COBRA insurance, or the Consolidated Omnibus Budget Reconciliation Act, allows employees to continue their health insurance coverage after leaving their job. COBRA coverage starts on the date of a qualifying event, such as job loss, divorce, or the death of a covered spouse. Employees have 60 days to decide whether to elect COBRA coverage, which is retroactive if elected and paid for. Once elected, COBRA coverage is active immediately after the first premium payment is made.

| Characteristics | Values |

|---|---|

| When does COBRA coverage start? | The same day that the group health plan ended after the premium payment has been made |

| When do I need to sign up for COBRA? | 60 days from a "qualifying event" or the date your notice is mailed, whichever is later |

| How much does COBRA cost? | The full costs paid by both you and your former employer, plus an added 2% for administrative costs |

| How long will my COBRA coverage last? | 18 months but may extend up to 36 months if you have a second "qualifying event" |

| Is COBRA my only coverage option when I leave my job? | No, you may also qualify for other health benefits |

| What happens when my COBRA coverage runs out? | You need to choose one of the other coverage options |

| How do I sign up for COBRA coverage? | You'll have 60 days to notify your insurance company of your qualifying event |

| How long does it take for COBRA to kick in? | With all paperwork properly submitted, your COBRA coverage should begin on the first day of your qualifying event |

| How long can I stay on COBRA? | In most cases, 18 months from the date of the qualifying event |

| When do I need to pay my first COBRA premium? | Within 45 days of beginning your COBRA coverage |

| When I've made my first COBRA premium payment, when do I have to submit payments for all future COBRA premiums? | All other premium payments must be made within 30 days of the due date |

What You'll Learn

COBRA insurance becomes active after a qualifying event

COBRA insurance is a federal law that allows employees to continue their health insurance coverage after leaving their job. It is an acronym for the Consolidated Omnibus Budget Reconciliation Act, which was signed into law by President Ronald Reagan in 1985. This law made it illegal for certain employers to take specific tax deductions if they weren't also offering continued coverage under its employee health insurance plan.

Once a qualifying event occurs, the employer has 30 days to notify the group health plan administrator. Within 14 days of that notification, the plan administrator must notify the individual of their COBRA rights. The individual then has 60 days to decide whether to elect COBRA coverage. If the individual chooses to elect COBRA coverage, their benefits will be retroactive to the date their previous coverage ended.

The Donut Hole Conundrum: Unraveling the Mystery of Insurance Terminology

You may want to see also

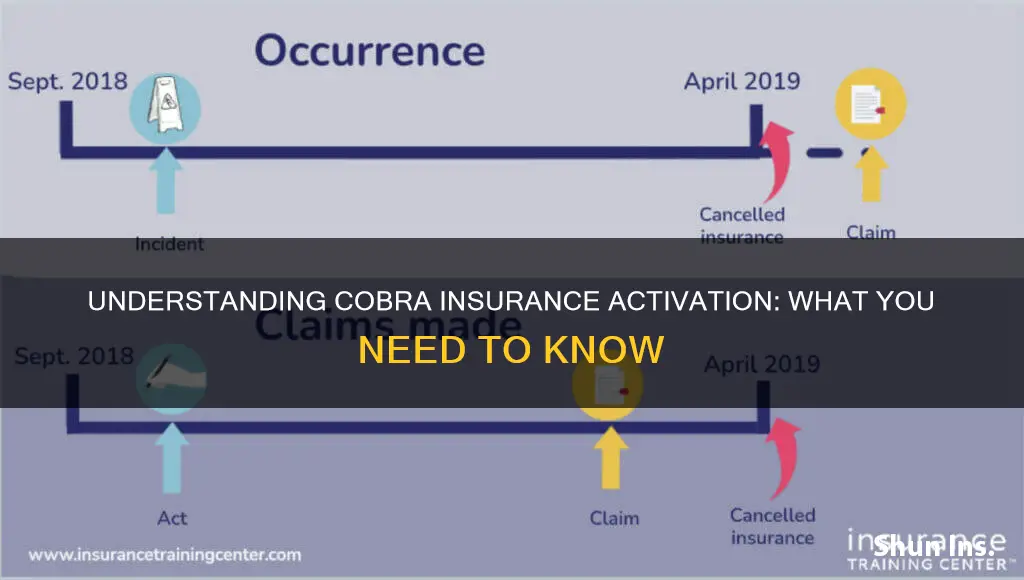

COBRA coverage is retroactive

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, is a federal law that allows employees to maintain their health insurance benefits after they are no longer employed by the company providing the insurance. COBRA coverage is retroactive, meaning that it can be applied to the period between the loss of insurance and the start of COBRA coverage. This is particularly useful if an individual requires medical attention during the period between insurance coverage.

After an individual's insurance restarts, they may submit out-of-pocket medical expenses for reimbursement. This is helpful for those who require medical attention during the period between their insurance coverage ending and their COBRA coverage beginning.

To be eligible for COBRA coverage, an individual must have been enrolled in an employer-sponsored medical, dental, or vision plan. Additionally, the former company must have had 20 or more full-time employees. Once eligible, an individual has 60 days to notify their insurance company of their "qualifying event", such as leaving their job. The insurance company then has 14 days to notify the individual of their COBRA rights. The individual then has another 60 days to decide whether to elect continuation coverage.

