A life insurance trust is a legal arrangement that can help individuals and their families achieve their financial goals and ensure a secure future. This type of trust is designed to manage and distribute the proceeds from a life insurance policy in a specific and controlled manner. By placing a life insurance policy within a trust, the policyholder can specify how the death benefit is to be utilized, whether for the trust's beneficiaries, the policyholder's estate, or a combination of both. This allows for a more personalized and efficient distribution of assets, providing financial security and peace of mind for the trust's creator and their loved ones.

| Characteristics | Values |

|---|---|

| Definition | A life insurance trust is a legal arrangement where a person (the settlor) places a life insurance policy into a trust, allowing the trust to own and manage the policy. |

| Purpose | The primary purpose is to provide financial security and control over the distribution of the death benefit to designated beneficiaries. |

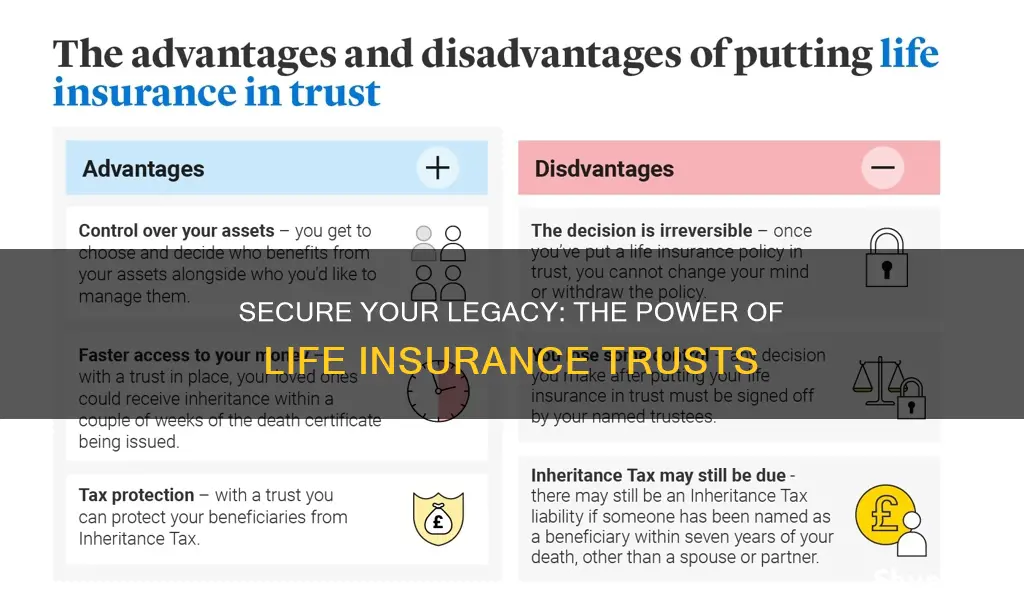

| Benefits | 1. Tax Advantages: Can help reduce income tax on the death benefit. 2. Asset Protection: Assets in the trust are generally protected from creditors and legal claims. 3. Control: Settlor can specify how and when the proceeds are distributed. |

| Types | 1. Irrevocable Life Insurance Trust: Cannot be revoked by the settlor. 2. Revocable Life Insurance Trust: Can be modified or terminated by the settlor. |

| Considerations | 1. Trust Administration: Requires ongoing management and administration. 2. Legal Fees: Setting up a trust may involve legal costs. 3. Complexity: Can be complex, especially for revocable trusts. |

| Examples of Use | 1. Charitable Purposes: Distributing proceeds to charities. 2. Family Needs: Providing financial support to spouse and children. 3. Business Continuity: Ensuring business operations continue after the settlor's death. |

What You'll Learn

- Asset Protection: Life insurance trust shields assets from creditors and legal claims

- Tax Efficiency: Trust structures can minimize estate taxes and income taxes

- Control and Flexibility: Trustors can specify beneficiaries and distribution terms

