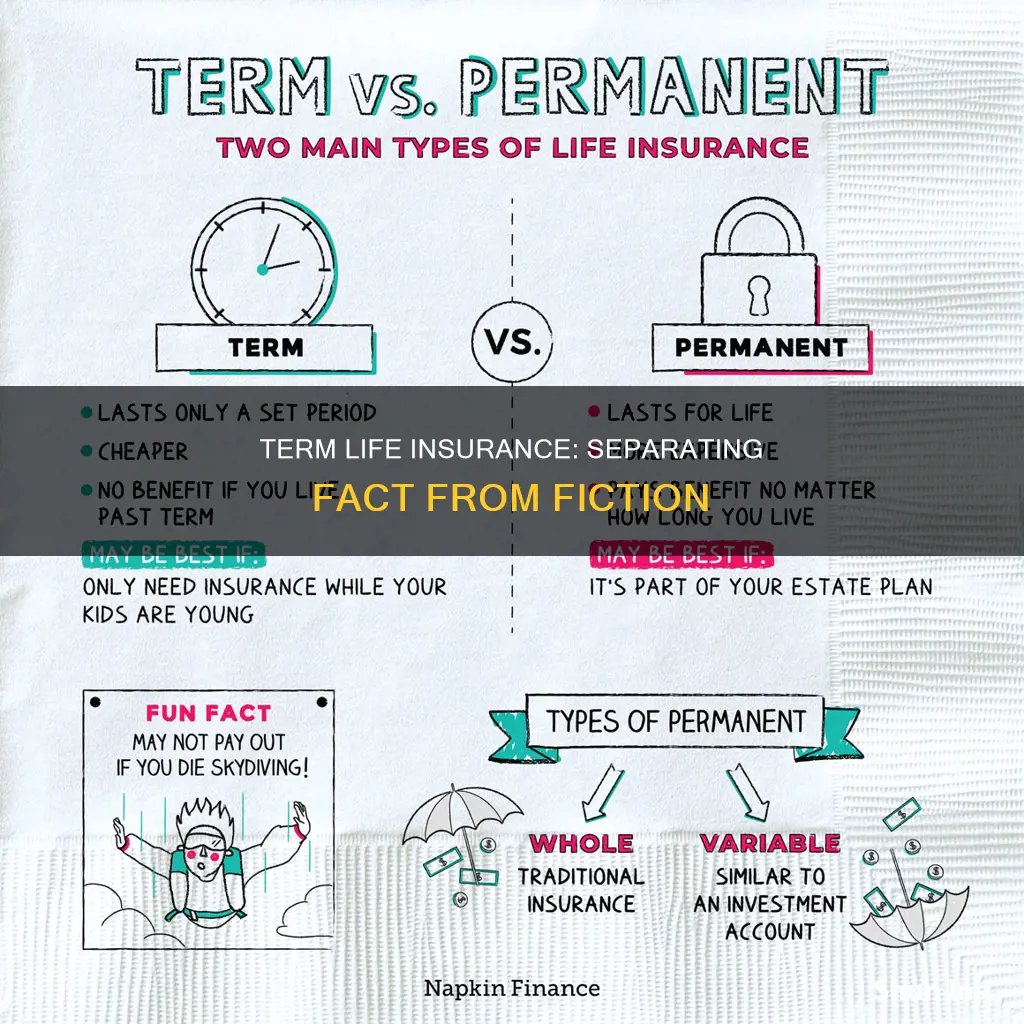

Term life insurance is a popular and affordable type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It is designed to offer financial protection to beneficiaries during the term, ensuring a steady income or a lump sum payment if the insured individual passes away during the policy period. However, it's important to note that term life insurance does not accumulate cash value over time, unlike permanent life insurance policies. This means that the primary purpose of term life insurance is to provide coverage for a defined period, and it does not serve as an investment vehicle or a source of long-term financial growth. Understanding the differences between term and permanent life insurance is crucial for individuals to choose the right coverage for their needs.

What You'll Learn

Term life insurance is not renewable indefinitely

Term life insurance is a type of coverage that provides protection for a specific period, typically 10, 20, or 30 years. One common misconception about this insurance is that it can be renewed indefinitely, which is not accurate. Here's why:

When you purchase a term life insurance policy, you're essentially agreeing to pay a premium for a defined period. At the end of this term, the policy may offer two options: conversion to a permanent policy or non-renewal. The insurance company cannot guarantee a renewal for an extended period without considering various factors. These factors include your age, health, and lifestyle, which can change over time, potentially affecting the insurer's willingness to offer a new policy.

