Bank on Yourself is a financial strategy that allows you to take control of your finances using a whole life insurance policy. Instead of relying on traditional banks for loans, you borrow against the cash value of your policy, creating your own personal banking system. This approach, known as the infinite banking concept, gives you flexibility and control. Your cash value continues to grow even as you borrow, allowing you to build wealth while funding major expenses without the high interest and restrictions of traditional loans.

| Characteristics | Values |

|---|---|

| Type of policy | Whole life insurance |

| Type of whole life insurance | Dividend-paying |

| Type of dividend-paying whole life insurance | High cash value |

| Riders | Paid-up additions rider |

| Life insurance supplement rider | |

| Additional life insurance rider | |

| Term life rider | |

| Guaranteed insurability rider | |

| Borrowing | Borrowing from the policy is possible once it accumulates sufficient cash value |

| Repayment | Repayment terms are flexible |

| Interest | Interest on the loan is paid back to the policy |

| Tax advantages | The cash value grows tax-deferred and can be accessed without triggering taxes |

What You'll Learn

Using a life insurance policy as a personal bank

The "Bank on Yourself" concept revolves around using a life insurance policy as a personal bank, allowing individuals to act as their own bankers. This strategy, also known as "infinite banking," involves treating a life insurance policy as a source of liquidity by borrowing against its cash value. Here's how it works and some things to consider before diving in.

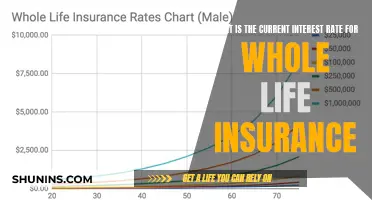

The first step is to purchase a whole life insurance policy, which is a type of permanent life insurance that combines a death benefit with a savings component, known as the cash value. The cash value of a whole life insurance policy grows over time, and this growth is guaranteed by the insurance company.

Once the policy has accumulated sufficient cash value, you can borrow against it. This is the heart of the "Bank on Yourself" concept. Instead of taking out a traditional loan from a bank, you borrow from the cash value of your life insurance policy. This provides flexibility and control over your finances. You set the repayment terms, and there are no credit checks or lengthy approval processes.

As you borrow from your policy, you also continue to build its cash value by making regular premium payments. This is a key aspect of the strategy—you borrow from yourself while simultaneously growing your savings. The interest you pay on the loan goes back into your policy, further increasing your wealth.

Benefits of Using Life Insurance as a Personal Bank

There are several advantages to using a life insurance policy as your personal bank:

- Financial Control and Flexibility: You have complete control over your finances. You decide when to borrow, how much to borrow, and how quickly to repay. There are no bank approvals, credit checks, or restrictions.

- Build Wealth Over Time: When you borrow against the cash value of your policy, the interest you pay goes back into your policy, rather than to a lender. This allows your money to work in two ways—you can cover expenses while continuing to grow your savings.

- Tax Advantages: The cash value in a whole life insurance policy typically grows tax-deferred, and loans against the cash value are not taxed. This makes accessing money for large expenses or investments more tax-efficient.

- Liquidity and Accessibility: With traditional banks, accessing large amounts of money can be cumbersome and involve paperwork and delays. With this strategy, you can easily access the cash value in your policy whenever needed, providing liquidity for emergencies, investments, or major purchases.

- Protection and Security: Whole life insurance policies offer a guaranteed return on the cash value, shielding your money from market volatility and providing financial security.

- Estate Planning Benefits: In addition to the wealth built through borrowing and repayments, your beneficiaries receive a death benefit, ensuring a financial legacy for future generations.

Choosing the Right Whole Life Insurance Policy

Not all whole life insurance policies are created equal when it comes to the "Bank on Yourself" strategy. Look for policies specifically designed for infinite banking, with features such as high cash value accumulation and dividend payments. Consulting an experienced financial advisor can help you choose a policy that aligns with your financial goals.

Things to Consider

While using a life insurance policy as a personal bank offers benefits, there are also some drawbacks and complexities to keep in mind:

- Cost of Whole Life Insurance: Whole life insurance is generally more expensive than term life insurance due to the cash value component and lifelong coverage. The high premiums may be a significant financial commitment.

- Time to Build Cash Value: Building sufficient cash value in a whole life policy can take years, and infinite banking may not be a quick way to create wealth.

- Overfunding Risks: To make infinite banking work, you need to contribute a substantial sum of money to the policy's cash value. Overfunding your policy can be costly and may require allocating a significant portion of your income.

