When it comes to life insurance, it's easy to feel overwhelmed by the options and concerned about finding a policy that truly offers value. The market is saturated with various types of life insurance, each with its own set of features and benefits, and it can be challenging to discern which ones are genuinely worth the investment. In this article, we'll explore the different types of life insurance and shed light on the ones that are not just a rip-off but also provide genuine protection and peace of mind for you and your loved ones.

What You'll Learn

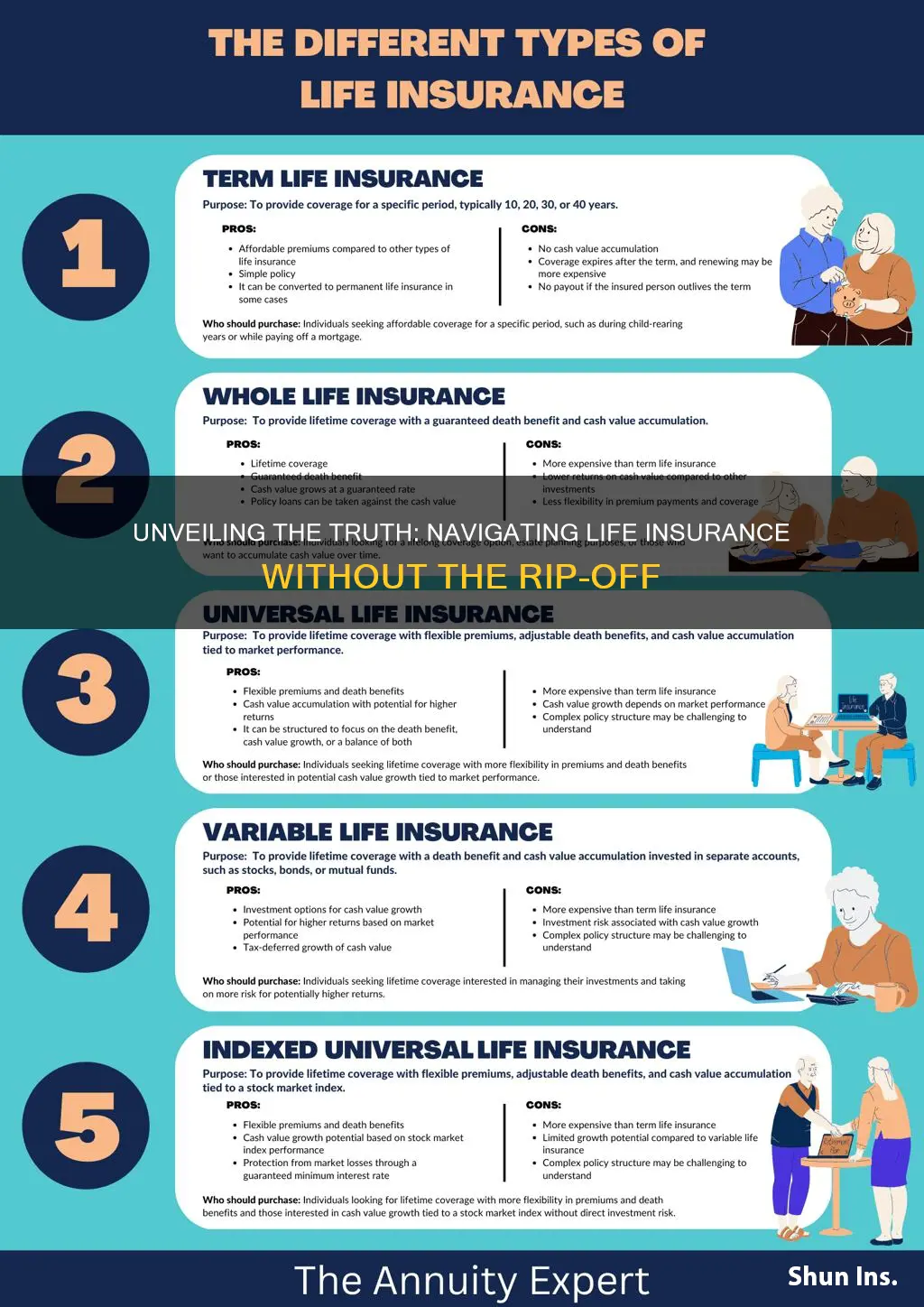

- Term Life Insurance: Affordable coverage for a specific period, offering peace of mind without long-term commitments