While COBRA coverage is retroactive, it is important to note that the individual will still need to pay their premiums for that period. This means that if an individual requires medical attention during the period between insurance coverage, they can enroll in COBRA after the fact and be covered. However, they will still be responsible for paying the premiums for that period.

Catastrophe Insurance: What's Covered?

You may want to see also

COBRA is available to former employees and their families

COBRA insurance is a federal law that allows employees and their families to continue their health insurance coverage after leaving their job. The Consolidated Omnibus Budget Reconciliation Act, signed into law by President Ronald Reagan in 1985, made it illegal for certain types of employers to take specific tax deductions if they weren't also offering the option of continued coverage under its employee health insurance plan.

The length of COBRA coverage depends on the type of qualifying event. For covered employees, COBRA coverage lasts for 18 months in the event of termination of employment or reduction of employment hours, regardless of whether the termination is voluntary or involuntary. If the qualifying event is the death of the covered employee, divorce or legal separation of the covered employee from their spouse, or the covered employee becoming entitled to Medicare, COBRA coverage for the spouse or dependent child can last for up to 36 months.

In the case of disability, qualified beneficiaries may be eligible for an 11-month extension of COBRA coverage, for a total of 29 months. To be eligible for this extension, the covered employee must be determined to be disabled under Title II or Title XVI of the Social Security Act, and the disability must begin within the first 60 days of COBRA coverage.

UPS Declared Value: Insurance or Not?

You may want to see also

COBRA is expensive

COBRA Insurance: Why It's Expensive

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, is a federal law that allows employees to continue their employer-based health insurance for a limited time after they leave their job. While COBRA can be a great way to maintain insurance coverage during periods of unemployment, it is often more expensive than people expect.

COBRA insurance costs include the entire monthly premium of the employer's plan, plus an additional 2% administration fee. This means that individuals opting for COBRA are responsible for covering the full cost of the insurance premium, including both the part previously covered by the employer and their own prior contribution.

The cost of COBRA insurance can vary depending on location and individual circumstances. However, on average, COBRA insurance premiums range from $400 to $700 per individual per month. This is significantly higher than the average cost of individual health insurance in the United States, which is $584 per month as of 2024.

The high cost of COBRA is often due to the fact that employers typically cover most of the monthly premium costs for their employees' health insurance. When an employee transitions to COBRA, they are now responsible for covering the full premium themselves, which can result in a significant increase in their monthly insurance costs.

Alternatives to COBRA

It's important to note that COBRA is not the only option for individuals who have lost their job-based health insurance. Other alternatives include enrolling in a spouse's employer plan, choosing a health insurance market plan, or enrolling in a trade or professional group plan. These options may provide more affordable coverage for individuals who find the cost of COBRA insurance prohibitive.

Overpricing: Insurance Fraud or Simple Mistake?

You may want to see also

COBRA is not the only option

COBRA is a great way to ensure that you have the coverage you need, regardless of your current employment status. However, it is not your only option. Here are some alternatives to COBRA:

Private Health Insurance

You can purchase a health insurance plan directly from a private organization or agent. This option is typically better if you need fuller coverage and don't have a limited budget. Private health plans are sold outside of your state or federal Marketplace, and coverage may vary depending on what they offer. These plans typically include some form of coverage for preventive care as well as services for pre-existing conditions.

Health Insurance Marketplace

The Health Insurance Marketplace is a great health coverage option for both individuals and families. Many states run their own health exchanges where you can shop, compare and enroll in a plan that works best for your needs and budget. If your state doesn’t have its own Marketplace, you can use the federal government Marketplace. With a Special Enrollment, you can shop for coverage even if you’re outside of the standard Open Enrollment Period. During this Special Enrollment Period, you’ll have 60 days from the time your employer-provided benefits end to enroll in a health plan.

Spouse's Plan

If you are married, you may be able to enroll in your spouse's employer plan. Leaving your job triggers a special enrollment period, allowing you to join your spouse's plan. Even if they aren’t enrolled in their employer’s plan, your job loss lets you both sign up outside the usual open enrollment period. But you must do so within 30 days.

Medicaid

Medicaid is an insurance option created for those with limited income. Eligibility varies by monthly income, the size of your household, and more. You can apply to enroll in Medicaid at any time – there is no annual enrollment period to meet. You can apply for Medicaid through the Health Insurance Marketplace or your state’s Medicaid agency.

Trade or Professional Group Plan

You may be able to find plans that cost less through national organizations that offer benefits for independent workers. For example, the National Association for the Self-Employed ($120/year membership fee) or the Freelancers Union (free membership).

Insurance Buying: Key Considerations

You may want to see also

Frequently asked questions

COBRA insurance becomes active on the date of the qualifying event, which could be the loss of a job, the death of a covered employee, divorce, etc.

With all the paperwork properly submitted, your COBRA coverage should begin on the first day of your qualifying event, ensuring no gaps in your coverage.

You have 60 days from a qualifying event or the date your notice is mailed, whichever is later, to enroll in COBRA.

You'll need to pay for your first COBRA premium within 45 days of beginning your COBRA coverage, which will begin with day one of your qualifying event.

COBRA coverage typically lasts for 18 months from the date of the qualifying event. However, in cases of death or divorce, COBRA coverage can be extended up to 36 months.