Survivorship Universal Life Insurance, also known as second-to-die life insurance, is a unique type of life insurance policy designed to benefit both the insured individual and their beneficiaries. This policy is structured to pay out a death benefit only after both the insured and their spouse or partner have passed away. It offers a way to provide financial security for loved ones while also allowing the insured individual to retain control over their policy, making it a versatile and flexible insurance option.

What You'll Learn

- Definition: Survivorship universal life insurance is a type of permanent life insurance that provides coverage for two lives

- Features: It offers flexibility, high cash value accumulation, and potential for investment growth

- Benefits: Provides guaranteed death benefit, tax-deferred growth, and potential for loan features

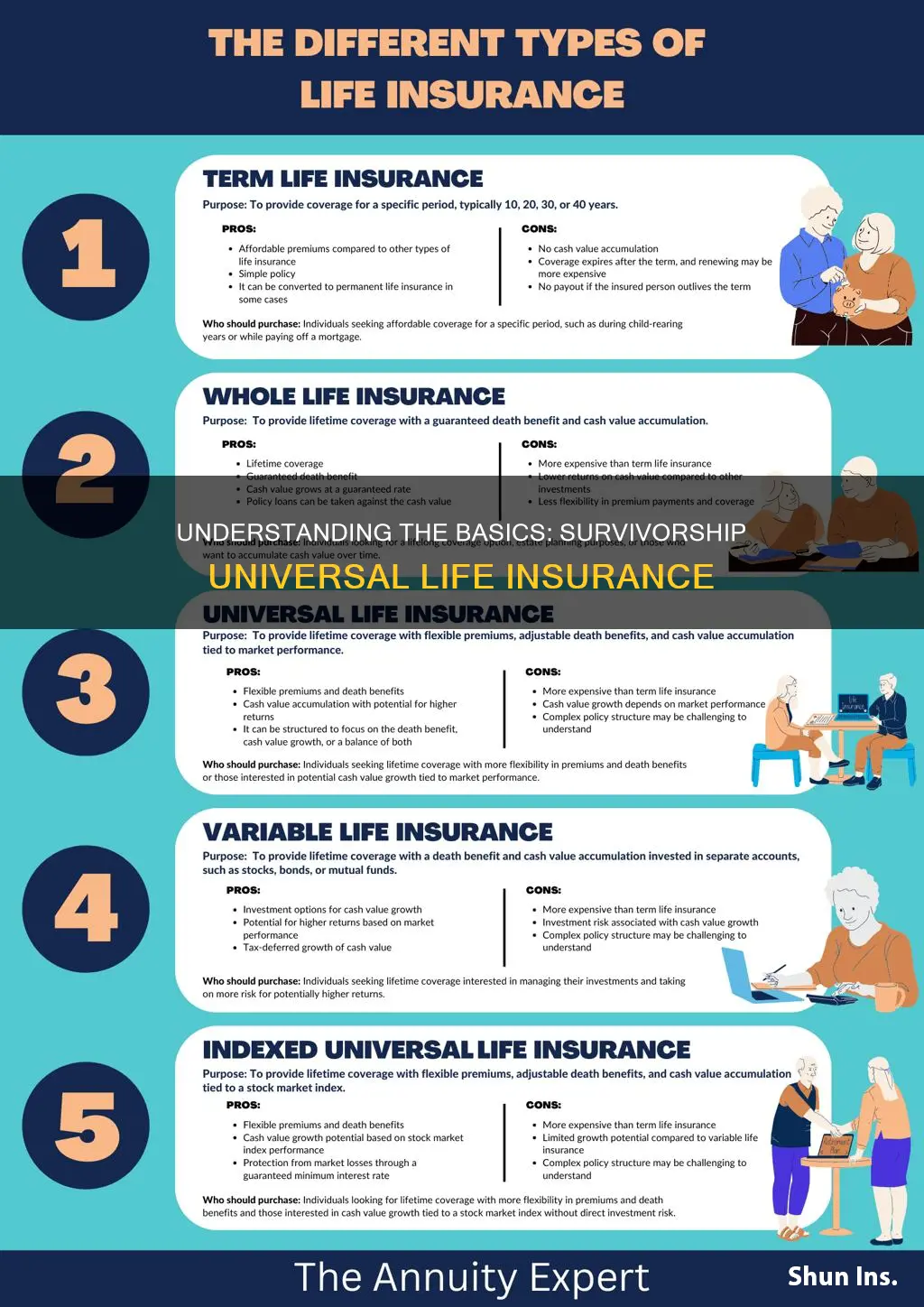

- Comparison: Unlike term life, it offers lifelong coverage and builds cash value over time

- Advantages: Provides financial security for beneficiaries and potential investment opportunities for the insured

Definition: Survivorship universal life insurance is a type of permanent life insurance that provides coverage for two lives

Survivorship Universal Life Insurance is a specialized form of life insurance designed to provide coverage for two individuals, typically a married couple. This type of policy is a permanent life insurance product, meaning it offers lifelong coverage as long as the policy is in force and the premiums are paid. The unique aspect of survivorship universal life insurance is that the death benefit is paid out upon the death of the second insured individual, ensuring that the surviving spouse or partner receives financial support.