Renewing term life insurance indefinitely is not a standard practice for insurance providers. Most companies will require a new medical examination and assessment of your current health status before extending the policy. This process ensures that the insurer can accurately evaluate your risk and determine if they can continue providing coverage. As you age, your health may change, and certain medical conditions or lifestyle choices could impact the terms and conditions of the policy.

Furthermore, term life insurance is designed to provide coverage during a specific period, often when you have a family or financial responsibilities that require protection. After this period, your needs might change, and the insurance may no longer be necessary. The idea of indefinite renewal may not align with the original purpose of the policy, which is to provide temporary coverage for a defined time.

In summary, while term life insurance offers valuable protection, it is not a long-term commitment. The option to renew indefinitely is not a standard feature, and insurance companies will assess your eligibility based on current health and circumstances. Understanding these nuances is essential for making informed decisions about your insurance needs.

Unlocking the Best Value in Whole Life Insurance

You may want to see also

Premiums do not increase with age

Term life insurance is a popular and affordable way to protect your loved ones financially in the event of your untimely death. It provides a death benefit to your beneficiaries for a specified period, known as the "term." One of the key advantages of term life insurance is its simplicity and predictability, especially regarding premium payments.

A common misconception about term life insurance is that premiums remain constant throughout the policy's duration. Many people believe that as you age, your risk profile increases, and thus, your insurance premiums should rise accordingly. However, this is not the case with term life insurance. When you purchase a term life insurance policy, the premium you pay is determined by several factors, including your age, health, lifestyle, and the amount of coverage you choose. The premium is typically calculated based on the risk associated with insuring your life during the specified term.

The beauty of term life insurance is that the premium rate is locked in for the entire term, regardless of age-related changes. This means that your premium will not increase as you get older, providing a sense of financial stability and predictability. For example, if you purchase a 10-year term life insurance policy at age 30, your premium will remain the same for the entire 10 years, even if your health or lifestyle choices change over time. This is in contrast to permanent life insurance, where premiums can increase with age due to the accumulation of cash value and the changing risk profile of the insured.

The lack of age-based premium increases in term life insurance is a significant advantage, especially for those who want to ensure their loved ones are protected without the financial burden of increasing premiums. It allows individuals to plan and budget effectively, knowing that their insurance costs will remain stable over the term. This predictability can be particularly beneficial for young families, homeowners, or anyone with financial commitments that require long-term planning.

In summary, term life insurance offers a straightforward and cost-effective solution for temporary coverage without the worry of premium increases. Understanding this aspect of term life insurance can help individuals make informed decisions about their insurance needs and ensure that their loved ones are protected without unexpected financial strain.

Life Insurance and Inflation: Are Your Investments Protected?

You may want to see also

It provides coverage for a specific period

Term life insurance is a type of insurance policy that provides coverage for a specific period, typically 10, 20, or 30 years. This is in contrast to permanent life insurance, which offers coverage for the entire lifetime of the insured individual. One of the key advantages of term life insurance is its affordability and simplicity. It is designed to provide financial protection during a specific time frame, often when individuals have significant financial responsibilities, such as raising a family, paying for children's education, or covering mortgage payments. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured person passes away within the specified period.

The specific period of coverage is a defining feature of term life insurance. It ensures that the insurance is tailored to the individual's needs during a particular stage of life. For example, a young professional with a growing family might opt for a 20-year term policy to cover their children's upbringing and education. As the individual's circumstances change, they can adjust their coverage by either renewing the term or transitioning to a permanent life insurance policy.

A common misconception about term life insurance is that it is not suitable for long-term financial planning. This is not correct. While it is true that term life insurance does not accumulate cash value, which is a feature of permanent life insurance, it is an excellent choice for those seeking affordable and focused coverage. The simplicity of term life insurance allows individuals to obtain substantial coverage without the complexity and higher costs associated with permanent policies.

Furthermore, the specific period of coverage in term life insurance can be extended or renewed. Many policies offer the option to convert the term life insurance into a permanent policy at the end of the term, ensuring long-term financial protection. This flexibility is a significant advantage, allowing individuals to adapt their insurance needs as their life circumstances evolve.

In summary, the statement that term life insurance does not provide coverage for a specific period is incorrect. It is designed precisely for this purpose, offering affordable and focused financial protection during a defined time frame. Understanding this feature is essential for individuals to make informed decisions about their insurance needs and ensure they have the right coverage at the right time.

