Life insurance is a vital component of estate planning, and it's important to understand how it fits into the broader picture of your finances. When it comes to life insurance, there are two main types: term insurance and whole or universal life insurance. Term insurance is typically purchased annually and becomes more expensive as the insured person ages. On the other hand, whole or universal life insurance combines insurance protection with a savings plan, allowing the policyholder to borrow or withdraw from the accumulated cash value. This cash value component is a key feature of permanent life insurance policies and can be used for various purposes, including paying premiums or borrowing against the policy. However, it's important to note that accessing the cash value may result in a reduction in the death benefit.

When it comes to estate planning, life insurance can play a crucial role in providing needed funds for survivors. It can also be used to create or enhance an estate by passing on money to heirs. However, the ownership of the policy is an important consideration, as death benefits are generally included in the estate of the policy owner, regardless of who pays the premiums or is named as a beneficiary. This is where the concept of the gross estate comes into play. The gross estate refers to the total value of a person's assets, including life insurance proceeds, at the time of their death. According to Section 2042 of the Internal Revenue Code, the value of life insurance proceeds is included in the gross estate if it is payable to the estate or if the deceased had any ownership incidents in the policy at the time of death.

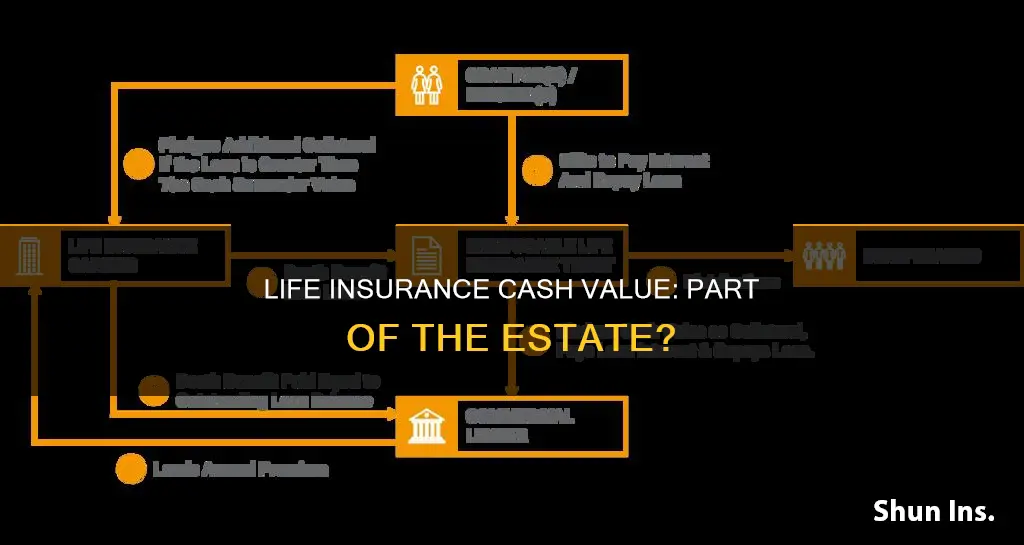

To avoid unintended tax consequences, careful planning is necessary. One common strategy is to establish an irrevocable life insurance trust (ILIT), where the trust owns the policy, and the death benefit is not included in the estate value. This can be particularly useful in large estates or when the business entity purchases life insurance for owner-operators. Overall, by understanding the intricacies of life insurance and its impact on the gross estate, individuals can make informed decisions to ensure their heirs receive the maximum benefit.

What You'll Learn

- The cash value of life insurance is included in the gross estate if the insured person possessed any incidents of ownership in the policy at the time of their death

- The cash value of life insurance can be accessed by withdrawing money, taking out a loan, or surrendering the policy

- The cash value of life insurance grows tax-deferred and is not taxed until withdrawal

- The cash value of life insurance can be used to pay policy premiums

- The cash value of life insurance can be used to create or enhance an estate by providing money to heirs

The cash value of life insurance is included in the gross estate if the insured person possessed any incidents of ownership in the policy at the time of their death

The inclusion of life insurance proceeds in the gross estate is a crucial consideration in estate planning. It can inadvertently increase the value of the estate, potentially leading to higher estate taxes. To avoid this, individuals can transfer ownership of their life insurance policies to another person or entity, such as an irrevocable life insurance trust (ILIT). By doing so, the proceeds are no longer included in their estate, reducing the potential tax burden on their heirs. However, it is important to note that the three-year rule applies to ownership transfers, meaning that if the insured person dies within three years of the transfer, the proceeds will still be included in their estate and taxed accordingly.

