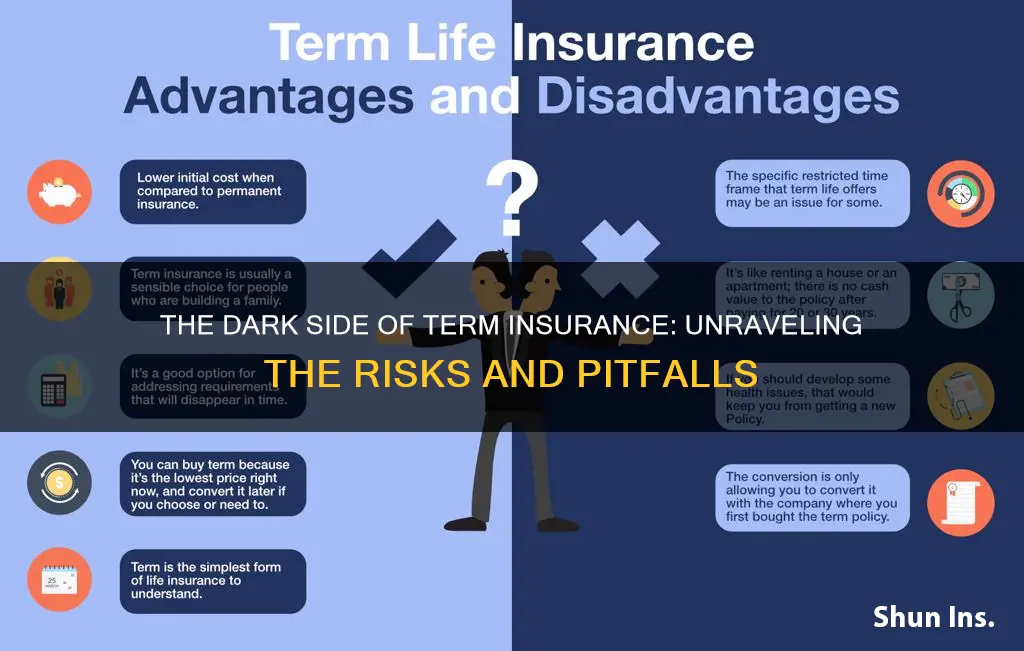

Term life insurance is a form of life insurance that provides coverage for a set number of years, such as 10, 20, or 30 years. While it can be an affordable option for those who want to ensure their loved ones are financially secure in the event of their death, there are several reasons why it may be considered a bad choice. Firstly, term life insurance does not offer any cash value or investment component, which means that if the policyholder outlives the term, they do not receive any payout. Additionally, the premiums for term life insurance can increase significantly upon renewal, especially if the policyholder is older and their health has deteriorated. Furthermore, term life insurance may not be suitable for those who wish to save money for specific needs, such as education or retirement, as it does not provide a hedge against inflation. Another disadvantage is the limited availability of term life insurance at older ages, with most companies not offering it beyond 65 or 70. In conclusion, while term life insurance can be a simple and flexible option, it may not be the best choice for individuals seeking long-term financial security or investment opportunities.

| Characteristics | Values |

|---|---|

| More expensive | Whole life insurance |

| Simple | Term life insurance |

| Temporary | Term life insurance |

| No cash value | Term life insurance |

| No investment component | Term life insurance |

| Not flexible | Whole life insurance |

| Not suitable for older people | Term life insurance |

| Not suitable for saving for specific needs | Term life insurance |

What You'll Learn

No investment or savings component

Term insurance is a type of life insurance that provides coverage for a specified number of years. Unlike whole life insurance, it does not have a cash value component, meaning there is no investment or savings element to the policy. This feature of term insurance is often cited as a disadvantage when compared to whole life insurance. Here are 4-6 paragraphs discussing the "No investment or savings component" of term insurance and why it might be considered a negative aspect.

Term insurance, by definition, is designed to provide financial protection for a specified term or period. If the insured individual dies during the term and the policy is active, a death benefit will be paid to the policy's beneficiaries. However, if the insured individual outlives the policy term, there is typically no payout or return on investment. This is because term insurance does not have a cash value component, which means that the policy has no investment or savings element. In other words, the policyholder is not accumulating any cash value or savings over time.

