Life insurance is a crucial financial decision that many people consider, as it provides a safety net for their loved ones in the event of their untimely demise. The process of choosing the right life insurance policy can be complex, and it often involves careful consideration of various factors. Some individuals conclude that life insurance is a necessary investment to ensure financial security for their families, especially when they have dependents or significant financial obligations. This decision is often influenced by personal circumstances, such as age, health, and financial goals, making it a highly personalized choice.

What You'll Learn

- Risk Assessment: People evaluate their mortality risk to determine insurance needs

- Financial Planning: Life insurance is a key component of comprehensive financial planning

- Benefits and Coverage: Understanding the benefits and coverage options available is crucial

- Cost and Affordability: The cost of insurance is a significant factor in decision-making

- Trust and Legality: People seek reputable insurers and ensure legal compliance

Risk Assessment: People evaluate their mortality risk to determine insurance needs

When considering life insurance, a crucial step for individuals is to assess their mortality risk. This risk assessment is a fundamental process that helps people understand their likelihood of passing away at any given time, which is essential for determining the appropriate insurance coverage. By evaluating mortality risk, individuals can make informed decisions about the type and extent of life insurance they need to protect their loved ones and financial interests.

The process begins with a comprehensive review of personal and family medical history. People should consider factors such as age, gender, and family medical history, as these can significantly influence mortality risk. For instance, older individuals generally face a higher risk of mortality compared to younger people. Additionally, certain medical conditions or genetic predispositions can impact life expectancy. By analyzing these factors, individuals can gain insights into their potential longevity and the associated risks.

Another critical aspect of risk assessment is lifestyle and environmental considerations. Smoking, excessive alcohol consumption, and participation in high-risk activities can all contribute to an increased mortality risk. For example, smokers often face a higher likelihood of developing smoking-related diseases, which can significantly impact life expectancy. Similarly, individuals living in areas with higher crime rates or those involved in dangerous professions may face elevated risks. Understanding these lifestyle and environmental factors allows people to make necessary adjustments to mitigate potential risks.

Financial planning is also an integral part of this assessment. People should evaluate their financial obligations, such as mortgage payments, children's education costs, or business debts, to determine the potential impact of their death on these financial commitments. By calculating the financial needs and considering the duration of these obligations, individuals can decide on the appropriate death benefit coverage to ensure their loved ones are financially secure.

