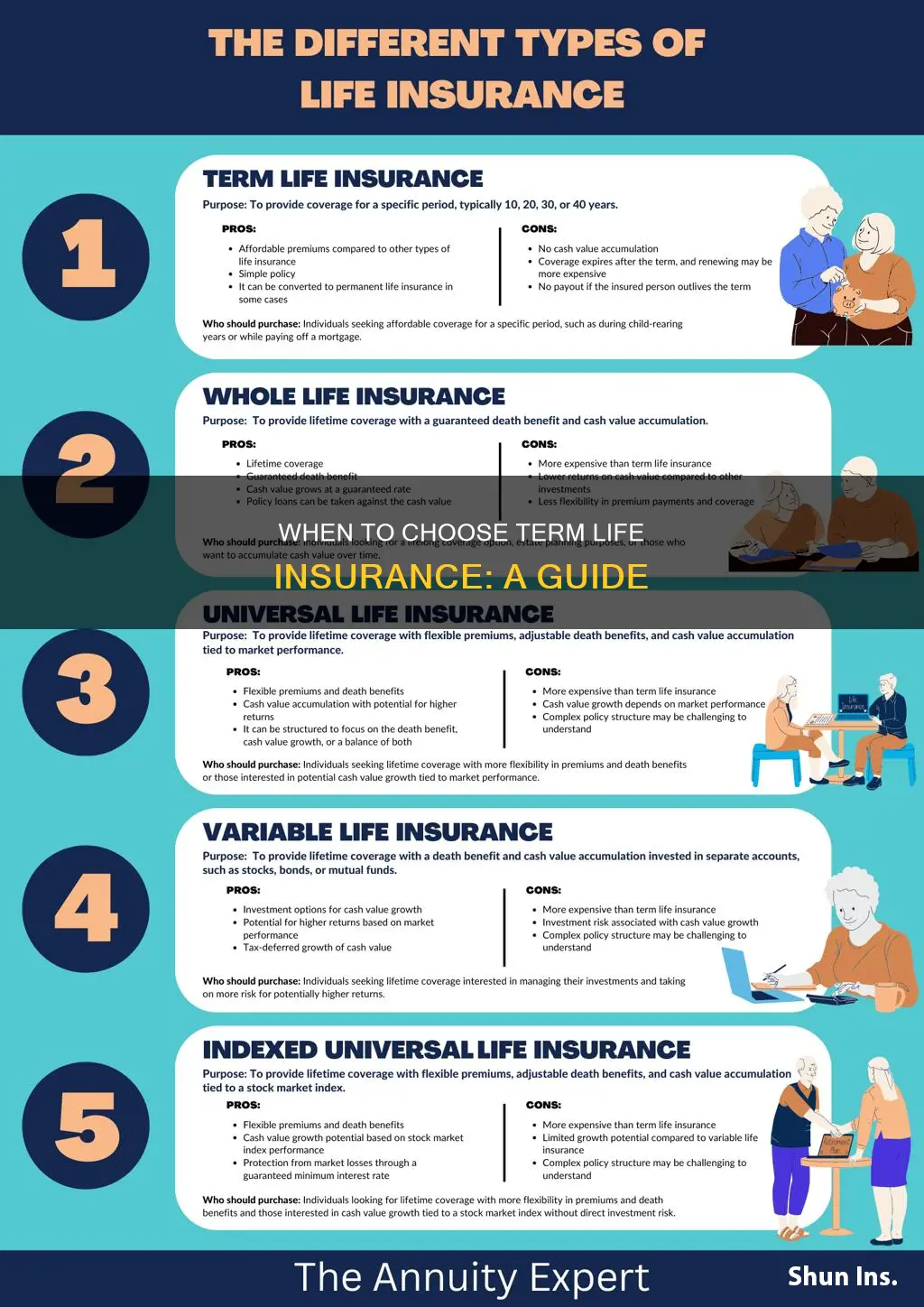

Term life insurance can be a smart choice for individuals who want affordable coverage for a specific period, such as when they have a mortgage or are supporting a family. It provides a straightforward and cost-effective solution to secure financial protection during these times, ensuring that loved ones are financially supported if something happens to the policyholder. This type of insurance is particularly appealing because it offers a clear and defined period of coverage, typically 10, 20, or 30 years, making it easier to manage and plan for specific financial goals. Understanding when and why term life insurance is beneficial can help individuals make informed decisions about their insurance needs.

