outstanding debts, mortgage, children's education costs, and future retirement goals. |

| Consider Permanent Life Insurance | Look into converting your term life insurance to a permanent policy, such as whole life or universal life, which provides lifelong coverage. |

| Evaluate Your Coverage Needs | Determine if you still need life insurance coverage. Consider your age, health, and financial obligations. |

| Increase Your Coverage | If you still require insurance, consider increasing the coverage amount to ensure adequate protection for your loved ones. |

| Decide on a New Policy | Research and compare different life insurance policies, considering factors like term length, premium costs, and coverage options. |

| Review and Update Your Will | Ensure your will is up-to-date and reflects your current life insurance benefits. |

| Consult a Financial Advisor | Seek professional advice to help you make informed decisions about your insurance needs and overall financial planning. |

| Consider Other Financial Options | Explore alternative financial strategies, such as building an emergency fund, investing in assets, or utilizing retirement plans. |

| Review Regularly | Periodically reassess your life insurance needs and adjust your policy as your circumstances change. |

What You'll Learn

- Review Your Needs: Assess current financial obligations and plan for future needs

- Consider Term Extensions: Explore options like converting to permanent insurance

- Evaluate Alternative Coverage: Research other insurance types to ensure continued protection

- Plan for Financial Goals: Adjust investments and savings to meet post-term objectives

- Consult a Financial Advisor: Seek professional guidance for informed decision-making

Review Your Needs: Assess current financial obligations and plan for future needs

When your term life insurance policy comes to an end, it's crucial to review your financial situation and plan for the future. This is a significant step in ensuring your loved ones are protected and your financial goals are met. Here's a detailed guide on how to approach this process:

Assess Your Current Financial Obligations: Start by making a comprehensive list of all your current financial commitments. This includes regular expenses such as mortgage or rent payments, car loans, credit card debts, and any other personal loans. Also, consider your family's daily living expenses, such as groceries, utilities, and healthcare costs. Understanding these obligations is essential as it will help you determine the level of coverage you need to maintain financial stability. For instance, if you have a substantial mortgage or a young family with significant expenses, you might want to consider extending your insurance coverage to ensure these needs are met.

Evaluate Your Future Financial Goals: Think about your long-term financial aspirations. Do you plan to send your children to college? Are there any specific savings goals, such as purchasing a home or investing in a business? Consider your retirement plans and any other significant financial milestones you aim to achieve. By evaluating these goals, you can decide whether extending your life insurance coverage is necessary to provide the financial security required to reach these milestones. For example, if you're planning to start a business, you might want to ensure that your insurance policy can support your venture during the initial stages.

Consider Inflation and Interest Rates: Economic factors like inflation and interest rates can impact your financial plans. Inflation erodes the purchasing power of money over time, meaning that future expenses might be more significant than they are today. Similarly, interest rates can affect the growth of your savings and investments. When reviewing your needs, consider these economic factors to ensure your insurance coverage remains adequate. You might need to adjust your policy to account for potential future increases in living costs.

Review and Adjust Your Policy: Based on your assessment, decide whether to extend your term life insurance policy. If you determine that your current coverage is sufficient, you might consider converting it to a permanent life insurance policy, which provides lifelong coverage. Alternatively, you could explore other insurance options, such as whole life insurance, which offers a combination of coverage and savings components. When reviewing your policy, also check for any potential discounts or benefits you might be eligible for, such as reduced rates for non-smokers or healthy individuals.

Seek Professional Advice: Financial advisors or insurance brokers can provide valuable insights and guidance tailored to your specific circumstances. They can help you navigate the various insurance options and ensure you make informed decisions. These professionals can also assist in creating a comprehensive financial plan that considers all aspects of your life, including insurance, investments, and retirement planning.

Understanding Level Term Life Insurance: A Comprehensive Guide

You may want to see also

Consider Term Extensions: Explore options like converting to permanent insurance

When your term life insurance policy comes to an end, it's a crucial moment to consider your long-term financial security and the well-being of your loved ones. One of the primary reasons people opt for term life insurance is to provide coverage during a specific period, often tied to a mortgage, a child's education, or a business venture. As this coverage expires, it's essential to evaluate your current financial situation and future needs.