The absence of an investment or savings component in term insurance can be seen as a drawback for several reasons. Firstly, it means that policyholders do not receive any financial benefit if they outlive the policy term. This can be disappointing for those who have been diligently paying premiums for many years, only to receive nothing at the end of the term. Secondly, term insurance does not provide a way to grow wealth over time. With whole life insurance, policyholders can accumulate a cash value that grows tax-free and can be borrowed against or withdrawn. This feature can be especially attractive to those who want to use their life insurance policy as a form of investment or savings.

Another consequence of the lack of an investment or savings component in term insurance is the potential need for additional financial planning. Without the ability to accumulate cash value within the policy, individuals may need to explore other investment or savings options to meet their financial goals. This can include investing in stocks, mutual funds, retirement accounts, or other types of insurance policies with a cash value component. For some, this may be a more complicated and time-consuming approach to financial planning.

Furthermore, the absence of an investment or savings component in term insurance can limit its usefulness in certain situations. For example, term insurance may not be suitable for individuals who wish to save for specific needs such as education, retirement, or old-age provisions. In these cases, a policy with a cash value component, such as whole life insurance, may be more appropriate as it provides both insurance coverage and a way to accumulate savings.

Finally, it is important to note that the lack of an investment or savings component in term insurance can impact the overall cost of the policy. Term insurance is generally more affordable than whole life insurance because the insurance company assumes less risk. However, this also means that policyholders are not building any cash value or savings over time. As a result, they may need to allocate a larger portion of their budget to other investment or savings vehicles to meet their financial goals.

In conclusion, while the absence of an investment or savings component in term insurance can be seen as a disadvantage, it is important to consider the purpose of this type of policy. Term insurance is designed to provide pure protection at a low cost. By separating insurance from investment, individuals can tailor their financial plans to their specific needs and goals.

The Mystery of CH Insurance: Unraveling the Industry's Acronyms

You may want to see also

Expensive premiums

Term life insurance is often considered a more affordable option than whole life insurance, but that doesn't mean it's cheap. The premiums for term life insurance can be expensive, especially when compared to other types of insurance.

Term life insurance premiums are based on several factors, including age, gender, health, family medical history, smoking status, and occupation. The older you are and the unhealthier you are, the higher your premiums will be. For example, a 30-year-old non-smoking male in good health can expect to pay around $29 per month for a $500,000 20-year term life insurance policy. The same policy for a 50-year-old male would cost around $78 per month.

The length of the term also affects the cost, with longer terms being more expensive. A 30-year term will cost more than a 20-year term. Additionally, term life insurance premiums increase with age, so if you wait too long to purchase a policy, you may end up paying much more.

While term life insurance may be cheaper than whole life insurance, it is still a significant expense, especially for those on a tight budget. The high cost of term life insurance can be a burden, especially for those who may not have any dependents or financial liabilities. In such cases, the benefits of term life insurance may not outweigh the cost.

Furthermore, term life insurance premiums do not accumulate any cash value. Unlike whole life insurance, which has an investment component, term life insurance premiums are purely for the insurance coverage. This means that if you outlive your policy, you do not get any money back. This can be a significant disadvantage, especially for those who are paying high premiums.

Overall, while term life insurance may be a more affordable option than whole life insurance, the premiums can still be expensive, and it is important to consider your financial situation and needs before purchasing a policy.

The Proposal Form: Unraveling the Intricacies of Term Insurance Applications

You may want to see also

Poor returns on investment

Term life insurance is often marketed as an investment opportunity, but the reality is that it offers poor returns. Term life insurance is a type of life insurance that covers the policyholder for a set period, such as 10, 20, or 30 years. If the policyholder dies within the specified term, their beneficiaries will receive a payout. However, if the policyholder outlives the term, they will not receive any money.

While term life insurance can provide peace of mind and financial protection for loved ones in the event of the policyholder's death, it is not a good investment strategy. The premiums paid for term life insurance are typically higher than the eventual payout, resulting in a negative return on investment. Additionally, term life insurance does not offer any cash value or investment growth opportunities. The money paid in premiums is simply the cost of purchasing the insurance coverage, and there is no potential for profit or capital appreciation.