What You'll Learn

- Affordable Coverage: Term life is cost-effective for short-term needs, like mortgage protection

- Fixed Premiums: Premiums remain constant, providing predictable insurance costs

- No Lapse: Unlike permanent life, term policies don't lapse if premiums aren't paid

- Specific Needs: Ideal for covering debts or providing income for a set period

- No Cash Value: No investment component, making it simple and direct

Affordable Coverage: Term life is cost-effective for short-term needs, like mortgage protection

Term life insurance is an excellent choice for individuals seeking affordable coverage for specific, short-term financial obligations. It provides a safety net during critical periods, ensuring financial stability for those who rely on it. One of the primary benefits of term life is its cost-effectiveness, making it an ideal solution for short-term needs, such as mortgage protection.

When you take out a mortgage, you're essentially borrowing a significant amount of money to purchase a property. This loan is typically secured by the home itself, and if you were to pass away, the lender would have the right to claim the property to recover the debt. Term life insurance steps in here as a safeguard. By taking out a term life policy, you can ensure that your loved ones are protected financially in the event of your death. The insurance company pays out a lump sum to your beneficiaries, which can be used to cover the remaining mortgage balance, providing peace of mind and financial security.

The beauty of term life insurance for mortgage protection lies in its affordability. Unlike permanent life insurance, which offers lifelong coverage, term life policies are designed for specific periods, often ranging from 10 to 30 years. This shorter-term nature makes it more cost-effective, as you only pay for the coverage you need during the mortgage period. Once the mortgage is paid off, the policy can be reviewed, and if no longer required, it can be canceled, saving you money over time.

In addition, term life insurance is highly customizable. You can choose the coverage amount based on the mortgage balance and any other short-term financial obligations. This flexibility ensures that you only pay for the protection you need, making it an affordable and efficient solution. It's a practical approach to safeguarding your loved ones and your financial assets without breaking the bank.

In summary, term life insurance is a wise investment for those seeking affordable coverage for short-term needs, particularly mortgage protection. Its cost-effectiveness, flexibility, and ability to provide financial security during critical periods make it an attractive option for individuals and families. By considering term life, you can ensure that your loved ones are protected, and your financial obligations are met, all while keeping insurance costs manageable.

Life Insurance: TIAA-CREF's Comprehensive Coverage Options

You may want to see also

Fixed Premiums: Premiums remain constant, providing predictable insurance costs

Term life insurance is a type of coverage that offers a straightforward and cost-effective solution for individuals seeking temporary protection. One of its key advantages is the predictability it brings to insurance costs. When you opt for term life insurance, you agree to pay a fixed premium for a specified period, known as the "term." This term can vary, ranging from a few years to several decades, depending on your needs and preferences. The beauty of this arrangement lies in the stability it provides. During the term, your premiums remain constant, ensuring that your insurance costs are predictable and easy to budget for. This predictability is particularly valuable as it allows you to plan and manage your finances effectively without the worry of sudden premium increases.

In contrast to other types of life insurance, where premiums can fluctuate based on various factors, term life insurance offers a consistent and reliable payment structure. This consistency is especially beneficial for those who want to ensure that their loved ones are financially protected without the uncertainty of changing costs. By locking in the premium rate for the duration of the term, you gain peace of mind, knowing exactly how much you'll pay each year or month. This predictability is a significant advantage, especially when compared to whole life insurance, where premiums can increase over time.

The fixed nature of term life insurance premiums makes it an attractive option for individuals who prioritize financial planning and stability. Whether you're a young professional building a career or a family looking to secure their future, knowing exactly how much you'll spend on insurance can help you allocate resources more efficiently. This predictability also allows you to make informed decisions about other financial commitments, ensuring that your insurance costs don't strain your budget.

