Auto insurance rates are determined by a multitude of factors, including driving history, age, gender, location, and the type of car being insured. The frequency and severity of accidents, vandalism, theft, and litigation in a particular area can also impact insurance rates. Insurance companies use these factors to assess risk and set premiums accordingly. In addition, insurance rates can vary across different providers, so it is beneficial to compare quotes from multiple carriers to find the most affordable coverage. Understanding these factors and staying informed about market conditions can help individuals make informed decisions about their auto insurance and potentially lower their premiums.

What You'll Learn

Driving record

Auto insurance rates are determined by a variety of factors, and one of the most significant factors is an individual's driving record. A driving record provides a history of a person's driving behaviour and can have a substantial impact on insurance rates.

In the United States, most states utilise a points system to monitor and quantify driving infractions. These points are assigned based on the severity of the violation, with more severe violations, such as speeding, reckless driving, or driving under the influence (DUI), resulting in a higher number of points. Accumulating points on your driving record indicates repeated or serious offences and increases your insurance premiums. For instance, according to WalletHub, just two points on your driving record can increase your auto insurance premiums by 20% or more. The presence of more points or more serious violations can lead to an increase of up to 100%.

The points on your driving record directly correlate to the risk you pose as a driver. Insurance companies interpret these points as a reflection of your driving behaviour and use them to assess the likelihood of you filing a claim. The higher the points, the higher the risk, and consequently, the higher the insurance rates.

It is important to note that not all violations carry the same weight. Minor violations, such as parking tickets or a broken taillight, typically do not affect your insurance rates. However, major violations, such as DUIs or leaving the scene of an accident, can result in your insurance company dropping you altogether. Additionally, each state has different thresholds for suspending your license based on the accumulated points. For example, New York will suspend your license if you accumulate 11 points or more within 18 months, while California's threshold is lower at 4 points in a year or 6 points in two years.

To maintain lower insurance rates, it is advisable to keep your driving record as clean as possible. This includes avoiding aggressive or inattentive driving, adhering to speed limits, and never drinking and driving. Additionally, taking a defensive driving course can help remove points from your record and lower your insurance premiums.

Auto and General Insurance: Is It Worth the Hype?

You may want to see also

Car usage

The amount you drive your car will impact your auto insurance rate. The more miles you drive, the more likely you are to be involved in an accident, so the higher your premium will be. If you drive for work or commute long distances, your insurance rate will be higher than if you only drive occasionally, which some companies refer to as "pleasure use".

High-mileage drivers, typically defined as those who drive 15,000 miles or more per year, will pay more for car insurance. On the other hand, those who drive less than 12,000 or 10,000 miles per year are often eligible for lower rates.

If you don't drive much, you can choose low-mileage car insurance options such as pay-per-mile or usage-based insurance, which can result in significant savings. For instance, if you drive under 10,000 miles a year, you can report your mileage to your insurance company and qualify for a lower premium.

Your rates are also calculated based on the number of kilometres you drive per year and whether you drive to work or school. Usually, the more you drive, the higher your premiums.

If you use your car for business purposes, such as making deliveries, you will typically need commercial auto insurance instead of a personal auto policy.

Gap Insurance: Is It Covered by Marcosian Auto Insurance?

You may want to see also

Location

Auto insurance rates are calculated based on several factors, including a driver's age, gender, marital status, vehicle, driving history, and credit score. One of the most critical factors in determining insurance rates is the driver's location or place of residence.

Insurance companies examine data related to auto losses, including accidents and thefts, to determine the likelihood of claims being filed in specific geographic areas. These claims fall into two main categories: those arising from auto accidents and those resulting from vandalism or theft of the vehicle.

When it comes to auto accidents, insurance companies consider the county or state where the driver resides. The calculation is based on the assumption that the chances of an auto accident depend on the traffic and road conditions in the areas where the vehicle is typically driven. On the other hand, vehicle theft and vandalism usually occur when the car is parked, so the insurance calculation for these risks focuses on the city or neighborhood where the car is typically parked.

While it is often assumed that insurance rates are higher in cities than in rural areas, the reality is more nuanced. Some predominantly rural states, like Oklahoma and Montana, have higher average auto insurance rates than certain states with large urban areas. This can be attributed to factors such as long travel distances and a higher likelihood of accidents in these rural states.

Within a state or city, insurance rates can also vary between different areas. For instance, within the same city, insurance rates may be higher in neighborhoods with higher rates of car theft or vandalism. Additionally, insurance companies may offer lower rates to drivers who park their cars in locked garages instead of on the street.

In conclusion, location plays a significant role in determining auto insurance rates. Insurance companies use data on auto losses and geographic areas to assess the likelihood of claims and set rates accordingly. While urban areas tend to have higher rates, other factors, such as travel distances and road conditions, also come into play, resulting in variations within and across states.