- Whole Life Insurance: Provides lifelong coverage with a savings component, ensuring financial security for the long term

- Universal Life Insurance: Flexible policy with adjustable premiums, allowing policyholders to customize their coverage and savings

- Variable Life Insurance: Offers investment options, providing potential for higher returns but with more risk and complexity

- Riders and Endorsements: Additional benefits like critical illness coverage can enhance basic policies without excessive costs

Term Life Insurance: Affordable coverage for a specific period, offering peace of mind without long-term commitments

Term life insurance is a straightforward and cost-effective solution for individuals seeking temporary coverage with a defined purpose. It provides a safety net for a specified period, typically ranging from 10 to 30 years, making it an ideal choice for those who want affordable protection without the complexity of permanent policies. This type of insurance is particularly beneficial for individuals who have specific financial obligations or goals that require coverage for a limited time. For instance, it can be a wise investment for young families to ensure financial security during the critical years when children are growing up and expenses are high.

The beauty of term life insurance lies in its simplicity and affordability. It offers a fixed death benefit, meaning the insurance company will pay out a predetermined amount if the insured individual passes away during the term. This straightforward structure allows for lower premiums compared to permanent life insurance, making it accessible to a broader range of individuals. By choosing a term policy, you're not tied down to long-term commitments, and the coverage can be tailored to your specific needs and financial situation.

One of the key advantages is the flexibility it provides. You can select the term length that aligns with your requirements, ensuring that the coverage lasts only as long as needed. For example, if you're saving for your child's education, you might opt for a 10-year term, covering the duration of their studies. This approach allows you to manage your finances effectively, as the premiums are typically lower than those of permanent policies, making it a more sustainable option.

Furthermore, term life insurance is an excellent choice for those who want to build a financial cushion without the burden of long-term insurance payments. It provides a sense of security and peace of mind, knowing that your loved ones will be financially protected if something unforeseen happens. This type of insurance is often more affordable because it doesn't accumulate cash value, which is a feature found in permanent life insurance policies. As a result, the premiums are competitive, making it an attractive option for those seeking value for money.

In summary, term life insurance is a practical and cost-efficient solution for individuals who require temporary coverage. It offers a defined period of protection, allowing you to manage your finances effectively and providing peace of mind. With its simplicity and affordability, term life insurance is a wise choice for those who want to ensure their loved ones' financial security without long-term commitments. It's a versatile tool that can be tailored to various life stages and financial goals, making it a popular and reliable form of life insurance.

Maximizing Life Insurance Benefits: When to Let Dependents Claim

You may want to see also

Whole Life Insurance: Provides lifelong coverage with a savings component, ensuring financial security for the long term

Whole life insurance is a type of permanent life insurance that offers a range of benefits, making it a popular choice for those seeking long-term financial security. Unlike term life insurance, which provides coverage for a specified period, whole life insurance guarantees coverage for the entire lifetime of the policyholder. This means that as long as the premiums are paid, the insurance will remain in force, providing a safety net for the insured and their beneficiaries.

One of the key advantages of whole life insurance is its dual nature. It serves both as a death benefit and a long-term savings or investment vehicle. When you purchase a whole life policy, a portion of your premium goes towards building a cash value, which accumulates over time. This cash value can be borrowed against or withdrawn, providing financial flexibility and a sense of security. The savings component of whole life insurance allows policyholders to build a substantial fund that can be used for various purposes, such as funding education, starting a business, or planning for retirement.

