When considering the cancellation of a life insurance policy, it's important to understand the implications and alternatives. Dave Ramsey, a well-known financial advisor, often emphasizes the importance of life insurance as a crucial component of financial planning. However, there may be situations where individuals need to reassess their insurance coverage and consider whether to cancel their policy. This could include changes in personal circumstances, such as improved health, marriage, or the birth of a child, which may reduce the need for extensive coverage. Additionally, financial advisors like Dave Ramsey might advise on canceling policies if the premiums are too high or if the coverage no longer aligns with one's current financial goals and risk tolerance. Understanding the reasons for cancellation and exploring alternative options can help individuals make informed decisions regarding their life insurance coverage.

What You'll Learn

- Understanding Dave Ramsey's Guidelines: When to cancel based on his advice

- Term Life Insurance: Consider cancellation if term ends

- Financial Goals: Evaluate if life insurance no longer meets needs

- Alternative Savings: Explore other savings options before cancellation

- Health Changes: Major health improvements may warrant re-evaluation

Understanding Dave Ramsey's Guidelines: When to cancel based on his advice

When considering whether to cancel your life insurance policy, it's essential to understand the guidelines provided by Dave Ramsey, a renowned personal finance expert. Ramsey offers a unique perspective on insurance, emphasizing the importance of financial planning and the potential drawbacks of certain insurance practices. Here's an overview of his advice on when to cancel life insurance:

Dave Ramsey suggests that individuals should carefully evaluate their insurance needs and make informed decisions. He believes that life insurance is a crucial component of financial planning, especially for those with dependents or significant financial obligations. However, he also acknowledges that there are situations where canceling a policy might be the right choice. One of his key principles is the idea of "financial freedom" and ensuring that your insurance decisions align with your long-term financial goals. Ramsey advises against canceling life insurance if it provides essential coverage for your family's financial security. He recommends assessing your policy to ensure it meets your current and future needs, especially if your circumstances have changed. For example, if you've recently started a family or taken on new financial responsibilities, maintaining adequate life insurance coverage becomes even more critical.

According to Ramsey, canceling a life insurance policy might be considered if you've achieved a level of financial independence where the policy's benefits are no longer necessary. This could include situations where you've paid off significant debts, accumulated substantial savings, or have a reliable source of income that can support your family in the event of your passing. Ramsey emphasizes the importance of regularly reviewing and adjusting your insurance coverage as your financial situation evolves. He suggests that individuals should not be afraid to cancel a policy if they no longer require the coverage, as this can help avoid unnecessary financial burdens.

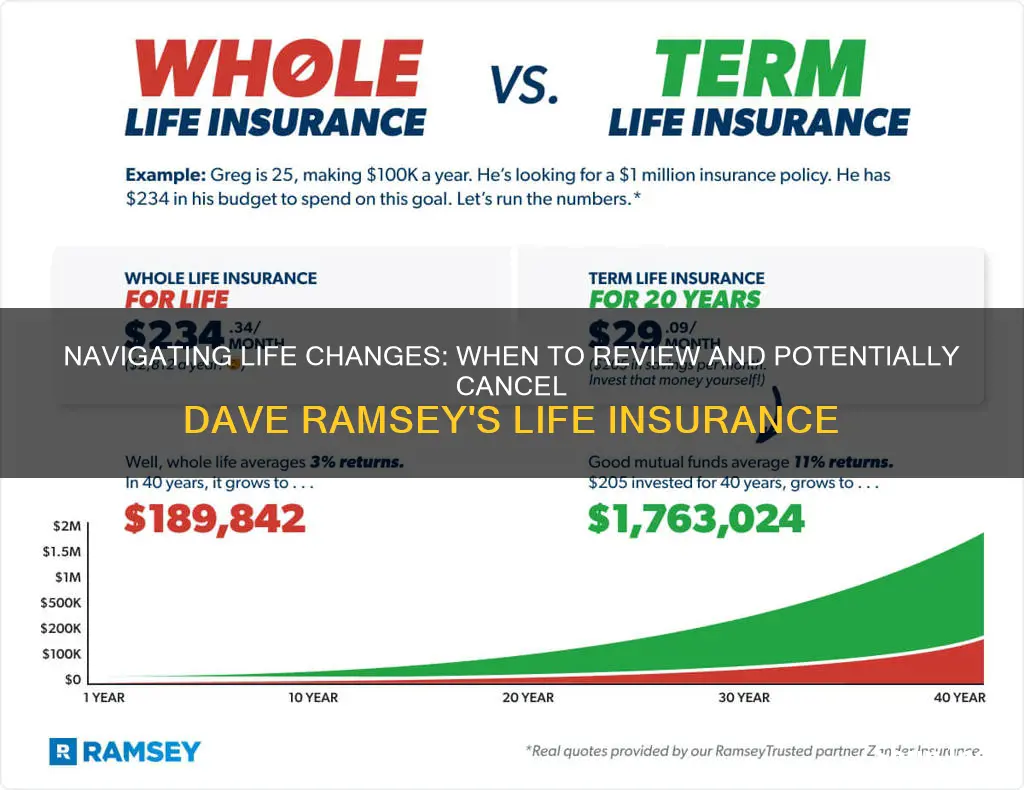

Additionally, Ramsey encourages policyholders to explore alternative options before canceling. He suggests that individuals should consider converting term life insurance to a permanent policy or increasing the coverage amount if needed. This approach allows for more flexibility and ensures that you have the appropriate level of protection without canceling the policy entirely. It's worth noting that Dave Ramsey's advice often focuses on minimizing financial expenses and maximizing financial freedom. While he encourages careful consideration of insurance needs, he also highlights the potential benefits of canceling policies that no longer serve a purpose, allowing individuals to reallocate funds towards other financial priorities.

