Choosing a higher deductible for your auto insurance can be a great way to lower your insurance premium, but it's important to understand the trade-offs. A deductible is the amount you pay out of pocket when you make a claim, and a higher deductible typically means a lower insurance rate. While this can save you money on premiums, it also means you'll pay more out of pocket if you need to file a claim. It's essential to consider your budget, risk tolerance, driving history, and the value of your vehicle when deciding between a higher or lower deductible.

| Characteristics | Values |

|---|---|

| Insurance premiums | Lower |

| Out-of-pocket costs | Higher |

| Risk of financial consequences | Higher |

| Claims | Less likely to be filed |

| Emergency fund | Requires a solid one |

| Risk tolerance | Higher |

What You'll Learn

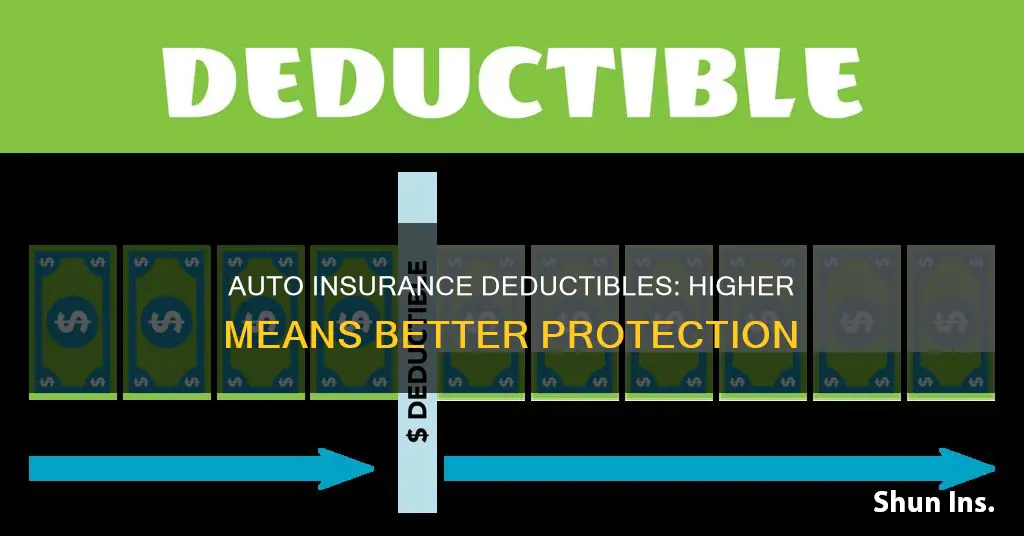

Higher deductibles = lower insurance rates

Choosing a higher deductible over a lower one is a good way to lower your insurance rates. This is because a higher deductible means a lower insurance premium.

A deductible is the amount of money you pay out of pocket before your insurance coverage pays out. For example, if you have a deductible of $1,000 and your car repair costs $4,000, you will have to pay $1,000 out of pocket, and your insurance company will cover the remaining $3,000.

The relationship between the deductible and premium is such that a lower deductible means higher monthly payments. If you opt for a lower deductible, you will have more coverage from your insurance company, but you will have to pay more out of pocket in the event of a claim. Conversely, a higher deductible means a reduced cost in your insurance premium.

For example, if your policy includes $5,000 in coverage, a low deductible of $500 means your insurance company is covering you for $4,500. A higher deductible of $1,000 means your company is covering you for only $4,000. Since a lower deductible equates to more coverage, you will have to pay more in monthly premiums to balance out this increased coverage.

It is important to note that choosing a higher deductible is a gamble. While it will lower your insurance rates, it also means that you will have to pay more out of pocket if you need to file a claim. Therefore, it is essential to consider your financial situation and comfort level with risk when deciding whether to opt for a higher or lower deductible.

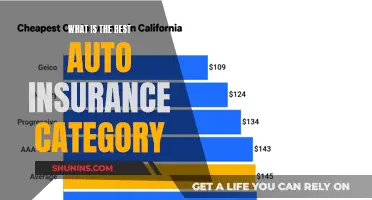

Best Auto Gap Insurance Providers in California

You may want to see also

Lower deductibles = higher insurance rates

When it comes to auto insurance, the deductible is the amount you pay out of pocket on a claim before your insurance covers the rest. Typically, you have a choice between a low and a high deductible.

A lower deductible means a higher insurance rate, while a higher deductible means a lower insurance rate. This is because, with a lower deductible, your insurance company covers more of the cost, and you pay less out of pocket in the event of a claim. This increased coverage means you'll need to pay more in monthly premiums to balance out the additional coverage.

For example, if your policy includes $5,000 in coverage, a low deductible of $500 means your insurance company is covering you for $4,500. On the other hand, a higher deductible of $1,000 means they are only covering $4,000. As a result, you'll pay higher premiums to make up for the extra coverage provided by the insurance company.

It's important to note that choosing a lower deductible may provide advantages such as affordable short-term costs, quicker claim processing, and more predictable insurance expenses. However, the trade-off is higher premiums, which may outweigh the benefits over time, especially if claims are infrequent.