The guaranteed death benefit is another critical aspect of whole life insurance. It ensures that the policyholder's beneficiaries receive a specified amount upon the insured's passing. This provides financial protection and peace of mind, knowing that your loved ones will have a financial safety net even if you are no longer around. The death benefit is typically tax-free, making it a valuable asset in estate planning and wealth transfer.

In contrast to some other insurance products, whole life insurance offers consistent premiums, which remain the same throughout the policy's duration. This predictability is a significant advantage, as it allows policyholders to budget effectively and plan for the future without worrying about premium increases. Additionally, the long-term nature of whole life insurance means that the policyholder can build a substantial cash value over time, providing a valuable asset that can be utilized or passed on to beneficiaries.

For those seeking a comprehensive and reliable insurance solution, whole life insurance stands out as a robust option. It provides the security of lifelong coverage, ensuring that your loved ones are protected, while also offering a savings component that can contribute to your financial goals. When considering life insurance, it is essential to understand the different types available and their unique features to make an informed decision that aligns with your long-term needs and objectives.

How to Cancel Your Aviva Life Insurance Policy

You may want to see also

Universal Life Insurance: Flexible policy with adjustable premiums, allowing policyholders to customize their coverage and savings

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a customizable and potentially cost-effective solution. Unlike traditional term life insurance, which offers a fixed death benefit for a set period, universal life insurance is a long-term policy that allows individuals to tailor their coverage and savings goals. This type of insurance provides a sense of security and adaptability, making it an attractive option for those seeking a more personalized insurance plan.

One of the key advantages of universal life insurance is its flexibility. Policyholders have the freedom to adjust their premiums and death benefits according to their changing needs and financial circumstances. This adaptability is particularly beneficial for individuals who want to ensure their insurance coverage keeps pace with their evolving life goals. For example, a young professional might opt for a higher death benefit to cover potential future expenses, such as a mortgage or their children's education. As their financial situation improves, they can increase their premiums to build up more cash value in the policy, which can be used for various purposes, including loan repayment or future investments.

The adjustable nature of universal life insurance premiums is a significant departure from traditional whole life insurance, where premiums are locked in for the life of the policy. With universal life, policyholders can choose to pay higher premiums during their earning years to accumulate more cash value, which can be borrowed against or withdrawn when needed. This feature provides a safety net and financial flexibility, especially during periods of financial strain or unexpected expenses. Additionally, the cash value built up in the policy can earn interest, further enhancing the policy's value over time.

Another advantage is the ability to customize the policy to fit individual needs. Policyholders can decide how much of their premium goes towards the death benefit and how much is allocated to the cash value accumulation. This customization ensures that the insurance plan aligns with the policyholder's specific requirements and risk tolerance. For instance, someone who values long-term savings might opt for a higher cash value allocation, while another individual might prioritize a substantial death benefit to protect their family.

In summary, universal life insurance provides a flexible and tailored approach to life coverage, allowing individuals to customize their premiums, death benefits, and savings goals. This type of insurance is particularly appealing to those who want to adapt their insurance plan as their life circumstances change. With the ability to adjust and customize, universal life insurance offers a sense of security and control, making it a valuable consideration for anyone seeking a non-rip-off life insurance solution that suits their unique needs.

How to Adjust Your Life Insurance Payout

You may want to see also

Variable Life Insurance: Offers investment options, providing potential for higher returns but with more risk and complexity

Variable life insurance is a type of permanent life insurance that offers a unique combination of insurance coverage and investment opportunities. Unlike traditional whole life insurance, which provides a fixed death benefit and a guaranteed interest rate, variable life insurance allows policyholders to invest a portion of their premiums in various investment options. This feature sets it apart and can be a significant advantage for those seeking to maximize their financial growth.

The investment aspect of variable life insurance is what makes it stand out. Policyholders can choose from a range of investment options, often including stocks, bonds, and mutual funds. These investments are typically managed by the insurance company or an affiliated investment manager. The idea is to provide policyholders with the potential for higher returns compared to traditional fixed-rate investments. This can be particularly attractive to those who want to grow their money over time and potentially accumulate a substantial cash value in their policy.

