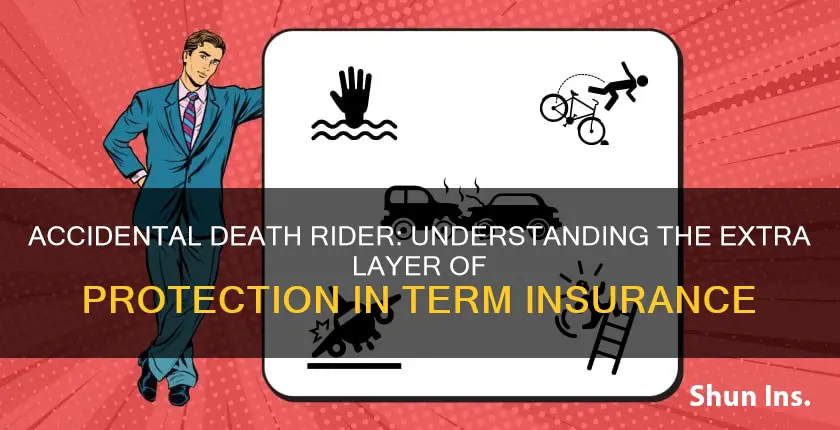

An accidental death benefit rider is an optional feature that can be added to a term life or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or death benefit, if you die in a covered accident. This means that your family will be protected financially if you pass away unexpectedly from an accident.

| Characteristics | Values |

|---|---|

| Definition | An accidental death benefit rider is an optional feature you can add to a term life or whole life insurance policy. |

| Purpose | To provide financial aid to the family of the deceased in case of an unforeseen death caused by an accident during the coverage period. |

| Payout | The rider offers a larger cash payment, or "death benefit," to the beneficiary, which can be twice the amount of the original policy. |

| Coverage | Covers accidental deaths, including car accidents, industrial accidents, plane crashes, slips, choking, drowning, machinery accidents, etc. |

| Exclusions | Self-inflicted injuries, drug overdose, alcohol abuse, participation in civil unrest, death after a specified period from the accident, dangerous hobbies, high-risk jobs. |

| Eligibility | People who travel frequently, work in hazardous environments, or are the main breadwinners are advised to opt for this rider. |

| Cost | Adding an accidental death benefit rider will likely increase premium payments. |

| Benefits | Extra layer of protection, multiple payout options, tax exemptions, no medical examination required, minimal documentation, easy claim settlement. |

What You'll Learn

- Accidental death riders offer an additional sum to the beneficiary, which can be twice the amount of the original policy

- The rider covers accidents such as industrial incidents, car crashes, and plane crashes

- It is a good option for those who travel frequently or work in hazardous environments

- The rider may not cover accidents during extreme sports or high-risk activities

- The rider can be purchased as a stand-alone policy for those who don't qualify for traditional life insurance

Accidental death riders offer an additional sum to the beneficiary, which can be twice the amount of the original policy

An accidental death benefit rider is an optional feature that can be added to a term life or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or a "death benefit", if you die in an accident during the coverage period. This additional sum can be twice the amount of the original policy, and is intended to protect your family from financial struggles and uncertainty.

Accidental death benefit riders are particularly beneficial for those who work in hazardous environments, or those who travel or commute frequently. This type of rider can also cover major non-fatal injuries that prevent the policyholder from working, depending on the specific rider.

It is important to note that accidental death benefit riders have certain limitations and exclusions. For example, they may not cover accidents that occur during extreme sports or other high-risk activities, and they typically exclude deaths related to suicide, drug or alcohol abuse, or participation in civil unrest or illegal activities.

By adding an accidental death benefit rider to your insurance plan, you can gain peace of mind knowing that your loved ones will receive enhanced financial protection in the event of your accidental death.

The Importance of Term Insurance for Wives: Securing a Family's Future

You may want to see also

The rider covers accidents such as industrial incidents, car crashes, and plane crashes

An accidental death benefit rider is an optional feature that can be added to a term life or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or a "death benefit", if you pass away in a covered accident. This means that your family will be protected financially in the event of your unexpected death.

Accidental death benefit riders cover a range of accidents, including industrial incidents, car crashes, and plane crashes. These riders provide an extra layer of financial protection for both the policyholder and their family, in the event of an unforeseen accident.

In the unfortunate event of an accident, if the policyholder does not immediately pass away, the term insurer will provide the nominee with the sum assured within 120-180 days from the date of the accident. This rider is particularly relevant for individuals who travel frequently, whether by personal vehicle or public transportation.

The accidental death benefit rider offers a higher payout, which can be twice as much as the initial policy's benefit. This additional sum can help cover daily expenses, end-of-life costs, and provide financial stability for the family. It is important to note that the rider only guarantees an additional sum on top of the basic sum assured by the policy.

Accidental death riders are a common choice for individuals who work in hazardous environments or have jobs that expose them to higher risks. However, accidents can happen to anyone, and adding this rider to your term insurance policy can provide valuable peace of mind and financial security.

