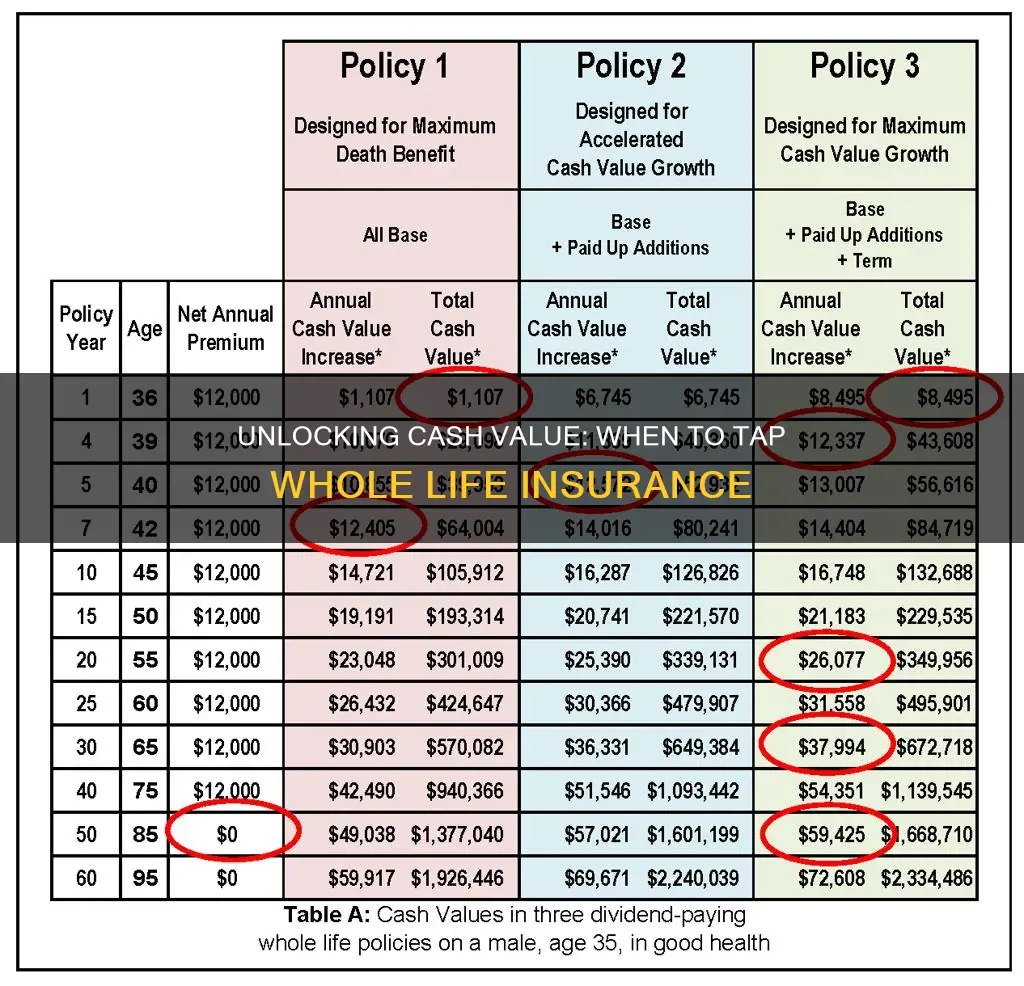

When considering the use of cash value in whole life insurance, it's important to understand that this feature offers a unique financial advantage. The cash value of a whole life policy grows over time, providing a substantial sum that can be borrowed against or withdrawn. This can be particularly useful for individuals seeking a long-term financial strategy, as it allows them to access funds for various purposes, such as funding education, starting a business, or covering unexpected expenses, while still maintaining the insurance coverage. Additionally, the cash value can be a valuable asset that can be utilized to secure loans or as a source of emergency funds, providing financial flexibility and security.

