Insurance is a contract between an insurer and an insured, in which the insured receives financial protection from the insurer for losses they may suffer under specific circumstances. The insured pays a regular premium to the insurer, who pays a predetermined sum to the insured if an unfortunate event occurs, such as damage to the insured or their property, or the death of the insured.

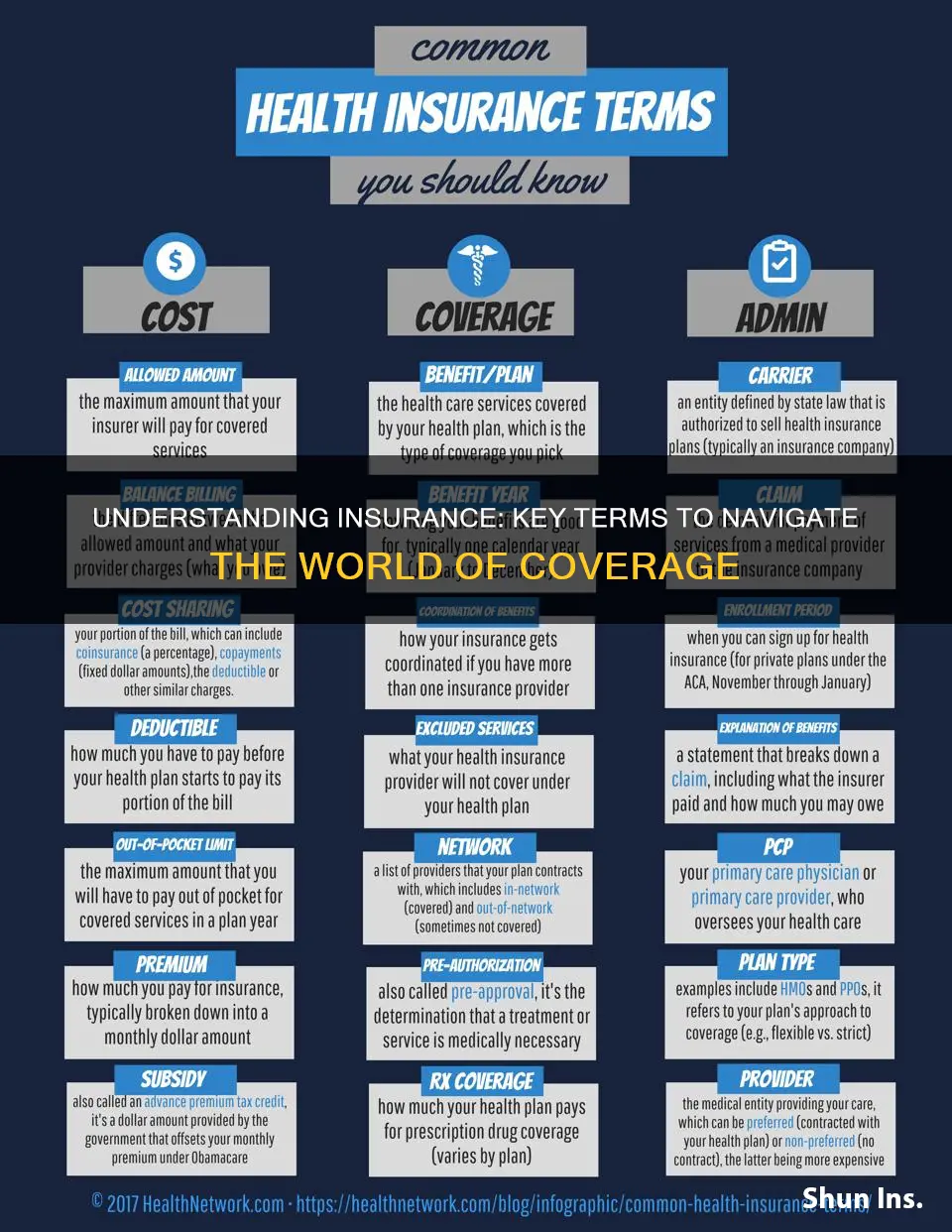

The insurance industry has its own unique language, with many terms and concepts that are important to understand when purchasing a policy. Here are some key insurance terms to know:

- Premium: The amount of money paid by the insured to the insurer for the insurance coverage.

- Policy Limit: The maximum amount of compensation that the insurer will pay for a covered loss under a policy.

- Deductible: The amount that the insured must pay out-of-pocket before the insurer covers the rest of the costs.

- Claim: A formal request filed by the policyholder to the insurer for compensation for covered losses or damages.

- Conditions: The section of the policy document that outlines the duties and responsibilities of both the insured and the insurer, as well as the requirements that must be met for the coverage to be valid.

