When a wife passes away, the life insurance policy's value becomes a crucial aspect of the surviving spouse's financial security. This insurance policy, often taken out by the husband, can provide a substantial financial cushion for the family, especially if the wife was the primary breadwinner or contributed significantly to the household income. The role of the wife in such a scenario is significant, as her death can leave a void in the family's financial stability. The insurance payout can help cover expenses, such as mortgage payments, children's education, and daily living costs, ensuring the family's well-being and providing a sense of peace during a difficult time. Understanding the implications of life insurance and its value is essential for the surviving spouse to navigate this challenging period effectively.

What You'll Learn

- Grief and Adjustment: Coping with loss, adjusting to new role, and emotional healing

- Legal and Financial Affairs: Managing assets, updating wills, and ensuring financial security

- Emotional Support: Providing comfort, listening, and offering a safe space for grieving

- Life Insurance Claims: Navigating the process, understanding policies, and accessing benefits

- Legacy and Memorials: Honoring the deceased, creating lasting memories, and celebrating life

Grief and Adjustment: Coping with loss, adjusting to new role, and emotional healing

The death of a spouse is an incredibly challenging and life-altering event, often leaving the surviving partner to navigate a complex journey of grief and adjustment. This process is unique to each individual, and it's essential to understand the various aspects of coping with loss and adapting to a new role. Here's a guide to help you through this difficult time:

Coping with Grief: Grief is a natural response to loss, and it's important to acknowledge and accept the emotions that arise. The initial shock and denial may give way to intense feelings of sadness, anger, or even guilt. It's crucial to create a safe space for yourself to process these emotions. Consider keeping a journal to express your thoughts and feelings privately. Writing can be therapeutic and help you make sense of your experiences. During this period, it's beneficial to lean on your support network; reach out to friends and family who can provide comfort and understanding. Sharing your feelings with trusted individuals can help alleviate the burden of grief.

Adjusting to a New Role: After the death of your wife, you may find yourself in a completely different role, one that you never anticipated. Suddenly, you might be the primary caregiver, the decision-maker, and the sole provider for your family. This transition can be overwhelming, and it's essential to be patient with yourself. Take time to understand your new responsibilities and gradually adapt to this changed dynamic. Seek guidance from professionals, such as financial advisors or legal experts, to navigate the practical aspects of your new role. They can provide valuable advice on managing finances, making important decisions, and ensuring the well-being of your family.

Emotional Healing: Healing from loss is a gradual process, and it requires self-care and dedication. Engage in activities that bring you comfort and help you relax. This could be spending time in nature, practicing meditation or mindfulness, or taking up a new hobby. Physical health is often closely tied to emotional well-being, so ensure you maintain a healthy lifestyle. Regular exercise, a balanced diet, and sufficient sleep can significantly contribute to your emotional healing. Additionally, consider joining support groups or seeking counseling to connect with others who have gone through similar experiences. Sharing your story and learning from others can be incredibly empowering and healing.

As you navigate the path of grief and adjustment, remember that healing takes time and there is no rush. Be kind to yourself, embrace the support of your loved ones, and gradually explore the new path that lies ahead. It's a journey of self-discovery, and with each step, you will gain a deeper understanding of your strength and resilience.

Nationwide Insurance: Drug Testing for Life Insurance Policies

You may want to see also

Legal and Financial Affairs: Managing assets, updating wills, and ensuring financial security

When a wife passes away, the management of her legal and financial affairs becomes a crucial aspect for her family and beneficiaries. This process involves several key steps to ensure that her assets are properly managed and her wishes are honored. Here's a guide to navigating these essential tasks:

Asset Management: After the wife's death, it is essential to locate and secure her assets. This includes reviewing and organizing financial records, bank statements, investment portfolios, and any other valuable possessions. Start by gathering all relevant documentation, such as deeds, property titles, insurance policies, and retirement accounts. These documents will help identify the value and nature of her assets. It is advisable to consult with a financial advisor or estate planner to create an inventory of her possessions and determine the best course of action for their distribution.

Updating Legal Documents: The death of a spouse often triggers a review of various legal documents. One of the most critical tasks is to update or create a will. If the wife had a will, it should be reviewed and potentially revised to reflect any changes in her wishes, especially regarding the distribution of assets. Additionally, consider updating power of attorney documents, which appoint individuals to make financial and legal decisions on her behalf if she becomes incapacitated. This ensures that her affairs remain in order even if she is unable to manage them personally.

