Life insurance is a valuable financial tool that provides financial security for loved ones in the event of the insured's death. One of the key features of life insurance is the death benefit, which is the amount paid out to beneficiaries upon the insured's passing. While standard life insurance policies offer a fixed death benefit, some policies provide an option to increase the death benefit through dividends. In this article, we will explore the concept of life insurance dividend options and specifically focus on how these options can increase the death benefit, offering enhanced financial protection for policyholders and their families.

What You'll Learn

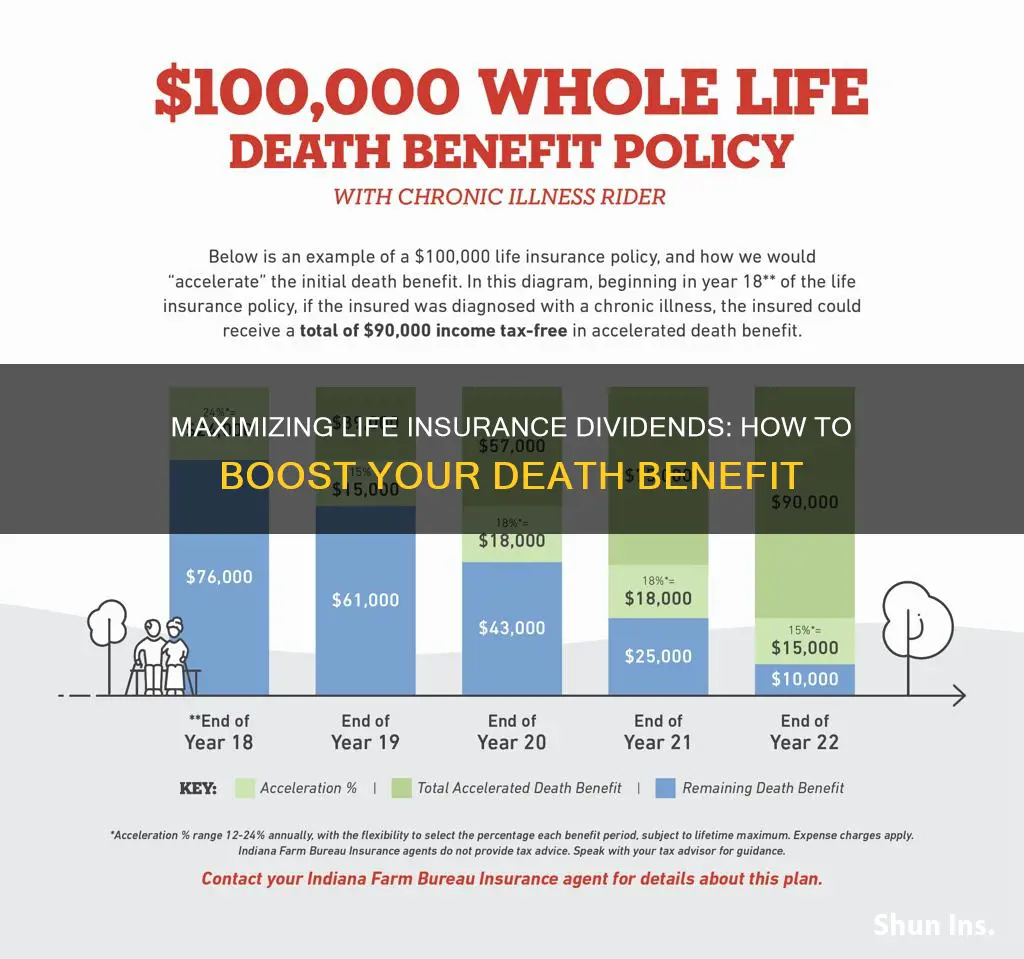

- Dividend-Paying Policies: Life insurance policies that pay dividends can increase the death benefit

- Dividend Reinvestment: Reinvesting dividends can grow the policy's cash value and increase the death benefit