- Privacy and Confidentiality: Trust keeps beneficiaries' identities and financial details private

- Long-Term Wealth Transfer: Trust ensures consistent wealth transfer over generations

Asset Protection: Life insurance trust shields assets from creditors and legal claims

A life insurance trust is a powerful tool for asset protection, offering a strategic way to safeguard your wealth from potential creditors and legal claims. This type of trust is designed to hold a life insurance policy, and its primary purpose is to provide financial security and peace of mind for the policyholder and their beneficiaries. By placing a life insurance policy within a trust, you can effectively shield the proceeds from the policy from the reach of creditors, including those arising from divorce settlements, child support orders, or even future lawsuits.

The trust structure ensures that the insurance proceeds are distributed according to the trust's terms, which you, the grantor, can customize. This customization allows you to specify how and when the benefits are paid out, providing a level of control that is not possible with a direct payment to the policyholder. For instance, you might choose to have the proceeds paid directly to your spouse or children, ensuring their financial well-being, or you could set up a series of payments to be made over a specific period, providing a steady income stream.

One of the key advantages of using a life insurance trust for asset protection is the ability to maintain privacy. Unlike other forms of asset protection, such as placing assets in a limited liability company (LLC), the trust does not provide a layer of secrecy. Instead, it offers a structured way to manage and distribute assets, ensuring that the insurance proceeds are protected while still allowing for a clear and transparent process. This transparency can be particularly important in family matters, as it provides a clear path for beneficiaries to access their inheritance without the potential complications of legal proceedings.

In the event of a legal dispute, the trust can also act as a protective measure. If you are involved in a lawsuit, for example, the life insurance trust can ensure that the proceeds from the policy are not subject to garnishment or attachment, thus safeguarding your assets. This is especially relevant for high-net-worth individuals or those with significant financial interests who may be more likely to face legal challenges.

Furthermore, the life insurance trust can be an effective strategy for those who want to ensure their beneficiaries receive their intended inheritance without the risk of it being diminished by creditors. By placing the policy within the trust, you can provide a clear and direct path for the distribution of funds, reducing the potential for disputes or legal challenges that could otherwise delay or reduce the amount received by the beneficiaries. This level of protection and control is a significant benefit of using a life insurance trust as part of your overall asset protection strategy.

Companion Life Insurance: What Vision Benefits Are Covered?

You may want to see also

Tax Efficiency: Trust structures can minimize estate taxes and income taxes

A life insurance trust is a powerful tool for managing and protecting assets, particularly in the context of tax efficiency. When you place your life insurance policy within a trust, you can take advantage of various tax benefits that can significantly reduce the financial burden on your beneficiaries and ensure a more efficient distribution of your wealth.

One of the primary advantages of using a trust for life insurance is the ability to minimize estate taxes. Estate taxes can be substantial, and by utilizing a trust, you can potentially reduce the taxable value of your estate. When you fund a trust with a life insurance policy, the insurance proceeds become part of the trust's assets, which are then distributed according to the trust's terms. This strategic move can help reduce the overall taxable estate, as the insurance proceeds are often considered a form of death benefit and may be exempt from estate tax. As a result, your beneficiaries receive the insurance payout with a reduced tax impact, allowing them to retain more of the value you intended to pass on.

Additionally, trust structures can provide tax efficiency by optimizing income tax considerations. Life insurance trusts can be designed to generate tax-free income for beneficiaries. By setting up the trust appropriately, you can ensure that the income from the policy's cash value is distributed tax-free to the intended recipients. This is particularly beneficial for those who want to provide a steady stream of income to their family or beneficiaries without incurring significant tax liabilities. The trust can be structured to make regular payments, ensuring a consistent flow of funds while minimizing the tax impact on the recipients.

Furthermore, the flexibility of trust structures allows for customized tax strategies. You can tailor the trust to take advantage of various tax laws and deductions. For instance, you might allocate different portions of the insurance policy's value to different trust compartments, each with its own tax implications. This level of customization enables you to optimize the tax treatment of the policy, ensuring that the trust's assets are utilized in the most tax-efficient manner possible.

