Turning 26 is a significant milestone when it comes to health insurance. In most states, individuals are no longer eligible to remain on their parent's health insurance plans and must purchase their own health coverage. This change is due to the Affordable Care Act (ACA), which mandates that health insurance companies cover dependents until they turn 26. As a result, young adults must navigate the process of obtaining their own health insurance, which can be overwhelming for those new to the process. Understanding the different options, such as employer-sponsored plans, marketplace plans, and short-term policies, is crucial to ensuring continuous health coverage.

| Characteristics | Values |

|---|---|

| Age limit for parent's insurance plan | 26 |

| Special Enrollment Period window | 120 days, including 60 days before and after your birthday |

| States allowing extended coverage | Florida, Illinois, Nebraska, New Jersey, New York, Pennsylvania, South Dakota, Wisconsin |

| Age limit in extended coverage states | 27-31 |

| Eligibility requirements for extended coverage | Not married, no dependents, resident of the state or full-time student, no other health insurance |

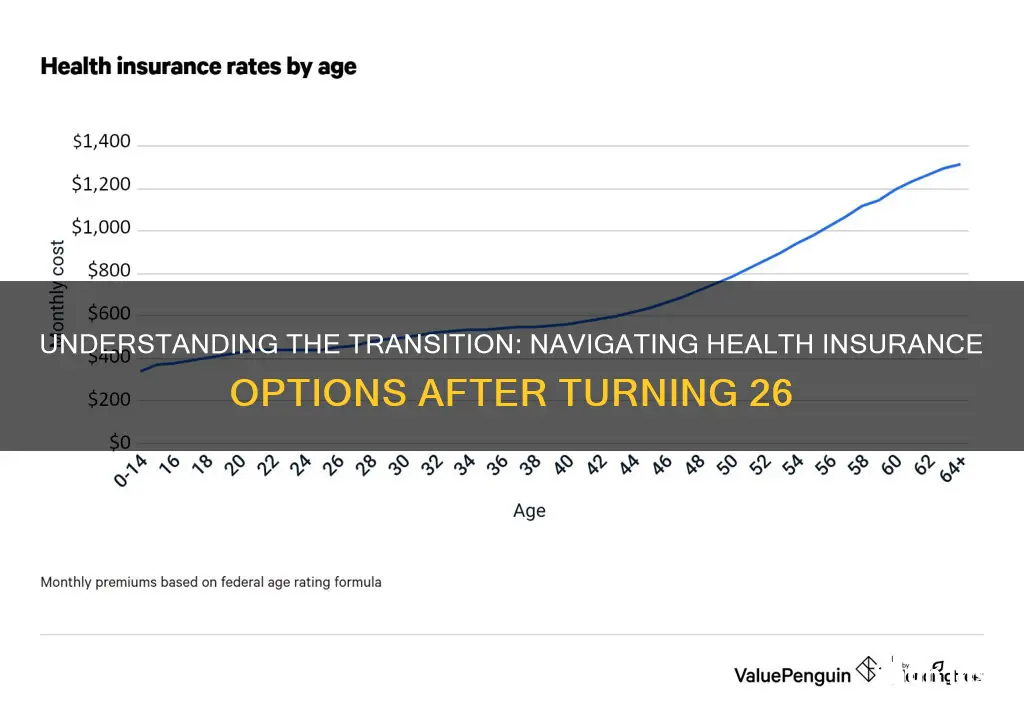

| Average monthly cost of Silver health insurance plan | $468 |

What You'll Learn

When does health insurance coverage through parents end?

In most cases, you will no longer be covered by your parent's health insurance once you turn 26. However, this does depend on the type of insurance plan and the state you live in.

The exact date that your coverage ends depends on the type of insurance plan your parents have. If your parents have an employer-based insurance plan, you will likely be covered until the end of the month in which you turn 26. If your parents have a Marketplace plan, you will likely be covered until the end of the calendar year in which you turn 26.

If you don't get your own insurance before your parent's coverage ends, you may have a gap in your insurance coverage. This means that you will have to pay full price for any healthcare services you require, including medical emergencies. In some states, you may also be fined for being uninsured.

