When it comes to life insurance, one of the key considerations for many individuals and families is the potential for cash flow. The best life insurance policy for cash flow will depend on your specific needs and financial goals. In this article, we will explore the various types of life insurance and how they can provide financial security and flexibility through regular payments, lump sums, or other benefits, helping you make an informed decision about which policy best suits your requirements.

What You'll Learn

- Term Life Insurance: Offers guaranteed death benefit, no cash value accumulation

- Whole Life Insurance: Provides lifelong coverage with cash value accumulation, offering tax-deferred growth

- Universal Life Insurance: Flexible coverage with adjustable premiums and potential for higher cash values

- Variable Universal Life Insurance: Combines life insurance with investment options, allowing for potential higher returns

- Whole Life with Income Rider: Provides guaranteed income stream and death benefit, ensuring cash flow

Term Life Insurance: Offers guaranteed death benefit, no cash value accumulation

Term life insurance is a straightforward and effective solution for those seeking a guaranteed death benefit without the added complexity of cash value accumulation. This type of insurance is designed to provide financial protection for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in return, the insurance company promises to pay a predetermined amount to the beneficiary(ies) upon the insured individual's death. The beauty of term life insurance lies in its simplicity and focus on providing a financial safety net during a critical period.

One of the key advantages of term life insurance is its affordability. Since it doesn't include an investment component, the premiums are generally lower compared to permanent life insurance policies. This makes it an attractive option for individuals who want to secure their family's financial future without incurring significant long-term costs. For example, a 30-year-old purchasing a $500,000 20-year term life insurance policy might pay an annual premium of around $250, providing excellent coverage at a relatively low cost.

The guaranteed death benefit is a critical feature of term life insurance. If the insured individual passes away during the term, the insurance company will pay out the specified amount to the designated beneficiary, tax-free. This benefit ensures that the family's financial obligations, such as mortgage payments, children's education, or other long-term commitments, are covered, providing peace of mind and financial security.

Unlike permanent life insurance, term life insurance does not accumulate cash value. This means that the policy does not grow an investment component over time, and there are no dividends or interest earned on the policy's cash value. While this might seem like a drawback, it is precisely what makes term life insurance so efficient and cost-effective. Without the need to build up an investment, the insurance company can offer competitive rates, ensuring that the primary goal of providing a death benefit is achieved without unnecessary complexity.

In summary, term life insurance is an excellent choice for individuals who prioritize simplicity, affordability, and a guaranteed death benefit. It is a powerful tool for managing financial risks and ensuring that loved ones are protected during critical life stages. With its straightforward nature, term life insurance allows policyholders to focus on what matters most—securing their family's future without the added complexity of cash value accumulation.

Life Insurance Payouts: Who Gets Them and How?

You may want to see also

Whole Life Insurance: Provides lifelong coverage with cash value accumulation, offering tax-deferred growth

Whole life insurance is a type of permanent life insurance that offers a range of benefits, particularly in terms of cash flow and long-term financial security. This insurance policy provides lifelong coverage, ensuring that your loved ones are protected even in the event of your passing. One of its key advantages is the accumulation of cash value over time, which can be a valuable financial asset.

As with any insurance product, the primary purpose is to provide financial protection and peace of mind. However, whole life insurance goes a step further by offering a unique combination of insurance and investment features. With each premium payment, a portion goes towards covering the cost of insurance, while the remaining amount contributes to building cash value. This cash value grows tax-deferred, meaning it can accumulate without being subject to annual taxes, allowing it to grow significantly over the policy's lifetime.

The tax-deferred growth aspect is particularly attractive for long-term financial planning. It enables the cash value to accumulate and potentially grow into a substantial sum, which can be borrowed against or withdrawn in the future. This feature provides a source of cash flow that can be utilized for various purposes, such as funding education, starting a business, or covering unexpected expenses. Additionally, the cash value can be used to pay for the policy's premiums in the future, ensuring that the coverage remains in force even if other sources of income are unavailable.

Over time, the cash value in a whole life insurance policy can become a significant financial asset. It can be borrowed against, providing a tax-efficient way to access funds without selling the policy. This flexibility allows policyholders to utilize the cash value for various financial goals, such as starting a business, investing in real estate, or funding retirement. The ability to access funds while still maintaining the insurance coverage is a unique advantage of whole life insurance.

In summary, whole life insurance offers a comprehensive solution for those seeking lifelong coverage and tax-efficient cash flow. Its combination of insurance protection and tax-deferred cash value accumulation makes it an attractive option for individuals and families looking to secure their financial future. With its potential for long-term growth and flexibility, whole life insurance can provide a reliable source of financial support throughout one's life.