| Characteristics | Values |

|---|---|

| Financial Goals | The cash value of whole life insurance can be used to meet short-term financial goals, such as paying for college tuition or a down payment on a house. It provides a guaranteed, accessible source of funds. |

| Emergency Fund | It serves as a valuable emergency fund, offering a lump sum that can be withdrawn tax-free in case of unforeseen circumstances like job loss or medical emergencies. |

| Debt Management | With its tax-advantaged nature, the cash value can be utilized to pay off high-interest debt, such as credit card balances or personal loans, reducing financial burden. |

| Business Needs | Business owners can leverage the cash value to fund business expansion, purchase equipment, or provide a financial safety net during transitions. |

| Retirement Planning | The cash value grows over time, providing a potential source of retirement income. It can be used to supplement other retirement savings, ensuring a more secure financial future. |

| Tax Efficiency | Tax-deferred growth is a key advantage, allowing the cash value to accumulate without immediate taxation, making it an efficient way to build wealth. |

| Long-Term Savings | It encourages long-term savings, as the funds can grow tax-free and be used for various financial objectives, including future investments or business ventures. |

| Legacy Planning | Whole life insurance with cash value can be used to create a legacy by providing financial support to beneficiaries or funding charitable causes. |

| Flexibility | Policyholders have the flexibility to borrow against the cash value or make withdrawals, allowing for financial adaptability and control. |

| Guaranteed Growth | Unlike some investment options, the cash value of whole life insurance offers guaranteed growth, providing a stable and predictable financial asset. |

What You'll Learn

- Financial Flexibility: Cash value provides liquidity, allowing policyholders to access funds for various financial needs

- Debt Management: It can be used to pay off debts, offering a financial safety net

- Business Capital: Policyholders can borrow against the cash value to start or expand businesses

- Education Funding: The cash value can be used to pay for college tuition or other educational expenses

- Emergency Fund: It serves as a financial cushion during unexpected emergencies or medical crises

Financial Flexibility: Cash value provides liquidity, allowing policyholders to access funds for various financial needs

The cash value of whole life insurance is a powerful financial tool that offers policyholders a unique advantage: financial flexibility. This feature provides a safety net and a source of funds that can be utilized for various financial needs and goals. Understanding when to tap into this cash value can significantly impact one's financial well-being.

One of the primary benefits of cash value is its liquidity. Unlike traditional savings accounts or investments, the cash value in a whole life insurance policy is accessible to the policyholder. This accessibility allows individuals to borrow against their policy or withdraw funds when needed, providing a sense of security and control over their finances. For instance, if an individual requires funds for a business venture, a home renovation, or an unexpected expense, they can utilize the cash value as a reliable source of capital.

The flexibility offered by cash value is particularly valuable during times of financial strain or when opportunities arise. For example, if a policyholder faces a medical emergency or a job loss, they can access the cash value to cover immediate expenses without disrupting their long-term financial plans. Similarly, when an opportunity to invest in a new business venture or a property arises, the cash value can be utilized to seize such prospects, potentially leading to significant financial gains.

Furthermore, the cash value can be a strategic tool for wealth accumulation. Policyholders can borrow against the cash value, allowing them to invest in other assets or ventures while still maintaining their insurance coverage. This strategy enables individuals to grow their wealth while ensuring they are protected against unforeseen circumstances. Over time, the borrowed amount can be repaid, and the policy continues to build cash value, providing a continuous cycle of financial support.

In summary, the cash value of whole life insurance offers a unique blend of security and financial flexibility. It empowers policyholders to make informed decisions about their finances, providing a safety net during challenging times and an opportunity to capitalize on favorable situations. By understanding and utilizing this feature, individuals can ensure they have the financial resources to navigate life's various stages with confidence and control.

Uncover the Secrets: Extraordinary Life Insurance Explained

You may want to see also

Debt Management: It can be used to pay off debts, offering a financial safety net

The cash value of whole life insurance can be a powerful tool for managing and eliminating debt, providing a financial safety net when you need it most. This feature of whole life insurance allows policyholders to build up a cash reserve over time, which can be utilized for various financial purposes, including debt repayment. Here's how it can be a strategic approach to debt management:

When you have outstanding debts, such as credit card balances, personal loans, or even a mortgage, tapping into the cash value of your whole life insurance policy can be a strategic move. This is especially useful if you have a significant amount of debt and are looking for a way to accelerate your repayment. By accessing the cash value, you can make larger payments towards your debts, potentially saving on interest and reducing the overall financial burden. For instance, if you have a whole life insurance policy with a substantial cash value accumulation, you can borrow against it or take out a loan using the policy's value as collateral. This allows you to access funds quickly and efficiently to tackle your debts.

