Self-Insured Retention (SIR) is a type of insurance policy where the insured manages claims as if they were self-insured. It is a specific dollar amount in a liability insurance policy that the insured pays before the insurance policy covers any damage, defence or loss. SIR is often used alongside various insurance policies such as worker's compensation, general liability, and auto liability policies. It is a way for the insured to retain some of the risk of a liability insurance policy while saving money on insurance premiums. SIR policies are more common among mid- to large-sized businesses as they require the financial capability to pay out claims.

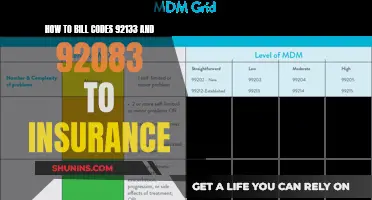

| Characteristics | Values |

|---|---|

| Full Form | Self-Insured Retention |

| Type | Risk transfer mechanism |

| Used with | Worker’s compensation, general liability, and auto liability policies |

| Advantage | Savings on insurance premiums |

| Improved cash flow | |

| More control over claims adjustments | |

| No collateral requirement | |

| Lower insurance premiums | |

| Increased cash flow | |

| Increased insurance policy limit | |

| More control over claims adjustments | |

| Claims not included in loss history | |

| Disadvantage | Need to dedicate time and resources to handling insurance claims |

| May be a poor fit for small businesses due to out-of-pocket costs |

What You'll Learn

- Self-insured retention (SIR) is a specific dollar amount in a liability insurance policy

- SIR is different from deductibles. A claim against an SIR policy is covered from the first dollar, but the insured pays up to the SIR and the cost of defence

- SIR insurance policies are popular with mid- to large-sized businesses

- SIR offers businesses the opportunity to control the claims process

- SIR insurance has the added benefit of giving businesses additional motivation to reduce claims

Self-insured retention (SIR) is a specific dollar amount in a liability insurance policy

SIR is often used in conjunction with various insurance policies, including worker's compensation, general liability, and auto liability. It is important for businesses to evaluate their liability risks and estimate the potential cost of a significant loss to determine an appropriate SIR limit. The business then needs to set up a fund to cover any losses within the SIR, taking into account the maximum anticipated damages during the insurance period.

SIR provides businesses with more control over the claims adjustment process and the opportunity to reduce costs by paying for losses as they occur rather than through insurance premiums. It also incentivises businesses to take proactive measures to prevent losses. However, it is essential to have sufficient financial resources to cover the SIR and any associated expenses.

SIR is different from deductibles, another mechanism in insurance policies. While both require the insured to bear a portion of the loss, there are key differences. With a deductible, the insurer typically assumes the duty to indemnify the insured for a covered loss after the deductible amount is met. In contrast, with SIR, the insured is responsible for administering and defending claims within the SIR limit, and the insurer has no obligation to provide defence costs until the SIR is satisfied.

The Intricacies of Loss Pick: Unraveling the Insurance Industry's Unique Language

You may want to see also

SIR is different from deductibles. A claim against an SIR policy is covered from the first dollar, but the insured pays up to the SIR and the cost of defence

Self-Insured Retention (SIR) is a specific dollar amount in a liability insurance policy. It is an alternative to deductibles, where the insured pays a certain amount before the insurer covers the rest. SIR policies are different from deductible policies in several ways.

With an SIR policy, the insured is responsible for paying up to the SIR amount and the cost of defence. This means that the insured will pay for the claim up to the SIR amount and handle the claim administration, including providing a defence. On the other hand, with a deductible policy, the insurer will pay for the claim and then seek reimbursement from the insured for the amount of the deductible.

In terms of insurance limits, SIRs do not erode the limit of the insurance policy, whereas deductibles do. For example, a $1 million policy limit with a $50,000 SIR would provide the full $1 million of coverage after the claim exceeds $50,000. In contrast, a $1 million policy limit with a $50,000 deductible would result in only $950,000 of insurance coverage.

Another difference relates to legal costs. SIRs often encompass both damages and legal costs, whereas deductibles typically do not include legal costs. The insurer is usually responsible for the payment of legal costs in addition to the policy limit.

Additionally, SIRs must be disclosed on insurance certificates, as the insurer has no responsibility to pay claims until the SIR is exhausted. In contrast, a deductible policy does not need to disclose the deductible amount on the insurance certificate, as the insurer is ultimately responsible for paying covered losses.

Finally, collateral is generally not required for SIRs since the insured is responsible for the SIR. However, large deductibles often require collateral, such as a letter of credit, to cover expected losses within the deductible.