- Dividend Options: Policyholders can choose to take dividends in cash or reinvest them

- Death Benefit Enhancement: Dividends can be used to enhance the death benefit through various options

- Dividend Payouts: Regular dividend payouts can provide financial security and increase the death benefit

Dividend-Paying Policies: Life insurance policies that pay dividends can increase the death benefit

Dividend-paying life insurance policies offer a unique and powerful feature that can significantly enhance the value of your life insurance coverage: the potential to increase the death benefit through dividends. This option is particularly attractive for those seeking to maximize the financial impact of their life insurance investment. Here's a detailed breakdown of how it works and why it's a valuable consideration.

When you opt for a dividend-paying policy, you're essentially choosing a life insurance plan that allows the insurer to reinvest a portion of the policy's earnings back into the policy itself. These earnings come from the investment of the policy's assets, and they can be paid out as dividends to policyholders. The key advantage here is that these dividends can be used strategically to boost the death benefit, which is the amount paid out upon the insured individual's passing.

The process is straightforward. Over time, the policy's value grows due to the investment of premiums. When the policy earns dividends, these funds can be allocated to increase the death benefit. This means that instead of being paid out as cash to beneficiaries, the dividends are used to purchase additional coverage, effectively raising the policy's death benefit. This strategy can be especially beneficial for those who want to ensure their loved ones receive a higher payout without necessarily increasing their monthly premiums.

One of the critical aspects of this option is its flexibility. Policyholders can choose how to utilize the dividends. They may decide to have the dividends reinvested to further grow the policy's value or opt to take the dividends in cash. If the policyholder decides to increase the death benefit, the dividends are directly applied to this purpose, providing a substantial boost to the policy's value. This flexibility allows individuals to tailor their life insurance strategy to their specific financial goals and circumstances.

In summary, dividend-paying life insurance policies offer a unique way to enhance the death benefit of your life insurance coverage. By strategically utilizing the dividends, you can increase the financial protection for your beneficiaries without necessarily increasing your monthly premiums. This option provides a powerful tool for those seeking to maximize the value of their life insurance investment and ensure a more secure financial future for their loved ones.

Bad Credit: A Deal-Breaker for Aspiring Life Insurance Agents?

You may want to see also

Dividend Reinvestment: Reinvesting dividends can grow the policy's cash value and increase the death benefit

Dividend Reinvestment: A Powerful Strategy for Growing Your Life Insurance Policy

One of the most effective ways to maximize the benefits of your life insurance policy is through dividend reinvestment. This strategy involves reinvesting the dividends earned by your policy back into the policy itself, allowing your investment to grow over time. Here's how it works and why it's a valuable option:

When you opt for dividend reinvestment, the dividends generated by your life insurance policy are automatically used to purchase additional policy units or shares. These additional units increase the overall value of your policy, known as the "cash value." The cash value is a crucial aspect of permanent life insurance policies, as it can be borrowed against or withdrawn to meet financial needs. By reinvesting dividends, you essentially compound your investment, leading to a substantial increase in the policy's value over the long term.

The beauty of this strategy lies in its ability to enhance the death benefit, which is the primary purpose of life insurance. As the cash value grows, it contributes to a larger reserve that can be used to pay out a more substantial death benefit upon your passing. This means that your beneficiaries will receive a higher payout, providing them with greater financial security during a challenging time. Dividend reinvestment essentially accelerates the growth of your policy, ensuring that your loved ones are protected with a more substantial financial safety net.

It's important to note that not all life insurance policies offer dividend reinvestment as an option. Typically, this feature is associated with permanent life insurance policies, such as whole life or universal life. These policies are designed to provide long-term coverage and accumulate cash value over time. When choosing a life insurance provider, ensure that they offer dividend reinvestment as a dividend option to maximize the potential growth of your policy.

