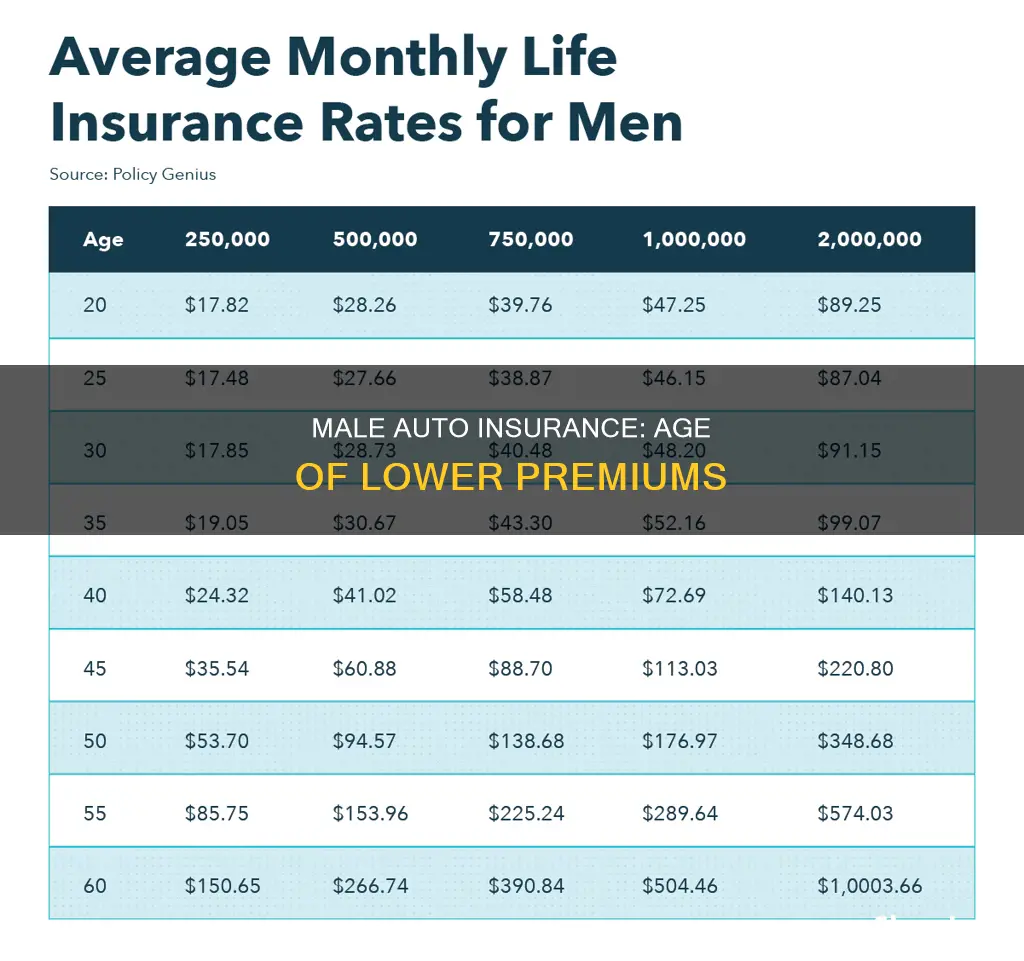

Car insurance rates for males typically start to decrease in their mid-twenties and stabilise in their thirties. This is because insurance companies consider younger drivers to be less experienced and more likely to take risks on the road, and therefore more likely to have accidents and make claims. However, car insurance rates are influenced by a variety of factors, including driving history, location, credit history, and the number of people on the policy. Maintaining a clean driving record and shopping around for insurance quotes can help male drivers find lower rates.