- Effective Date: The date when the insurance policy goes into effect.

- Declarations Page: A page in the policy document, usually the front page, that summarises the key details of the policy, including coverages, limits, deductibles, and the effective date.

- Hazard: A situation or condition that increases the likelihood of a loss occurring.

- Loss: The basis for filing an insurance claim, which includes direct and accidental damage sustained by the insured or their property.

- Named Insured: The person or business named in the policy, also referred to as the policyholder.

- Peril: Something that causes a loss, such as fire, theft, collisions, natural disasters, illnesses, or death.

- Lapse in Coverage: A period when one goes without insurance coverage, often due to failure to renew a policy.

- Rider: An optional coverage that policyholders can add to their policies, such as identity theft or water backup coverage for home insurance.

These are just a few of the many terms used in the insurance industry. Understanding these terms can help individuals make informed decisions when purchasing insurance policies and ensure they have the right coverage for their needs.

| Characteristics | Values |

|---|---|

| Insurance type | Life, Health, Home/Property, Auto, etc. |

| Policy type | Individual, Group, etc. |

| Premium | The amount paid by the insured to the insurer |

| Sum Insured | The maximum cap on the costs covered in a year |

| Sum Assured | The amount paid to the insured/nominee in the event of the insured's death |

| Policy Limit | The maximum compensation for certain types of losses |

| Deductible | The maximum amount of loss covered by the insured |

| Claim | A request by the insured for compensation of losses |

| Claimant | The person filing the claim |

| Insured | The person or entity covered by the insurance policy |

| Insurer | The company providing insurance coverage and services |

| Policy | A written contract of insurance |

| Coverage | The scope of protection provided by the insurance |

What You'll Learn

- Deductibles: The amount you pay out-of-pocket before insurance covers expenses

- Premiums: The amount insurance companies charge for coverage

- Policyholder: The person who applied for, pays for, and is issued the policy

- Claims: A formal request by the policyholder to the insurer for compensation

- Coverage: The protection against financial loss provided by an insurance contract

Deductibles: The amount you pay out-of-pocket before insurance covers expenses

A deductible is the amount of money that a policyholder agrees to pay out-of-pocket before their insurance company shoulders the cost. Deductibles are a common feature of many types of insurance coverage, including homeowners, renters, auto, and health insurance. The deductible is a key component of an insurance policy, alongside the premium and policy limit.

Deductibles are a way for insurance companies to ensure that policyholders have "skin in the game" and will share the cost of any claims. They also help to cushion insurance companies against the financial stress of catastrophic loss or an accumulation of small losses. Deductibles vary based on the coverage, insurer, and how much you pay in premiums. Typically, a higher deductible will result in lower premiums, and vice versa.

How deductibles work will depend on the type of insurance. With auto and homeowners insurance, you pay a deductible for each individual claim. With health insurance, there is only one deductible that covers all claims within a calendar year.

When shopping for insurance, you can typically choose your deductible amount. A higher deductible will reduce your rate, while a lower deductible will increase it. It's important to choose a deductible that you can afford to pay, as you will be responsible for this amount each time you make a claim.

The Truth About Term Insurance: Unraveling the Mystery of Surrender and Refund Values

You may want to see also

Premiums: The amount insurance companies charge for coverage

Premiums are a fundamental component of insurance policies. They refer to the amount of money charged by an insurance company in exchange for providing coverage. Premiums are essentially the price of an insurance policy, typically paid on a monthly basis. The amount of a premium can vary depending on several factors, such as age, gender, driving history, location, health status, and coverage levels. For instance, auto insurance premiums may be influenced by factors such as the policyholder's history of claims, age, location, and creditworthiness. Similarly, health insurance premiums can be determined by factors like age, gender, location, and health status.

In the context of insurance, premiums represent the financial commitment made by individuals or businesses to obtain protection against various risks. By paying premiums, policyholders transfer their risk to the insurance company, which pools these premiums to cover potential losses. This allows the insurance company to spread the risk across a larger group, making it more affordable for individuals.

It is important to note that the premium amount is not arbitrary but is carefully calculated by the insurer based on the perceived risk of a claim being made. For example, an individual with a history of reckless driving and multiple expensive automobiles is likely to pay a higher auto insurance premium compared to someone with a perfect driving record and a single midrange car.

Additionally, the premium amount can also be influenced by the policy limit, which is the maximum amount the insurer will pay for a covered loss. Higher policy limits typically result in higher premiums. It is worth noting that different insurance companies may offer similar policies with varying premium rates, so it is essential for individuals to compare prices and find the most suitable option for their needs.