Furthermore, the constancy of premiums in term life insurance encourages long-term financial planning. With a fixed cost, you can set aside funds in a savings or investment account, knowing that the insurance premium won't unexpectedly rise. This strategy can help build a financial safety net for your beneficiaries or contribute to your overall financial goals.

In summary, term life insurance with fixed premiums is a good idea for those seeking a simple, predictable, and cost-effective way to protect their loved ones. The stability it offers in terms of insurance costs allows individuals to make informed financial decisions, plan for the future, and ensure that their insurance needs are met without the worry of unexpected premium changes. This type of coverage is particularly suitable for temporary financial protection, providing a reliable safety net during specific life stages or periods.

Borrowing Against AFBA Life Insurance: Is It Possible?

You may want to see also

No Lapse: Unlike permanent life, term policies don't lapse if premiums aren't paid

Term life insurance is a popular and straightforward choice for individuals seeking coverage for a specific period. One of its key advantages is the absence of a lapse in coverage, which sets it apart from permanent life insurance. When you opt for a term policy, you're essentially purchasing insurance for a defined term, such as 10, 20, or 30 years. During this period, the policy remains in force, providing financial protection to your loved ones if something happens to you.

The 'no lapse' feature of term life insurance is a significant benefit, especially when compared to permanent life insurance. With permanent life insurance, if the insured individual passes away, the policy's death benefit is paid out. However, if the policyholder fails to pay the premiums, the policy can lapse, and the coverage may end. This is a critical difference that term life insurance policies do not face.

In the case of term life insurance, if the premiums are not paid, the policy will not lapse. The insurance company will not terminate the coverage, and the policy will remain in effect until the end of the specified term. This is a crucial aspect for individuals who want to ensure their loved ones are protected without the worry of potential policy lapses due to missed payments. It provides a sense of security and peace of mind, knowing that the coverage will continue as long as the policy was initially intended.

This feature is particularly attractive to those who want a simple and cost-effective solution for a specific period. For example, a young professional might choose a 20-year term life insurance policy to cover their mortgage or provide financial security for their family during their working years. Even if they change jobs or experience financial fluctuations, the term policy will continue to offer protection without the risk of lapse.

In summary, the 'no lapse' characteristic of term life insurance is a powerful advantage, ensuring that coverage remains in place for the agreed-upon term, regardless of premium payment issues. This aspect makes term life insurance an excellent choice for those seeking a straightforward and reliable way to protect their loved ones without the complexities associated with permanent life insurance policies.

Life Insurance Payout Process for South African Beneficiaries

You may want to see also

Specific Needs: Ideal for covering debts or providing income for a set period

Term life insurance is a financial tool that can be particularly beneficial for individuals facing specific financial obligations or those seeking a structured financial plan. It is designed to provide coverage for a defined period, making it an excellent choice for addressing particular needs and goals. One of the most common and compelling reasons to consider term life insurance is to cover debts or provide a steady income for a set duration.

When you have significant debts, such as a mortgage, student loans, or business loans, term life insurance can act as a safety net. In the event of your passing, the death benefit from the insurance policy can be used to settle these debts, ensuring that your loved ones are not burdened with financial obligations. This is especially crucial if you are the primary breadwinner in your family, as it provides financial security and peace of mind, knowing that your family's financial stability is protected.

Additionally, term life insurance can be tailored to meet specific income needs. For instance, if you are planning to start a business and require capital to launch it, or if you are saving for a child's education, a term policy can provide the necessary financial support. The policy's death benefit can be used to generate an income stream for a set period, ensuring that your financial goals are met. This is particularly useful when you want to provide a consistent income for a defined time frame, such as until your child reaches college age or until your business loan is fully repaid.

