Navigating the intricacies of officer life insurance can be a complex task, especially when it comes to understanding how the proceeds are reported on tax forms. For those in the military, the 1120s form is a crucial document that details various financial aspects, including life insurance benefits. This paragraph aims to shed light on the specific section where officer life insurance proceeds are recorded, ensuring that service members and their families are aware of the necessary tax implications and reporting requirements. By providing clarity on this matter, individuals can ensure compliance with tax regulations and make informed decisions regarding their financial well-being.

| Characteristics | Values |

|---|---|

| Type of Insurance | Officer Life Insurance |

| Form 1120s | This is a tax return form for corporations, and it doesn't have a specific section for listing officer life insurance. |

| Reporting Requirements | Corporations must report the cost of providing life insurance to officers on their tax return. This is typically done by adding the cost to the officer's compensation. |

| Tax Implications | The cost of officer life insurance is generally tax-deductible for the corporation. However, the benefits received by the officers are taxable income. |

| Beneficiary Information | The corporation should provide details of the beneficiaries and the amount of insurance coverage provided to each officer. |

| Frequency of Reporting | This information is typically reported annually on the corporation's tax return. |

| Compliance | Accurate reporting is essential to comply with tax laws and regulations. |

What You'll Learn

- Tax Treatment: Officer life insurance premiums are deductible business expenses on Form 1120

- Deduction Limits: There are limits on the amount of officer life insurance that can be deducted

- Documentation: Proper documentation is required to claim officer life insurance deductions on Form 1120

- Compliance: Ensure compliance with IRS regulations regarding officer life insurance deductions

- Reporting: Report officer life insurance premiums on Schedule A of Form 1120

Tax Treatment: Officer life insurance premiums are deductible business expenses on Form 1120

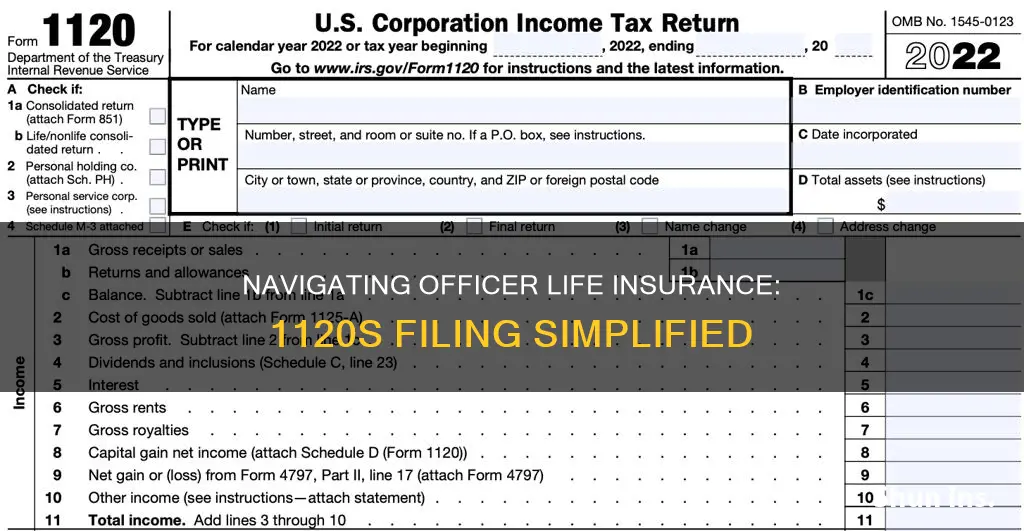

Officer life insurance premiums can be a significant expense for businesses, especially those with key personnel covered under such policies. When it comes to tax treatment, these premiums can be claimed as a deductible business expense on Form 1120, the U.S. Corporation Income Tax Return. This deduction is an important consideration for companies, as it can result in substantial tax savings.

The tax treatment of officer life insurance premiums is based on the principle that such policies provide a financial benefit to the business. The insurance coverage ensures that the company's operations can continue in the event of a key officer's death, thereby protecting the business's interests and potentially preventing significant financial losses. As a result, the premiums paid for this coverage are considered an ordinary and necessary business expense, eligible for deduction under the Internal Revenue Code (IRC) Section 162(a)(1).

To claim this deduction, the business must provide specific information on Form 1120. The premiums paid for officer life insurance should be reported under the 'Other Deductions' section of the return. This ensures that the insurance costs are properly allocated and accounted for in the company's financial records. It is essential to maintain accurate documentation, including policy details, premium payments, and any relevant correspondence with the insurance provider, to support the deduction claim.

When preparing Form 1120, businesses should ensure that they provide a clear and detailed explanation of the insurance coverage and its relevance to the company's operations. This may include a description of the policy, the insured individual(s), and the purpose of the coverage. Proper documentation and explanation are crucial to avoid any potential issues or challenges during tax audits or examinations.