There are several options for getting your own insurance once you turn 26. You can:

- Get insurance through your employer, if they offer this

- Purchase your own Marketplace plan

- Apply for Medicaid, if you meet the income requirements

- Apply for COBRA coverage, which allows you to retain your parent's coverage for up to 36 months after turning 26 (although this can be very expensive)

Understanding Insurance Billing Cycles: When to Expect Your Next Premium Payment

You may want to see also

What are the options for health insurance after turning 26?

Turning 26 is a significant milestone when it comes to health insurance, as you will no longer be eligible to remain on your parents' health plan. However, this milestone birthday triggers a special enrollment period, allowing you to choose coverage right away and avoid a coverage gap. This period includes a 60-day window before and after your 26th birthday. It is important to act promptly to ensure continuous coverage.

Special Enrollment Period

If you are approaching your 26th birthday, you can take advantage of the special enrollment period to enrol in a new health insurance plan. This period typically includes the two months before your birthday, your birthday month, and the two months after you turn 26. During this time, you can enrol in a plan of your choice, whether through your employer or the Health Insurance Marketplace.

Job-Based Plans

If your employer offers health insurance, you can qualify to enrol outside of the yearly Open Enrollment period due to your upcoming birthday. Contact your job's human resources representative to understand their specific procedures and next steps. It is recommended to do this at least 30 days before losing your current coverage to ensure a smooth transition.

Marketplace Plans

If you do not have access to health insurance through your job, you can enrol in a Marketplace plan. The Marketplace offers a range of plans with different levels of coverage and price points. You can visit Healthcare.gov or your state's health insurance website to apply for coverage and learn about any available subsidies. You will need personal information, such as your Social Security number and household income, to complete the application process.

Other Options

In addition to job-based and Marketplace plans, there are a few other options to consider. These include private insurance and "affinity plans," which are offered to specific groups, such as professional associations or alumni groups. However, be cautious of short-term health insurance plans, as they may not provide comprehensive coverage.

Understanding Plan Details

When choosing a health insurance plan, it is important to understand the different components, such as the premium, deductible, coinsurance, and co-payments. The premium is the amount you pay each month, while the deductible is how much you must pay out of pocket before your insurance coverage kicks in. Coinsurance refers to the share you will still be responsible for even after meeting your deductible, and co-payments are fixed amounts you pay for healthcare services after meeting your deductible.

Dental and Vision Coverage

In addition to medical insurance, consider whether you need dental and vision coverage. Evaluate the costs of these additional coverages by comparing them to the prices of routine dental and vision care.

Unraveling the Complexities of Insurance Billing for DOs and MDs

You may want to see also

What is the Special Enrollment Period?

The Special Enrollment Period (SEP) is a time outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for a Special Enrollment Period if you've had certain life events, such as losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

The Special Enrollment Period for choosing a health insurance plan is a 4-month window, which includes 60 days before your 26th birthday, your 26th birthday, and 60 days after. If you enroll in a health care plan before you lose coverage, your new plan can start as soon as the first day of the month after you lose coverage. If you enroll after losing coverage, your new plan can start the first day of the month after you pick a plan.

In the case of involuntary loss of coverage, the special enrollment period begins in advance of the loss of coverage so that enrollees can purchase a new plan with no gap in coverage. The rest of the qualifying events trigger a special enrollment period that begins on the date of the qualifying event and continues for 60 days. In most cases, the earliest that coverage can take effect is the first of the month after the enrollment is completed. But if the qualifying event is the birth or adoption of a child, coverage can be backdated to the birth/adoption date.

If you do not qualify for a special enrollment period, you can only enroll in an ACA-compliant plan during the regular annual open enrollment period.

Understanding Safelite's Billing Practices: Navigating the Insurance Landscape

You may want to see also

What are the pros and cons of employer-based health insurance?

In the United States, you can stay on your parent's health insurance plan until you turn 26. Once you turn 26, you will need to take action to ensure you have health coverage. If your employer offers health insurance, you can qualify to enroll outside of their yearly Open Enrollment period. Alternatively, you can enroll in your own Marketplace plan.