When deciding between a lower or higher deductible, it's crucial to consider factors like your budget, financial situation, driving record, and the area in which you live. While a lower deductible offers more coverage and security, it also comes with higher premiums. Therefore, it's essential to carefully evaluate your needs and circumstances before making a decision.

Vehicle Insurance Declaration: What's Covered?

You may want to see also

Higher deductibles = higher out-of-pocket costs when filing a claim

Choosing a higher deductible for your auto insurance means you'll pay less in premiums but will result in higher out-of-pocket costs when filing a claim. This is because, with a higher deductible, you're assuming more of the financial burden in the event of a claim.

Let's say you have a $3,000 repair and a $1,000 deductible. You would be responsible for paying the first $1,000, with the insurance company covering the remaining $2,000. If the repair costs less than your deductible, you'll have to pay the entire bill.

It's important to consider your ability to cover these out-of-pocket costs when choosing your deductible. While a higher deductible can lower your premiums, it may not be the best choice if you don't have the financial resources to cover a high deductible in the event of a claim.

Additionally, if you have a history of car accidents or engage in high-risk driving behaviours, you may be more likely to file a claim. In this case, a lower deductible might be a better option, as it will result in lower out-of-pocket costs when filing a claim.

When deciding between a higher or lower deductible, consider your financial situation, your driving history, and your tolerance for risk. A higher deductible may be suitable if you have the savings to cover a large repair bill and are comfortable with taking on more risk. However, if you're concerned about affording a large, unexpected bill, a lower deductible might be a better choice.

Georgia Drivers: Avoid Underinsurance

You may want to see also

Lower deductibles = lower out-of-pocket costs when filing a claim

When it comes to auto insurance, a deductible is the amount you pay out of pocket before your insurance carrier starts covering costs. For instance, if you have a $3,000 repair and a $1,000 deductible, you pay the deductible first, and then the insurance company covers the remaining $2,000.

The deductible is paid each time you file a claim. Most drivers choose a $500 deductible, but policies with higher deductibles cost less. Lower deductibles mean higher monthly payments, as you have more coverage from your insurance company and pay less out of pocket in the event of a claim.

Let's say you have a deductible of $1,000 and get into an accident that causes $4,000 worth of damage to your car. You will need to pay the $1,000 deductible, and then your insurance will cover the remaining $3,000 (up to your coverage limit).

Lower deductibles are ideal for those who:

- Have a history of car accidents or engage in high-risk driving behaviours

- Don't have savings to cover a large unexpected bill

- Are risk-averse

- Have a lower-value car

- Are leasing or financing their car

Insurance: Who or What Is Covered?

You may want to see also

Higher deductibles may be better if you have an emergency fund to cover repairs

Choosing a higher deductible over a lower one for your auto insurance can be a gamble. While it can be a good idea if you have an emergency fund to cover repairs, it's important to weigh the pros and cons before making a decision.

A deductible is the amount you pay out of pocket when you make a claim. Typically, a higher deductible means a lower insurance premium, which can make a difference in whether you can afford essential insurance or not. If you have an emergency fund, a higher deductible could be a good option as it may allow you to save money on premiums. This is a good strategy if you're comfortable with taking on more risk and are confident that you won't need to file a claim.

However, it's important to note that with a higher deductible, you'll pay more out of pocket when you do file a claim. If you don't have an emergency fund or savings to cover this cost, it could put you in a difficult financial situation. Repairs to your vehicle might also be delayed if you can't afford the deductible right away.

When deciding whether to opt for a higher deductible, it's crucial to assess your financial situation and your tolerance for risk. Calculate the cost difference between a high and low deductible, and consider how often you may need to file a claim. If you have a history of accidents or engage in high-risk driving behaviours, a lower deductible might be a safer choice.

Additionally, consider the value of your vehicle. If you have an expensive car, a higher deductible might make sense as it could result in higher savings on your premiums. On the other hand, if your car is less valuable, a lower deductible may be preferable as the cost of repairs might not justify a high deductible.

In conclusion, while a higher deductible can be beneficial if you have an emergency fund and are comfortable with the associated risks, it's important to carefully evaluate your personal circumstances before making a decision.

Atlanta: No Car Insurance, Now What?

You may want to see also

Frequently asked questions

A higher deductible generally means lower insurance premiums. Depending on your budget, this could make the difference between purchasing essential insurance or going without.

A deductible is the amount of money you'll have to pay out of pocket before your insurance coverage pays out. Auto insurance deductibles are usually a dollar amount (such as $500).

Choosing the right insurance deductible comes down to estimating how often you expect to file a claim and your ability to cover out-of-pocket costs.

A lower deductible means higher monthly payments. A higher deductible means a reduced cost in your insurance premium.

Some factors to consider are:

- Whether you can afford a higher deductible in the case of an incident.

- The payback—how much you would save on a lower premium if you had a higher deductible.

- How often you have accidents. If you have a lot of accidents, you'll want a lower deductible.