Life insurance is a crucial financial product that provides financial security and peace of mind to individuals and their loved ones. When purchasing or reviewing a life insurance policy, it's essential to understand the importance of the license number associated with the policy. This unique identifier is a critical piece of information that ensures the legitimacy and authenticity of the policy. In this paragraph, we will explore the significance of the life insurance license number and why it is essential to know and keep this information readily available.

What You'll Learn

- Life Insurance Policy Details: Accessing and verifying the policy number and coverage details

- License Verification: Checking the validity and authenticity of the license

- Contact Information: Locating the insurance company's contact details for inquiries

- Policyholder Rights: Understanding rights and responsibilities as a policyholder

- License Renewal: Information on license renewal processes and requirements

Life Insurance Policy Details: Accessing and verifying the policy number and coverage details

When it comes to managing your life insurance policy, having easy access to your policy details is crucial. The policy number is a unique identifier for your insurance contract, and it plays a vital role in ensuring that your coverage is accurately recorded and accessible when needed. Here's a guide on how to access and verify your life insurance policy number and coverage details:

- Policy Documents: The first place to look for your policy number is the original insurance documents you received when you purchased the policy. These documents typically include a welcome kit or a summary of your policy. It might be on the front or back of the main policy document, often in a section titled "Policy Information" or "Policy Details." If you can't find it there, check the correspondence or any emails from your insurance provider related to the policy activation.

- Insurance Provider's Website: Most insurance companies provide an online portal or a customer service website where you can access your policy information. Log in to your account using your credentials, which you should have received via email or can request if you've forgotten them. Once logged in, navigate to the "Policy" or "Coverage" section, where you should find your policy number and other relevant details. This is a convenient way to update your personal information and review your coverage regularly.

- Contact Your Insurance Agent or Broker: If you purchased your policy through an agent or broker, they should have the policy number and other essential details readily available. They can provide you with the information or guide you through the process of accessing it. Your insurance agent is also a valuable resource for any questions or concerns you may have about your policy.

Verifying Coverage Details:

Along with the policy number, it's essential to understand and verify your coverage. Here's how:

- Review Policy Documents: Carefully examine the original policy documents to understand the terms and conditions, coverage types (e.g., term life, whole life), benefits, and any exclusions. Pay attention to the duration of the policy and any conversion options.

- Online Account: If you have access to your online account, review the summary of your policy, which should outline the coverage amount, type, and any additional benefits or riders. Look for any recent changes or updates to your policy.

- Contact Your Insurance Company: Reach out to your insurance provider's customer service team to verify the accuracy of your coverage details. They can provide a breakdown of your policy, including the death benefit amount, any additional riders or endorsements, and the policy's status (active, lapsed, etc.).

- Annual Reviews: Insurance companies often send annual policy reviews or statements, providing an overview of your coverage and any changes made during the year. Review these documents to ensure your policy remains aligned with your needs.

Remember, keeping your policy details accurate and accessible is essential for making informed decisions about your life insurance. Regularly review your policy and update your personal information to ensure a smooth experience when you need to file a claim or make changes to your coverage.

Life Insurance Proceeds: Taxable in Canada?

You may want to see also

License Verification: Checking the validity and authenticity of the license

When it comes to verifying the authenticity and validity of a life insurance license, it's crucial to follow a structured approach to ensure accuracy and protect yourself from potential fraud. Here's a step-by-step guide on how to check the license status:

- Contact the Insurance Regulatory Body: The primary step is to reach out to the regulatory authority or insurance commission responsible for overseeing life insurance companies in your region. This body maintains a database of licensed insurers and their credentials. You can typically find their contact information on their official website. Provide the name of the insurance company or agent you're interested in verifying, and they will guide you through the process. They might require additional details to ensure the security of the information.