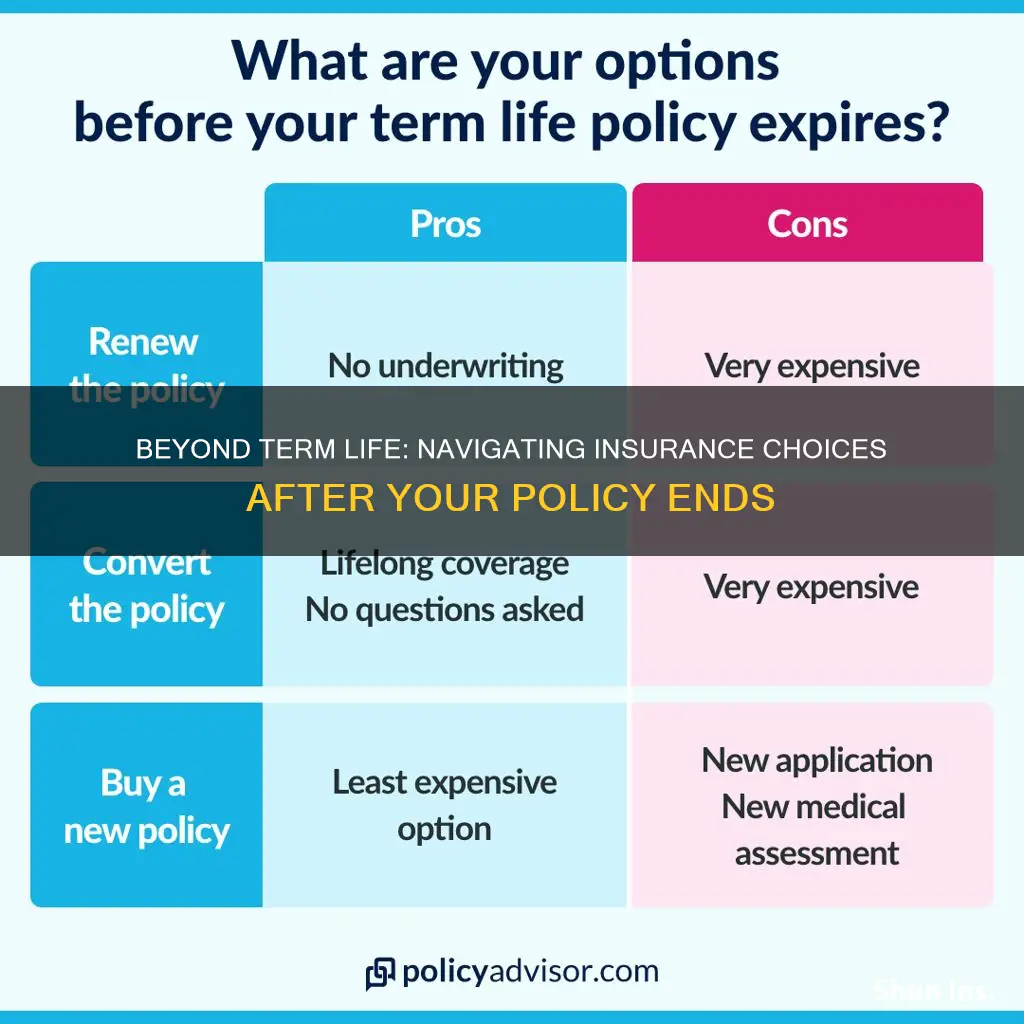

One of the most common options to consider is extending your term life insurance. This could involve reviewing your policy and deciding whether to renew it for another term. Term life insurance is typically more affordable than permanent insurance because it provides coverage for a limited time. By extending the term, you can ensure that your family remains protected for an extended period, especially if your financial obligations or responsibilities have not changed. For instance, if you have a mortgage that will take several more years to pay off, extending the term of your life insurance can provide the necessary coverage until the mortgage is cleared.

Another strategy to consider is converting your term life insurance into a permanent policy. This option allows you to keep the coverage indefinitely, providing long-term financial protection for your beneficiaries. Permanent insurance, such as whole life or universal life, offers several advantages. Firstly, it provides lifelong coverage, ensuring that your family is protected even in your later years. Secondly, permanent policies often accumulate cash value over time, which can be borrowed against or withdrawn, providing a financial safety net. This can be particularly useful if you want to build a substantial insurance portfolio or have other financial goals.