Life Insurance and Hospital Bills: What's Covered?

You may want to see also

Coverage ends upon the insured's death

Term life insurance is a type of coverage that provides financial protection for a specific period, typically 10, 20, or 30 years. One of the key features of this insurance is that the coverage amount is guaranteed to pay out if the insured individual passes away during the term. However, it's important to understand that the coverage does not continue indefinitely.

The statement "Coverage ends upon the insured's death" is not entirely accurate. While it is true that the primary purpose of term life insurance is to provide financial support during the specified term, the coverage does not automatically terminate when the insured dies. Instead, the insurance company will pay out the death benefit to the designated beneficiaries, and the policy will no longer be in effect.

After the insured's death, the policy's value may still be significant, especially if the policy has a cash value component. This cash value can be used to pay for various expenses or even surrendered for a lump sum payment. It's worth noting that the policy's terms and conditions will dictate what happens to the remaining value after the death benefit is paid out.

It is crucial for policyholders to understand that term life insurance is a temporary solution and may not provide long-term financial security. If the insured individual outlives the term, the policy will not offer any further coverage or benefits. Therefore, it is essential to review and assess one's insurance needs regularly and consider extending or converting the term life insurance into a permanent policy if required.

In summary, while the statement "Coverage ends upon the insured's death" is partially correct, it oversimplifies the post-death process of term life insurance policies. Policyholders should be aware of the potential value and options available after the death benefit is paid, ensuring they make informed decisions regarding their insurance coverage.

Understanding Life Insurance Grace Periods: Your Coverage Safety Net

You may want to see also

It is not permanent insurance

Term life insurance is a type of coverage that is designed to provide protection for a specific period, often 10, 20, or 30 years. It is a popular choice for individuals who want to ensure their loved ones are financially protected during a particular phase of their lives, such as when they are the primary breadwinners or when they have young children to support. One of the key characteristics of term life insurance is its temporary nature, which is often misunderstood.

The statement "It is not permanent insurance" is incorrect because term life insurance is, in fact, a permanent solution for a specific period. While it may not last a lifetime, it provides a defined and fixed level of coverage for the agreed-upon term. After the term ends, the policyholder can choose to renew the coverage, often at a higher premium, or they can opt for a different type of insurance, such as permanent life insurance, which offers lifelong coverage.

The misconception might arise from the fact that term life insurance is often seen as a more affordable and straightforward option compared to permanent life insurance. It is true that term life insurance is generally more cost-effective, especially for younger individuals, as it does not accumulate cash value over time. However, this does not mean it is not permanent. The term duration is a commitment to providing coverage for a specific time, and once the term ends, the insurance remains valid if the policy is renewed.

When considering term life insurance, it is essential to understand the options available at the end of the term. Policyholders can decide to convert their term life insurance into a permanent policy, ensuring lifelong coverage. This flexibility allows individuals to adapt their insurance needs as their circumstances change over time. For example, a young professional might start with a 10-year term policy and, as they approach retirement, consider extending the coverage or transitioning to a different type of insurance.

In summary, the statement "It is not permanent insurance" is misleading. Term life insurance is a permanent solution for a defined period, offering a level of protection that can be tailored to specific life stages. Understanding the options and benefits of term life insurance can help individuals make informed decisions about their insurance needs and ensure they have the right coverage at every stage of their lives.

Maximizing Your Term Life Insurance: Essential Questions to Ask

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. It offers a death benefit if the insured individual passes away during this term.

Unlike permanent life insurance, which provides coverage for the entire life of the insured and includes a cash value component, term life insurance is pure coverage. It is designed to offer affordable and temporary protection for a specific period, making it suitable for individuals who need coverage for a particular goal, such as covering mortgage payments or providing for children's education.

Yes, many term life insurance policies offer the option to convert the coverage to permanent life insurance at the end of the term. This conversion privilege allows policyholders to ensure long-term protection without the need for a new medical examination, making it convenient for those who want to switch to permanent insurance later.

Term life insurance policies are not renewable in the traditional sense. Once the term ends, the policy expires, and coverage ceases unless the policyholder chooses to renew or convert it. However, some insurers may offer the option to renew the policy for a limited time, often with a re-underwriting process that may result in higher premiums or different terms.

The primary advantage of term life insurance is its affordability. It provides high coverage amounts at lower premiums compared to permanent life insurance, making it an excellent choice for individuals who need substantial coverage for a specific period without the long-term financial commitment of permanent insurance.