The beauty of term life insurance in this context is its simplicity and cost-effectiveness. It offers pure insurance, focusing solely on providing financial protection during a specific period. This makes it an affordable option, especially for those with limited budgets, as the premiums are typically lower compared to permanent life insurance policies. By choosing a term policy, you can allocate your financial resources efficiently, ensuring that your money is directed towards covering debts or providing income for the intended duration.

In summary, term life insurance is an ideal solution for individuals with specific financial needs, such as debt coverage or income generation for a set period. It provides a structured and affordable way to address these concerns, offering financial security and peace of mind. By understanding your unique circumstances and consulting with a financial advisor, you can determine the appropriate term length and coverage amount to meet your specific goals.

BDO Life Insurance: Application Process Simplified

You may want to see also

No Cash Value: No investment component, making it simple and direct

Term life insurance is a straightforward and cost-effective way to protect your loved ones financially during a specific period, typically 10, 20, or 30 years. One of its key advantages is that it offers pure insurance without any investment components, making it a simple and direct choice for many individuals.

When you opt for term life insurance with no cash value, you're essentially purchasing a policy that provides a death benefit if you pass away during the term. This benefit is paid out to your designated beneficiaries, ensuring they receive the financial support they need during a challenging time. The beauty of this type of insurance lies in its simplicity; it's a pure insurance product, free from any investment or savings elements.

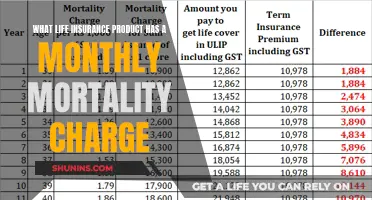

In contrast to permanent life insurance, which includes an investment component, term life insurance focuses solely on providing coverage for a defined period. This means no long-term savings or investment growth, making it a more affordable option. The premiums are typically lower because there's no need to build a cash value, and the insurance company doesn't have to invest your money to generate returns.

This type of insurance is ideal for individuals who want to provide financial security for their families or dependents without the complexity of an investment-based policy. It's a direct approach to ensuring that your loved ones are taken care of should something happen to you during the specified term. With no cash value accumulation, the policy remains straightforward, and the focus remains on the insurance coverage.

In summary, term life insurance with no cash value is a good choice when you prioritize simplicity, affordability, and direct financial protection for your beneficiaries. It's a pure insurance product that ensures your loved ones are financially secure during a specific period without the added complexity of investment components.

Life Insurance Requirements: Preferred Plus Eligibility Criteria

You may want to see also

Frequently asked questions

Term life insurance is a good idea when you have a specific need for coverage that aligns with a particular time frame. It is often recommended for individuals who want to provide financial security for their loved ones during a specific period, such as covering mortgage payments, children's education expenses, or other short-term financial obligations.

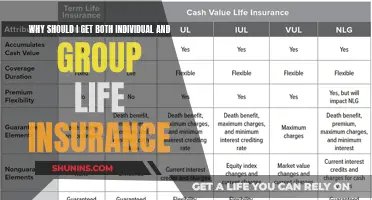

This type of insurance offers several advantages. Firstly, it provides a guaranteed death benefit if the insured person passes away during the term period. Secondly, it is typically more affordable than permanent life insurance, making it accessible to a wider range of individuals. Additionally, term life insurance can be renewed at the end of the term, allowing for long-term coverage if needed.

The term length should be based on your financial obligations and the time frame during which you believe your loved ones will need financial support. Common term lengths include 10, 15, 20, or 30 years, but you can choose a term that best fits your specific circumstances. For example, if you have a 15-year mortgage, a 15-year term policy might be suitable.

Yes, many term life insurance policies offer the option to convert to a permanent life insurance policy, such as whole life or universal life, before the term ends. This allows you to continue coverage beyond the initial term, providing lifelong protection. It's essential to review the policy details and consider your long-term financial goals before making a conversion.

While term life insurance is generally affordable, it may not be suitable for those seeking long-term financial planning or investment opportunities. Unlike permanent life insurance, term policies do not accumulate cash value, and the coverage ends at the end of the term. Additionally, if you outlive the term, the policy may not provide any further benefits.