When exploring these options, it's crucial to assess your current financial health and future plans. Consider your age, income, and any existing insurance policies. If you have a stable income and a secure financial future, extending the term of your current policy might be sufficient. However, if your financial obligations have changed or you want to ensure long-term coverage, converting to a permanent policy could be a wise decision. Consulting with a financial advisor or insurance specialist can provide valuable insights tailored to your specific circumstances.

In summary, when your term life insurance is about to expire, consider extending the term to maintain coverage for your current financial obligations. Alternatively, converting to a permanent policy can offer lifelong protection and potential financial benefits. Making an informed decision based on your unique financial situation will ensure that you and your loved ones remain adequately protected.

Unlock the Benefits: Understanding Guaranteed Cash Value Life Insurance

You may want to see also

Evaluate Alternative Coverage: Research other insurance types to ensure continued protection

When your term life insurance policy expires, it's crucial to evaluate your insurance needs and consider alternative coverage options to ensure you and your loved ones remain protected. Here's a detailed guide on how to approach this important decision:

Understand Your Current Coverage: Begin by reviewing your existing term life insurance policy. Understand the coverage amount, duration, and any riders or additional benefits included. Knowing these details will help you assess the level of protection you currently have and identify any gaps in coverage.

Assess Your Changing Circumstances: Life is full of changes, and your insurance needs may evolve over time. Consider factors such as:

- Family Structure: Do you have a growing family, a new dependent, or elderly parents who rely on your financial support?

- Financial Responsibilities: Have your financial obligations changed? Do you have a mortgage, business, or other significant financial commitments?

- Health and Lifestyle: Any recent health changes or lifestyle modifications can impact your insurance rates and eligibility.

- Long-Term Goals: Are you saving for retirement, planning for your child's education, or investing in a business? These goals may require different insurance strategies.

Research Alternative Insurance Types: There are several insurance types that can provide long-term coverage and fill the gap left by a term life insurance policy:

- Whole Life Insurance: This permanent life insurance offers lifelong coverage and includes a savings component, allowing you to build cash value over time. It provides predictable premiums and death benefits, making it a reliable long-term solution.

- Universal Life Insurance: Similar to whole life, universal life insurance offers flexible premiums and death benefits. It allows you to adjust your coverage and investment strategy as your needs change.

- Variable Life Insurance: This type combines insurance protection with investment options, providing potential for higher returns. It offers more investment flexibility but also carries more risk.

- Annuities: Annuities provide a steady income stream and can offer tax-deferred growth. They are particularly useful for retirement planning and can provide guaranteed income for life.

Compare and Evaluate: Research and compare different insurance providers and policies. Consider factors such as coverage amounts, premiums, policy terms, and the financial strength of the insurance company. Seek professional advice from insurance agents or financial advisors who can help you navigate the options and choose the best fit for your specific circumstances.

Review and Adjust Regularly: Insurance needs are not set in stone. Life events, financial changes, and evolving goals may require adjustments to your coverage. Schedule regular reviews of your insurance portfolio to ensure it remains aligned with your current situation. This proactive approach will help you stay protected throughout your life's journey.

Mercury's Life Insurance: What's the Verdict?

You may want to see also

Plan for Financial Goals: Adjust investments and savings to meet post-term objectives

When your term life insurance policy comes to an end, it's crucial to reassess your financial situation and make adjustments to ensure your long-term goals are still on track. Here's a comprehensive guide on how to plan for your financial objectives after the term life insurance coverage expires:

Review and Evaluate: Begin by taking a thorough look at your current financial landscape. Calculate your remaining term life insurance coverage and understand the duration it provides. During this period, assess your financial goals, including retirement plans, education funds for children, or any other long-term objectives. Evaluate your income, expenses, and any existing savings or investments. This review will help you identify any gaps in your financial strategy.

Adjust Investment Strategies: Consider your investment portfolio and make necessary modifications. If you've been relying on term life insurance as a primary source of coverage, you might need to rebalance your investments. Diversify your portfolio to include a mix of assets such as stocks, bonds, and mutual funds. Consult with a financial advisor to determine the right asset allocation strategy based on your risk tolerance and financial goals. Regularly review and rebalance your portfolio to ensure it aligns with your objectives as you progress through different life stages.