The beauty of using whole life insurance for debt management is the flexibility it offers. You can choose to make lump-sum payments to settle debts or set up a structured repayment plan. This approach can be particularly beneficial for high-interest debts, as it provides a way to break free from the cycle of debt accumulation. By utilizing the cash value, you gain control over your financial situation and can work towards becoming debt-free more rapidly. Additionally, the interest earned on the cash value is typically tax-deferred, providing a further advantage during the repayment process.

It's important to note that while using whole life insurance for debt management can be advantageous, it should be approached with caution. Borrowing against your policy or taking out loans may have long-term implications, and it's crucial to understand the terms and potential risks. Consulting with a financial advisor or insurance professional can help you navigate this strategy effectively and ensure it aligns with your overall financial goals.

In summary, the cash value of whole life insurance provides a unique opportunity to manage and reduce debt. It offers a financial safety net, enabling individuals to take proactive steps towards financial freedom. By strategically utilizing this feature, you can make significant progress in paying off debts and securing a more stable financial future. Remember, when considering any financial strategy, it's essential to seek professional advice to ensure it suits your specific circumstances.

Nicotine Gum: Impact on Life Insurance and Your Health

You may want to see also

Business Capital: Policyholders can borrow against the cash value to start or expand businesses

When considering the use of cash value in whole life insurance for business purposes, it is essential to understand the potential benefits and risks involved. Policyholders can access the cash value of their whole life insurance policy as a valuable financial resource, offering a unique advantage in the business world. This feature allows individuals to leverage their insurance policy as a source of capital, providing an alternative to traditional business funding methods.

Borrowing against the cash value can be a strategic move for policyholders who want to invest in their business ventures. It provides a means to access funds without selling the insurance policy or disrupting the ongoing coverage. By taking out a loan against the cash value, policyholders can utilize this money to finance business expansion, cover operational costs, or invest in new projects. This approach can be particularly beneficial for small business owners who may struggle to secure loans from banks or other financial institutions.

The process typically involves the insurance company lending the policyholder a portion of the cash value accumulated in the policy. The loan is secured by the insurance policy itself, ensuring that the lender has a claim on the policy's benefits. Policyholders can choose to repay the loan with interest over time, ensuring that the insurance coverage remains intact. This method of borrowing can be advantageous as it often has more favorable terms compared to other business loans, especially for those with limited credit history or collateral.

However, it is crucial to approach this strategy with caution. Borrowing against the cash value means that the death benefit of the insurance policy will be reduced by the loan amount, which could impact the financial security of the policyholder's beneficiaries. It is essential to carefully consider the loan terms, interest rates, and repayment schedules to ensure that the policy remains viable and the business benefits from the borrowed funds.

In summary, using the cash value of whole life insurance as business capital can be a powerful tool for policyholders. It provides an opportunity to access funds for business growth while maintaining insurance coverage. By understanding the process and potential risks, individuals can make informed decisions about leveraging their insurance policy as a financial asset, ultimately contributing to the success and sustainability of their business ventures.

Borrowing Against Your Americo Whole Life Insurance: What You Need to Know

You may want to see also

Education Funding: The cash value can be used to pay for college tuition or other educational expenses

The cash value of whole life insurance can be a valuable financial tool for education funding, offering a unique way to save for future educational expenses. This feature of whole life insurance allows policyholders to build up a cash reserve over time, which can be utilized for various financial goals, including education. Here's how it can be a beneficial strategy for funding your child's or your own education:

When considering education funding, the cash value of whole life insurance can be a reliable and consistent source of funds. Unlike other savings accounts or investments, the cash value grows tax-deferred, and the policyholder retains ownership of the policy. This means that the money accumulated in the policy is accessible and can be used for educational purposes without incurring penalties or taxes. As the policyholder, you have the flexibility to decide when and how to access this cash value, making it a versatile option for various financial needs.

One of the significant advantages of using the cash value for education is the potential for long-term savings. Whole life insurance policies typically have a guaranteed death benefit, ensuring that the insurance company pays out a specified amount upon the insured's death. However, the cash value within the policy can be borrowed against or withdrawn, providing immediate access to funds. This feature allows families to start saving for education early, taking advantage of the power of compounding interest. Over time, the cash value can grow significantly, providing a substantial amount for college tuition or other educational costs.