In summary, officer life insurance premiums are a deductible business expense on Form 1120, allowing companies to claim significant tax savings. By properly accounting for these premiums and providing relevant documentation, businesses can ensure compliance with tax regulations and maximize their financial benefits. This tax treatment highlights the importance of considering insurance coverage as a strategic business decision, offering both protection and potential tax advantages.

Spousal Life Insurance: Taxable or Not?

You may want to see also

Deduction Limits: There are limits on the amount of officer life insurance that can be deducted

When it comes to officer life insurance, understanding the deduction limits is crucial for businesses and their tax implications. The Internal Revenue Service (IRS) imposes specific rules regarding the deductibility of life insurance premiums, especially for officers and key employees. These limits ensure that the tax benefits are provided fairly and within reasonable boundaries.

For tax purposes, the deduction of officer life insurance premiums is generally limited to the amount of the premium paid by the employer. This means that the employer's contribution towards the insurance is what can be deducted from their taxable income. However, there are certain conditions and restrictions to consider. Firstly, the insurance must be considered a "qualified" life insurance plan as defined by the IRS. This typically includes group term life insurance with certain coverage amounts and eligibility criteria.

The deduction limit for officer life insurance is generally set at a specific percentage of the officer's compensation. This percentage is designed to ensure that the tax benefit is proportional to the officer's income. As of the latest IRS guidelines, the limit is often set at a percentage of the officer's annual compensation, which may vary depending on the jurisdiction and the specific tax laws applicable. For instance, it could be a fixed percentage of the W-2 wages or a percentage of the total compensation package.

It's important to note that these deduction limits apply to the total amount of life insurance premiums paid by the employer. If the employer provides multiple types of life insurance coverage, the deduction will be limited to the combined premiums for all qualifying policies. Additionally, any additional benefits or riders attached to the life insurance policy may have their own set of rules and limitations regarding deductibility.

Understanding these deduction limits is essential for businesses to ensure compliance with tax regulations. By adhering to these limits, companies can maximize their tax benefits while maintaining transparency and fairness in their financial reporting. It is recommended to consult tax professionals or refer to the latest IRS publications for specific details and any recent changes in the deduction limits for officer life insurance.

Finding Income from Life Insurance Payouts

You may want to see also

Documentation: Proper documentation is required to claim officer life insurance deductions on Form 1120

When it comes to claiming officer life insurance deductions on Form 1120, proper documentation is crucial. This ensures that your organization can accurately report the expenses and take advantage of the tax benefits. Here's a breakdown of the key documentation requirements:

Policy Details: Start by gathering all the necessary information about the life insurance policy. This includes the policy number, the name of the insured officer, the date of coverage, and the premium amount. Having this information readily available will make the deduction process smoother.

Premium Payments: You'll need to provide evidence of the regular premium payments made towards the officer's life insurance. This can be in the form of receipts, bank statements, or official payment confirmations from the insurance provider. Ensure that the documentation clearly shows the payment amount, date, and the policy number.

Death Benefit Information: In the unfortunate event of the insured officer's death, the life insurance policy will typically pay out a death benefit. Document this amount and any relevant details, such as the date of death and the beneficiary information. This documentation is essential for accurately reporting the deduction.

Consistency and Timing: It's important to maintain consistent documentation throughout the year. Keep track of premium payments and any changes to the policy. Additionally, ensure that you have the necessary documentation readily available when it's time to file your Form 1120. This will help expedite the process and ensure accuracy.

Consultation with Professionals: Given the complexity of tax regulations, it is advisable to consult with accounting professionals or tax advisors. They can provide guidance on specific documentation requirements and help ensure that your organization complies with all relevant tax laws. Proper documentation not only facilitates the deduction process but also demonstrates your organization's commitment to transparency and compliance.

Life Insurance and ADD: What You Need to Know

You may want to see also

Compliance: Ensure compliance with IRS regulations regarding officer life insurance deductions

Compliance with Internal Revenue Service (IRS) regulations is crucial when it comes to officer life insurance deductions. The IRS has specific rules and guidelines that organizations must follow to ensure that any deductions claimed for officer life insurance are valid and compliant. Here's a detailed guide on how to ensure compliance:

Understand the IRS Regulations: Begin by thoroughly understanding the IRS's position on officer life insurance deductions. The IRS allows deductions for life insurance premiums paid by an employer for its employees, including officers. However, there are certain conditions and limitations that must be met. Familiarize yourself with the relevant IRS publications, instructions, and guidelines, such as IRS Publication 15-B, which provides detailed information on employer-provided benefits.

Determine Eligibility: To claim a deduction, the life insurance must be considered a qualified plan under the IRS rules. This typically means the insurance is provided by the employer and is not a personal policy. Officer life insurance policies should be reviewed to ensure they meet these criteria. If the policy is a personal one, the employer may not be able to claim a deduction, and the individual officer would need to consider the tax implications.