Gap Insurance: California's Essential Coverage

You may want to see also

Age

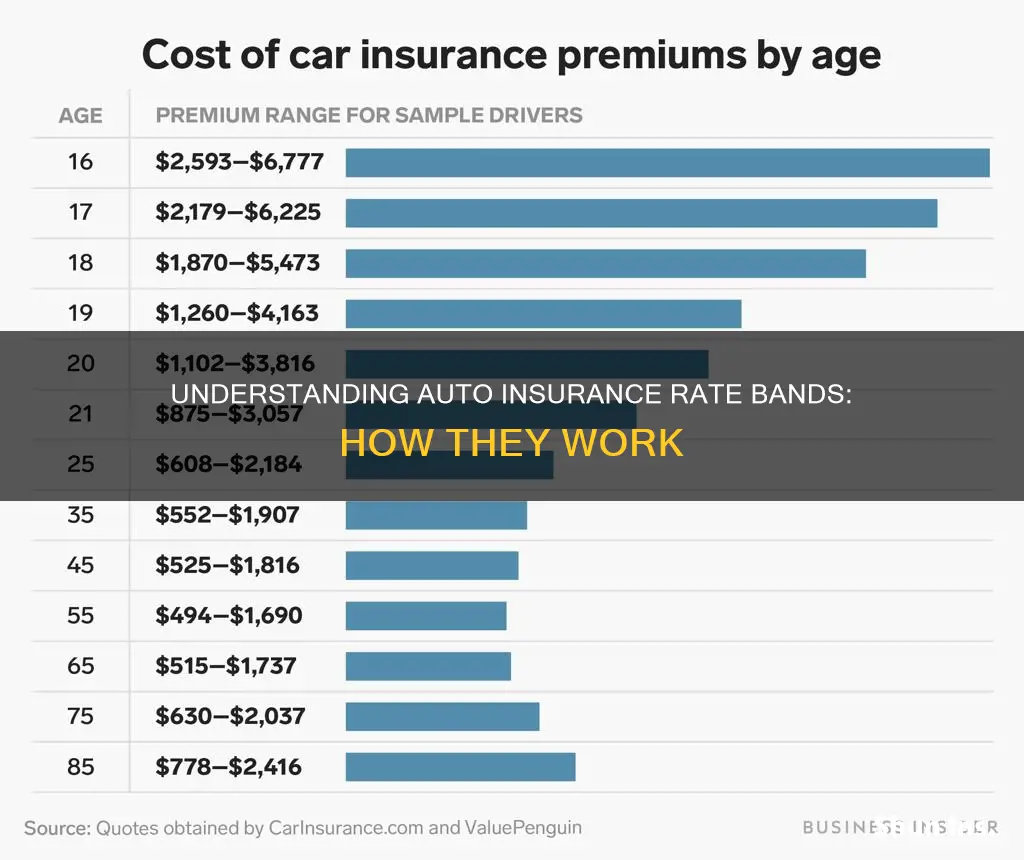

In general, young drivers can expect to pay higher rates than older drivers, and around age 70, car insurance rates start to increase again. This is due to accident trends and data, as men are riskier to insure than women and often pay higher rates.

When analyzing average car insurance costs by age, you may notice a trend. Coverage starts out relatively expensive for teens and young adults. Over the years, premiums generally decrease as drivers gain more experience behind the wheel. But as drivers reach their senior years, premiums can creep back up. In general, this is due to risk factors associated with each age group.

Teens

Teenagers are considered some of the riskiest drivers to insure. Per mile driven, drivers aged 16 to 19 get into almost three times as many fatal car accidents as any other age group. Insurers frequently charge more to insure teen drivers to offset the higher costs associated with teen driving claims.

Adults

The cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s. By age 25, drivers might notice a pretty significant reduction in their premiums. Throughout adulthood, provided that drivers have a history of safe driving and no insurance claims, premiums generally continue to drop as drivers gain more experience.

Seniors

Unfortunately, the downward trend of insurance premiums typically comes to an end as drivers reach their 70s. Aging-related factors like vision or hearing loss and slowed response time might make seniors more likely to get into accidents. However, while seniors may see their insurance premiums increase, they likely will not go back to paying the high rates of teen drivers, assuming their driving record is clean.

Most insurers understand that car insurance can be expensive for certain age groups, and offer discounts to help reduce those premiums. Common discounts for young drivers include good student discounts and driver training discounts. Senior drivers may earn discounts for company loyalty or affiliation with organizations such as AARP.

Canceling Geico Auto Insurance: What Fees Will I Incur?

You may want to see also

Gender

When it comes to auto insurance, gender is a factor that can influence premium rates, with men often facing higher costs than women. This is primarily due to men being generally considered riskier to insure. They tend to drive more miles, exhibit riskier driving behaviours like speeding, and are more likely to be involved in car accidents and incur major injuries. As a result, insurers often view them as having a higher probability of filing claims, leading to increased premiums.

The impact of gender on car insurance rates is particularly notable for younger drivers. Women aged 16 to 24 typically pay significantly less than their male counterparts, with an average annual difference ranging from $140 to $784. This gap narrows as drivers age, with rates becoming more comparable in the mid-to-late 20s and beyond. By the time drivers reach their 50s, the gender gap in rates is often negligible, and female drivers may even start paying less again as they get older.

It's worth noting that the use of gender as a pricing factor in auto insurance is not universal. Some states, including California, Michigan, Hawaii, Massachusetts, North Carolina, and Pennsylvania, have banned insurance companies from considering gender when determining premiums. In these states, rates for men and women should be similar, provided other rating factors, such as driving history and vehicle type, are comparable.

While gender plays a role in auto insurance rates, it's important to remember that it is just one of many factors that insurers consider. Age, driving record, credit score, claim history, and the types of coverage selected also influence premium calculations. Additionally, insurance companies use different methods to determine premiums, so rates can vary significantly between companies. As a result, shopping around and comparing quotes from multiple insurers is always a good idea to find the most favourable rates.

Gap Insurance: Which Auto Insurers Offer This?

You may want to see also