Life Insurance Scams: Targeting the Elderly and How to Stop Them

You may want to see also

Universal Life Insurance: Flexible coverage with adjustable premiums and potential for higher cash values

Universal life insurance is a versatile and flexible type of life insurance that offers a range of unique features, making it an attractive option for those seeking both coverage and financial benefits. One of its key advantages is the ability to customize and adjust the policy to fit individual needs and financial goals. Unlike traditional term life insurance, where premiums are fixed for the duration of the policy, universal life insurance provides a level of flexibility that can be highly beneficial in managing cash flow.

With universal life insurance, policyholders have the freedom to adjust their premiums and death benefits over time. This flexibility is particularly useful for those who want to optimize their cash flow and financial resources. For instance, during the initial years of the policy, when the insured individual may have a higher income, they can choose to pay higher premiums, building up more cash value in the process. This strategy can be advantageous as it allows the policyholder to maximize the potential for higher cash values, which can be borrowed against or withdrawn when needed.

The concept of cash value accumulation is a significant feature of universal life insurance. As premiums are paid, a portion of the premium goes towards building a cash reserve, which grows over time through interest credited by the insurance company. This cash value can be used for various purposes, such as taking out loans, making additional payments to reduce the term of the policy, or even withdrawing funds as a tax-free loan. The potential for higher cash values makes universal life insurance an excellent choice for those who want to have a financial safety net and the ability to access funds without selling the policy.

Furthermore, the adjustable nature of universal life insurance premiums can be particularly useful for individuals with fluctuating income or financial goals. If a policyholder's income changes, they can adjust their premiums accordingly, ensuring that the policy remains affordable and aligned with their current financial situation. This adaptability is a significant advantage over other forms of life insurance, where any changes would require a policy review and potential adjustments.

In summary, universal life insurance stands out for its flexibility and potential for higher cash values. The ability to adjust premiums and death benefits, coupled with the accumulation of cash value, provides policyholders with a powerful tool to manage their finances effectively. For those seeking a life insurance policy that offers both coverage and financial flexibility, universal life insurance is a compelling option, allowing individuals to tailor their insurance to their unique needs and changing circumstances.

Firefighter's Life Insurance: Protecting Heroes and Their Families

You may want to see also

Variable Universal Life Insurance: Combines life insurance with investment options, allowing for potential higher returns

Variable Universal Life Insurance (VUL) is a type of life insurance that offers a unique blend of life coverage and investment opportunities, making it an attractive option for those seeking both financial security and the potential for higher returns. This insurance product is designed to provide a flexible and customizable approach to managing your finances and protecting your loved ones.

One of the key advantages of VUL is its ability to offer a range of investment options. Unlike traditional fixed-rate life insurance policies, VUL allows policyholders to allocate their premiums across various investment accounts. These investment options can include stocks, bonds, and mutual funds, providing the potential for higher returns compared to more conservative investment vehicles. By diversifying your investments, you can aim to grow your policy's cash value over time, which can be used to pay for future expenses or withdrawn as needed.

The flexibility of VUL is a significant benefit. Policyholders can adjust their investment allocations based on their financial goals and risk tolerance. This adaptability is particularly useful for those who want to optimize their investment strategies as market conditions change. Additionally, VUL policies often provide a death benefit, ensuring that your beneficiaries receive a payout in the event of your passing, providing financial security for your loved ones.

Another advantage is the potential for tax-deferred growth. The investment accounts within the VUL policy may offer tax-deferred status, allowing your investments to grow without being subject to annual income taxes. This feature can be especially beneficial for long-term wealth accumulation. Furthermore, VUL policies often provide a loan feature, allowing policyholders to borrow against the cash value of their policy, providing access to funds without selling the policy or disrupting its long-term growth potential.

In summary, Variable Universal Life Insurance offers a comprehensive solution for those seeking both life insurance coverage and investment opportunities. With its customizable investment options, flexibility, and potential for higher returns, VUL can be a powerful tool for managing your finances and securing your family's future. It provides a unique combination of insurance and investment benefits, making it an attractive choice for individuals looking to optimize their cash flow and financial planning.

Life Insurance and SSI Disability: How Does OPM Affect You?

