Life insurance is often seen as a reliable way to provide for loved ones after you're gone, and one of its biggest advantages is the tax relief it offers. In most cases, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts or covering funeral costs. However, there are a few situations where taxes could come into play, and it's important to know when that might happen. For example, if your loved ones choose to receive the life insurance payout in instalments instead of a lump sum, any interest that builds up on those payments could be taxed.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | In most cases, life insurance proceeds are not considered taxable income. |

| Are there any exceptions? | Yes, there are a few exceptions. For example, if the proceeds have accumulated interest, taxes are usually due. |

| Are there different types of life insurance taxes? | Yes, there are estate tax, inheritance tax, income tax, and generation-skipping tax. |

| When do you have to pay taxes on life insurance? | If the cash value of the policy exceeds a certain amount, you may encounter the estate tax or the generation-skipping tax. |

| What if there are more than two parties involved? | If a third person is involved, the beneficiary on the life insurance policy may be taxed. |

| Can you withdraw money from a cash value life insurance policy? | Yes, but if you take out a loan against the cash value, you may be subjected to interest payments. |

| Can you sell a life insurance policy? | Yes, but if the profits are worth more than what you've paid so far, this payout can be taxed. |

| Can you surrender a life insurance policy? | Yes, but you will have to pay taxes on the life insurance cash value. |

| What if the life insurance policy goes into a taxable estate? | If the beneficiary isn't named in the policy, the benefits will go into a taxable estate. |

What You'll Learn

Interest on death benefits

Life insurance death benefits are generally not taxable, but there are some circumstances in which the beneficiary may have to pay taxes on the interest accrued.

In the United States, the Internal Revenue Service (IRS) states that while life insurance proceeds received by a beneficiary due to the death of the insured are not considered taxable income, any interest earned on the proceeds is taxable. This means that if the death benefit payout is made in installments, the interest accrued on the remaining portion of the benefit that has not yet been disbursed would be subject to tax.

The IRS further clarifies that interest on life insurance proceeds is computed from the date of death of the insured to the date of payment, and not from the date that the claim is fully filed with the life insurer. This means that interest begins to accrue from the date of death, regardless of whether the claim process has been initiated or completed.

The specific rules and rates for calculating interest on life insurance proceeds may vary by state. For example, in New York, the interest rate is determined by the rate in effect on the date of death, and it is subject to fluctuations and changes that occur until the date of payment.

It is important for beneficiaries to be aware of their tax obligations when receiving life insurance proceeds, especially if the payout is made in installments. Consulting with a tax professional can help beneficiaries understand their specific tax liabilities and ensure they comply with IRS requirements.

Life Insurance: When to Drop and How to Decide

You may want to see also

Estate tax

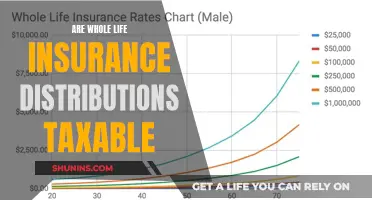

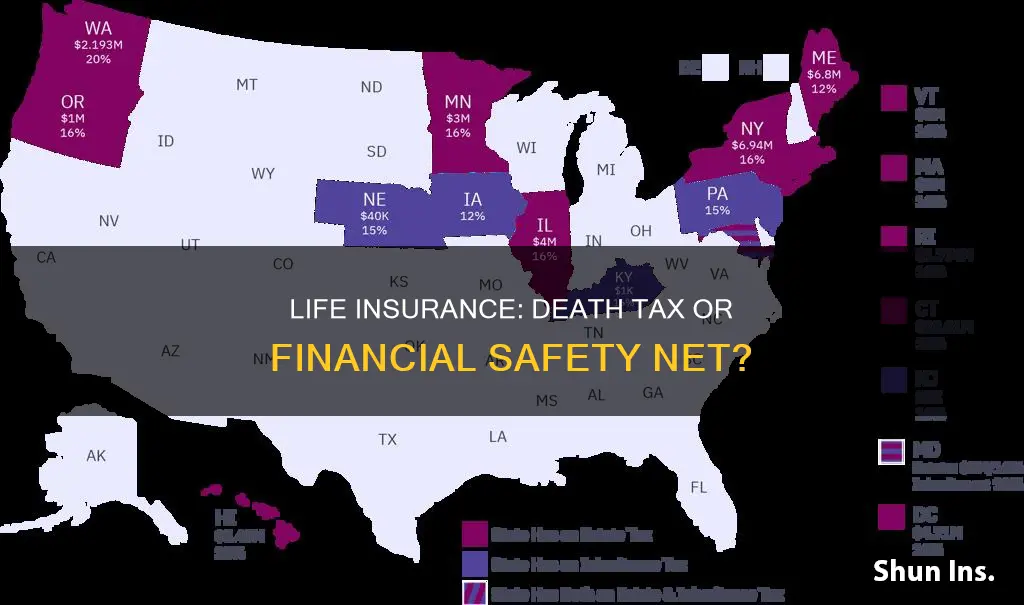

In addition to the federal tax, twelve states and the District of Columbia impose an estate tax, with the exemption limit ranging from $1 million in Oregon to $13.61 million in Connecticut.