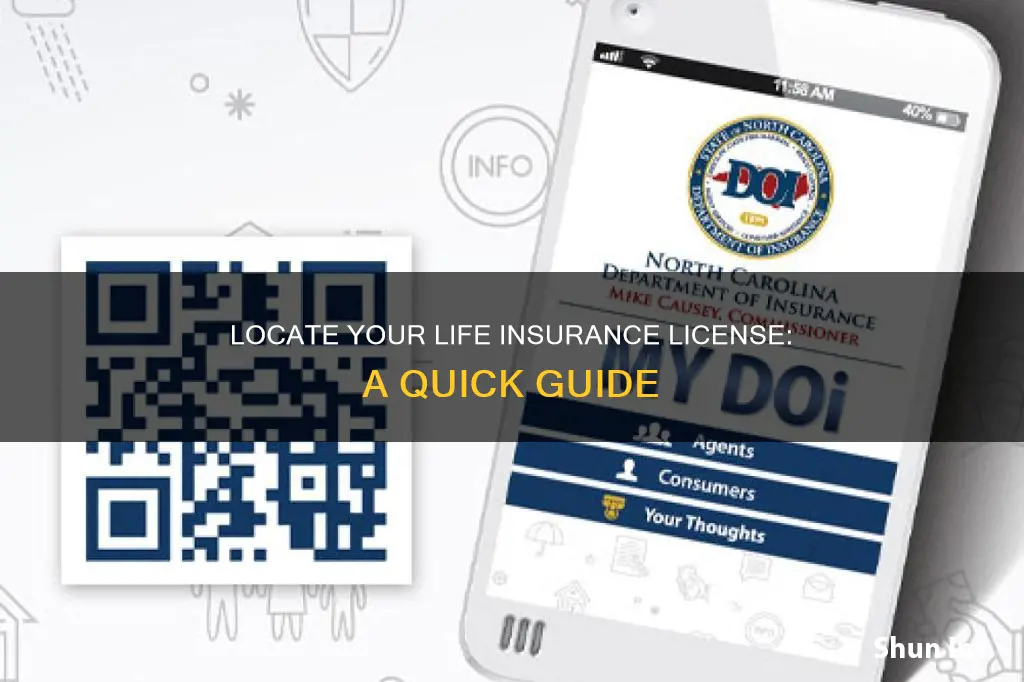

- Online Verification Portals: Many regulatory bodies now offer online verification services. Visit the official website of the insurance regulator and look for a 'License Verification' or 'Search' section. Enter the license number or the name of the insurance company, and the system will display the license status, including the validity period and any additional information. This method is often quick and provides real-time updates.

- Review the License Details: Once you have access to the license information, carefully review the details. Check the license number, the name of the insurance company or agent, the type of license (e.g., life insurance agent, company license), and the expiration date. Ensure that the information matches the details you have for the specific insurer or agent. Look for any additional notes or restrictions mentioned in the license.

- Cross-Reference with Multiple Sources: To ensure accuracy, cross-reference the license verification with multiple sources. Apart from the regulatory body's website, you can also try searching for the company's official website or social media pages. Reputable insurance companies often provide their license details and contact information on their online platforms. Additionally, you can contact the insurance company directly and inquire about their license status, providing them with the license number or any other identifying details.

- Stay Informed and Report Suspicious Activity: Regularly checking the license status is essential, especially if you're considering a long-term insurance policy. If you notice any discrepancies or suspect fraudulent activity, report it to the regulatory body immediately. They will guide you on the appropriate course of action and may take necessary steps to protect consumers.

By following these steps, you can ensure that you are dealing with a licensed and legitimate life insurance provider, safeguarding your interests and financial well-being. Remember, verifying the license is a crucial aspect of making informed decisions in the insurance industry.

Life Insurance with Sleep Apnea: Is It Possible?

You may want to see also

Contact Information: Locating the insurance company's contact details for inquiries

When you need to reach out to your insurance provider regarding your life insurance policy, having the correct contact information is crucial. Here's a step-by-step guide on how to locate the necessary details:

- Policy Documents: Start by locating your insurance policy documents. These documents typically include important information such as the insurance company's name, address, and contact numbers. Look for a summary page or a section titled "Contact Us" or "Customer Service." This section usually provides the primary phone number, email address, and sometimes even a dedicated customer service website.

- Online Account Access: Many insurance companies offer online account access, allowing policyholders to manage their policies. Log in to your online account and navigate to the 'Contact' or 'Support' section. Here, you might find detailed contact information, including phone numbers for different departments, such as customer service, claims, and underwriting. Online accounts often provide a convenient way to locate the most up-to-date contact details.

- Insurance Company Website: Visit the official website of your insurance company. Typically, the contact page will display the company's address, phone numbers, and email addresses. Look for a 'Contact Us' or 'Customer Support' tab, which often provides a comprehensive list of contact options. This includes general inquiries, claims reporting, and policy-specific questions.

- Policy Number or ID: If you have your policy number or unique identifier, you can use it to locate specific contact information. Insurance companies often use this number to verify your identity and provide personalized details. You can search for a 'Policy Lookup' or 'Find My Policy' tool on their website, which will allow you to enter your policy number and retrieve the corresponding contact information.

- Customer Service Representatives: In some cases, you can directly contact a customer service representative to inquire about your policy details. They can provide you with the most accurate and current contact information for your specific policy. You can usually find a phone number for customer service on the company's website or in your policy documents.

Remember, having quick access to the insurance company's contact information is essential for efficient communication and resolving any inquiries or concerns you may have about your life insurance policy.

Life Insurance and FAFSA: What You Need to Know

You may want to see also

Policyholder Rights: Understanding rights and responsibilities as a policyholder

As a policyholder, it's crucial to understand your rights and responsibilities when it comes to life insurance. This knowledge empowers you to make informed decisions and ensures you receive the benefits you're entitled to. Here's an overview of some key aspects:

Right to Information: Policyholders have the right to receive clear and comprehensive information about their insurance policy. This includes understanding the terms, conditions, coverage limits, and any exclusions. Insurers are required to provide a detailed policy document, often referred to as the "insurance contract," which outlines all the relevant details. It's essential to review this document thoroughly and ask questions if any part is unclear. Knowing the specifics of your coverage ensures you can make the most of your policy and take appropriate actions when needed.