In summary, life insurance trusts offer a strategic approach to tax efficiency. By minimizing estate taxes and optimizing income tax considerations, these trusts provide a way to preserve and distribute wealth effectively. With the right trust structure, you can ensure that your life insurance policy becomes a powerful tool for tax planning, allowing your beneficiaries to receive the intended benefits while minimizing the tax burden.

AD&D Life Insurance: What You Need to Know

You may want to see also

Control and Flexibility: Trustors can specify beneficiaries and distribution terms

A life insurance trust is a powerful tool that allows trustors (the person creating the trust) to exert control over how their life insurance proceeds are distributed upon their passing. This level of control is a significant advantage of using a trust, especially for those who want to ensure their assets are managed according to their wishes.

One of the primary benefits of a life insurance trust is the ability to specify beneficiaries. Trustors can choose who will receive the death benefit from the life insurance policy. This is particularly useful for those who want to provide for specific family members, such as a spouse, children, or even extended family members. By naming beneficiaries in the trust, trustors can ensure that the proceeds go directly to the intended recipients without the need for a court-supervised distribution process, which can be time-consuming and potentially costly.

Additionally, trustors have the flexibility to set distribution terms. This means they can dictate when and how the beneficiaries receive the funds. For instance, a trustor might choose to provide a lump sum to a primary beneficiary, while also setting up a series of smaller payments over time for other beneficiaries. This level of customization allows for a more tailored approach to wealth distribution, ensuring that the needs of each beneficiary are met in a way that aligns with the trustor's intentions.

The control and flexibility offered by a life insurance trust are particularly valuable in complex family situations. For example, trustors can use the trust to provide for beneficiaries with special needs, ensuring they receive financial support without depleting their inheritance. It also allows for the distribution of assets to different beneficiaries at different times, which can be beneficial for tax planning and estate management.

In summary, a life insurance trust empowers trustors with the ability to specify beneficiaries and distribution terms, providing a high degree of control over the management and distribution of life insurance proceeds. This feature is especially advantageous for those seeking to create a structured and personalized plan for their loved ones' financial future.

Life Insurance Cash Value: Safe from Government Seizure?

You may want to see also

Privacy and Confidentiality: Trust keeps beneficiaries' identities and financial details private

A life insurance trust is a powerful tool for managing and protecting assets, especially in the context of life insurance policies. One of its key advantages is the ability to maintain privacy and confidentiality regarding the identities and financial details of beneficiaries. When you set up a trust, you can ensure that sensitive information remains secure and out of the public eye.

In the event of your passing, the trust acts as a legal entity that holds the life insurance proceeds. This means that the insurance company deals directly with the trust, and the beneficiaries' personal information is not exposed. The trust agreement, which outlines the distribution of funds, can be structured to provide specific instructions on how and when the beneficiaries receive their inheritance. This level of control ensures that the beneficiaries' identities and financial details are protected, especially if the trust is set up with a complex distribution plan.

The trust also provides a layer of privacy by allowing you to specify the conditions under which the beneficiaries can access their funds. You can set up triggers or conditions that must be met before the beneficiaries receive their inheritance, ensuring that the distribution process is controlled and secure. This level of control is particularly useful for families with complex financial situations or those who wish to protect their beneficiaries from potential financial pitfalls.

Furthermore, a life insurance trust can be designed to maintain confidentiality by keeping the details of the trust and its beneficiaries confidential. This is especially important if the beneficiaries are minors or if the trust is set up for charitable purposes. By keeping the trust's existence and the beneficiaries' information private, you can ensure that the distribution of assets is handled discreetly and according to your wishes.