In this insurance arrangement, both the husband and wife are named as insureds, and their combined lives are the focus of the policy. When the first insured dies, the policy continues, and the death benefit is paid out to the second insured. This feature is particularly valuable for couples who want to ensure financial security for their surviving partner in the event of their untimely death. The policy can provide a substantial financial cushion, allowing the surviving spouse to maintain their standard of living, cover expenses, and potentially plan for the future.

The key advantage of survivorship universal life insurance is the guaranteed payout to the surviving spouse, which can be a significant financial benefit. This type of policy is often chosen by couples who want to provide long-term financial protection and peace of mind. It is a commitment to each other's financial well-being, ensuring that the surviving partner is cared for, even if the other passes away.

When considering this type of insurance, it's essential to understand the policy's terms and conditions. These may include the initial death benefit amount, the premium payments, and any potential cash value accumulation over time. Policyholders should also be aware of any surrender charges or penalties that may apply if the policy is canceled or surrendered before a certain period.

In summary, survivorship universal life insurance is a powerful tool for couples seeking to secure their financial future together. It provides a permanent safety net, ensuring that the surviving partner is financially protected and can maintain their desired lifestyle. This type of insurance is a testament to the commitment between two individuals and their desire to leave a lasting legacy of financial security.

American Family Insurance: Do They Provide Life Insurance Policies?

You may want to see also

Features: It offers flexibility, high cash value accumulation, and potential for investment growth

Survivorship Universal Life Insurance, often referred to as 'Surviving Spouse Universal Life', is a type of permanent life insurance policy designed to provide financial security for the surviving spouse and beneficiaries in the event of the insured's death. This insurance product offers several key features that make it a valuable financial tool for families.

One of its primary features is flexibility. This type of policy allows policyholders to customize their coverage to meet their specific needs. You can adjust the death benefit, which is the amount paid to beneficiaries upon your passing, to reflect changing financial circumstances. For instance, if you have children and want to ensure their education costs are covered, you can increase the death benefit accordingly. This flexibility is particularly useful for those who want to adapt their insurance coverage as their life situation evolves.

Survivorship Universal Life policies also excel in high cash value accumulation. Unlike term life insurance, which provides coverage for a specified period, this policy builds a substantial cash value over time. The cash value is the portion of the premium that is invested and grows tax-deferred. This feature is advantageous because it can be borrowed against or withdrawn to meet financial obligations or as a source of emergency funds. For example, if you need to cover unexpected medical expenses or want to start a business, you can access the cash value without disrupting your insurance coverage.

The potential for investment growth is another significant advantage. The cash value in these policies is typically invested in a variety of investment options, such as stocks, bonds, and mutual funds. These investments can offer the opportunity for long-term growth, which can be particularly beneficial for those who want to maximize the value of their insurance policy. As the cash value grows, it can be used to enhance the death benefit, providing even greater financial security for your loved ones.

In summary, Survivorship Universal Life Insurance offers a unique combination of flexibility, high cash value accumulation, and investment growth potential. This makes it an excellent choice for individuals who want to ensure their family's financial security and have the ability to adapt their insurance coverage as their life circumstances change. By providing both immediate protection and long-term financial benefits, this policy can be a valuable component of a comprehensive financial plan.

Life Insurance: When Payments Outweigh Benefits

You may want to see also

Benefits: Provides guaranteed death benefit, tax-deferred growth, and potential for loan features

Survivorship Universal Life Insurance offers a range of advantages that make it an attractive financial product for those seeking both security and growth. One of its key benefits is the provision of a guaranteed death benefit, ensuring that your loved ones receive a specified amount of financial support upon your passing. This feature provides peace of mind, knowing that your family's financial needs will be met regardless of life's uncertainties.

In addition to the death benefit, survivorship universal life insurance encourages tax-deferred growth. This means that any earnings or investment gains generated within the policy can grow tax-free until they are withdrawn or utilized. This tax advantage allows your money to accumulate and potentially grow more rapidly over time, providing a substantial financial cushion for the future.

Another advantage is the potential for loan features. Policyholders can access funds from their insurance policy as a loan, which can be particularly useful for various financial needs. These loans often have favorable interest rates compared to traditional loans, and the borrowed amount can be repaid with interest, ensuring the policy's value remains intact. This feature provides flexibility and access to funds without the need for extensive paperwork or high-interest rates typically associated with personal loans.

The combination of a guaranteed death benefit, tax-deferred growth, and loan features makes survivorship universal life insurance a comprehensive financial tool. It provides a safety net for your family while also offering the potential for wealth accumulation and access to funds when needed. This type of insurance is particularly valuable for individuals and families who want to ensure financial security and have a long-term financial strategy in place.

