Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. While individual life insurance offers personalized coverage tailored to your specific needs, group life insurance provides an additional layer of protection through employer-sponsored plans. By combining both options, you can ensure comprehensive coverage that adapts to your changing circumstances. Individual life insurance offers flexibility and control, allowing you to choose the coverage amount and term that best suits your financial goals and risk tolerance. On the other hand, group life insurance provides immediate coverage at a potentially lower cost, often with no medical exam required. Understanding the benefits of both can help you make an informed decision and create a robust financial safety net for your future.

What You'll Learn

- Personalized Coverage: Individual insurance offers tailored protection to meet unique needs and preferences

- Financial Security: Group insurance provides a safety net for loved ones in the event of death

- Affordability: Group plans often offer lower premiums due to shared risk among a larger group

- Flexibility: Individual policies allow for customization, ensuring comprehensive coverage for specific circumstances

- Peace of Mind: Having both ensures comprehensive protection and financial security for various life stages

Personalized Coverage: Individual insurance offers tailored protection to meet unique needs and preferences

When it comes to life insurance, one size does not fit all. Individual life insurance policies are designed to provide personalized coverage, ensuring that your unique needs and preferences are met. This type of insurance allows you to have full control over the terms and conditions, giving you the flexibility to choose the level of coverage that suits your specific circumstances. Whether you're a young professional starting out or an older individual with a substantial amount of assets, individual life insurance can be tailored to your exact requirements.

The beauty of individual insurance lies in its ability to provide customized protection. You can select the amount of coverage you desire, ensuring that your loved ones are financially secure in the event of your passing. For instance, if you have a large family and want to ensure their long-term financial stability, you can opt for a higher death benefit. Conversely, if you have fewer financial dependents or a more modest estate, a lower coverage amount might be more appropriate. This level of customization allows you to make informed decisions based on your personal and financial goals.

Furthermore, individual life insurance offers the advantage of being portable. Unlike group insurance, which is often tied to your employer, individual policies remain with you regardless of job changes or career shifts. This portability ensures that your coverage continues uninterrupted, providing peace of mind as your life circumstances evolve. For example, if you change jobs, you can still maintain your individual policy, keeping the same level of protection without any gaps in coverage.

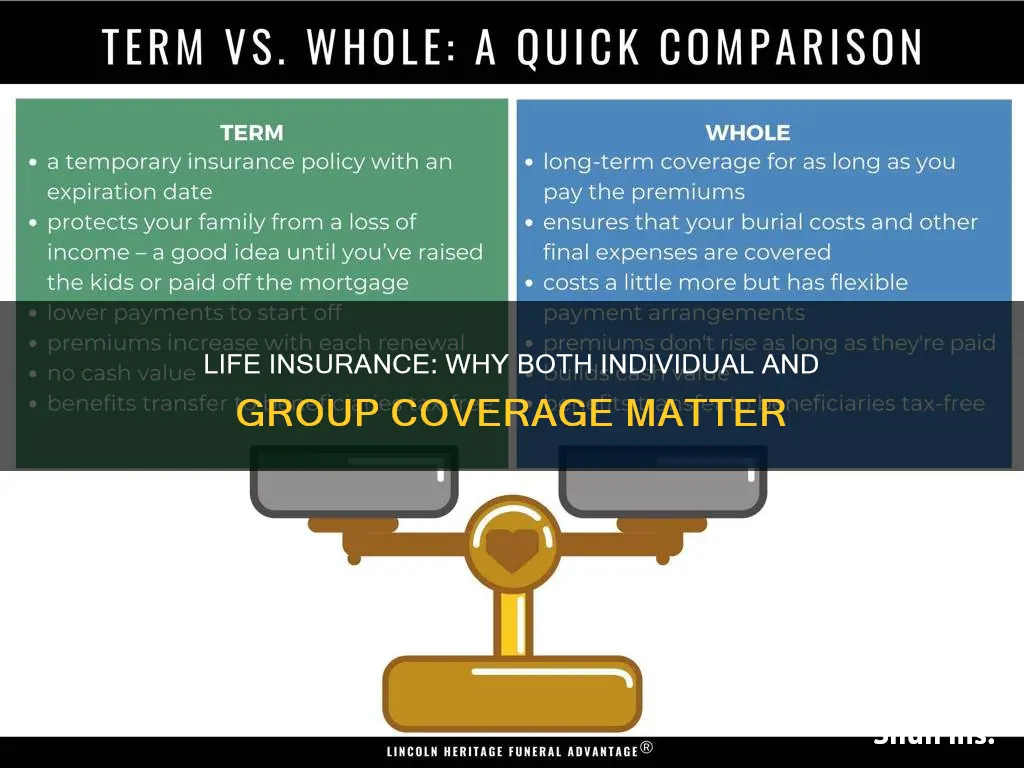

Another aspect of personalized coverage is the ability to choose the type of policy that best suits your needs. There are various types of individual life insurance, such as term life, whole life, and universal life. Each type has its own benefits and features, allowing you to make an informed decision. Term life insurance provides coverage for a specified period, while whole life offers lifelong protection with an investment component. Understanding these options and selecting the one that aligns with your financial goals is essential in ensuring you receive the most suitable coverage.