Right to Benefits: When a covered event occurs, such as the death of the insured individual, the policyholder is entitled to receive the death benefit as stipulated in the policy. This benefit is typically paid out to the designated beneficiaries, who can be individuals or entities specified by the policyholder. It's important to regularly review and update beneficiary information to ensure that the intended recipients receive the payments. Understanding the claims process and knowing how to initiate a claim is also a critical aspect of this right.

Right to Contest and Amend: Policyholders have the right to contest or challenge certain aspects of their policy if they believe there are inaccuracies or unfair terms. This could include disputing the premium rates, coverage amounts, or policy terms. Additionally, you have the right to request amendments to your policy, such as changing the coverage type, adding riders, or adjusting the beneficiary information. Insurers should provide a fair and transparent process for making these changes or contesting policy details.

Responsibility to Pay Premiums: One of the primary responsibilities of a policyholder is to ensure timely premium payments. Failure to pay the required premiums can result in the policy becoming inactive or lapsing. It's essential to understand the payment schedule and methods accepted by the insurer. Many companies offer convenient payment options, including automatic deductions, online payments, or installment plans. Staying up-to-date with premium payments is vital to maintaining the policy's validity and ensuring continuous coverage.

Responsibility to Provide Accurate Information: When purchasing life insurance, policyholders must provide accurate and honest information during the application process. This includes disclosing relevant health details, lifestyle factors, and any other information requested by the insurer. Misrepresentation or omission of critical facts can lead to policy cancellations or denial of claims. It's in your best interest to provide complete and truthful information to ensure a smooth experience and maintain the integrity of your policy.

Utilizing Life Insurance to Fund Your College Education

You may want to see also

License Renewal: Information on license renewal processes and requirements

License renewal is a critical process for life insurance professionals, ensuring that agents and brokers maintain the necessary standards of knowledge, ethics, and compliance. The renewal process typically involves several steps and requirements that must be met to keep the license active and valid. Here's an overview of what you need to know about license renewal:

Understanding the Renewal Cycle: Life insurance licenses usually have a specific renewal period, often annually or every two years, depending on the regulatory body and jurisdiction. It is essential to be aware of the renewal deadline to avoid any license suspension or revocation. Most regulatory authorities provide clear guidelines and deadlines on their official websites, so it's crucial to stay informed.

Renewal Application and Fees: The renewal process often begins with submitting an application, which may include providing updated personal and professional information. Along with the application, there is typically a renewal fee associated with maintaining the license. This fee can vary depending on the state or region and the type of license held. Ensure you pay the required fees on time to avoid any additional penalties.

Continuing Education Requirements: One of the most critical aspects of license renewal is completing the mandatory continuing education (CE) courses. Regulatory bodies often mandate a certain number of CE hours or credits to be completed within the renewal period. These courses cover various topics, including insurance regulations, ethical practices, and product knowledge. Many states offer online CE courses, making it convenient for licensees to fulfill their requirements.

Background Checks and Compliance: During the renewal process, regulatory authorities may conduct background checks to verify the licensee's integrity and compliance with legal and ethical standards. This step ensures that licensees have not been involved in any fraudulent activities or violations. It is essential to maintain a clean professional record to avoid any complications during the renewal process.

Renewal Benefits and Privileges: Successfully renewing your license grants you the right to continue practicing as a life insurance agent or broker. It allows you to maintain your professional reputation and provide insurance services to clients. Additionally, renewal may grant access to specific resources, networking opportunities, or benefits offered by industry associations or regulatory bodies.

Remember, the specific renewal procedures and requirements can vary based on your location and the regulatory body overseeing your license. Always refer to official sources and stay updated with the latest guidelines to ensure a smooth license renewal process.

Bankruptcy's Impact: Life Insurance and Your Future

You may want to see also

Frequently asked questions

Your life insurance license number is typically provided by the insurance regulatory authority in your region. It can be found on your insurance policy documents, especially in the fine print or on the cover page. If you have lost your policy documents, you can contact your insurance company's customer service, and they should be able to provide you with the necessary information, including your license number.

No, these are two different identifiers. Your life insurance license number is issued by the regulatory body to ensure compliance and is specific to the insurance company. On the other hand, your policy number is a unique identifier assigned to your individual insurance policy. While they are distinct, they both play a crucial role in identifying your insurance coverage.

You can verify the authenticity of your life insurance license number by checking with the insurance regulatory authority in your country or state. They maintain a database of licensed insurance companies and their respective license numbers. You can usually find this information on their official website or by contacting their customer support. It's essential to ensure that you are dealing with a legitimate insurance provider to protect yourself from fraud.