Pros and cons of employer-based health insurance

Pros

- Lower premiums and out-of-pocket expenses, as your employer may subsidize part of the cost.

- No need to do extensive research and decision-making when it comes to selecting a plan.

- You can't be denied coverage based on pre-existing conditions or medical history.

- Guaranteed renewability, meaning you won't lose your coverage as long as you remain employed.

- Tax advantages, as money paid toward monthly employee premiums is usually tax-deductible for employers, and employees pay monthly premiums with pre-tax dollars.

- It boosts morale and aids retention, as employees recognize and appreciate the cost-sharing of group premiums.

Cons

- Your employer chooses the plan, so you may not have as many options for coverage and benefits.

- Lack of portability, as you may lose your health insurance coverage if you leave your job, which could leave you without coverage if you have a gap between jobs.

- Lack of flexibility, as the plan might be a great fit for one employee but could offer limited resources for others.

- Lack of control for employees, as they don't get a say in the plan chosen, the deductible they'll need to meet, or the premium they'll have to pay.

What are the pros and cons of marketplace health insurance?

Marketplace health insurance is an option if you can't get an employer-sponsored health plan. ACA health plans, or Obamacare, offer comprehensive coverage and are the only type of health insurance with premium tax credits that reduce the cost of health insurance if you qualify.

Advantages of Marketplace Insurance

- Widely applicable options: Plan options can be customized to your location, medical needs, medications, preferred physicians, and more.

- 10 essential benefits guaranteed: You’re guaranteed 10 essential benefits without worry or extra research. These include outpatient care, pregnancy, maternity, and newborn care, mental health and substance use disorder services, services and devices to help with disabilities, injuries, or chronic conditions, and more.

- Free preventive services: The 10 essential benefits include many free preventative services you may have to pay for out of pocket if you purchase a short-term insurance plan.

- Tax credits: You can find out immediately if you qualify for a cost-sharing reduction that lowers your premium.

- One-stop shop for eligibility: You will be able to discover whether you are eligible for Medicaid or your children are eligible for CHIP.

- You can shop for pricing and compare benefits from multiple plans from multiple insurers.

- You can determine if you qualify for state-sponsored insurance like Medicaid or the Children’s Health Insurance Program (CHIP).

Disadvantages of Marketplace Insurance

- Delayed start: Even if you qualify for a special enrollment period and pay your premium, your coverage will not start until the first of the following month after payment.

- Not wholly customizable: If you need particular coverage, such as a plan that covers your medical bills overseas, you may not be able to find it on the marketplace.

- Can be overwhelming: If you live in an area with many insurers, reviewing marketplace plans online can lead to information overload.

Additional Information

- The federal government runs the marketplace in most states, but 17 states and Washington, D.C. have their own marketplaces.

- The marketplace offers health plan benefits similar to those found in employer-sponsored health insurance plans, with comprehensive benefits like doctor visits, outpatient care, prescription drugs, emergency care, and mental health services.

- The marketplace indicates a health plan's costs by metal tier: bronze, silver, gold, and platinum. Bronze and silver plans have the lowest premiums but higher out-of-pocket costs compared to gold or platinum plans.

- If you have Medicare coverage, you’re not eligible to use the Marketplace to buy a health or dental plan.

Navigating the Claims Process: Submitting Bills to The Hartford Insurance

You may want to see also

Frequently asked questions

Yes, you will need to change your health insurance when you turn 26. This is because, in most states, you will no longer be able to stay on your parent's health insurance plan.

The exact date that your parent's health insurance coverage ends for you depends on the type of insurance plan. If you are covered under your parent's employer policy, your coverage will likely end during the month you turn 26. If you have coverage under your parent's ACA marketplace plan, your coverage will likely end on December 31 of the year you turn 26.

There are several options for health insurance after turning 26. You can get health insurance through your employer, through a state health care marketplace, or through COBRA, which allows you to stay on your parent's plan for up to 36 months after turning 26. If you are a low-income earner, you may qualify for Medicaid.

If you are enrolling in health insurance provided by your employer, you can speak to someone in the human resources department. If you are enrolling in a marketplace plan, you can apply for coverage on Healthcare.gov or your state's health insurance website.