- Complexity: Using life insurance as an investment and source of liquidity is complex. It requires discipline and careful monitoring of your policy's cash value to ensure you maintain your life insurance coverage.

In conclusion, using a life insurance policy as a personal bank can provide financial control and flexibility, but it is important to carefully consider the potential drawbacks and complexities before implementing this strategy. Consulting a fee-based financial advisor can help you make an informed decision that aligns with your goals and budget.

Unlocking Term Life Insurance: Strategies to Maximize Your Benefits

You may want to see also

Borrowing against a policy's cash value

The process of borrowing against a policy's cash value is relatively straightforward. Policyholders can request a loan from their life insurance company, with the only requirement being that they have sufficient cash value to borrow against. This minimum amount varies by insurer but is typically no more than 90% of the policy's cash value. It's important to note that borrowing against a life insurance policy does come with risks; if the loan is not repaid, it may reduce the death benefit or even result in the loss of the policy.

One of the advantages of borrowing against a policy's cash value is the lack of a strict approval process or additional requirements such as credit checks or employment verification. This makes it a convenient option for those who need quick access to funds. Additionally, the policyholder's cash value continues to grow even after they borrow against it, and there is no set repayment schedule. However, it is in the policyholder's best interest to repay the loan as soon as possible to minimise the interest owed.

While borrowing against a policy's cash value can provide much-needed funds, it is important to consider the potential drawbacks. Any unpaid loans at the time of the policyholder's death will be deducted from the death benefit, reducing the amount received by the beneficiaries. Additionally, borrowing against the cash value may affect the growth of the policy, and the interest rates charged by the insurance company may be higher than expected.

Overall, borrowing against a policy's cash value can be a useful feature of cash value life insurance, providing policyholders with access to funds for various expenses. However, it is important to carefully consider the risks and potential consequences before utilising this option.

Term Life Insurance Renewal: Is It Possible?

You may want to see also

Overfunding a policy

Overfunding a life insurance policy involves paying more premiums than required to grow the cash value faster. This strategy is part of the "infinite banking" concept, where policyholders treat their life insurance as a personal bank account. Here are some key points about overfunding a policy:

Pros of Overfunding a Policy

- Faster Cash Value Growth: Overfunding helps accumulate cash value more quickly, allowing you to access your funds faster. This is particularly beneficial if you need to grow savings for future financial needs. The compound interest may also have a greater impact, leading to accelerated growth.

- Access to Cash Value: Overfunding is part of the "infinite banking" strategy, which allows you to access the cash value through loans with low-interest rates and flexible repayment options. You can also withdraw from the cash value to avoid more debt, but this may reduce your death benefit or have tax consequences.

- Maximizing Dividends: If your policy pays dividends, overfunding can increase the amount of dividends you earn. You can choose to receive the dividends as cash, save them in an interest-bearing account, use them to pay premiums, or purchase paid-up additions to boost your coverage.

- Tax Benefits: The cash value growth in a life insurance policy is generally tax-deferred, and loans or withdrawals up to the total premiums paid are typically tax-free. This helps maximize the tax advantages associated with life insurance.

Cons of Overfunding a Policy

- Complexity and Planning: Overfunding adds complexity to your financial planning. You need to carefully track the cash value growth, loans, and withdrawals alongside your other financial accounts. Additionally, there may be tax consequences in certain situations, further complicating your tax situation.

- Modified Endowment Contract (MEC) Risk: Overfunding your policy increases the risk of it being reclassified as an MEC by the IRS. If the cash value grows beyond certain limits, the policy loses its tax advantages associated with loans and withdrawals. This reclassification can have significant tax implications.

- Increased Fees: Overfunding may result in higher administrative fees, mortality and expense risk charges, and surrender charges. These additional costs can reduce the overall benefit of overfunding.

- Budget Impact: Overfunding requires larger premium payments and higher fees, which may not be feasible for everyone. It is essential to consider your budget and ensure that overfunding does not compromise your other financial obligations.

- Limited to Permanent Policies: Overfunding is only applicable to permanent life insurance policies with a cash value component, such as whole life, universal life, and variable universal life insurance. Term life insurance policies, which do not have a cash value, cannot be overfunded.

Life Insurance and Carbon Monoxide Poisoning: What's Covered?

You may want to see also

Pros and cons of infinite banking

Pros of Infinite Banking

Infinite banking is a personal finance strategy that leverages a whole life policy as a "personal bank". Here are some of the benefits:

- Tax benefits: The cash value within a permanent life insurance policy generally grows tax-free, and loans against that value aren't taxed. Life insurance payouts to beneficiaries are also tax-free.

