When it comes to life insurance license renewal, understanding the late fee structure is crucial for agents and brokers. The late fee for renewing a life insurance license can vary depending on the state and the specific circumstances. Typically, late fees are charged when the renewal process is not completed by the due date. These fees are designed to encourage timely renewal and ensure that all necessary requirements are met. It's important to be aware of these fees to avoid any penalties and to maintain compliance with regulatory bodies. This paragraph sets the stage for a detailed exploration of the late fee policies and their implications.

| Characteristics | Values |

|---|---|

| Late Fee for Life Insurance License Renewal | Varies by state and insurance department |

| Typical Range | $50 to $200 |

| Due Date | Within 30 days after the original due date |

| Payment Methods | Online, check, money order |

| Consequences of Non-Payment | License suspension or revocation |

| Grace Period | Some states offer a short grace period before late fees apply |

| Late Fee Calculation | Often a flat fee or a percentage of the annual premium |

| Payment Options | Direct payment to the insurance department or through the insurance company |

| Renewal Frequency | Annually |

| Late Fee Reduction | Some states may waive fees for good cause or financial hardship |

What You'll Learn

- Late Fee Calculation: Understand the formula for late fees on life insurance license renewals

- Renewal Deadlines: Know the exact dates for license renewal to avoid penalties

- Payment Methods: Discover accepted payment options for late fees

- Grace Period: Learn about the grace period for late renewal and its implications

- Penalty Structure: Explore the different penalty tiers for delayed life insurance license renewals

Late Fee Calculation: Understand the formula for late fees on life insurance license renewals

To calculate the late fee for life insurance license renewal, it's important to understand the specific regulations and fee structures set by your insurance regulatory body. The late fee is typically a percentage of the annual renewal fee and is applied if the license renewal is not submitted on time. Here's a step-by-step guide to help you calculate this fee:

- Determine the Standard Renewal Fee: Start by identifying the standard annual fee for renewing your life insurance license. This fee is usually a fixed amount and is applicable to all license holders. It is essential to know this figure as it forms the basis for calculating the late fee.

- Understand the Late Fee Percentage: Insurance regulators often specify a late fee percentage that is applied to the standard renewal fee. This percentage can vary depending on the jurisdiction and the specific rules governing license renewals. For instance, the late fee might be 10% of the standard renewal fee for the first month of delay, increasing to 15% for the second month, and so on.

- Calculate the Late Fee: The formula for calculating the late fee is straightforward. You multiply the standard renewal fee by the late fee percentage for the number of months the renewal is late. For example, if the standard renewal fee is $100 and the late fee percentage for the first month is 10%, the late fee for the first month would be $10 (0.10 * $100). If the renewal is two months late, the calculation would be $20 for the first month and $30 for the second month, totaling $50 in late fees.

- Consider Grace Periods: Some regulatory bodies offer a grace period during which no late fees are charged. This period allows license holders to renew their licenses without incurring any additional costs. If your jurisdiction provides a grace period, you can calculate the late fee only after this period has expired.

- Stay Informed: Late fee regulations can vary, so it's crucial to stay updated with the latest guidelines from your insurance regulatory authority. They may provide specific instructions or a detailed fee schedule, ensuring you have the most accurate information for calculating late fees.

Understanding the late fee calculation process is essential for life insurance professionals to ensure timely license renewals and avoid unnecessary financial penalties. By following these steps and staying informed about regulatory changes, you can effectively manage your license renewal process.