| Characteristics | Values |

|---|---|

| Age when insurance starts to go down | Mid-twenties |

| Age when insurance is cheapest | 35-55 |

| Age when insurance starts to go up again | 65+ |

| Average annual decrease in insurance cost between ages 16 and 21 | $814 |

| Average insurance cost for males at age 25 | $766 less per year than at age 21 |

| Average insurance cost for males at age 19 | $1,595 per year |

What You'll Learn

- Auto insurance rates for males decrease with age and driving experience

- Males face the highest auto insurance premiums in their teens

- Premiums stabilise in the late twenties and remain low through middle age

- Premiums are based on risk factors, including age, gender, and driving history

- Maintaining a good driving record helps reduce auto insurance costs

Auto insurance rates for males decrease with age and driving experience

Age and Driving Experience

Age is one of the most important factors in determining car insurance rates. Younger drivers are generally more likely to have accidents or take risks on the road. Experienced drivers are less likely to make accident claims, which means they cost less to insure.

The Impact of Age on Insurance Rates

Insurance rates typically decrease significantly from ages 19 to 34, then stabilize or decrease slightly from 34 to 75. After age 75, the average premium begins to trend upward.

The Impact of Driving Experience on Insurance Rates

Each year of driving experience gained as a new driver results in lower insurance premiums. This is because insurance companies view drivers with more experience as less risky to insure.

The Impact of Gender on Insurance Rates

On average, male drivers pay higher insurance rates than female drivers between the ages of 16 and 25. This is because younger male drivers are seen as riskier to insure due to their overall inexperience behind the wheel. However, by their mid-twenties, insurance rates for males will start to decrease.

Ways to Decrease Auto Insurance Rates

In addition to age and driving experience, there are other factors that can help reduce auto insurance rates. These include maintaining a good credit history, taking advantage of easy discounts offered by major insurance companies, and adding a teen driver to a parent's existing policy.

The Bottom Line

While auto insurance rates for males do decrease with age and driving experience, it is important to note that gaining experience behind the wheel and maintaining a clean driving record are also essential to keeping insurance costs low.

Mandatory Vehicle Insurance: What's Covered?

You may want to see also

Males face the highest auto insurance premiums in their teens

Car insurance rates are determined by several factors, including age, gender, driving experience, and records. While it may seem unfair, younger drivers are generally more likely to have accidents or take risks on the road, making them a cause for concern for both their parents and insurance companies. As a result, they are often required to pay higher insurance premiums.

Male drivers, in particular, face the highest auto insurance premiums during their teenage years. This is because insurance companies consider them to be riskier to insure due to their inexperience behind the wheel, as well as their higher likelihood of being involved in car accidents. Teenage males who drive on weekends account for a significant proportion of road accidents. Consequently, insurance companies charge them higher rates to compensate for the increased risk.

The good news for male drivers is that their insurance rates typically start to decrease in their mid-twenties. This reduction in rates is due to their increasing driving experience and the perception that they are less likely to engage in risky behaviour as they mature. The rate reductions usually plateau and remain stable throughout middle age, providing several decades of relatively lower insurance costs.

It is worth noting that maintaining a good driving record is crucial for keeping insurance rates low. Both male and female drivers can expect their insurance rates to decrease annually if they renew their policies without making any claims. Additionally, insurance companies offer various discounts that can help lower insurance costs, such as good student discounts, safe driver discounts, and loyalty discounts.

In summary, while male drivers face the highest auto insurance premiums during their teenage years, their rates gradually decrease as they gain driving experience and age. By maintaining a clean driving record and taking advantage of available discounts, they can further reduce their insurance costs.

Smart Ways to Save on Auto Insurance

You may want to see also

Premiums stabilise in the late twenties and remain low through middle age

Car insurance rates are generally highest for young and inexperienced drivers, particularly teenagers, due to their higher likelihood of accidents and risk-taking on the road. As drivers gain more experience, their insurance premiums tend to decrease.

For male drivers, car insurance rates typically start to decrease in their mid-twenties and stabilise in their late twenties, remaining low through middle age. This is because insurance companies consider older drivers less risky to insure as they gain more experience behind the wheel and become less likely to file insurance claims.