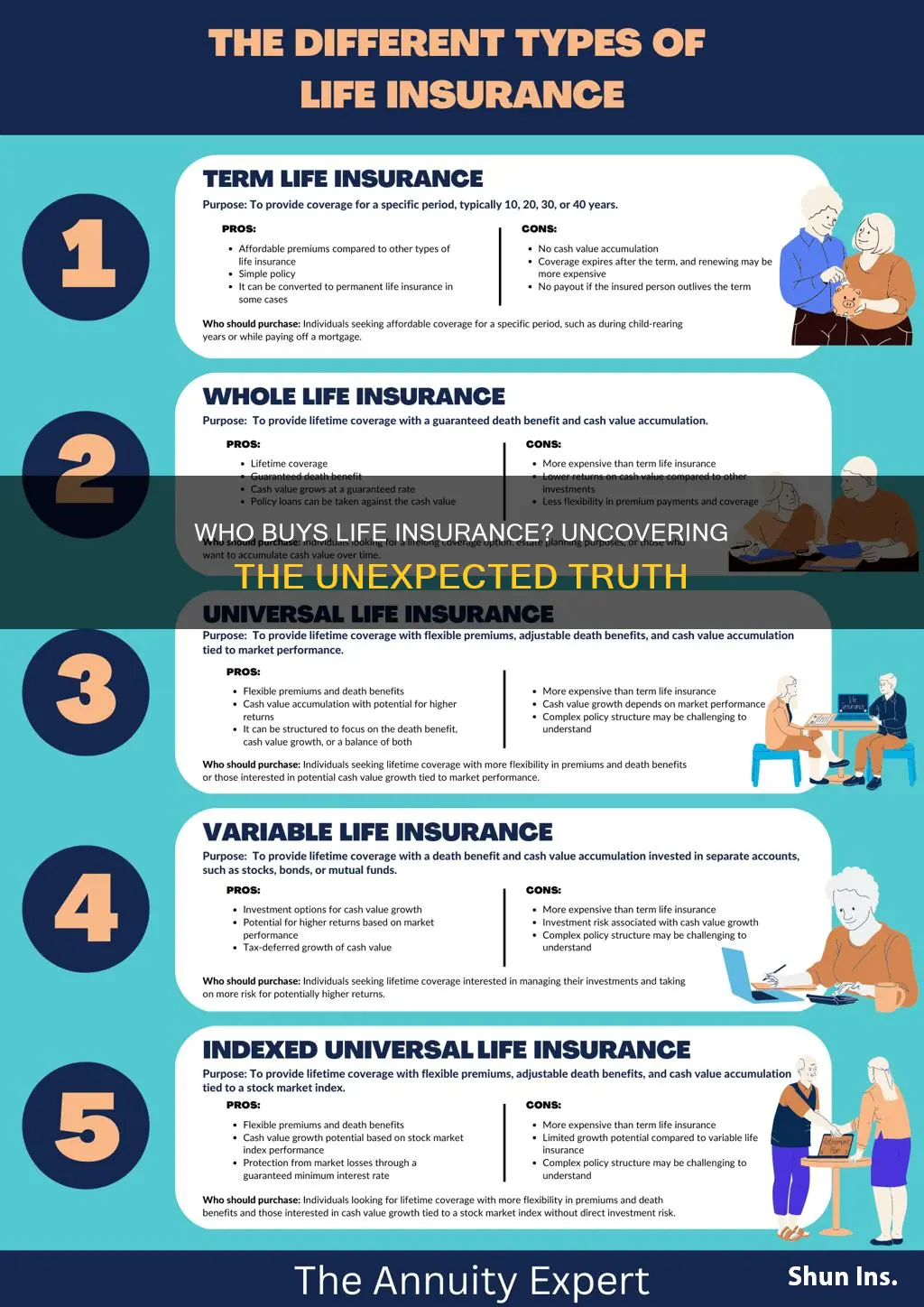

Furthermore, risk assessment involves understanding the various types of life insurance available. Term life insurance, for instance, provides coverage for a specified period, while permanent life insurance offers lifelong coverage. By evaluating their long-term financial goals and the level of protection required, individuals can choose the most suitable insurance policy. This assessment ensures that people select the right insurance product that aligns with their specific needs and provides adequate financial security.

In summary, evaluating mortality risk is a critical step in the process of concluding life insurance. It empowers individuals to make informed decisions about their insurance needs by considering personal health, lifestyle, and financial factors. Through this risk assessment, people can ensure they have the appropriate coverage to protect their loved ones and financial interests, providing peace of mind and long-term financial security.

Life Insurance: Navigating Disclosures for a Smooth Application Process

You may want to see also

Financial Planning: Life insurance is a key component of comprehensive financial planning

Life insurance is an essential tool for financial planning, providing a safety net for individuals and their families in the event of unexpected death. It is a crucial component of a comprehensive financial strategy, offering both financial security and peace of mind. When considering life insurance, it's important to understand the various types available and how they can be tailored to meet specific needs.

In financial planning, life insurance serves multiple purposes. Firstly, it ensures that your loved ones are financially protected if something happens to you. This is particularly important for those with dependents, such as children or a spouse, who rely on your income. By having a life insurance policy, you can provide a steady income stream to cover essential expenses, such as mortgage payments, education costs, or daily living expenses, ensuring that your family's standard of living is maintained even in your absence.

There are different types of life insurance policies to choose from, each with its own benefits. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It is generally more affordable and offers a straightforward way to secure financial protection during a specific life stage. On the other hand, permanent life insurance, such as whole life or universal life, provides lifelong coverage and includes a savings component, allowing your policy to accumulate cash value over time. This type of insurance can be a valuable long-term investment strategy.

When evaluating life insurance options, it's crucial to consider your unique circumstances and financial goals. Factors such as age, health, occupation, and the number of dependents will influence the type and cost of the policy. For instance, younger individuals may opt for term life insurance to cover a specific period, while those with long-term financial goals might prefer permanent life insurance. Consulting with a financial advisor can help you navigate these choices and ensure that your life insurance strategy aligns with your overall financial plan.

In summary, life insurance is a vital element of financial planning, offering financial security and peace of mind. By understanding the different types of policies and their benefits, individuals can make informed decisions to protect their loved ones and achieve their long-term financial objectives. It is a powerful tool that enables people to conclude life insurance policies that are tailored to their specific needs, ensuring a more secure and stable future for themselves and their families.

