Life insurance is a crucial financial tool that provides financial security for individuals and their families. When considering life insurance options, it's important to understand the different types available and their unique features. One aspect to consider is the cash surrender value, which refers to the amount of money an insurance policyholder can receive if they decide to surrender or cancel the policy before the death of the insured individual. In this article, we will explore the various types of life insurance and delve into which ones offer cash surrender values, providing valuable insights for those seeking financial protection and flexibility.

What You'll Learn

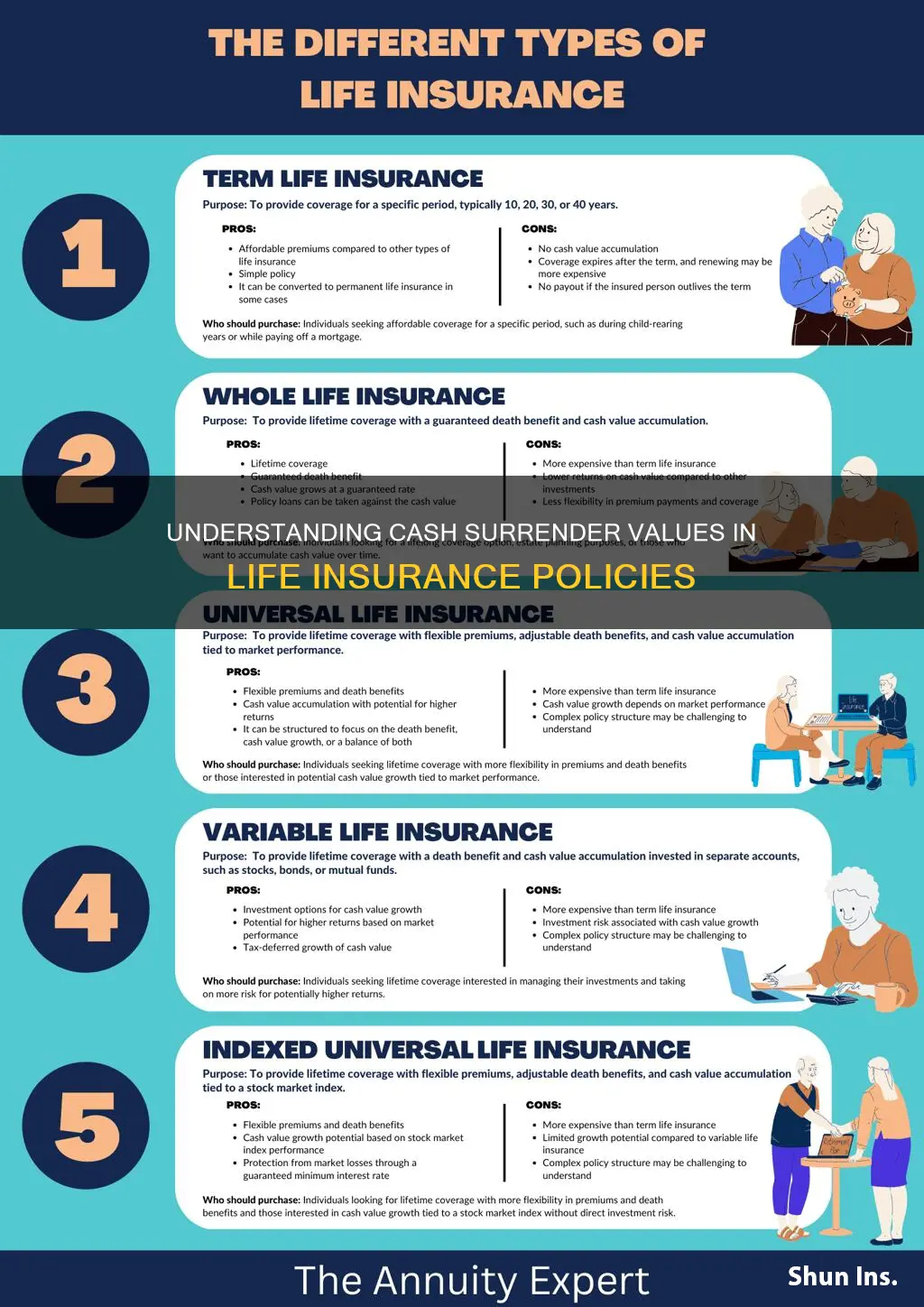

- Term Life Insurance: Offers coverage for a specific period with no cash surrender value