While age is a significant factor in determining car insurance rates, it is important to note that rates can vary depending on other factors such as driving record, credit history, location, and the number of people on the policy. Additionally, insurance companies may offer discounts for safe driving, good student performance, and loyalty, which can further reduce premiums.

Maintaining a clean driving record is crucial for keeping car insurance costs low. Accidents, violations, and traffic tickets can cause insurance rates to increase and may continue to affect rates for up to ten years, depending on the state and the severity of the infraction.

In summary, car insurance premiums for male drivers stabilise in their late twenties and remain low through middle age, but other factors besides age also influence insurance rates.

Canceling Liberty Mutual Auto Insurance: A Guide

You may want to see also

Premiums are based on risk factors, including age, gender, and driving history

Car insurance premiums are calculated based on several risk factors, including age, gender, and driving history. While these factors are considered across the board, their relative weightages may vary from insurer to insurer.

Age

Age is one of the most important factors in determining car insurance rates. Younger drivers, especially teenagers, are considered riskier to insure due to their inexperience and higher likelihood of accidents. As a result, they often pay higher premiums. Premiums tend to decrease significantly as drivers age from 19 to 34, stabilise or slightly decrease from 34 to 75, and then begin to increase again after 75.

Gender

Women typically pay less for auto insurance than men because they are statistically less likely to be involved in accidents or commit serious driving violations, and they are more likely to wear seatbelts. However, it is important to note that some states prohibit the use of gender as a factor in determining insurance rates or approvals.

Driving History

An individual's driving record, including moving traffic violations and at-fault accidents, is one of the biggest factors influencing insurance rates. Most driving infractions and accidents will remain on a driver's record for at least three years, and some serious violations, such as DUIs, may be considered for longer. A clean driving record, free of accidents, speeding tickets, and violations, can help lower insurance premiums.

Uninsurable: Why Auto Insurance is Impossible

You may want to see also

Maintaining a good driving record helps reduce auto insurance costs

Maintaining a good driving record is one of the best ways to reduce auto insurance costs. Insurance companies view drivers with clean records as less risky to insure, which results in lower premiums. Safe drivers can also benefit from discounts such as the No Claim Bonus, which can reduce insurance costs by up to 50%.

In addition to safer driving behaviours, there are other factors that contribute to a good driving record. These include respecting traffic rules and regulations, such as avoiding signal jumping and speeding, as well as paying fines and challans on time. Checking your driving record regularly can help you identify areas for improvement and maintain a clean history.

The type of vehicle you drive also impacts your insurance rates. When buying a car, consider its safety record, the cost of repairs, overall safety features, and the likelihood of theft. Insurers offer discounts for vehicles with features that reduce the risk of injuries or theft.

Furthermore, insurance companies reward customer loyalty. Staying with the same insurer for a longer period can lead to loyalty discounts and lower premiums. However, it is still worth shopping around and comparing rates from different providers, as costs can vary significantly.

By combining safe driving practices with smart insurance choices, males can work towards reducing their auto insurance costs and securing more affordable coverage.

Vehicle Insurance Status: Check and Verify

You may want to see also

Frequently asked questions

Auto insurance rates for males usually start decreasing in their mid-twenties and stabilise in their late twenties, remaining low throughout middle age.

Auto insurance is cheapest for drivers between the ages of 35 and 55.

Male drivers pay around $766 less per year at age 25 compared to when they were 21. At Progressive, rates drop by an average of 9% at age 25.

Maintaining a good driving record, switching insurance companies, and taking advantage of discounts offered by major insurance companies are some ways to reduce auto insurance costs.

Younger drivers are generally considered riskier to insure due to their inexperience, resulting in higher insurance rates. As drivers age and gain experience, they become less likely to file insurance claims, leading to lower insurance costs.