In summary, a life insurance trust offers a robust solution for maintaining privacy and confidentiality. It provides a secure and controlled environment for managing life insurance proceeds, ensuring that the beneficiaries' identities and financial details remain private. This aspect of trust law is particularly valuable for those seeking to protect their loved ones' financial interests while also safeguarding their personal information.

Life Insurance: What if the Body is Missing?

You may want to see also

Long-Term Wealth Transfer: Trust ensures consistent wealth transfer over generations

A life insurance trust is a powerful tool for long-term wealth transfer, ensuring that assets are distributed according to the creator's wishes over generations. This type of trust is designed to provide a consistent and structured approach to wealth management, offering several advantages for those looking to secure their legacy. By utilizing a trust, individuals can avoid the complexities and potential delays of the probate process, which can often lead to significant tax implications and legal fees.

The primary purpose of a life insurance trust is to facilitate the smooth transfer of wealth while providing a layer of protection and control. When an individual purchases a life insurance policy and names the trust as the beneficiary, the proceeds from the policy are paid directly to the trust upon the insured's death. This immediate transfer of funds allows the trust to manage and distribute the wealth as intended, bypassing the often lengthy and public process of probate.

One of the key benefits of this approach is the ability to maintain control over the distribution of assets. The trust document, created by the grantor (the individual setting up the trust), outlines specific instructions for how the insurance proceeds should be utilized. This level of customization ensures that the wealth is transferred according to the grantor's specific goals, whether it's supporting family members, funding education, or contributing to charitable causes. Over time, the trust can be structured to provide consistent payments to beneficiaries, ensuring a steady flow of resources.

Furthermore, life insurance trusts offer a degree of protection and privacy. Since the trust is the direct recipient of the insurance payout, the details of the distribution are not made public, unlike in the case of a will, which becomes a matter of public record after probate. This privacy can be particularly important for high-net-worth individuals who wish to keep their financial affairs confidential.

In summary, a life insurance trust is an effective strategy for long-term wealth transfer, providing a structured and controlled approach to asset distribution. By utilizing this trust, individuals can ensure that their wealth is passed on consistently over generations, while also maintaining control, protection, and privacy for their beneficiaries. This method offers a sophisticated way to secure one's legacy and provide financial support to loved ones in a timely and efficient manner.

Finding Life Insurance Policies of the Deceased: A Guide

You may want to see also

Frequently asked questions

A Life Insurance Trust is a legal arrangement where an individual (the settlor) places a life insurance policy into a trust. The trust is typically set up to benefit a designated beneficiary or beneficiaries upon the settlor's death. The insurance policy becomes a trust asset, and the trust's terms dictate how the proceeds are distributed. This structure can provide tax advantages and ensure that the insurance money is paid out according to the settlor's wishes, bypassing the probate process.

There are several reasons to consider a Life Insurance Trust. Firstly, it offers privacy; the trust's terms are not made public, unlike a will, which can be a matter of public record. Secondly, it provides control over the distribution of the insurance proceeds, allowing the settlor to specify the timing and amount to be received by beneficiaries. Additionally, a Life Insurance Trust can help minimize estate taxes and ensure that the intended beneficiaries receive the funds quickly and efficiently.

Yes, there are various types of trusts that can be used with life insurance policies, each with its own advantages. A simple trust, for instance, is a basic arrangement where the settlor names a trustee to manage the policy and distribute the proceeds according to the trust's terms. An irrevocable trust, on the other hand, permanently transfers ownership of the policy to the trust, offering enhanced tax benefits. An annuitant trust is another type, where the insurance proceeds are used to provide income to a beneficiary for a specified period.

A Life Insurance Trust can provide several benefits to the designated beneficiaries. Firstly, it ensures that the insurance money is distributed according to the settlor's instructions, which can be especially important for minor children or beneficiaries who require financial support. The trust can also provide a steady stream of income to beneficiaries, as some trust structures allow for the distribution of interest or earnings from the insurance policy. Furthermore, the trust's terms can include provisions for the management and investment of the proceeds, potentially growing the assets over time.