Income Fluctuations: Life Insurance Impact and Adjustments

You may want to see also

Renewal Deadlines: Know the exact dates for license renewal to avoid penalties

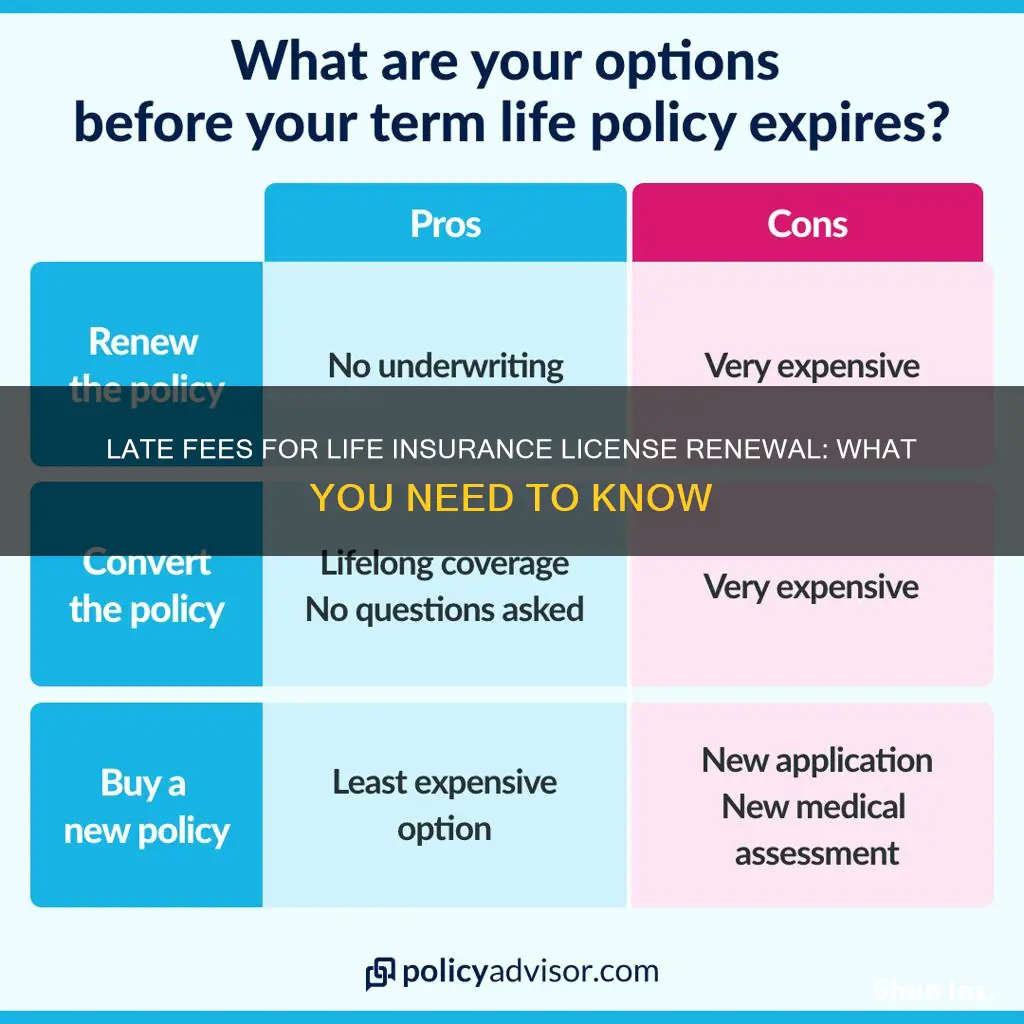

Understanding the renewal process for your life insurance license is crucial to maintaining your professional standing and avoiding any unnecessary penalties. Each state or region has its own set of rules and deadlines for license renewal, so it's essential to be aware of these specific requirements. The renewal process typically involves submitting an application, providing updated information, and paying the associated fees.

Renewal deadlines are often strict, and late submissions can result in significant consequences. It is imperative to mark these dates on your calendar and plan accordingly. Many regulatory bodies provide online resources or notifications to remind license holders of their upcoming renewals. Take advantage of these tools to ensure you never miss a crucial deadline. By staying organized and proactive, you can avoid the stress and financial burden of late fees.

The late fee for license renewal can vary depending on the jurisdiction and the timing of your submission. Some states may charge a flat fee for late renewals, while others may impose a percentage-based fee based on the number of days overdue. In some cases, the late fee might be substantial, and it could even lead to the suspension of your license if not addressed promptly. It is, therefore, in your best interest to renew your license on time to prevent any financial or professional setbacks.