- Whole Life Insurance: Provides permanent coverage and a cash surrender value

- Universal Life Insurance: Flexible coverage with potential cash surrender value

- Variable Universal Life Insurance: Offers investment options and a cash surrender value

- Guaranteed Universal Life Insurance: Permanent coverage with a guaranteed cash surrender value

Term Life Insurance: Offers coverage for a specific period with no cash surrender value

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It is a pure risk product, meaning it offers financial protection during a defined time frame without any investment or savings component. This type of insurance is often chosen for its simplicity and affordability, making it a popular choice for individuals seeking temporary coverage.

One key characteristic of term life insurance is that it does not accumulate cash value over time. Unlike permanent life insurance policies, term life insurance does not have a cash surrender value. This means that if the insured individual decides to terminate the policy before the end of the term, they will not receive any cash back or surrender the policy for its cash value. The primary purpose of term life insurance is to provide a financial safety net during a specific period, ensuring that beneficiaries receive a lump sum payment if the insured person passes away within the covered term.

The lack of cash surrender value in term life insurance is a direct result of its temporary nature. Since the coverage is limited to a specific period, there is no need for an investment component to build cash value. This simplicity makes term life insurance straightforward and cost-effective, allowing individuals to focus solely on the insurance coverage they need during a particular time frame.

When considering term life insurance, it is essential to understand the duration of coverage. The term length should align with the individual's specific needs and goals. For example, a young professional might choose a 10-year term to cover potential financial obligations, such as a mortgage or children's education, during that period. As individuals age and their financial obligations change, they may opt for longer-term coverage or explore other insurance options.

In summary, term life insurance offers a pure risk product with coverage for a defined period, providing financial protection without the accumulation of cash value. Its simplicity and affordability make it an attractive choice for those seeking temporary life insurance coverage. Understanding the term length and its alignment with personal goals is crucial when selecting term life insurance, ensuring that individuals have the necessary protection during the specified time frame.

Employer Life Insurance: Paperwork and Its Importance

You may want to see also

Whole Life Insurance: Provides permanent coverage and a cash surrender value

Whole life insurance is a type of permanent life insurance that offers a range of benefits, including a guaranteed death benefit and a cash surrender value. This feature is particularly valuable for policyholders who may need access to their insurance funds before their passing. When purchasing whole life insurance, the policyholder pays a fixed premium for the entire term of the policy, ensuring that coverage remains in force as long as the premiums are paid. One of the key advantages of whole life insurance is the accumulation of cash value over time. This cash value is built up through the investment of the premiums and can be borrowed against or surrendered for cash.

The cash surrender value is a critical aspect of whole life insurance, allowing policyholders to access a portion of their premiums paid if they decide to terminate the policy early. This value increases over time as the cash value grows, providing a financial safety net for the policyholder. When a policyholder surrenders the policy, they receive the cash surrender value, which can be used for various purposes, such as paying off debts, funding education, or investing in other financial goals. This flexibility is especially beneficial for those who may encounter financial challenges or wish to make significant purchases during their lifetime.

In the event of the insured individual's death, the whole life insurance policy will pay out the death benefit, which is typically the same as the policy's cash surrender value. This ensures that the beneficiaries receive a guaranteed amount, providing financial security for their future needs. The cash surrender value also allows policyholders to build equity in the policy, which can be borrowed against to access funds without surrendering the entire policy. This feature is particularly useful for those who want to leverage the cash value for personal or business expenses while still maintaining the insurance coverage.

Whole life insurance is an excellent choice for individuals seeking long-term financial security and the potential for tax-advantaged savings. The cash surrender value provides a level of flexibility and control over the policy, allowing policyholders to make informed decisions about their insurance needs and financial goals. It is a comprehensive insurance product that offers both protection and the potential for wealth accumulation, making it a popular choice for those seeking a permanent insurance solution.