In summary, individual life insurance provides tailored protection by allowing you to customize the coverage amount, type of policy, and other terms to fit your unique situation. This level of personalization ensures that your insurance needs are met effectively, providing financial security for your loved ones and peace of mind for you. It empowers you to make decisions that are right for your life, offering a sense of control and assurance in an uncertain world.

Life Insurance and Cervical Cancer: What's Covered?

You may want to see also

Financial Security: Group insurance provides a safety net for loved ones in the event of death

When it comes to financial security, group life insurance is a powerful tool that can provide a safety net for your loved ones in the event of your untimely death. This type of insurance is an essential component of a comprehensive financial plan, offering a sense of reassurance and peace of mind. Here's why group insurance is a valuable asset:

Group life insurance is designed to provide financial protection to a group of individuals, typically employees of a company or members of an organization. In the unfortunate event of a member's death, the insurance policy ensures that a lump sum payment, known as a death benefit, is paid out to the designated beneficiaries. This financial support can be a lifeline for the family, covering essential expenses and providing a sense of financial stability during a difficult time. The death benefit can be used to cover various costs, such as mortgage payments, children's education, outstanding debts, and daily living expenses, ensuring that the family's financial obligations are met and their long-term goals remain on track.

One of the key advantages of group insurance is its affordability. Since the policy is purchased for a group, the cost is typically shared among the members, making it more accessible and cost-effective compared to individual life insurance. This shared responsibility allows for lower premiums, making it an attractive option for those who may not qualify for or afford individual coverage. By providing financial security to the group, the insurance company ensures that the loved ones of the deceased member are cared for, even if the primary breadwinner is no longer present.

Furthermore, group life insurance often offers additional benefits and features. These may include accelerated death benefits, which allow policyholders to access a portion of the death benefit if they are diagnosed with a critical illness or are terminally ill. This feature provides financial support for medical expenses and can help ease the financial burden during a challenging period. Additionally, some group policies may offer flexible payment options, allowing policyholders to choose the most suitable payment plan that fits their financial situation.

In summary, group life insurance serves as a vital financial safety net, ensuring that your loved ones are protected and their financial well-being is maintained even in your absence. It provides a sense of security and peace of mind, knowing that your family will receive the necessary financial support to navigate life's challenges. By considering group insurance as part of your overall financial strategy, you can take a proactive approach to safeguarding your loved ones' future.

Life Insurance: Money Laundering's Unlikely Friend

You may want to see also

Affordability: Group plans often offer lower premiums due to shared risk among a larger group

When considering life insurance, one of the key factors that often influences your decision is affordability. This is where group life insurance plans can be a game-changer. Group plans are typically more affordable than individual policies because they spread the risk across a larger pool of people. In a group plan, the insurance company pools together the premiums from all the members, which allows them to offer lower rates. This shared risk model is a significant advantage, especially for those who might not qualify for individual coverage due to health issues or other factors.

The affordability of group life insurance is particularly beneficial for employees who are offered such coverage as part of their benefits package. By sharing the cost with a large number of participants, the financial burden on any single individual is reduced. This makes it an attractive option for those who may have limited financial resources or prefer to allocate their budget to other essential expenses. Moreover, group plans often provide a sense of security and peace of mind, knowing that you have coverage without the high costs associated with individual policies.

In a group setting, the insurance company can assess the overall health and demographics of the group, which can lead to more accurate risk assessments. This allows them to set premiums that are fair and competitive. For instance, if a group consists of mostly young, healthy individuals, the premiums will likely be lower compared to a group with a higher proportion of older or less healthy members. This shared risk approach ensures that the cost of coverage is distributed fairly, making it an economically viable option for many.

Additionally, group life insurance plans often come with other benefits that enhance their value. These may include simplified underwriting processes, which can result in quicker approval and lower administrative costs. Some group plans also offer additional perks such as term life insurance at no extra cost, providing comprehensive coverage without additional fees. These features further contribute to the affordability and attractiveness of group life insurance.

In summary, group life insurance plans offer a cost-effective solution by distributing the risk across a larger group, resulting in lower premiums. This affordability factor, combined with the potential for additional benefits, makes group coverage an appealing choice for many individuals. It is a strategic approach to securing life insurance without breaking the bank, especially for those who may not have access to individual policies due to various factors.

Understanding Level Benefit Life Insurance: A Comprehensive Guide

You may want to see also

Flexibility: Individual policies allow for customization, ensuring comprehensive coverage for specific circumstances

When it comes to life insurance, the concept of flexibility is a key advantage of individual policies. These policies offer a level of customization that is not always available with group insurance plans. This flexibility is crucial as it allows you to tailor the coverage to your unique needs and circumstances.