To ensure a smooth renewal process, consider the following steps: First, check the official website of your state's insurance department or the relevant regulatory body to obtain the most accurate and up-to-date information. Look for specific guidelines on the renewal process, required documents, and payment methods. Second, create a reminder system to notify you a few months before the renewal deadline. This could be in the form of calendar alerts or setting reminders on your phone or email. Finally, if you anticipate any challenges or delays, reach out to the regulatory office for guidance and clarification.

By being proactive and well-informed, you can navigate the license renewal process with ease. Remember, timely renewal not only ensures your compliance with regulatory requirements but also demonstrates your commitment to maintaining a professional and ethical standard in the life insurance industry. Stay organized, keep track of deadlines, and take advantage of available resources to avoid any unnecessary penalties.

Life Insurance: Cashing in While Still Alive?

You may want to see also

Payment Methods: Discover accepted payment options for late fees

When it comes to paying late fees for life insurance license renewal, it's important to understand the accepted payment methods to ensure a smooth and efficient process. Here's a breakdown of the common payment options:

Online Payment Platforms: Many regulatory bodies and insurance departments offer online payment systems for license renewals. This method often involves creating an account on their official website, where you can securely input your payment details. Common payment methods accepted here include credit cards (Visa, Mastercard, American Express) and debit cards. Some platforms might also facilitate electronic funds transfer (EFT) or bank transfers, allowing you to directly transfer funds from your bank account.

Mail-in Payments: Another traditional approach is to send in your payment via mail. This typically involves obtaining a payment voucher or coupon from the regulatory body, which you then attach to your check or money order. Make sure to include your license number and any necessary reference information. It's crucial to use the correct address provided by the insurance department to ensure timely processing.

In-Person Payments: For those who prefer a more personal approach, in-person payments can be made at designated locations. This could include the insurance department's office or a designated payment center. Cash, money orders, and sometimes even personal checks might be accepted. However, it's advisable to call ahead and confirm the accepted payment methods and hours of operation to plan your visit accordingly.

Phone Payments: Some insurance departments offer phone-based payment options. This method typically involves calling a dedicated phone line and providing your payment information over the phone. Credit cards and debit cards are usually accepted for this method. Ensure you have your license details and any required reference numbers readily available during the call.

It's essential to check the specific guidelines and requirements of your insurance regulatory body, as payment methods and procedures can vary. Additionally, be mindful of any deadlines or grace periods associated with late fee payments to avoid further penalties or license suspension. Understanding the accepted payment options in advance will help streamline the renewal process and ensure your life insurance license remains in good standing.

Cancer and Life Insurance: Can You Get Covered?

You may want to see also

Grace Period: Learn about the grace period for late renewal and its implications

The grace period is a crucial aspect of the late renewal process for life insurance licenses, offering a temporary reprieve from penalties for those who fail to meet the renewal deadline. This period provides licensees with a window of time to rectify their non-compliance without incurring additional fees or sanctions. Understanding the grace period and its implications is essential for life insurance professionals to navigate the renewal process effectively and maintain their regulatory compliance.

When a life insurance license is due for renewal, the grace period typically begins on the day after the renewal deadline. During this grace period, the licensee is not immediately subject to late fees or other penalties. Instead, they are given an opportunity to complete the necessary renewal procedures and bring their license back into good standing. The duration of the grace period can vary depending on the regulatory body and the jurisdiction, but it often provides a limited timeframe, usually a few days to a week, to address the issue.

The implications of the grace period are significant. Firstly, it allows licensees to avoid the financial burden of late fees, which can be substantial and may vary based on the jurisdiction and the number of days past the deadline. Secondly, it provides a chance to correct any administrative errors or misunderstandings that led to the late renewal. Licensees can contact the regulatory authority, provide the required documentation, and ensure their license is properly renewed within the grace period.

However, it is important to note that the grace period is not an extension of the renewal deadline itself. Licensees must still take action to renew their license before the grace period ends. If they fail to do so, the grace period will conclude, and the late fees and other consequences will be enforced. Therefore, it is crucial to understand the specific grace period rules and guidelines provided by the relevant regulatory body to ensure compliance.