Additionally, the entire amount of the benefit paid out to beneficiaries or the estate is included in the gross estate value for estate tax purposes if the insured person is the owner of the policy. On the other hand, life insurance proceeds paid to beneficiaries are generally not considered taxable income for the recipients.

The treatment of life insurance proceeds in the gross estate highlights the importance of careful estate planning. By understanding the tax implications and seeking expert advice, individuals can make informed decisions about their life insurance policies and ensure their heirs receive the maximum benefit.

Autopsy Reports: Life Insurance's Vital Requirement

You may want to see also

The cash value of life insurance can be accessed by withdrawing money, taking out a loan, or surrendering the policy

The cash value of a life insurance policy refers to a savings component that is built into some permanent life insurance policies, such as whole life and universal life insurance. This cash value grows over time and can be accessed by the policyholder in several ways, including withdrawing money, taking out a loan, or surrendering the policy.

Withdrawing money from the cash value of a life insurance policy is an option offered by many permanent life insurance policies. Withdrawals are typically limited to the amount that has been paid into the policy, and any withdrawals above this amount may be taxed as ordinary income. It is important to note that withdrawals will reduce the death benefit, and there may be fees or penalties associated with making withdrawals.

Taking out a loan against the cash value of a life insurance policy is another option for accessing the cash value. The loan amount is typically limited to a certain percentage of the policy's value, and interest will accrue on the outstanding principal. The loan balance will reduce the death benefit if the policyholder dies before the loan is repaid.

Surrendering the life insurance policy is a third way to access the cash value. This involves cancelling the policy and receiving a cash payment for the surrender value, which is the cash value minus any applicable fees and outstanding loan balances. Surrendering the policy will result in the loss of life insurance coverage, and there may be taxes and fees that reduce the amount received.

In addition to these options, the cash value of a life insurance policy can also be used to pay policy premiums, and in some cases, it may be possible to sell the policy to a third party for more than the surrender value but less than the death benefit. It is important to carefully consider the potential consequences of accessing the cash value, as it can impact the amount available, the death benefit, and the account's growth.

Hepatitis B: A Life Insurance Deal-Breaker?

You may want to see also

The cash value of life insurance grows tax-deferred and is not taxed until withdrawal

The cash value of a life insurance policy is a feature typically offered within permanent life insurance policies, such as whole life and universal life insurance. This feature allows the policyholder to use the cash value as an investment-like savings account. The cash value of life insurance grows tax-deferred, and taxes are only paid upon withdrawal. This means that the cash value accumulates over time without being subject to taxation until the policyholder withdraws funds.

The tax-deferred status of the cash value in a life insurance policy provides a significant advantage to policyholders. The accumulated cash value grows based on a fixed amount, investment gains, or interest accrued. As the cash value increases, the insurance company's risk decreases because the accumulated cash value offsets the insurer's liability. This means that the insurance company's liability is reduced by the amount of cash value accumulated. For example, if a policy has a death benefit of $25,000 and an accumulated cash value of $5,000, the insurance company's real liability cost is only $20,000.

While the cash value of life insurance grows tax-deferred, it is important to consider the tax implications when accessing the funds. Withdrawing funds from the cash value of a life insurance policy may result in taxable income. If the withdrawal amount exceeds the total premiums paid into the policy, the portion attributed to interest or investment gains will generally be subject to taxation. However, if the policyholder borrows against the cash value, they can do so tax-free as long as the policy remains active.

It is worth noting that the death benefit paid out to beneficiaries is generally not considered taxable income. However, if the payment is made to a trust and then later distributed to beneficiaries, it may become a taxable event if there has been growth or income. Additionally, if the policy is transferred to a beneficiary for cash or other valuable consideration, the exclusion for the proceeds may be limited, and taxes may apply.