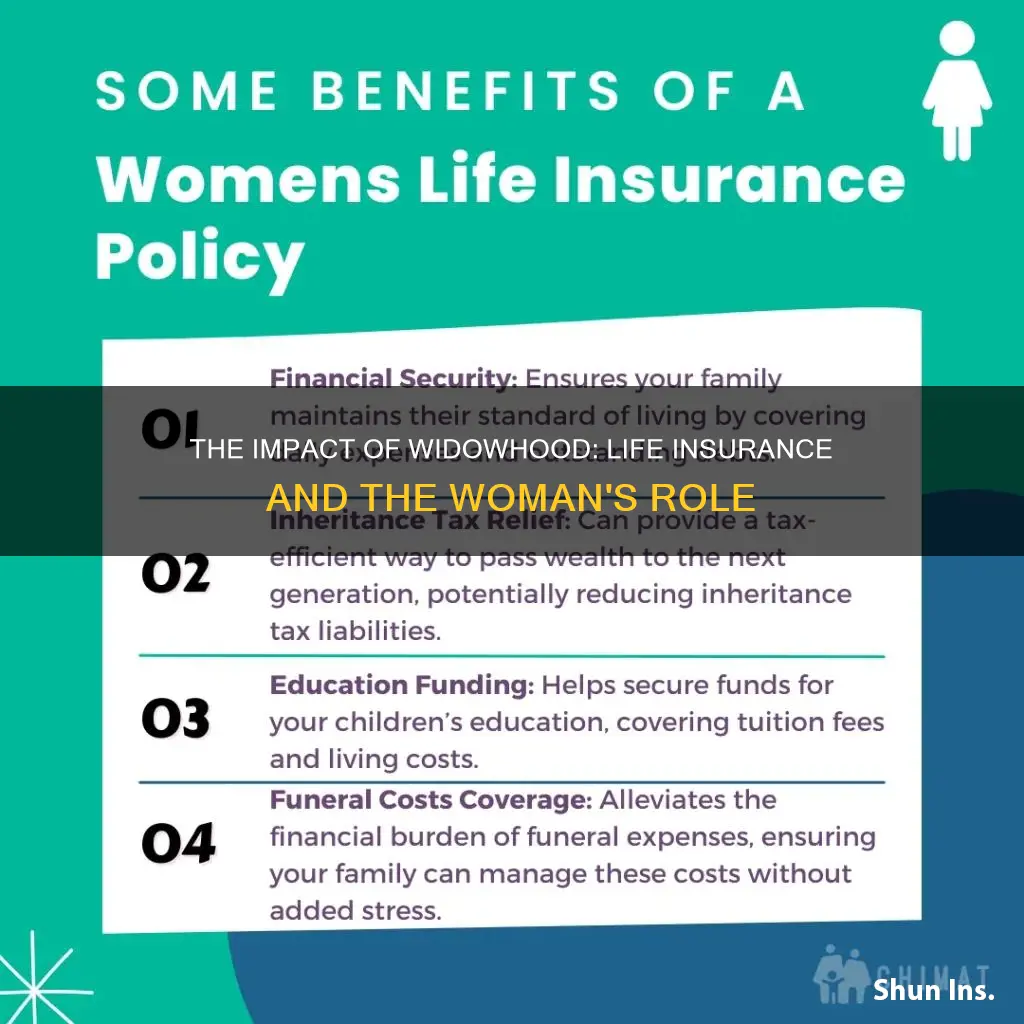

Life Insurance and Benefits: Life insurance policies can play a significant role in providing financial security for the family. Review the wife's insurance policies to understand the terms and benefits. This includes checking the policy's value, beneficiaries, and any potential payouts. If the policy has a beneficiary designated, they will receive the proceeds as per the terms. It is crucial to keep the insurance company informed of the wife's passing and follow their instructions for claiming the benefits.

Financial Security and Planning: Ensuring financial security for the surviving spouse and dependents is a top priority. This may involve reviewing and adjusting retirement plans, pension benefits, and any other financial arrangements she had in place. Consider consulting a financial advisor to create a comprehensive plan that addresses short-term and long-term financial goals. They can help navigate the complexities of tax laws, estate distribution, and investment strategies to provide stability and peace of mind during this challenging time.