In summary, whole life insurance provides permanent coverage and a significant cash surrender value, offering policyholders a sense of financial security and flexibility. The accumulation of cash value and the ability to surrender the policy early make it an attractive option for those who want to manage their insurance and financial needs effectively. Understanding the cash surrender value is essential for making informed decisions about life insurance, ensuring that individuals can choose the best coverage to meet their long-term objectives.

Life Insurance Allocation: Understanding Your Policy's Distribution

You may want to see also

Universal Life Insurance: Flexible coverage with potential cash surrender value

Universal life insurance offers a flexible and customizable approach to life coverage, providing policyholders with a unique set of features that set it apart from other types of life insurance. One of its key advantages is the potential for a cash surrender value, which can be a valuable financial tool for policyholders.

When it comes to universal life insurance, the cash surrender value is a critical aspect that distinguishes it from other life insurance products. This value represents the amount of money a policyholder can receive if they decide to surrender or cancel the policy before the maturity date. It is essentially the policy's cash value, which grows over time through regular premium payments and investment performance. The cash surrender value provides policyholders with financial flexibility, allowing them to access a portion of their investment if needed.

The flexibility of universal life insurance is one of its main attractions. Policyholders can adjust their coverage and premium payments according to their changing needs and financial circumstances. This adaptability is particularly useful for individuals who want to ensure their insurance coverage aligns with their evolving life goals and financial situations. For example, a policyholder might increase their coverage during their earning years and then reduce it as they approach retirement, ensuring a more efficient use of their financial resources.

Over time, the cash surrender value in a universal life policy can grow significantly. It is calculated based on the policy's investment performance and the policyholder's premium payments. As the policy's cash value accumulates, it can reach a point where it exceeds the policy's death benefit, providing the policyholder with a substantial cash surrender value. This value can be used for various purposes, such as funding education expenses, starting a business, or simply providing financial security during retirement.

In summary, universal life insurance offers a flexible and comprehensive solution for individuals seeking life coverage with the potential for a cash surrender value. The ability to customize coverage, combined with the potential for significant cash value accumulation, makes universal life insurance an attractive option for those who want financial flexibility and control over their insurance portfolio. Understanding the cash surrender value in this context is essential for policyholders to make informed decisions about their insurance and financial strategies.

Life Insurance Payouts for Missing Persons: What You Need to Know

You may want to see also

Variable Universal Life Insurance: Offers investment options and a cash surrender value

Variable Universal Life Insurance (VUL) is a type of life insurance that offers a unique combination of insurance protection and investment opportunities. It is designed to provide long-term financial security while allowing policyholders to make investment decisions that align with their financial goals and risk tolerance. One of the key features of VUL is its ability to offer a cash surrender value, which provides policyholders with a financial safety net.

When it comes to investment options, VUL policies offer a wide range of choices. Policyholders can choose from various investment accounts, such as mutual funds, stocks, bonds, and even real estate investment trusts (REITs). These investment options provide the opportunity to grow the policy's cash value over time, which can be used to pay for future expenses or to build a substantial financial asset. The investment performance is directly linked to the underlying investments, and policyholders can adjust their investment strategy as needed to match their changing financial objectives.

The cash surrender value of a VUL policy is a critical aspect that sets it apart from other life insurance products. It refers to the amount of money a policyholder can receive if they decide to surrender or cancel the policy before the death benefit is paid out. This value is typically based on the policy's cash value, which grows through the investment options selected by the policyholder. If a policyholder surrenders the policy, they can receive the cash surrender value, which can be used to cover financial obligations, provide a lump sum for retirement, or even be reinvested in other investment opportunities. This feature provides flexibility and financial security, especially during challenging economic times or when unexpected financial needs arise.

VUL policies also offer the advantage of being customizable. Policyholders can adjust the death benefit, premium payments, and investment allocations to suit their individual circumstances. This flexibility allows for a more tailored approach to life insurance, ensuring that the policy meets specific financial needs and goals. Additionally, VUL policies often provide a guaranteed minimum death benefit, ensuring that the policyholder or their beneficiaries receive a specified amount upon the insured's passing.