Assigning Life Insurance: Certificate Allocation Explained

You may want to see also

Benefits and Coverage: Understanding the benefits and coverage options available is crucial

When considering life insurance, it's essential to delve into the various benefits and coverage options to ensure you make an informed decision. This knowledge empowers you to choose a policy that aligns with your specific needs and provides adequate financial protection for your loved ones. Here's a breakdown of the key aspects to focus on:

Benefits of Life Insurance: Life insurance offers a range of advantages that go beyond just financial compensation in the event of your passing. Firstly, it provides peace of mind, knowing that your family's financial well-being is secured. This can be especially crucial for those with dependents, as it ensures their long-term financial stability. Additionally, life insurance can be a valuable tool for estate planning, helping to cover funeral expenses and outstanding debts, thus reducing the financial burden on your beneficiaries. Moreover, certain types of life insurance, such as whole life insurance, accumulate cash value over time, which can be borrowed against or withdrawn, providing a financial safety net for various life goals.

Coverage Options: Understanding the different coverage options is vital to tailoring your policy to your circumstances. The primary type of coverage is the death benefit, which is the amount paid out upon your passing. This benefit can be a lump sum or paid out over time as an annuity. Term life insurance offers coverage for a specified period, typically 10, 20, or 30 years, making it ideal for covering debts or specific financial goals during that time frame. Permanent life insurance, on the other hand, provides lifelong coverage and often includes an investment component, allowing your policy to grow over time. It's important to assess your financial obligations, future goals, and the duration of your need for coverage to determine the appropriate type and amount of coverage.

Customizing Your Policy: Life insurance policies can be tailored to your unique requirements. You can choose the coverage amount based on your family's financial needs, ensuring that your beneficiaries have sufficient funds to maintain their standard of living. Additionally, you can select the type of policy that best suits your goals. For instance, if you want long-term coverage, a whole life insurance policy might be preferable. You can also opt for additional riders or endorsements to enhance your policy, such as a waiver of premium rider, which allows your beneficiaries to skip premium payments if you become disabled, or a critical illness rider, which provides a payout if you're diagnosed with a critical illness.

Review and Adjustment: Life insurance is not a one-time decision; it requires regular review and adjustment. As your life circumstances change, so should your insurance needs. Major life events like marriages, births, or significant financial milestones should prompt a policy review. For instance, if you start a family, you might want to increase your coverage to ensure your family's financial security. Similarly, if you pay off a mortgage or achieve financial goals, you may consider reducing your coverage to avoid over-insuring. Regularly assessing your policy ensures that you maintain adequate protection without paying for unnecessary coverage.

In conclusion, understanding the benefits and coverage options of life insurance is fundamental to making a wise decision. It empowers you to select a policy that provides financial security for your loved ones and aligns with your unique life circumstances. By customizing your policy, regularly reviewing it, and staying informed about your insurance needs, you can ensure that your life insurance remains a valuable asset throughout your life's journey.

Understanding Cash Value Life Insurance: Term vs. Permanent

You may want to see also

Cost and Affordability: The cost of insurance is a significant factor in decision-making

The decision to purchase life insurance is a significant one, and cost is often a primary concern for many individuals. When considering life insurance, it's essential to understand the various factors that influence the price of a policy, as this can greatly impact one's decision-making process. The cost of life insurance can vary widely depending on several key elements, and being aware of these factors is crucial for making an informed choice.

Age and health are fundamental considerations. Younger individuals typically benefit from lower insurance premiums as they are statistically less likely to require early payouts. Conversely, older adults may face higher costs due to increased health risks and potential pre-existing conditions. Additionally, overall health plays a vital role; individuals with a history of chronic illnesses or those who smoke or engage in risky activities might be categorized as higher-risk clients, resulting in more expensive insurance premiums.

The amount of coverage required also directly affects the price. A higher coverage amount means a more substantial financial commitment from the policyholder. Insurance companies calculate the cost based on the risk associated with providing a large payout in the event of the insured's death. Therefore, individuals seeking substantial coverage may need to consider the long-term financial implications and explore options to ensure affordability.

Another critical aspect is the type of life insurance policy. Term life insurance, which provides coverage for a specified period, often costs less than permanent life insurance, which offers lifelong coverage. Term policies are generally more affordable because they do not include a savings component, making them an attractive option for those on a budget. Understanding the different policy types and their associated costs can help individuals choose the most suitable option for their needs and financial situation.