Managing the legal and financial affairs of a deceased spouse requires attention to detail and a proactive approach. By taking these steps, the family can navigate the process with clarity and confidence, ensuring that the wife's wishes are respected and her loved ones are provided for. It is always advisable to seek professional guidance from legal and financial experts who can offer tailored advice based on individual circumstances.

AIG Life Insurance: Drug Testing and Policy Details

You may want to see also

Emotional Support: Providing comfort, listening, and offering a safe space for grieving

When a wife passes away, the emotional impact on her family can be profound and multifaceted. During this difficult time, it's crucial to provide emotional support to help the bereaved navigate their grief. Here are some ways to offer comfort and create a safe environment for the grieving process:

Listen Actively and Empathically: One of the most valuable things you can do is simply listen. Create a non-judgmental and supportive atmosphere where the grieving individuals feel comfortable expressing their emotions. Encourage them to share their memories, feelings, and experiences related to the deceased. Show empathy by acknowledging their pain and offering a shoulder to lean on. Avoid making statements like "I know how you feel" unless you have experienced a similar loss, as it can be patronizing. Instead, focus on being present and providing a safe space for their emotions to flow.

Offer Reassurance and Patience: Grieving is a natural and unique process for everyone. It's important to remind the bereaved that there is no right or wrong way to grieve. Encourage them to take their time and be patient with themselves. Offer reassurance that it's okay to feel overwhelmed, sad, or even angry. Let them know that their emotions are valid and that healing takes time. Be available to listen and provide comfort whenever they need it, as grief can be unpredictable and may resurface unexpectedly.

Create a Supportive Environment: Make the grieving process more manageable by helping with practical tasks. Offer to take care of daily responsibilities or run errands to give the bereaved time to focus on their emotions. Prepare meals, offer transportation to appointments, or simply be present to provide a sense of comfort and companionship. Additionally, create a safe and familiar environment by maintaining routines and traditions that bring comfort. This can include keeping the deceased's belongings, playing their favorite music, or visiting their favorite places together.

Encourage Self-Care: Grief can be all-consuming, so encourage the bereaved to take care of themselves. Suggest activities that promote relaxation and emotional well-being, such as meditation, yoga, or spending time in nature. Encourage them to maintain a healthy diet and stay hydrated, as proper nutrition is essential for emotional healing. Also, remind them to get enough rest and consider taking short breaks throughout the day to recharge. Self-care is vital for managing grief and preventing burnout.

Connect with Support Networks: Encourage the family to reach out to their support networks, including friends, extended family, and community groups. Sometimes, the bereaved may feel isolated, so connecting them with a support group or a bereavement counselor can be immensely helpful. These resources can provide professional guidance and a sense of community, allowing the individual to share their experiences with others who understand. Additionally, consider organizing a memorial service or celebration of life to bring people together and honor the deceased's memory.

Cigna Freedom Life: Quality Health Insurance?

You may want to see also

Life Insurance Claims: Navigating the process, understanding policies, and accessing benefits

Life insurance claims can be a complex and often emotional process, especially when dealing with the loss of a loved one. When a wife passes away, the life insurance policy she held can provide financial security and peace of mind for her family. However, navigating the claims process and understanding the policy's terms are crucial steps to ensure a smooth transition of benefits. Here's a guide to help you through this challenging time:

Understanding Your Policy: The first step is to thoroughly review the life insurance policy. This document outlines the terms and conditions, including the coverage amount, beneficiaries, and any specific requirements for claiming the benefits. Pay close attention to the definition of death, payment options, and any exclusions or limitations mentioned. It is essential to comprehend the policy's specifics to avoid any potential issues during the claims process.

Notifying the Insurance Company: After the passing of your wife, promptly inform the life insurance company. They will guide you through the necessary steps and provide the required documentation. Typically, you will need to provide proof of death, such as a death certificate, and personal identification documents. The insurance company will then initiate the claims process, which may involve an investigation to verify the circumstances of the death.

Gathering Required Documents: Prepare a set of documents that the insurance company will need to process the claim. This may include the original policy document, death certificate, identification papers of the deceased, and any other supporting documents related to the policy. Ensure that all information is accurate and up-to-date to avoid delays.

Designating Beneficiaries: Life insurance policies often allow the policyholder to name beneficiaries, who are the individuals or entities that will receive the death benefits. If your wife was the primary beneficiary, ensure that the policy is updated with the desired distribution of benefits. If there are any joint policies or beneficiaries named, the process may be different, and you should consult the insurance provider for guidance.