Pacific Life Insurance: Mail Payment Reminders?

You may want to see also

The cash value of life insurance can be used to pay policy premiums

The cash value of a life insurance policy can be used to pay policy premiums. This is a feature of permanent life insurance policies, such as whole life and universal life insurance, which accumulate cash value over time.

Permanent life insurance policies are more expensive than term life insurance policies because of the cash value element. A portion of each premium payment is allocated to the cost of insurance, while the remainder is deposited into a cash value account. This cash value account earns interest, and taxes on the accumulated earnings are deferred. As the cash value increases, the insurance company's risk decreases because the accumulated cash value offsets part of the insurer's liability.

If there is a sufficient amount in the cash value account, the policyholder can use it to cover the cost of premiums and may no longer need to pay premiums out of pocket. However, it's important to note that accessing the cash value of a life insurance policy may have certain implications, such as reducing the death benefit or incurring penalties for early withdrawal.

Before utilising the cash value to pay premiums, it is advisable to consult with an insurance agent or financial professional to understand the specific rules and potential consequences. Additionally, the availability of this option may vary depending on the insurance company and the specific policy terms.

By using the cash value to pay premiums, policyholders can gain some financial flexibility while ensuring their life insurance policy remains in force. This can be particularly helpful if unexpected expenses arise in other areas of their lives.

Who Can Be a Life Insurance Beneficiary as an Adult?

You may want to see also

The cash value of life insurance can be used to create or enhance an estate by providing money to heirs

The cash value of life insurance can be a useful tool for creating or enhancing an estate, providing money to heirs, and achieving financial goals. Here are some key points to consider:

Understanding Cash Value Life Insurance

Cash value life insurance is a type of permanent life insurance that offers a savings component in addition to the death benefit. This means that a portion of the premium payments goes into a cash value account that earns interest or investment gains over time. This cash value can be accessed by the policyholder in various ways, such as loans or withdrawals, providing financial flexibility while the insured is still alive.

Building and Enhancing an Estate

The cash value of life insurance can be used to create or enhance an estate by providing a source of funds for heirs. This is particularly useful for individuals who want to ensure their heirs receive an inheritance, even if they don't have significant assets during their lifetime. By purchasing a suitable life insurance policy, the death benefit can serve as a financial legacy for loved ones.

Providing Money to Heirs

The cash value of life insurance can be accessed by the policyholder during their lifetime, and it can also be left to beneficiaries upon the insured's death. This provides a source of money for heirs, which can be especially beneficial if the insured had debts or financial obligations that need to be settled. The death benefit can help heirs cover these expenses and provide financial support.

Tax Considerations

While the cash value of life insurance can be a valuable tool, it's important to consider the tax implications. Withdrawals or loans from the cash value may be subject to taxes, and if the policy is surrendered for cash, there may be surrender charges and taxes on any interest or investment gains. Additionally, if the death benefit is substantial, it could increase the value of the estate, potentially triggering estate taxes for heirs. To mitigate this, individuals can consider placing the life insurance policy in an irrevocable life insurance trust (ILIT), which removes the policy from the taxable estate.

Planning and Professional Advice

It's essential to carefully plan and coordinate the use of life insurance in estate planning. Seeking advice from qualified professionals, such as estate planners or insurance agents, is crucial. They can help navigate the complexities of ownership, beneficiary designations, and tax implications to ensure that the life insurance policy aligns with the individual's goals and provides the intended benefits to heirs.

Life Insurance: Understanding the Industry and Its Significance

You may want to see also

Frequently asked questions

Cash value is a component of some types of life insurance, typically offered within permanent life insurance policies such as whole life and universal life insurance. It is a savings-like account that grows with interest over time.

Yes, the cash value of life insurance is included in the gross estate if the insured person dies. The entire amount of the benefit paid out to the beneficiaries or estate is included for estate tax purposes if the deceased is the owner of the policy.

One way to avoid taxation on life insurance proceeds is by transferring the ownership of the policy to another person or entity. Another way is to create an irrevocable life insurance trust (ILIT), where the trust owns the policy, and the death benefit is not included in the estate value.