Understanding premiums is crucial when purchasing insurance as it directly impacts the cost of coverage. By considering factors that affect premiums, individuals can make informed decisions about their insurance choices and find the best value for their money.

The Intricacies of Reciprocal Insurance: Unraveling the Unique Concept in the Industry

You may want to see also

Policyholder: The person who applied for, pays for, and is issued the policy

A policyholder is the person who owns an insurance policy. They are the ones who have purchased the policy and are responsible for paying the premium. The policyholder is also the person who can make changes to the policy, such as adding insured individuals or changing the beneficiaries. In most cases, the policyholder is the only person who can make these changes.

The policyholder is often the insured, but not always. For example, if you buy life insurance for your spouse, you are the policyholder, but your spouse is the insured. Similarly, if you are the primary driver of a vehicle but do not own it, you may still be considered the policyholder and be responsible for premium payments and policy changes.

The policyholder is sometimes referred to as the "named insured". This is the person who is specifically identified as the policyholder in the insurance policy.

Being a policyholder comes with certain rights and responsibilities. The policyholder is responsible for paying the premium on time and ensuring continuous coverage. They may also need to communicate with the insurance company, submit claims, and address any concerns or disputes.

In the context of health insurance, the policyholder is the primary contact for the insurance company and is responsible for enrolling in the policy and filing claims. They also have the right to add dependents to their policy and are usually covered for all members of their household.

The Many Faces of Term Insurance: Unraveling the Five Distinct Forms

You may want to see also

Claims: A formal request by the policyholder to the insurer for compensation

An insurance claim is a formal request made by the policyholder to their insurance company for compensation for covered losses or damages. This is also known as a request for remittance. The policyholder is the person or business named in the policy, also referred to as the insured or claimant.

The claim is a key part of the insurance process. It is the mechanism through which the policyholder accesses the financial protection offered by the insurance company. When an insured event occurs, the policyholder will contact their insurance company to initiate the claim. The insurance company will then validate the claim. If the claim is approved, the insurance company will issue payment to the insured or an approved interested party on behalf of the insured.

The claim process can vary depending on the type of insurance and the nature of the claim. For example, health insurance claims are often filed by healthcare providers on behalf of the policyholder. In the case of life insurance, the beneficiary of the policy will need to file a claim.

The claim process may also involve several steps, including information gathering, damage assessment, and negotiation. The time taken to process a claim can range from a few weeks to a few years, depending on the complexity and size of the claim.

Claims can have a significant impact on insurance premiums. Filing multiple claims in a short period can lead to an increase in premiums as insurers believe there is a higher likelihood of future claims.

Unraveling the RCV Mystery: A Comprehensive Guide to Insurance Terminology

You may want to see also

Coverage: The protection against financial loss provided by an insurance contract

Coverage is a fundamental aspect of insurance, encompassing the financial protection provided by an insurance contract against losses. When an individual purchases an insurance policy, they are essentially paying for coverage, which serves as a safety net in the event of unforeseen circumstances or accidents.

The extent of coverage varies across different types of insurance policies, such as auto, health, homeowners, and life insurance. For instance, auto insurance typically covers damage to one's vehicle resulting from collisions, vandalism, or natural disasters. Health insurance, on the other hand, helps cover routine and emergency medical care costs. Homeowners insurance protects against damage to one's home and belongings due to natural disasters, theft, or vandalism. Meanwhile, life insurance provides financial protection for one's loved ones in the event of the policyholder's death.

When purchasing an insurance policy, it is crucial to understand the specific coverage it offers. This includes knowing what types of losses or damages are covered, as well as any exclusions or limitations. Additionally, the cost of coverage, or the premium, is an important consideration, as it varies based on factors such as age, gender, health status, and the type of insurance.

Understanding the concept of coverage is essential for individuals seeking to protect themselves financially through insurance. By familiarising oneself with the terms and conditions of their insurance policy, individuals can ensure they have adequate protection against potential losses.

Understanding Insurance: A Simple Guide to Managing Your Risks

You may want to see also

Frequently asked questions

A deductible is the amount that you must pay out of your own pocket before the insurance company will begin paying towards any covered expenses. The deductible affects how much money you will pay to the doctor or hospital, and is typically paid at the time of treatment.

A rider, sometimes referred to as an endorsement, is an optional coverage that policyholders can add to their policies. This includes identity theft and water backup coverage for home insurance, and accident forgiveness and roadside assistance for auto policies.

A peril is something that causes a loss. This includes fire, theft, collisions, natural disasters, illnesses, and death.

A loss is the basis for filing an insurance claim. This includes direct and accidental damage the insured or their property sustains.