- Guaranteed returns: Unlike some other permanent policies, the cash value growth of whole life policies isn't tied to the market — instead, the returns are fixed at a rate set by the insurer. If your policy is with a mutual life insurer, you might also earn annual dividends based on the company's financial performance.

- Loan flexibility: Cash value policies can make it easier to get a loan. Traditional lenders require loan applications, credit checks, and set repayment dates for personal loans. In contrast, policyholders with whole life policies can borrow against the cash value without explanations or credit score requirements once it has accumulated enough value.

- Repayment flexibility: You don't need to pay back a cash value loan by a specific date — or at all. This might be appealing if you want to repay a loan at your own pace.

Cons of Infinite Banking

Infinite banking can be a pricey and complex way to manage your wealth. Here are some of the drawbacks:

- High cost: The foundational requirement, a permanent life insurance policy, is pricier than its term counterparts.

- Slow cash value growth: Cash value takes a long time to grow, so unless you have a lot of discretionary funds, infinite banking isn't a quick way to create wealth.

- Substantial contributions needed: To make infinite banking work, you'll need to contribute a substantial amount of money to your policy's cash value. Allocating around 10% of your monthly income to the policy is just not feasible for most people.

- Complexity: Utilizing life insurance as an investment and source of liquidity requires discipline and monitoring of policy cash value. Consult a financial advisor to determine if infinite banking aligns with your priorities.

Life Insurance Test: Is New Jersey's Exam Tough?

You may want to see also

Steps to becoming your own banker

The concept of "Banking on Yourself" involves using a life insurance policy as a personal bank. It's important to note that this strategy is complex and may not be suitable for everyone. Here are the steps to becoming your own banker:

Step 1: Choose the Right Insurance Policy

Select a whole life insurance policy that is specifically designed for "infinite banking." Look for features such as high cash value accumulation, dividend payments, and riders that enhance the policy's benefits. Consult with a financial advisor experienced in this concept to ensure you choose a policy that aligns with your goals.

Step 2: Build Up the Policy's Cash Value

Once your policy is in place, a portion of your premium payments will go towards building its cash value. Contribute as much as you can to accelerate this process, as the more cash value you have, the greater your ability to borrow for future needs.

Step 3: Borrow Against Your Policy

After you've built up sufficient cash value, you can start borrowing against it. This is the core of becoming your own banker. You won't need credit checks or lengthy approval processes; simply access the funds when needed.

Step 4: Repay the Loan at Your Own Pace

One of the biggest advantages of this strategy is the flexibility in repayment. You set your own terms, and there are no strict deadlines or penalties. The interest you pay goes back into your policy, growing your wealth.

Step 5: Enjoy the Long-Term Benefits

As your policy grows in cash value and dividends, you'll see the compounding effects of your strategy. Over time, you'll have a robust self-financing method, allowing you to cover large expenses without relying on traditional lenders.

Additional Considerations:

- Tax Advantages: The cash value in a whole life insurance policy typically grows tax-deferred, and you can access it without triggering taxes, making this strategy tax-efficient.

- Liquidity and Accessibility: With this strategy, you can easily access large amounts of money without the paperwork, delays, and fees typically associated with traditional banks.

- Protection and Security: Whole life insurance policies offer guaranteed returns, protecting your financial security even during uncertain times.

- Estate Planning: This strategy also allows you to pass on wealth to your heirs. The death benefit of the policy provides a lump sum that can offer financial security for generations.

Can Felons Pursue a Career in Michigan Life Insurance?

You may want to see also

Frequently asked questions

Bank on Yourself is a retirement plan alternative that uses a little-known variation of dividend-paying whole life insurance. It lets you bypass Wall Street and take control of your financial future. It can help almost anyone, regardless of age, income, or financial sophistication, reach their financial goals without taking unnecessary risks.

The Bank on Yourself life insurance method works by treating life insurance as a personal bank. You contribute extra money to the cash value of your whole life insurance policy to boost its growth and take out loans against the value instead of relying on traditional lenders or dipping into savings accounts.

The Bank on Yourself life insurance method offers several benefits, including financial control and flexibility, tax advantages, liquidity and accessibility, protection and security, and estate planning benefits. It also provides a way to sidestep traditional banks and lenders and create wealth.

The Bank on Yourself life insurance method has some drawbacks, including the high cost of whole life insurance, the long time it takes to build cash value, the complexity of using life insurance as an investment and source of liquidity, and the need to contribute a hefty sum of money to the policy's cash value.