In summary, Dave Ramsey's guidelines on canceling life insurance emphasize the importance of a personalized approach based on individual financial circumstances. He encourages policyholders to regularly review their insurance needs, ensuring that the coverage remains relevant and beneficial. By following Ramsey's advice, individuals can make informed decisions about their life insurance, balancing financial security with the potential savings from canceling unnecessary policies.

Understanding TEFRA: Unlocking Life Insurance Benefits

You may want to see also

Term Life Insurance: Consider cancellation if term ends

Term life insurance is a popular and cost-effective way to protect your loved ones financially during a specific period, often 10, 20, or 30 years. It provides a death benefit if you pass away within the term period, ensuring your family has financial security. However, as life circumstances change, you might find yourself wondering if it's time to cancel or review your term life insurance policy. One critical factor to consider is what happens at the end of the term.

When your term life insurance policy expires, you have a few options. Firstly, you can choose to renew the policy, which may be more expensive, especially if your health or lifestyle has changed. Alternatively, you can decide to let the policy lapse, which means the coverage ends, and you no longer have the financial protection it provided. This decision should not be taken lightly, as it can significantly impact your family's financial well-being.

If you've reached the end of your term and your financial obligations have decreased, or you no longer have dependents relying on the death benefit, it might be a good time to consider cancellation. For example, if your children have moved out of the house, or you've paid off your mortgage, the need for a large death benefit may have diminished. In such cases, canceling the policy can save you money on premiums and avoid paying for coverage you no longer need.

However, it's essential to carefully evaluate your financial situation and future plans before making a decision. Term life insurance can be a valuable tool for managing financial risks, and canceling it prematurely might mean losing the coverage you and your family need. Consider consulting a financial advisor or insurance professional to discuss your options and determine the best course of action based on your unique circumstances.

In summary, when your term life insurance policy comes to an end, it's a critical juncture to assess your current needs and future goals. If you've outlived the term and your financial obligations have changed, canceling the policy might be a wise decision. Nonetheless, it's crucial to weigh the pros and cons and seek professional advice to ensure you make the right choice for your family's long-term financial security.

Combining Life Insurance and Real Estate: A Smart Strategy

You may want to see also

Financial Goals: Evaluate if life insurance no longer meets needs

When it comes to life insurance, it's essential to periodically review and evaluate your policy to ensure it still meets your financial goals and needs. Dave Ramsey, a renowned financial expert, emphasizes the importance of regularly assessing your insurance coverage to avoid overpaying or having unnecessary expenses. Here's a step-by-step guide to help you determine if it's time to cancel or adjust your life insurance policy:

Assess Your Current Financial Situation: Begin by evaluating your current financial circumstances. Consider your age, health, income, and dependents. If you've experienced significant life changes, such as getting married, having children, or purchasing a home, your insurance needs might have evolved. For instance, starting a family may require increasing your coverage to ensure financial security for your loved ones. Conversely, if you've downsized your home or no longer have dependents, you might consider reducing your insurance coverage.

Review Your Policy and Coverage: Examine your life insurance policy documents thoroughly. Understand the terms, conditions, and coverage amounts. Check if the policy provides the desired level of protection for your family's financial needs. Look for any hidden fees, riders, or additional benefits that might be unnecessary or costly. Dave Ramsey often advises against paying for coverage you don't need, as it can lead to wasted money.

Compare with Current Needs: Evaluate your current and future financial goals. Consider your short-term and long-term objectives, such as saving for your child's education, paying off debts, or funding retirement. If your financial goals have changed, your insurance needs might have shifted accordingly. For example, if you've paid off your mortgage, you may no longer require a large death benefit to cover this expense. Adjusting your policy to reflect these changes can help optimize your financial resources.

Consider Alternative Options: If you determine that your life insurance policy no longer aligns with your financial goals, explore alternative options. You might consider converting a term life insurance policy to a permanent one, which can provide lifelong coverage. Alternatively, you could opt for a smaller policy or explore other insurance products that better suit your current needs. Dave Ramsey often suggests that individuals should prioritize their financial resources based on their unique circumstances.

Consult a Financial Advisor: Seeking professional advice can be invaluable when making decisions about life insurance. A financial advisor can help you navigate the complexities of insurance policies and provide personalized recommendations. They can assist in assessing your financial situation, understanding your goals, and making informed decisions about canceling or adjusting your life insurance coverage.