Understanding Life Insurance: Cover Length Explained

You may want to see also

Comparison: Unlike term life, it offers lifelong coverage and builds cash value over time

Survivorship Universal Life Insurance, often referred to as 'survivor protection' or 'second-to-die insurance', is a type of permanent life insurance policy that provides coverage for the entire life of the insured individual. Unlike term life insurance, which offers coverage for a specified period, survivorship universal life insurance is designed to pay a death benefit to the policy's beneficiaries when the insured person dies. This type of policy is particularly valuable for families or individuals who want to ensure financial security for their loved ones in the event of their passing.

One of the key advantages of survivorship universal life insurance is its lifelong coverage. This means that as long as the policyholder remains alive, the insurance company is obligated to pay the death benefit to the designated beneficiaries. This is in contrast to term life insurance, which provides coverage for a specific period, typically 10, 15, 20, or 30 years. With survivorship universal life, the coverage is permanent, providing peace of mind and long-term financial protection.

Another significant feature of this insurance is its ability to build cash value over time. As with other types of permanent life insurance, survivorship universal life policies accumulate cash value, which can be used for various purposes. The cash value grows tax-deferred and can be borrowed against or withdrawn, providing financial flexibility. This aspect sets it apart from term life insurance, which does not accumulate cash value and, therefore, does not offer any long-term financial benefits beyond the death benefit.

The cash value in survivorship universal life insurance can be utilized in several ways. Policyholders can use it to increase the death benefit, providing more financial security for their beneficiaries. It can also be used to pay for future expenses, such as college tuition or business investments, without the need for a loan or other forms of debt. Additionally, the cash value can be withdrawn to provide immediate financial assistance or to supplement retirement income.

In summary, survivorship universal life insurance offers a unique combination of lifelong coverage and the potential for cash value accumulation. This makes it an attractive option for individuals and families seeking long-term financial security and the ability to provide for their loved ones' future needs. When comparing it to term life insurance, the lifelong coverage and the potential for cash value growth are the key differentiators, making survivorship universal life a valuable tool in financial planning.

Anemia: A Barrier to Life Insurance Coverage?

You may want to see also

Advantages: Provides financial security for beneficiaries and potential investment opportunities for the insured

Survivorship Universal Life Insurance, often referred to as 'Surviving Spouse Life Insurance', is a type of permanent life insurance policy that offers a unique blend of financial protection and investment potential. This insurance is designed to provide financial security for the insured's beneficiaries in the event of their death, while also allowing the insured to build a valuable cash value over time. Here's an in-depth look at the advantages of this policy:

Financial Security for Beneficiaries: One of the primary benefits of survivorship universal life insurance is the guaranteed financial protection it offers to the designated beneficiaries. When the insured individual passes away, the death benefit is paid out to the beneficiaries, providing them with a substantial financial cushion. This can be especially crucial for families who rely on the income and support provided by the insured individual. The policy ensures that the beneficiaries are financially secure, even in the face of unexpected loss, allowing them to maintain their standard of living and cover essential expenses.

Potential Investment Opportunities: Survivorship universal life insurance policies also come with an investment component. The cash value that accumulates within the policy can be utilized as an investment tool. Over time, the cash value grows, and the insured can access this value through policy loans or by taking withdrawals. This provides an opportunity for the insured to potentially build wealth and achieve financial goals. The investment aspect allows for flexibility, as the insured can choose to invest in various options, such as stocks, bonds, or mutual funds, to potentially increase the value of their policy. This feature is particularly advantageous for those who want to secure a financial legacy for their loved ones while also exploring investment strategies.

The policy's investment nature also offers a sense of control and customization. Insured individuals can work with financial advisors to tailor their investment strategy, ensuring that the policy aligns with their risk tolerance and financial objectives. This level of customization is a significant advantage, allowing the insured to make informed decisions about their financial future.

In summary, survivorship universal life insurance offers a comprehensive approach to financial planning. It provides a safety net for beneficiaries during challenging times and presents investment opportunities for the insured to potentially grow their wealth. This type of insurance policy is a valuable tool for individuals seeking to secure their family's financial future and achieve their long-term financial aspirations.

Conventional Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Survivorship Universal Life Insurance is a type of permanent life insurance policy that provides coverage for two lives—the insured individual and their designated beneficiary. It is designed to offer a combination of death benefit, cash value accumulation, and investment features. When one of the insured individuals passes away, the death benefit is paid out to the beneficiary, ensuring financial security for the surviving spouse or partner.

While both are permanent life insurance policies, survivorship universal life insurance is unique because it covers two lives. Traditional universal life insurance, on the other hand, is typically designed for an individual and provides coverage for their sole benefit upon their death. Survivorship policies are often used to secure a family's financial future, especially in cases where both spouses want to ensure their children's financial well-being.

This type of insurance offers several advantages. Firstly, it provides a higher death benefit compared to individual policies, ensuring a more substantial financial safety net for the beneficiary. Secondly, the policy accumulates cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, survivorship policies often include investment options, allowing policyholders to grow their cash value through various investment strategies.

Survivorship universal life insurance is particularly beneficial for couples who want to ensure their family's long-term financial security. It is often chosen by high-net-worth individuals or those with significant assets who wish to protect their wealth and provide for their loved ones. Additionally, individuals with a long life expectancy and a desire to leave a substantial inheritance may consider this type of policy.