Claim Submission and Processing: Once all the necessary documents are gathered, submit the claim to the insurance company. They will review the information and may require additional documentation or clarification. The processing time can vary, so it's essential to be patient and keep the insurance company updated on any new developments. If there are any disputes or complications, the company will work with you to resolve them.

Navigating life insurance claims can be challenging, especially during a grieving period. However, understanding your policy, gathering the required documents, and promptly notifying the insurance company can significantly streamline the process. Remember, the life insurance policy was designed to provide financial support during difficult times, and accessing these benefits can help ease the financial burden on your family.

Understanding the Basics: Survivorship Universal Life Insurance

You may want to see also

Legacy and Memorials: Honoring the deceased, creating lasting memories, and celebrating life

When a wife passes away, the concept of life insurance takes on a profound significance, especially in the context of honoring her legacy and ensuring her impact on the world lives on. The role of a woman in a relationship is multifaceted, and her contributions often extend far beyond what is immediately apparent. Life insurance can play a crucial part in preserving her memory and providing financial security for those she leaves behind.

One of the most meaningful ways to honor the deceased is by creating a lasting legacy. This can be achieved through various means, such as establishing a scholarship fund in her name for students who share her passions or values. For instance, if she was an avid supporter of the arts, a scholarship for aspiring artists or musicians could be set up to nurture the next generation of creative talents. Alternatively, a charitable foundation can be created to support causes she believed in, ensuring her compassion and generosity continue to make a difference. These initiatives not only keep her spirit alive but also provide a tangible way for loved ones to remember her.

Memorials are another powerful way to celebrate and commemorate the life of a woman who has passed. These can take the form of physical monuments, such as a plaque or statue in a public space, which serves as a reminder of her impact on the community. For instance, a park bench dedicated to her memory in a local park can become a cherished spot for family and friends to gather and reflect. Alternatively, a digital memorial website can be created, allowing people from all over the world to pay their respects and share their favorite memories. This virtual space can include photos, stories, and even videos, ensuring that the deceased's life is forever etched in the hearts of those who knew her.

Celebrating life through memorial events is another essential aspect of honoring the deceased. These events can be tailored to the interests and passions of the departed, making them a unique and personal tribute. For example, a music festival can be organized in memory of a wife who loved classical music, featuring performances by local orchestras and choirs. Or, a sports tournament can be held in her honor, with proceeds going to a charity she supported. Such events not only provide a space for grieving but also create a positive and uplifting atmosphere, allowing loved ones to find solace and joy in remembering her.

In addition to these tangible and emotional ways of honoring the deceased, life insurance can also provide financial security, ensuring that the legacy she built continues to thrive. The proceeds from a life insurance policy can be used to fund the aforementioned initiatives, providing a solid foundation for the creation of lasting memories. This financial aspect allows the family to focus on the emotional healing process while also ensuring that the wife's role in their lives is not forgotten. It is a practical way to turn grief into action, creating a lasting impact that reflects the values and contributions of the woman who has passed.

Whole Life Insurance: Benefits and Security for Life

You may want to see also

Frequently asked questions

When the wife dies, the life insurance policy will typically pay out the death benefit to the designated beneficiaries. If the primary beneficiary is the deceased wife, the proceeds will be paid to the remaining beneficiaries as per the policy's terms. This ensures that the intended recipients receive the financial support intended by the policyholder.

Yes, in many jurisdictions, life insurance policies can be assigned or transferred. This process allows the policyholder to change the beneficiary or assign the policy's value to another individual. For example, if the insured woman's role is to provide financial security for her children, the policy can be assigned to a trust or a legal entity to ensure the benefits are utilized according to her wishes.

The death of a wife can significantly affect the family's financial situation and the distribution of assets. Life insurance proceeds can provide a crucial financial safety net for the surviving spouse and dependent children. The policy's terms will dictate how the benefits are distributed, ensuring that the family's financial obligations and goals are met. Proper estate planning and beneficiary selection are essential to navigate this transition smoothly.

Yes, there can be tax implications and legal considerations. The life insurance payout may be subject to income tax, and the beneficiary may need to provide certain documentation for tax purposes. Additionally, if the policy has a cash value component, there could be tax implications upon surrender or withdrawal. It is advisable to consult with financial and legal professionals to understand the specific tax laws and ensure compliance with any legal requirements related to the distribution of the insurance proceeds.