While SIRs and deductibles have their differences, they are both designed to keep premiums down by having the insured assume some of the risk. However, it is important to carefully consider the pros and cons of each option before selecting the one that best suits your needs.

Understanding the Nature of Prepaid Insurance: A Short-Term Asset Strategy

You may want to see also

SIR insurance policies are popular with mid- to large-sized businesses

A Self-Insured Retention (SIR) policy is an alternative method for businesses to take on some of the risk of a liability insurance policy while saving money at the same time. In a traditional insurance policy with a deductible, the insurer pays the full value of the claim up to the policy limit, and then charges the insured for the money they spent up to the amount of the deductible. With an SIR policy, the insured pays the initial amount out-of-pocket with no input or support from the insurance company. The insured also takes over the role of managing the claim up to the SIR amount.

Because the insurance company doesn't play any role in a claim until the SIR is exhausted, the insured party is able to exert more control over the claims process. This increased responsibility also results in lower insurance premiums.

SIR insurance policies are a good fit for mid- to large-sized businesses with the capital to fund an SIR and experience a high frequency of low-cost claims. If a business typically faces more than 20 to 25 claims per year, a high-deductible policy may be a better option.

Businesses that constantly deal with low-level insurance claims may find that an SIR insurance policy is a good fit for them.

Smoking Relapse: Impact on Term Insurance and Your Health

You may want to see also

SIR offers businesses the opportunity to control the claims process

A self-insured retention (SIR) is a dollar amount specified in a liability insurance policy that must be paid by the insured before the insurance policy will respond to a loss. SIR is a risk financing strategy that is an effective cost-saving tool, particularly for mid- to large-sized businesses with large risks characterised by high-frequency and low-severity claims.

With an SIR, the insured is responsible for the administration of claims within the SIR, including the provision of a defence. The insured controls its own defence for all claims within the SIR. Until the SIR has been satisfied by the insured, the insurer has no obligation to provide or pay for the insured's defence.

An SIR insurance policy is more labour-intensive, but it offers businesses the opportunity to control the claims process. The business sets up a fund and either outsources the work to a third party or uses one of its own employees to manage the program. This gives the business more freedom to manage and negotiate smaller claims without the involvement of the insurance provider.

SIR insurance is a good fit for businesses with the capital to fund an SIR and a high frequency of low-cost claims. It is also a good fit for businesses that want to save on insurance premiums and get more value out of their insurance limit.

Term Insurance Traps: Understanding the High Lapse Rates

You may want to see also

SIR insurance has the added benefit of giving businesses additional motivation to reduce claims

SIR insurance, or Self-Insured Retention, is a type of insurance policy that allows the insured to manage claims against them as if they were self-insured. This means that the insured pays a certain amount, known as the self-insured retention, out-of-pocket before their insurance company begins to pay out their claims. This gives businesses additional motivation to reduce claims as they are responsible for managing the ins and outs of each claim, creating a feeling of responsibility and incentive to reduce risk.

With an SIR insurance policy, the insured takes on more risk and gains more control over their insurance costs. In exchange for this increased risk, the insured receives lower insurance premiums. This can result in improved cash flow for the business as more of their capital is spent only in the event of a claim, rather than on higher premiums. Additionally, the business has more control over the claims adjustment process and can decide whether to settle or contest a claim.

SIR insurance policies are popular with mid- to large-sized businesses that have the financial capacity to handle the extra responsibility of paying out early costs from their own funds. These businesses typically experience a high frequency of low-cost claims and have the resources to pay out these claims without relying on their insurance company. By taking on this additional risk, businesses with SIR insurance can benefit from reduced premiums and improved cash flow.

However, one of the drawbacks of SIR insurance is that the business will need to dedicate time and resources to handling insurance claims. This can be mitigated by hiring a third-party administrator or using a risk management information system to assist with claims management. Nonetheless, SIR insurance provides businesses with the motivation to reduce claims and the opportunity to control the claims process, resulting in potential cost savings and improved cash flow.

The Intricacies of Liens in Insurance: Understanding the Legal Hold

You may want to see also

Frequently asked questions

SIR stands for Self-Insured Retention. It is a specific dollar amount in a liability insurance policy that the insured needs to pay before the insurance policy can take care of any damage, defence or loss.

The insured has to pay a clearly defined amount, after which the insurer takes care of the remaining damage, defence and indemnity costs. The insurer will only pay for what the specific plan covers.

Both SIR and deductible refer to a specific sum that the insured must pay. However, with a deductible, the insurer takes care of the indemnity and defence costs that are part of the claim. The insured then compensates the insurer for the deductible payments. With SIR, the insured is responsible for the administration of claims, including the provision of a defence.