Weighing the Benefits: Navigating the Decision to Continue Term Insurance

You may want to see also

It is a good option for those who travel frequently or work in hazardous environments

An accidental death benefit rider is an optional feature that can be added to a term life or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or "death benefit", if you pass away due to a covered accident. This can be particularly useful for those who travel frequently or work in hazardous environments.

Accidental death benefit riders offer extra financial protection for your loved ones in the event of your accidental death. This can be especially relevant for those who commute or travel frequently, as it provides additional coverage for accidents that may occur during these trips. The rider can also be beneficial for those who work in hazardous environments, such as manual labour jobs or around heavy machinery, by offering increased financial security in the event of an accident.

The rider typically provides a higher payout compared to the base insurance policy, sometimes doubling the overall payment. This extra money can help cover various expenses for your loved ones, from end-of-life costs to everyday expenses. Additionally, some riders may also cover major non-fatal injuries that prevent you from working, providing financial protection for your family if you lose your income due to an accident.

It's important to note that accidental death benefit riders have certain limitations and exclusions. For example, they may not cover accidents during extreme sports or other high-risk activities. Additionally, the rider may not be suitable for those who already have accident insurance or are less likely to be involved in accidents.

Overall, an accidental death benefit rider can provide valuable peace of mind and financial security for those who travel frequently or work in hazardous environments. By adding this rider to your insurance policy, you can ensure that your loved ones will receive enhanced financial support in the unfortunate event of an accidental death.

Haven Insurance: Understanding the Fine Print

You may want to see also

The rider may not cover accidents during extreme sports or high-risk activities

An accidental death benefit rider is an optional feature that can be added to a term life or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or "death benefit", if you die in a covered accident.

Accidental death benefit riders often exclude coverage for accidents that occur during extreme sports or other high-risk activities. This means that if you engage in these types of activities and suffer an accident, your rider may not provide coverage. It's important to carefully review the terms and conditions of the rider to understand what is and is not covered.

- Skydiving

- Mountain climbing

- Scuba diving

- Street luge

- BASE jumping

- Highlining

- Creeking

- Tow-in surfing

- Free soloing

- Volcano surfing

- Wing walking

These activities are considered high-risk due to the potential for serious injury or death. As such, insurance companies may exclude them from coverage under an accidental death benefit rider. It's important to carefully review the terms and conditions of your rider to understand what specific activities are excluded from coverage.

Additionally, if you work in a high-risk occupation, such as law enforcement, firefighting, or the military, you may not be eligible for an accidental death benefit rider. Insurance companies typically assess the level of risk associated with your occupation and may exclude certain occupations from coverage.

It's important to note that the specific exclusions and limitations of an accidental death benefit rider can vary depending on the insurance company and the specific terms of the rider. Therefore, it's always advisable to carefully review the terms and conditions before purchasing this type of rider.

Understanding Bite Splints: Navigating Insurance Coverage for This Dental Appliance

You may want to see also

The rider can be purchased as a stand-alone policy for those who don't qualify for traditional life insurance

An accidental death benefit rider is an optional feature that can be added to a term life or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or a "death benefit", if you pass away due to a covered accident. This ensures that your family will be financially protected in the event of your accidental death.

In some cases, an accidental death benefit rider can be purchased as a stand-alone policy. This option is often chosen by individuals who don't qualify for traditional life insurance but still want to provide some financial protection for their loved ones in the event of their accidental death. This stand-alone coverage is commonly referred to as accidental death insurance.

Accidental death insurance is designed for those who don't meet the qualifications for traditional life insurance. For example, individuals who engage in high-risk activities, such as skydiving or mountain climbing, or those who work in hazardous occupations, like law enforcement or firefighting, may not be eligible for standard life insurance policies. By offering stand-alone accidental death insurance, insurance companies provide an alternative option for these individuals to secure some level of financial protection for their loved ones.

The process of purchasing stand-alone accidental death insurance is similar to buying a rider. You will need to provide basic personal information, and the insurance provider will assess your application. The cost of this coverage will depend on factors such as your age, health, and the amount of coverage you select.

It is important to note that stand-alone accidental death insurance policies have their limitations. They only provide coverage in the event of an accidental death and may have exclusions for certain types of accidents or high-risk activities. Additionally, the benefits paid out may be lower compared to the rider option. Nevertheless, for those who don't qualify for traditional life insurance, stand-alone accidental death insurance can offer a valuable safety net for their loved ones.

The Hidden Hazards of Moral Risk in Insurance: Unraveling the Complexities

You may want to see also

Frequently asked questions

An accidental death benefit rider is an optional feature that can be added to a term or whole life insurance policy. This rider provides your loved ones with a larger cash payment, or a "death benefit", if you pass away due to a covered accident during the coverage period.

Most accidental death benefit riders offer your family an additional payout on top of the death benefit from your standard life insurance policy. This extra payment can sometimes double the total amount received by your family, hence the previous name of "double indemnity rider".

Adding an accidental death benefit rider to your insurance plan can provide several benefits, including:

- Just-in-case coverage for unpredictable accidents.

- A larger payout for your family, helping to cover end-of-life costs and everyday expenses.

- Potential living coverage in case of injury, if your rider option includes coverage for major trauma or dismemberment.

- Tax exemptions on premiums paid, depending on the applicable tax laws in your region.