Individual life insurance policies provide an opportunity to assess your personal situation and design a plan that fits like a glove. You can choose the specific coverage amount that aligns with your financial goals and obligations. For instance, if you have a large mortgage or a substantial amount of debt, you might opt for a higher coverage amount to ensure your loved ones are financially secure in the event of your passing. This level of customization ensures that your insurance policy is comprehensive and addresses your particular risks and responsibilities.

Furthermore, individual policies often offer a range of riders and add-ons that can enhance your coverage. These options allow you to customize your policy to include additional benefits such as critical illness coverage, accidental death insurance, or long-term disability protection. By adding these riders, you can create a policy that provides a safety net for various life events and unexpected situations, ensuring that your loved ones are protected in multiple ways.

The flexibility of individual policies also means that you can adjust your coverage as your life changes. As you age, your health may evolve, and your financial obligations could shift. With an individual policy, you can review and modify your coverage periodically to reflect these changes. For example, if you start a new business or take on additional financial commitments, you can increase your coverage to match your growing responsibilities. This adaptability is a significant advantage, ensuring that your life insurance remains relevant and effective throughout your life.

In contrast, group life insurance plans typically offer standardized coverage with limited customization options. While they provide a convenient and often more affordable solution for employers to offer to their employees, they may not cater to the specific needs of each individual. Group policies usually have set benefits and may not allow for the same level of personalization. Therefore, individual life insurance policies offer the flexibility and customization required to create a comprehensive and tailored protection plan.

Canceling Guardian Life Insurance: A Step-by-Step Guide

You may want to see also

Peace of Mind: Having both ensures comprehensive protection and financial security for various life stages

Obtaining both individual and group life insurance can provide a sense of peace of mind, knowing that you have comprehensive protection and financial security tailored to your unique needs and life stage. Here's why this dual approach is beneficial:

Comprehensive Coverage: Individual life insurance offers a personalized policy, allowing you to choose the coverage amount that aligns with your specific financial goals and obligations. This ensures that your loved ones are adequately protected in the event of your passing. On the other hand, group life insurance provides coverage through your employer or an association, often at a lower cost. It can be an excellent way to secure basic protection without the complexity of individual policies. By combining these two, you gain a well-rounded approach to life insurance, covering both your personal and professional aspects.

Financial Security: Life insurance is a powerful tool to ensure financial stability for your family and dependents. Individual policies offer flexibility in terms of coverage duration and beneficiaries, allowing you to adapt as your life circumstances change. For instance, you might opt for a term life insurance policy to cover mortgage payments or children's education, providing a safety net during specific life stages. Group insurance, often provided as a benefit in the workplace, can offer a safety net for employees and their families. This dual coverage ensures that your financial obligations are met, even in the face of unexpected events.

Adaptability and Flexibility: Life insurance needs can evolve over time. Individual policies allow you to adjust coverage as your income, family size, or health status changes. For instance, you might start with a higher coverage amount when you have a growing family and then reduce it as your children become financially independent. Group insurance, while often more standardized, can still offer various coverage options. By having both, you gain the flexibility to adapt to life's twists and turns, ensuring that your protection remains relevant and effective.

Peace of Mind: Knowing that you have a comprehensive insurance plan in place can significantly reduce stress and anxiety. It provides a sense of security, knowing that your loved ones will be financially protected, even if you're no longer around. This peace of mind allows you to focus on other aspects of your life, knowing that you've made a responsible decision for your family's well-being. Additionally, having both individual and group coverage can simplify the process of updating and managing your insurance, as you can review and adjust both aspects as needed.

In summary, combining individual and group life insurance provides a robust and adaptable approach to financial security. It ensures that you have the coverage you need at various life stages, offering peace of mind and protection for your loved ones. This dual strategy empowers you to make informed decisions about your future, knowing that you've taken the necessary steps to safeguard your family's financial well-being.

Strategies to Boost Sales for Life Insurance Products

You may want to see also

Frequently asked questions

Having both individual and group life insurance offers comprehensive coverage and provides financial security for you and your loved ones. Individual life insurance allows you to customize the policy to your specific needs, ensuring that your beneficiaries receive the exact amount required to cover expenses like mortgage, education, and daily living costs. Group life insurance, on the other hand, is typically offered through employers or organizations, providing coverage for a group of people. It often comes with lower premiums and can be an affordable way to secure financial protection for your family.

Group life insurance is designed to provide coverage for a specific group or organization, such as employees of a company. It is usually more affordable because the risk is shared among the group. Premiums are typically paid by the employer, and the coverage amount is often a set percentage of the group member's salary. Individual life insurance, however, is tailored to your personal needs and can offer higher coverage amounts. It provides more flexibility in terms of policy customization, allowing you to choose the coverage duration, beneficiary, and any additional riders or benefits.

Yes, combining individual and group life insurance can often result in discounts and savings. Insurance companies may offer reduced rates when you have both types of coverage, as it demonstrates a commitment to financial security. Additionally, if you have a group life insurance policy through your employer and also purchase an individual policy, you may be eligible for a discount on the individual policy. This combination can provide comprehensive coverage while potentially saving you money on premiums.