In summary, Variable Universal Life Insurance offers a compelling solution for individuals seeking both insurance protection and investment growth. With its investment options, policyholders can actively manage their financial future, and the cash surrender value provides a valuable financial tool. VUL's flexibility and customization options make it an attractive choice for those who want to take control of their financial security and make informed decisions about their life insurance needs.

Dementia and Life Insurance: Who Gets the Benefits?

You may want to see also

Guaranteed Universal Life Insurance: Permanent coverage with a guaranteed cash surrender value

Guaranteed Universal Life Insurance (GUL) is a type of permanent life insurance that offers a unique combination of features, including a guaranteed cash surrender value. This aspect of GUL provides policyholders with a level of financial security and flexibility that is particularly valuable when considering long-term financial planning.

In the context of life insurance, a cash surrender value refers to the amount of money a policyholder can receive if they decide to terminate or surrender their policy before the death benefit is paid out. This feature is especially useful for individuals who may need to access the cash value of their policy for various financial needs or goals. With GUL, the cash surrender value is guaranteed, meaning it is a fixed amount that the insurance company promises to pay out if the policy is surrendered. This guarantee provides policyholders with a sense of security, knowing that they will receive a specific value for their policy, even if the insurance company's financial situation changes.

The guaranteed cash surrender value of GUL is typically calculated based on the policy's cash value, which grows over time through regular premium payments and investment earnings. As the policyholder pays premiums, the cash value accumulates, and this value is guaranteed by the insurance company. When the policy is surrendered, the insurance company will return the policy's cash surrender value, ensuring that the policyholder receives a predetermined amount. This feature is particularly attractive to those seeking long-term financial planning, as it provides a safety net and the potential for tax-free cash withdrawals.

One of the key advantages of GUL is that it offers permanent coverage, meaning it provides life insurance protection for the entire life of the insured individual. This is in contrast to term life insurance, which provides coverage for a specified period. With GUL, the death benefit is guaranteed to be paid out upon the insured's passing, ensuring that the policyholder's beneficiaries receive the intended financial support. Additionally, the guaranteed cash surrender value allows policyholders to access their accumulated cash value without having to terminate the policy, providing flexibility and control over their financial resources.

In summary, Guaranteed Universal Life Insurance offers permanent coverage with a guaranteed cash surrender value, providing policyholders with a reliable and secure financial option. This type of life insurance is ideal for those seeking long-term financial planning, as it combines the benefits of permanent coverage with the financial flexibility offered by a guaranteed cash surrender value. Understanding the features of GUL can help individuals make informed decisions about their life insurance needs and ensure they have a comprehensive financial strategy in place.

Understanding the Benefits of Increasing Coverage in Life Insurance

You may want to see also

Frequently asked questions

The cash surrender value is the amount of money an insurance policyholder can receive if they decide to terminate or surrender the policy before the death of the insured. It is essentially the cash value built up in the policy over time, which can be a valuable financial asset for policyholders.

The calculation of the cash surrender value depends on the type of life insurance policy and the insurance company's specific terms. Generally, it is determined by considering factors such as the policy's term, the insured's age, the amount of premiums paid, and the investment performance of the policy's cash value account.

Term life insurance and permanent life insurance (such as whole life and universal life) often include cash surrender values. Term life policies provide coverage for a specific period, and while they don't have a cash value accumulation, they may offer a return of premium at the end of the term if the policy is surrendered. Permanent life insurance, on the other hand, builds cash value over time and allows policyholders to borrow against or surrender the policy for its cash value.

Yes, there are several benefits. Firstly, it provides financial flexibility, allowing policyholders to access the cash value for various purposes, such as funding education, starting a business, or investing in other opportunities. Secondly, the cash surrender value can be a valuable asset in estate planning, providing a means to transfer wealth or pay for final expenses. Additionally, some policies with cash surrender values offer guaranteed death benefits, ensuring a fixed payout to beneficiaries regardless of market fluctuations.