In conclusion, when deciding on life insurance, cost is a critical factor that requires careful consideration. By evaluating age, health, coverage needs, and policy types, individuals can make informed choices. It is advisable to seek professional advice to navigate the complexities of insurance pricing and find a policy that offers the desired level of protection without straining one's financial resources. Being aware of these cost determinants empowers individuals to make the right decision regarding life insurance coverage.

Supplemental Life Insurance: Enhancing Your Basic Coverage

You may want to see also

Trust and Legality: People seek reputable insurers and ensure legal compliance

When it comes to making a life insurance decision, trust and legality are paramount considerations for many individuals. People often seek reputable insurance companies to ensure they are dealing with a trustworthy and reliable entity. This is especially important when it comes to a product as significant as life insurance, which involves financial commitments and promises that need to be honored over the long term.

Reputable insurers are typically well-established companies with a strong financial standing, a history of good customer service, and a commitment to ethical business practices. These companies often have a solid reputation in the market, which can be verified through customer reviews, ratings, and testimonials. By choosing a reputable insurer, individuals can have peace of mind knowing that their policy is likely to be honored and that the company will be around to provide support when needed.

Legal compliance is another critical aspect that influences people's choices. Life insurance policies are complex documents with various legal implications. Individuals want to ensure that the insurer they choose is legally compliant, meaning they adhere to all relevant laws and regulations governing the insurance industry. This includes fair treatment of policyholders, accurate policy documentation, and transparent communication about policy terms and conditions.

To ensure legal compliance, people should carefully review the insurer's policies and procedures. They should also verify the company's licensing and registration with relevant regulatory bodies. A licensed insurer has met the legal requirements to operate in a particular jurisdiction, providing a level of assurance that the company is legitimate and operates within the boundaries of the law. Additionally, individuals can check for any legal disputes or complaints against the insurer to gauge their compliance history.

In summary, when concluding a life insurance policy, people prioritize trust and legality. They seek reputable insurers with a proven track record of reliability and ethical conduct. By choosing a trustworthy company, individuals can have confidence in their insurance decision. Furthermore, they ensure legal compliance by verifying the insurer's legitimacy, licensing, and adherence to relevant laws, which ultimately protects their interests and provides a sense of security.

Maximize Savings: Top Cashback Life Insurance Plans Revealed

You may want to see also

Frequently asked questions

Life insurance is available to people of all ages, but the eligibility criteria can vary depending on the insurance provider and the type of policy. Generally, insurers consider factors such as age, health, lifestyle, and occupation when determining eligibility. Young and healthy individuals often have better rates, while those with pre-existing medical conditions or high-risk lifestyles may face higher premiums or limited coverage options.

The amount of life insurance you need depends on various factors, including your financial obligations, income, family responsibilities, and long-term goals. It's essential to consider your expenses, such as mortgage payments, children's education costs, daily living expenses, and any outstanding debts. A common rule of thumb is to get a policy that would provide 10-15 times your annual income to cover these expenses. However, consulting with a financial advisor can help you determine the right coverage amount for your specific situation.

There are several types of life insurance policies, each with its own features and benefits:

- Term Life Insurance: This provides coverage for a specified term, such as 10, 20, or 30 years. It offers a death benefit if the insured person passes away during the term.

- Permanent Life Insurance: Also known as whole life or universal life, this type of insurance provides lifelong coverage and includes a savings component, allowing policyholders to accumulate cash value over time.

- Whole Life Insurance: A form of permanent life insurance with fixed premiums and a guaranteed death benefit.

- Universal Life Insurance: Offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change.

Choosing the right life insurance provider is crucial to ensure you receive the best coverage and service. Here are some factors to consider:

- Financial Stability: Research the financial strength and ratings of insurance companies to ensure they can fulfill their obligations.

- Customer Service: Opt for providers with a reputation for excellent customer support and quick claim processing.

- Policy Options: Compare the different policy types and coverage options offered to find the best fit for your needs.

- Premiums and Affordability: Evaluate the premium rates and ensure they align with your budget while providing adequate coverage.

Yes, it is possible to obtain life insurance even with pre-existing health conditions, but it may be more challenging and expensive. Insurers often consider factors like the severity and stability of the condition, recent medical history, and lifestyle choices. Some companies offer specialized policies for individuals with specific health concerns, while others may require a medical examination and additional health questions on the application. It's advisable to shop around and compare quotes from multiple insurers to find the best options for your situation.