Enhance Savings and Retirement Planning: Term life insurance often provides a temporary safety net, so it's essential to build a robust savings and retirement plan. Review your retirement accounts, such as 401(k)s or IRAs, and ensure they are adequately funded. Consider increasing your contributions to these accounts, especially if you have caught up on savings during the term life insurance period. Explore additional retirement savings options, such as a Roth IRA or a 403(b) plan, to maximize tax advantages and secure your financial future.

Consider Long-Term Care and Health Insurance: As you age, long-term care and health insurance become increasingly important. Evaluate your current coverage and plan for potential future needs. Research and compare different long-term care insurance policies to find the best fit for your requirements. Additionally, review your health insurance options and consider any changes in coverage that might be necessary as you transition out of the term life insurance period.

Regularly Update and Monitor: Financial planning is an ongoing process. Set up regular reviews with your financial advisor to assess your progress and make any necessary adjustments. Life events, such as marriages, births, or career changes, may impact your financial goals. Stay proactive by monitoring market trends, economic conditions, and any changes in your personal circumstances that could affect your investment and savings strategies.

By following these steps, you can effectively navigate the transition when your term life insurance is up, ensuring that your financial goals remain achievable and well-protected. It is essential to stay informed, seek professional advice when needed, and regularly review your financial plan to adapt to life's changing circumstances.

Is Globe Life Insurance Rated Well?

You may want to see also

Consult a Financial Advisor: Seek professional guidance for informed decision-making

When your term life insurance policy comes to an end, it's a significant moment that requires careful consideration and planning. This is a crucial juncture to evaluate your current financial situation, life goals, and the evolving needs of your loved ones. Consulting a financial advisor at this stage is an invaluable step towards making informed decisions about your future. Here's why seeking professional guidance is essential:

Financial advisors are experts in assessing your overall financial health. They will review your income, expenses, savings, and investments to understand your current financial standing. By analyzing this information, they can provide tailored advice on how to proceed with your life insurance. For instance, they might suggest extending your coverage, switching to a permanent policy, or exploring other insurance options that better align with your current needs. Their expertise ensures that your decision is not only financially sound but also strategically aligned with your long-term goals.

The advisor will also consider your life goals and future plans. Are you planning to start a family, purchase a home, or pursue further education? These milestones often require different insurance coverage. A financial advisor can help you navigate these decisions by offering guidance on the types of insurance that will provide the necessary protection during these life stages. For example, they might recommend converting your term life insurance to a whole life policy, which offers lifelong coverage and potential investment benefits, ensuring your family's financial security even as your life circumstances change.

Moreover, financial advisors can help you understand the various insurance options available in the market. With numerous life insurance providers and policies, it can be overwhelming to make a choice. Advisors can simplify this process by explaining the differences between term, whole life, universal life, and other types of policies. They will present the pros and cons of each, helping you make an informed decision based on your specific requirements and preferences. This ensures that you choose the right insurance plan that suits your needs and budget.

In addition to providing advice, financial advisors can also assist with the practical aspects of policy management. They can help you understand the terms and conditions of your existing policy, including any conversion options or surrender values. If you decide to switch policies, they can guide you through the process, ensuring a smooth transition. Their expertise can also be invaluable when negotiating with insurance companies, as they can advocate for your best interests and help you secure favorable terms.

By consulting a financial advisor, you gain a trusted partner who will work collaboratively with you to make the most of your life insurance. They provide a comprehensive approach, considering all aspects of your financial life, and offer solutions that are both practical and aligned with your long-term vision. This professional guidance is particularly important when navigating significant life changes, ensuring that your insurance decisions are well-informed and tailored to your unique circumstances.

Credit Life Insurance: A Mortgage Must-Have?

You may want to see also

Frequently asked questions

When your term life insurance policy reaches its end date, the coverage will automatically terminate. This means that the insurance company will no longer provide financial protection in the event of your death. It's important to review your insurance needs and consider extending coverage before the term ends to ensure you and your loved ones remain protected.

Yes, many insurance companies offer the option to renew term life insurance policies. Renewal allows you to extend the coverage for another term, typically with the same or similar benefits. However, the cost and terms may change, and there could be additional medical questions or requirements during the renewal process. It's advisable to compare offers from different insurers to find the best deal.

If you choose not to renew your term life insurance, you might consider other insurance options like permanent life insurance or universal life insurance. These policies provide long-term coverage and can be tailored to your specific needs. Alternatively, you could also explore other financial planning strategies, such as purchasing a new term policy with a different insurer or using other investment vehicles to secure your family's financial future.