Calculate Deductions Accurately: When calculating the deduction, ensure that you follow the IRS's instructions precisely. The deduction is generally limited to the amount of the premium paid by the employer. If the officer pays a portion of the premium, the deduction should be limited to that amount. Accurate record-keeping is essential to support the claimed deduction.

Maintain Proper Documentation: Proper documentation is key to compliance. Keep detailed records of the life insurance policies, premium payments, and any related correspondence. This documentation should include the names of the insured officers, the policy details, the premium amounts paid by the employer, and any agreements or arrangements made with the insurance provider. In the event of an audit, this documentation will be crucial.

Stay Updated on Changes in Regulations: Tax laws and regulations can change frequently. Stay updated on any modifications to the IRS rules regarding officer life insurance deductions. Subscribe to IRS newsletters or alerts to ensure you are aware of any new guidelines or interpretations that may impact your organization's compliance.

By following these steps and maintaining a thorough understanding of the IRS regulations, organizations can ensure that their officer life insurance deductions are compliant and valid. Proper compliance not only avoids potential penalties but also fosters a culture of transparency and adherence to tax laws.

Life Insurance for SSI Recipients: Is It Possible?

You may want to see also

Reporting: Report officer life insurance premiums on Schedule A of Form 1120

When it comes to reporting officer life insurance premiums on your tax return, specifically on Form 1120, it's important to understand the process and the relevant sections of the form. Here's a detailed guide on how to approach this:

Understanding the Form 1120:

Form 1120 is the United States Corporation Income Tax Return, which is used by corporations to report their annual income and calculate their federal income tax liability. It is a comprehensive document that requires careful attention to detail when filling it out. One of the key sections related to insurance premiums is Schedule A, which is used to report various deductions, including those related to life insurance.

Reporting Officer Life Insurance Premiums:

Officer life insurance premiums can be a deductible expense for corporations, and it's essential to report them accurately. Here's how you can do it:

- Identify the Premiums: Determine the total amount of premiums paid during the tax year for officer life insurance policies. This includes any regular payments made to the insurance company.

- Schedule A, Line 17: On Schedule A of Form 1120, you will find a line specifically for "Life insurance premiums." Report the total amount of officer life insurance premiums as a deduction. This line is designed to capture various insurance-related expenses.

- Documentation: Ensure you have proper documentation supporting the premiums paid. This may include insurance statements, receipts, or any other records that provide evidence of the payments made. Proper documentation is crucial for tax purposes and may be requested by the IRS if needed.

- Accuracy and Limits: Be precise in your calculations and ensure that the reported amount adheres to the IRS guidelines. There are specific limits and rules regarding deductible insurance premiums, so it's essential to stay within these boundaries.

Additional Considerations:

- Group Term Life Insurance: If your corporation provides group term life insurance to officers, the premiums may be treated differently. Consult IRS publications or seek professional advice to understand the specific rules for group insurance.

- Taxable Benefits: Keep in mind that the deduction for life insurance premiums might be limited to a certain percentage of the officer's compensation. This is to prevent excessive deductions and ensure a fair tax system.

- Changes in Premiums: If there were any changes in premium amounts during the year, report the total for the entire tax year.

By carefully following these instructions and staying organized with your documentation, you can ensure that your corporation's officer life insurance premiums are reported correctly on Form 1120, taking full advantage of the available deductions while maintaining compliance with tax regulations.

Federal Life Insurance: A Good Deal or Not?

You may want to see also

Frequently asked questions

Officer Life Insurance is a type of group term life insurance provided by a company to its officers. It is a valuable benefit that offers financial protection to the officers and their families in the event of the officer's death while in service. Form 1120S, also known as the "S Corporation Income Tax Return," is a tax form used by S corporations to report their income, deductions, credits, and other relevant financial information to the Internal Revenue Service (IRS). The insurance proceeds from Officer Life Insurance are typically reported on this form as income or a reduction in the corporation's taxable income.

The payout from Officer Life Insurance is generally considered taxable income for the recipient. The amount paid out is subject to income tax, and the tax treatment depends on the recipient's tax status. If the insurance proceeds are received by the officer's beneficiaries, it may be treated as a death benefit and taxed differently. It's important to consult tax regulations and seek professional advice to understand the specific tax implications for the corporation and its officers.

Yes, there can be tax advantages associated with Officer Life Insurance premiums. The cost of providing this insurance to officers may be deductible as a business expense for the S corporation. Additionally, if the insurance is funded with after-tax dollars, the premiums paid by the corporation may be tax-deductible. However, the specific rules and limitations regarding these deductions or credits should be reviewed in the context of tax laws and regulations.

The value of Officer Life Insurance itself is not typically reported on Form 1120S. However, the insurance proceeds paid out upon the officer's death would be reported as income on the form. It's essential to accurately report all relevant financial information, including any insurance benefits, to ensure compliance with tax regulations and provide a comprehensive view of the corporation's financial status.