Using the cash value for education funding also offers a sense of security and control. With traditional savings accounts, there are risks associated with market volatility and interest rate fluctuations. In contrast, the cash value of whole life insurance is tied to the policy's performance, which is generally more stable. This stability provides peace of mind, knowing that your education funds are protected and can be relied upon when needed. Additionally, the policy's guaranteed death benefit ensures that your loved ones are financially secure even if you pass away during the policy term.

In summary, the cash value of whole life insurance provides an excellent avenue for education funding. It offers a tax-advantaged way to save, potential long-term growth, and the flexibility to access funds when required. By utilizing this feature, families can build a substantial educational savings plan, ensuring that the financial burden of college or other educational expenses is significantly reduced. This strategy empowers individuals to take control of their financial future and provide a solid foundation for their educational goals.

Life Insurance: Reviewing Your Policy and Making Changes

You may want to see also

Emergency Fund: It serves as a financial cushion during unexpected emergencies or medical crises

An emergency fund is a crucial component of financial planning, providing a safety net during unforeseen circumstances. It is designed to cover unexpected expenses and provide financial security when life takes an unexpected turn. The primary purpose of an emergency fund is to act as a buffer, ensuring that you have the necessary resources to handle emergencies without going into debt or depleting your savings. This fund is particularly important for individuals who may not have access to immediate credit or who want to avoid the financial strain of relying on high-interest loans during a crisis.

When building an emergency fund, it's essential to consider your specific financial situation and goals. A common rule of thumb is to aim for three to six months' worth of living expenses. This amount can vary depending on your personal circumstances, such as family size, income, and job stability. For instance, a single individual with a stable income might aim for three months' worth of expenses, while a family with variable income sources and dependent children might target six months or more. The key is to ensure that the fund covers essential living costs, including housing, utilities, food, and any other regular expenses.

Having an emergency fund can provide peace of mind and financial flexibility. It allows you to handle emergencies without the stress of finding immediate financial solutions. For example, if you or a family member requires unexpected medical treatment, the emergency fund can cover the costs, ensuring that you don't have to make difficult choices between paying for medical care and other essential expenses. Additionally, it can provide a safety net during job transitions, natural disasters, or other significant life events that may impact your income.

To build an emergency fund, start by setting aside a portion of your income regularly. Consider automating this process by setting up direct deposits or transfers from your paycheck or bank account. Even small contributions can add up over time. It's also beneficial to keep the funds in a readily accessible account, such as a high-yield savings account or a money market account, to ensure liquidity when needed. Diversifying your emergency fund across different types of assets can also provide a layer of protection, as it allows you to maintain the purchasing power of your savings despite market fluctuations.

In summary, an emergency fund is a vital tool for financial security, providing a safety net during unexpected emergencies. It empowers individuals to navigate through life's uncertainties with confidence, knowing they have a financial cushion to fall back on. By setting realistic goals and regularly contributing to this fund, individuals can ensure they are prepared for various financial challenges that may arise.

Life Insurance: Children as Beneficiaries, Good Idea?

You may want to see also

Frequently asked questions

The cash value of whole life insurance is the monetary benefit that accumulates over time within the policy. It represents the portion of the premium payments that are invested and grow tax-deferred. This cash value can be borrowed against or withdrawn, providing financial flexibility.

You can access the cash value of your whole life insurance policy in several ways. Firstly, you can take out a loan against the cash value, allowing you to borrow money while still maintaining the policy. Secondly, you can withdraw the cash value, although this may result in a reduction of the death benefit. It's important to consider the policy's terms and potential tax implications.

Utilizing the cash value of whole life insurance offers several advantages. Firstly, it provides a source of emergency funds or additional income during your lifetime. Secondly, the cash value can be used to pay for college tuition or other significant expenses. Additionally, the cash value grows tax-deferred, allowing it to accumulate over time.

While the cash value of whole life insurance can be beneficial, there are some considerations. Withdrawing or borrowing against the cash value may reduce the death benefit, which is the primary purpose of the policy. It's essential to carefully plan and understand the potential impact on your insurance coverage.

The cash value of whole life insurance is unique compared to other insurance products. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong coverage with a guaranteed death benefit. The cash value component allows for investment growth and provides financial flexibility, making it a comprehensive financial tool.