However, it's important to understand that this type of insurance also comes with a higher level of risk and complexity. The investment options can be volatile, and the performance of the policy's investment portfolio will directly impact the cash value and death benefit. If the investments underperform, the policy's value may decrease, and the death benefit could be reduced. This level of risk is a trade-off for the potential for higher returns, making it a more suitable choice for those who are comfortable with market fluctuations and long-term investment strategies.

Additionally, the complexity arises from the various features and riders that can be added to a variable life insurance policy. These additional benefits, such as riders for accelerated death benefits or long-term care, can provide extra flexibility and customization but may also increase the overall cost of the policy. Understanding the various investment options, fees, and policy structures is crucial for making informed decisions.

In summary, variable life insurance offers a unique blend of insurance and investment opportunities, allowing policyholders to potentially grow their money through various investment options. While it provides the advantage of higher returns, it also carries more risk and complexity. This type of insurance is best suited for individuals who are willing to accept market volatility and are comfortable with the level of investment knowledge required to navigate this type of policy. As with any financial decision, thorough research and consultation with a financial advisor are essential to ensure it aligns with your financial goals and risk tolerance.

Life Insurance Policy: Locating Your Coverage

You may want to see also

Riders and Endorsements: Additional benefits like critical illness coverage can enhance basic policies without excessive costs

When considering life insurance, it's important to understand the concept of riders and endorsements, which can significantly enhance your policy without necessarily being a rip-off. These additional benefits are designed to provide extra coverage and peace of mind, ensuring that your life insurance policy meets your specific needs and offers comprehensive protection.

Riders are optional add-ons to your base life insurance policy, allowing you to customize it to your liking. For instance, a critical illness rider is a popular choice that provides financial support if you are diagnosed with a critical illness, such as cancer, heart attack, or stroke. This rider can help cover medical expenses, replace lost income, and provide financial security during a challenging time. By adding this rider, you gain valuable coverage without altering the core aspects of your policy, making it a cost-effective way to enhance your protection.

Endorsements, on the other hand, are similar to riders but are typically more permanent additions to your policy. They often provide additional benefits that complement your existing coverage. For example, an accidental death endorsement ensures that your beneficiaries receive the full death benefit if your death is a result of an accident, regardless of the cause of death. This endorsement can provide extra reassurance, especially for those with active lifestyles or those involved in potentially dangerous activities.

The key to avoiding a rip-off is to carefully review and understand the terms and conditions of any rider or endorsement you consider. Some providers may offer unnecessary add-ons at an inflated cost, so it's crucial to assess the value and relevance of each option. Look for riders that align with your specific needs and health status, ensuring that the additional cost is justified by the enhanced coverage.

Additionally, consider the overall cost structure of the life insurance policy. While riders and endorsements can provide valuable benefits, they should not significantly increase the overall cost of the policy. A reputable insurance provider will offer a range of customization options without exploiting the customer's lack of knowledge. By carefully selecting the right riders and endorsements, you can create a tailored life insurance policy that provides comprehensive protection without excessive expenses.

Understanding Term BIALife Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is a more affordable option as it does not accumulate cash value over time. Whole life insurance, on the other hand, offers lifelong coverage and includes a savings component, where a portion of your premium contributes to a cash value that grows tax-free. While term life is generally more cost-effective for short-term needs, whole life provides long-term financial security and a guaranteed death benefit.

When choosing a life insurance policy, it's essential to understand your specific needs and compare options. Evaluate the coverage amount, term length, and premium costs. Look for policies with no hidden fees or excessive commissions. Read the policy documents carefully to understand the terms and conditions, including any exclusions or limitations. Consider seeking advice from a financial advisor who can provide personalized recommendations based on your circumstances.

Yes, there are a few signs that might indicate a potential rip-off. If a company pressures you to make an immediate decision without providing sufficient time to review the policy, it could be a red flag. Excessively high premiums or policies with complex structures that are hard to understand may also be cause for concern. Always ensure you have a clear understanding of the policy and its terms before committing.