In contrast, other types of life insurance, such as whole life insurance or universal life insurance, may offer investment components or cash value accumulation. However, these types of life insurance are generally more expensive and may not be suitable for everyone. It is important for individuals to carefully consider their financial goals and needs before deciding whether to purchase term life insurance or explore other investment opportunities.

Term vs. ROP Insurance: Understanding the Key Differences for Long-Term Financial Planning

You may want to see also

Not suitable for older people

Term life insurance is not suitable for older people due to a number of factors. Firstly, the premium for term insurance steeply increases with advancing age, making it unaffordable for many seniors. Secondly, beyond the age of 65 or 70, it becomes difficult to purchase term insurance as most companies do not offer it beyond these ages. Even if term insurance is offered beyond this age, several conditions disadvantageous to the insured are often attached.

Term insurance may not be a suitable option for older individuals who wish to save money for specific needs such as education, retirement, or old-age provisions. It also does not provide a hedge against inflation as it does not offer profit plans. Additionally, term insurance cannot be used to create wealth, and if an individual becomes uninsurable due to health or other reasons, new term insurance or renewal of an existing policy may not be available.

While term insurance can ensure future insurability and is a good option for those with tight budgets or low incomes, it may not be the best choice for older individuals due to the limited benefits and increasing costs associated with advancing age.

The Intricacies of Insurance: Unraveling the Concept of Contribution

You may want to see also

Limited tax benefits

Term insurance has limited tax benefits, especially when compared to whole life insurance. However, there are still some tax advantages to be gained from term insurance.

Tax Benefits Under Section 80C

Under Section 80C of the Income Tax Act, 1961, deductions of up to Rs 1.5 lakh per year can be claimed on the premiums paid towards a term insurance policy. This is one of the most popular tools for saving tax and the maximum deduction offered under this section is Rs. 1.5 Lakh on investments and instruments, including PPF, ULIP, and EPF ELSS. The conditions to get a term insurance benefit under 80C are:

- The annual premium should not exceed 10% of the sum assured. If it does, deductions will be applied proportionately.

- For policies issued before 31st March 2012, the deduction applies if the premium is not above 20% of the sum assured.

- The tax benefits do not apply to policies that were voluntarily terminated or surrendered before two years from the issuance date.

Tax Benefits Under Section 80D

Section 80D was designed for health insurance policies and provides deductions on the premiums paid for these policies. However, as many term insurance policies offer critical illness riders or other health riders, tax benefits can also be claimed on these. The maximum deduction amount covered under Section 80D is Rs. 25,000, and additional benefits of Rs. 25,000 can be claimed for senior citizens.

Tax Benefits Under Section 10(10D)

Under Section 10(10D) of the Income Tax Act, the death benefit given to the nominee is also tax-exempt. This means that, in the event of the policyholder's death, their family will receive the sum assured without losing out on taxes.

Tax Benefits on Riders

Riders are add-ons to a term insurance policy that provide extra coverage for certain illnesses, disability, accidental death, or waiver of premium. The premium paid for these riders is deductible up to Rs 25,000 (Rs 50,000 for senior citizens) under Section 80D of the Income Tax Act, 1961.

The Donut Hole Conundrum: Unraveling the Mystery of Insurance Terminology

You may want to see also

Frequently asked questions

Term insurance is not bad per se, but it does have some limitations. For example, the premium for term insurance steeply increases with advancing age, and insurance needs at higher ages cannot be met with term insurance. Moreover, term insurance is not suitable for those who wish to save money for specific needs, such as education or retirement.

Term insurance has several disadvantages. Firstly, it becomes difficult to buy term insurance at older ages, as most companies do not offer it beyond 65 or 70. Secondly, term insurance does not provide a hedge against inflation as it is a without-profit plan. Finally, term insurance does not allow for wealth creation, as it does not have a cash value component.

Term life insurance is cheaper and offers coverage for a specific period, usually 10 to 30 years. On the other hand, whole life insurance has higher premiums because it combines insurance and investing. It offers lifetime coverage and includes a cash value component that grows tax-free and can be borrowed against or withdrawn.