In summary, the grace period for late renewal of a life insurance license is a critical component of the renewal process, offering a temporary reprieve from penalties. It allows licensees to rectify their non-compliance and avoid financial burdens. However, it is essential to act promptly during this period to ensure the license remains valid and in good standing. Understanding the grace period's duration and implications is vital for life insurance professionals to navigate the renewal process effectively and maintain their regulatory compliance.

Life Insurance Licenses: California's Comprehensive Credentials

You may want to see also

Penalty Structure: Explore the different penalty tiers for delayed life insurance license renewals

The penalty structure for delayed life insurance license renewals can vary depending on the jurisdiction and the specific insurance regulatory body. However, understanding the different tiers of penalties is crucial for insurance professionals to avoid financial burdens and maintain compliance. Here's an overview of the penalty structure:

Tier 1: Late Fees

The initial penalty for delayed renewal typically involves a late fee, which is a fixed amount charged for each day or week the renewal is overdue. This fee is usually calculated as a percentage of the annual license fee. For instance, a common practice is to charge a 1% late fee for each month the renewal is late. This fee accumulates daily, so the longer the delay, the higher the late fee. For example, a one-month delay might incur a late fee of 1% of the annual fee, while a three-month delay could result in a 3% late fee.

Tier 2: Administrative Penalties

In addition to late fees, regulatory bodies often impose administrative penalties. These penalties are designed to cover the costs incurred by the regulatory body due to the delayed renewal. Administrative penalties may include a fixed fee for processing the late renewal application, which can range from $50 to $200 or more, depending on the jurisdiction. This fee is charged regardless of the duration of the delay.

Tier 3: License Suspension or Revocation

If the delay in renewal exceeds a certain period, more severe consequences may be applied. Regulatory bodies often have thresholds for license suspension or revocation. For instance, a license may be suspended or revoked if the renewal is not completed within 60 days of the due date. This means that if an insurance professional delays renewal for an extended period, they risk having their license temporarily or permanently suspended, which could significantly impact their ability to conduct business.

Tier 4: Legal and Financial Consequences

Beyond the regulatory penalties, there may be legal and financial repercussions. Insurance professionals must ensure compliance with all relevant laws and regulations. Failure to renew a license on time could result in legal issues, including lawsuits or investigations by regulatory authorities. Additionally, some jurisdictions may require insurance professionals to pay for any losses incurred by policyholders due to the delay in license renewal, which can be substantial.

Understanding the penalty structure is essential for life insurance professionals to manage their compliance obligations effectively. By being aware of the different tiers of penalties, they can take timely action to renew their licenses, avoiding the financial and legal consequences associated with delayed renewals. It is always advisable to consult the specific regulations of the insurance regulatory body in your region to ensure full compliance.

Term Life Insurance: Quick Approval Process Explained

You may want to see also

Frequently asked questions

The late fee for life insurance license renewal can vary depending on the state and the specific insurance regulatory body. Typically, it is calculated as a percentage of the annual premium tax due for the license. For example, in some states, the late fee might be 1% of the premium tax for each month or part of a month the renewal is delayed.

The premium tax is usually a percentage of the total premiums collected by the insurance company during the license period. This tax is then used to fund the regulatory body's operations and services. The specific tax rate and calculation method can vary by state and insurance type.

Yes, many states offer a grace period for license renewal, allowing insurers a short window of time after the due date to submit the required documents and fees without incurring late fees. This grace period can range from a few days to a month, providing flexibility for insurers to complete the renewal process.

In certain circumstances, late fees may be waived or reduced. For instance, if there are extenuating circumstances or an error on the part of the insurer, the regulatory body might grant a waiver. It's important to contact the relevant insurance department or agency to discuss your specific situation and understand the potential options for fee relief.

Failure to pay the late fee can result in the suspension or revocation of the life insurance license. This could lead to a loss of business operations and the inability to write new policies until the issue is resolved. It is crucial to stay on top of renewal deadlines and communicate with the regulatory body if there are any challenges to ensure a timely resolution.