You may want to see also

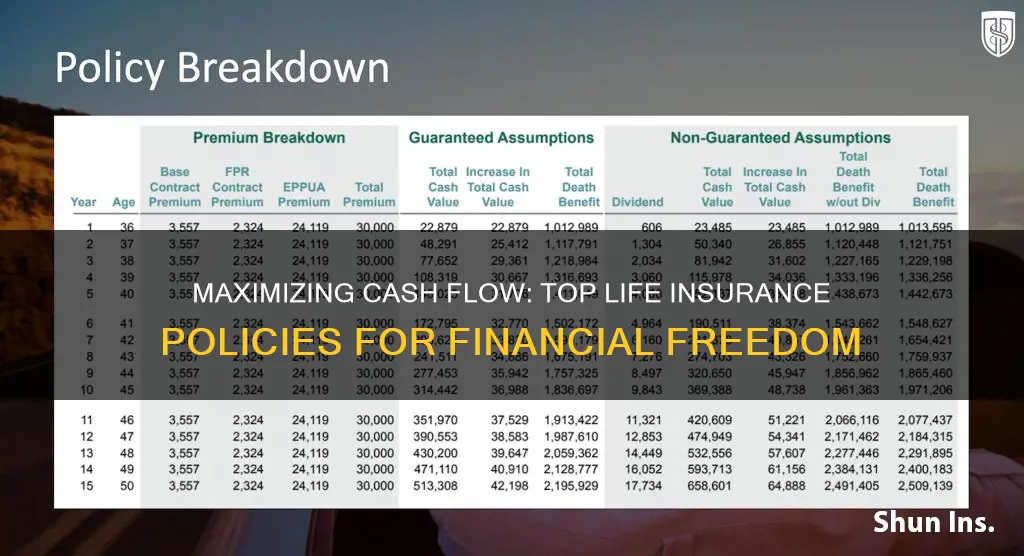

Whole Life with Income Rider: Provides guaranteed income stream and death benefit, ensuring cash flow

When considering life insurance options that offer the best cash flow, one of the most comprehensive and reliable choices is Whole Life with an Income Rider. This type of policy is designed to provide a guaranteed income stream to the policyholder or their designated beneficiaries, ensuring a steady financial flow during their lifetime and beyond. Here's a detailed breakdown of its benefits:

Whole Life Insurance, as the name suggests, is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a range of advantages, including a fixed premium, guaranteed death benefit, and a cash value component that grows over time. By adding an Income Rider to this policy, you can transform it into a powerful financial tool. The Income Rider allows a portion of the death benefit to be paid out as a regular income stream, providing financial security for the policyholder or their beneficiaries. This feature is particularly valuable as it ensures a consistent cash flow, which can be used for various purposes, such as retirement planning, covering living expenses, or funding education.

The beauty of this combination lies in its predictability and long-term security. Unlike term life insurance, which provides coverage for a specified period, whole life insurance with an income rider offers a guaranteed payout for life. This means that regardless of changes in the insurance market or the insured's health, the policyholder can rest assured that their beneficiaries will receive the promised income. Moreover, the cash value accumulation within the policy can be utilized to generate additional income or be borrowed against, providing further financial flexibility.

In terms of cash flow, this policy can be tailored to meet specific needs. The income stream can be adjusted to provide a regular payment that aligns with the policyholder's financial goals. For instance, it can be structured to provide a fixed amount annually, ensuring a steady cash flow for retirement or other long-term financial commitments. Additionally, the death benefit, which is also guaranteed, provides a substantial financial cushion for the beneficiaries, ensuring their financial well-being in the event of the insured's passing.

In summary, Whole Life with an Income Rider is an excellent strategy for those seeking to maximize cash flow and financial security. It offers a guaranteed income stream and a death benefit, providing peace of mind and long-term financial stability. This type of policy is particularly suitable for individuals who want a permanent solution, ensuring that their loved ones are protected and their financial goals are met, regardless of future uncertainties. By carefully considering the income rider's options, policyholders can customize their coverage to align perfectly with their unique financial requirements.

Life Insurance and Medicare: Retirement's Dynamic Duo

You may want to see also

Frequently asked questions

The ideal life insurance policy for maximizing cash flow depends on your unique financial goals and circumstances. It's essential to consider the policy's features, such as the death benefit amount, the cost of insurance, and the policy's flexibility. Term life insurance is often a popular choice for those seeking a straightforward and cost-effective solution, offering a fixed death benefit for a specified term.

To guarantee a steady cash flow, you can opt for a term life insurance policy with a convertible feature. This allows you to convert the term policy into a permanent one, typically whole life, after a certain period. This conversion option ensures that your insurance coverage remains in place, providing a consistent death benefit and potential cash value accumulation over time.

Yes, some life insurance companies offer policies tailored to provide a steady cash flow. These policies often include an additional rider or feature that allows policyholders to access a portion of the death benefit as a loan or withdrawal, providing immediate cash flow. However, it's crucial to understand the terms and conditions, as withdrawals may impact the policy's value and future benefits.

Absolutely! Many business owners utilize their life insurance policies as a business funding tool. By taking out a loan against the policy's cash value or assigning the policy as collateral, business owners can access funds for various purposes, such as expansion, debt repayment, or covering operational costs. This strategy can provide a stable source of capital while maintaining the insurance coverage.