If the beneficiary isn't named in your policy, your life insurance benefits will go into a taxable estate. The first $11.7 million is not taxed at a federal level – this is the threshold. Anything above this amount is subject to being taxed. State regulations have a lower chance of exemption and vary depending on location.

One of the main ways to remain protected is to name the beneficiary as an irrevocable life insurance trust. This keeps the cash value away from being lumped into the estate value. In this case, the value of the life insurance policy can be distributed among any beneficiaries listed in the trust. This option may shield beneficiaries from paying taxes on life insurance.

Understanding Level Benefit Term Life Insurance Policies

You may want to see also

Inheritance tax

If you live in one of the six states that enforce this measure, the inheritance tax may come into play if you are the beneficiary of a life insurance policy. The inheritance tax is separate from the estate tax, which is a tax on your right to transfer property upon your death.

It's important to note that the federal estate tax exemption was $13.61 million in 2024. Without congressional action, this limit will revert to $5 million (indexed for inflation) at the start of 2026.

In addition to the federal estate tax, twelve states and the District of Columbia impose an estate tax, with the exemption limit ranging from $1 million in Oregon to $13.61 million in Connecticut.

Life Insurance Payment: AARP's Missed Payment Policy and You

You may want to see also

Generation-skipping tax

The generation-skipping transfer tax (GSTT) is a federal tax on transfers of assets or property to individuals who are more than one generation below the transferor. This includes transfers from a grandparent to a grandchild or to individuals who are more than 37.5 years younger than the transferor.

The GSTT was introduced in 1976 to prevent wealthy families from avoiding estate taxes at the death of each generation. Prior to the GSTT, it was possible to pass an unlimited amount of assets to a trust for the benefit of multiple generations, thus permanently avoiding estate taxes as each generation passed away. The GSTT ensures that grandchildren receive the same value of assets that they would have if the inheritance was transferred directly from their parents, rather than their grandparents.

The GSTT is equal to the highest federal gift and estate tax rate at the time of transfer (40% in 2024) and is in addition to any other federal gift or estate tax that may be owed. The GSTT only applies to transfers over an exemption amount, which for 2024 is $13,610,000 per person or $27,220,000 for a married couple.

There are three types of taxable events that trigger the GSTT: direct skips, taxable distributions, and taxable terminations. Direct skips refer to transfers from one individual to a skip person, either outright or in trust. Taxable distributions occur when an irrevocable trust distributes income or principal to a skip person. Taxable terminations happen when an interest in property held in trust terminates, and there are no other non-skip beneficiaries.

The GSTT can be reduced or avoided through proper planning, such as by contributing to 529 plans or creating dynasty trusts. However, it's important to note that the GSTT exemption is temporary and is set to revert to a lower amount at the end of 2025 unless Congress takes action.

Hartford Life Insurance: Is It a Good Choice?

You may want to see also

Beneficiary is the insured's estate

If you don't name a beneficiary, the death benefit will be paid to your estate. This is known as the default order of payment. However, probate proceedings could delay the distribution of the money, and the cost of probate could reduce the amount available to your heirs.

The probate process can be lengthy and complicated, and it may take years before your loved ones can access your assets. This can be avoided by designating beneficiaries. It is also important to keep your beneficiary designations up to date as your life changes (marriage, children, divorce, etc.).

If the insured person does not name a beneficiary, the death benefit will be paid to the owner of the policy if they are different from the insured person and are still alive. Otherwise, it will be paid to the owner's estate. For group insurance policies, the order typically starts with the spouse, then the children, then the parents, and then the estate.

If the beneficiary is the insured's estate, the death benefit may be subject to estate taxes. In 2024, the federal estate tax ranges from 18% to 40%, depending on how much of the estate is over $13.61 million, the exclusion limit. Without congressional action, the limit will revert to $5 million (indexed for inflation) at the start of 2026. In addition to the federal tax, twelve states and the District of Columbia impose an estate tax, with the exemption limit ranging from $1 million in Oregon to $13.61 million in Connecticut.

Foresters Life Insurance: AM Best Rating and What It Means

You may want to see also

Frequently asked questions

In most cases, the money your beneficiaries receive from a life insurance payout is not taxed as income. However, there are some exceptions. For example, if the payout has accumulated interest, taxes are usually due.

Some common situations where beneficiaries might owe taxes on life insurance include:

- The payout has accumulated interest.

- The policyholder names the estate as a beneficiary.

- The insured and the policy owner are different individuals.

There are some strategies beneficiaries can use to avoid paying taxes on a life insurance payout, such as:

- Use an ownership transfer.

- Create an irrevocable life insurance trust (ILIT).

- Be aware of gift tax limits.

Typically, life insurance premiums are considered a personal expense and are not tax-deductible. However, there are a few exceptions. If you gift a life insurance policy to a charity and continue to pay the premiums, those payments are generally considered charitable donations and may be tax-deductible.