Life Insurance: Rated Classification Basis Explained

You may want to see also

Alternative Savings: Explore other savings options before cancellation

When considering whether to cancel your life insurance policy, it's crucial to explore alternative savings options first. Dave Ramsey, a renowned financial expert, emphasizes the importance of having a robust financial safety net before making any significant changes to your insurance coverage. Here are some alternative savings strategies to consider:

Review Your Current Financial Situation: Begin by evaluating your overall financial health. Calculate your net worth, including assets, investments, and savings. Understand your income, expenses, and any existing debts. This comprehensive assessment will help you identify areas where you can cut costs and redirect funds towards savings. By having a clear financial picture, you can make informed decisions about your insurance needs.

Build an Emergency Fund: One of the primary reasons for having life insurance is to provide financial security in case of emergencies. Before canceling your policy, ensure you have a substantial emergency fund in place. Aim to save enough to cover at least three to six months' worth of living expenses. This fund will act as a safety net during unforeseen circumstances, reducing the reliance on life insurance.

Consider Term Life Insurance: If you're still unsure about canceling your policy, explore the option of term life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a cost-effective way to secure financial protection during this time. By choosing a term policy, you can ensure that your loved ones are covered without the long-term financial commitment of a permanent policy.

Evaluate Other Insurance Options: Life insurance is not the only way to protect your loved ones. Explore other insurance options such as health, disability, and long-term care insurance. These policies can provide financial security in different areas of your life. By diversifying your insurance portfolio, you can ensure comprehensive coverage without solely relying on life insurance.

Maximize Retirement Savings: Consider redirecting some of the funds you were planning to allocate to life insurance towards retirement savings. Contribute to a 401(k) or an Individual Retirement Account (IRA) to build a substantial retirement nest egg. By maximizing your retirement savings, you can ensure financial security in your later years, reducing the need for life insurance as a primary source of income.

Consult a Financial Advisor: If you're still undecided, consider seeking advice from a certified financial planner or advisor. They can provide personalized guidance based on your unique financial situation. A financial advisor can help you navigate the complexities of insurance and savings options, ensuring you make the best decision for your long-term financial well-being.

Life Insurance: Protecting Your Dollar's Worth

You may want to see also

Health Changes: Major health improvements may warrant re-evaluation

When it comes to life insurance, it's important to regularly review and reassess your coverage, especially if your health has improved significantly. Major health improvements can be a sign that your current insurance policy may no longer be necessary or that you can benefit from adjusting the terms. Here's why and how to handle such situations:

Improved Health and Reduced Risk: If you've made substantial progress in managing a pre-existing condition, such as achieving a healthier weight, managing diabetes effectively, or quitting smoking, your overall health has likely improved. This reduction in risk can make you a more attractive candidate for insurance companies, potentially allowing you to secure better coverage or even qualify for lower premiums. For instance, if you've successfully overcome obesity-related health issues, you might no longer need the extensive coverage provided by a whole life policy.

Re-evaluating Coverage Needs: As your health improves, it's essential to re-evaluate your life insurance needs. You may find that you require less coverage due to reduced risk factors. For example, if you've quit smoking, you might be able to opt for term life insurance instead of a permanent policy, as the risk of smoking-related illnesses decreases over time. This adjustment can lead to significant savings on premiums.

Consulting an Insurance Advisor: When considering health improvements, it's crucial to consult with an insurance advisor or broker. They can provide personalized advice based on your specific circumstances. They will assess your current policy, understand your health changes, and guide you on whether to cancel or modify your insurance. This professional advice ensures that you make informed decisions about your coverage.

Documentation and Medical Evidence: When discussing health improvements with your insurance provider, be prepared to provide documentation and medical evidence. This includes medical records, lab results, and any relevant health assessments. Insurance companies will review this information to determine if your improved health justifies any changes to your policy.

Regular Review Schedule: It's a good practice to schedule regular reviews of your life insurance policy, especially if you have a history of health issues. Annually or every few years, review your coverage to ensure it aligns with your current health status and financial goals. This proactive approach allows you to make necessary adjustments and potentially save money on insurance premiums.

Trusts and Life Insurance: Who Gets the Payout?

You may want to see also

Frequently asked questions

Dave Ramsey, a well-known financial expert, suggests that canceling life insurance should be a last resort. He recommends reviewing your policy regularly and understanding the terms and conditions. If you have a term life insurance policy, it's generally a good idea to keep it until the term ends, especially if it provides coverage for a specific period, such as until your children are financially independent or a mortgage is paid off.

Canceling a life insurance policy prematurely might result in significant financial losses. Life insurance policies often have surrender charges, which are fees assessed if you cancel the policy within a certain period. These charges can be substantial and may offset any premiums paid. Additionally, if you have an investment component in your policy, canceling it might impact your long-term financial goals, as the policy's value could be lower than the cash surrender value.

Yes, there are certain circumstances where canceling life insurance might be justified. For instance, if you have a substantial amount of debt and no one dependent on your income, canceling the policy could free up some financial resources. However, it's crucial to explore other options first, such as reducing other expenses or reviewing your overall financial strategy. Dave Ramsey often emphasizes the importance of understanding your unique financial situation before making any significant changes to your insurance coverage.