In summary, dividend reinvestment is a powerful tool for growing the cash value of your life insurance policy and increasing the death benefit. By reinvesting dividends, you can compound your investment, leading to a more substantial financial safety net for your beneficiaries. This strategy is particularly beneficial for permanent life insurance policies, providing long-term value and protection. When considering your life insurance options, explore the dividend reinvestment feature to make the most of your policy's potential.

Federal Life Insurance USPS: Changing Your Coverage and Options

You may want to see also

Dividend Options: Policyholders can choose to take dividends in cash or reinvest them

Dividend options in life insurance policies provide policyholders with a flexible approach to managing their financial assets and can significantly impact the overall value of the policy. When it comes to choosing how to utilize these dividends, policyholders have two primary options: receiving them as cash or reinvesting them into the policy.

Taking dividends in cash offers policyholders immediate financial flexibility. This option allows individuals to access their money, providing them with the freedom to use it for various purposes. Whether it's for personal investments, debt repayment, or simply building an emergency fund, cash dividends give policyholders control over their finances. This can be particularly beneficial for those who prefer a more hands-on approach to managing their money and want to have direct access to their funds.

On the other hand, reinvesting dividends into the policy is a strategic move that can increase the death benefit over time. When policyholders choose to reinvest, the dividends are used to purchase additional insurance coverage, effectively boosting the policy's death benefit. This strategy is advantageous as it allows the policy to grow in value, providing a larger financial safety net for beneficiaries. By reinvesting, policyholders can ensure that their insurance coverage keeps pace with their financial goals and provides enhanced protection for their loved ones.

The decision between cashing out and reinvesting depends on the policyholder's financial objectives and risk tolerance. Some individuals may prefer the immediate liquidity that cash dividends offer, while others might view reinvestment as a long-term strategy to maximize the policy's potential. It is essential to carefully consider the policy's terms and conditions regarding dividend options to make an informed choice.

In summary, life insurance policies with dividend options empower policyholders to make strategic decisions about their financial well-being. By choosing between cashing out or reinvesting dividends, individuals can tailor their insurance plans to align with their unique needs and goals, ensuring a more secure future for themselves and their beneficiaries.

Life Insurance: A Legitimate Business Expense?

You may want to see also

Death Benefit Enhancement: Dividends can be used to enhance the death benefit through various options

Dividends in life insurance policies can be a powerful tool for policyholders, offering an opportunity to enhance the death benefit and provide additional financial security. When a life insurance policy accumulates dividends, it means the policy has performed well, and the insurance company has generated surplus earnings. These dividends can be utilized in several ways to increase the overall value of the policy and benefit the policyholder's beneficiaries.

One common method to enhance the death benefit is by opting for a "Dividend Reinvestment" plan. This option allows policyholders to reinvest the accumulated dividends back into the policy. Over time, this strategy can lead to a substantial increase in the policy's cash value, which, in turn, boosts the death benefit. By reinvesting, the policy grows exponentially, ensuring that the death benefit is significantly higher than the initial policy value. This approach is particularly advantageous for long-term policies, as the compounded effect of reinvesting dividends can be substantial.

Another strategy is to choose a "Dividend Option" that directly increases the death benefit. Some life insurance companies offer policies with dividend options that allow policyholders to allocate a portion of the dividends to increase the death benefit. This option provides a more immediate and tangible benefit, as the death benefit is directly enhanced by the dividends. For example, a policyholder might choose to allocate 50% of the dividends to the death benefit, ensuring that the beneficiaries receive a larger payout upon the insured's passing.

Additionally, some policies offer a "Dividend Bonus" feature, which is a percentage of the policy's cash value that is added to the death benefit each year. This bonus can accumulate over time, further enhancing the overall death benefit. The bonus amount is typically a fixed percentage, and it grows as the policy's cash value increases, providing a consistent and predictable way to boost the death benefit.

In summary, life insurance dividends offer policyholders various ways to enhance the death benefit. Through dividend reinvestment, direct allocation of dividends to the death benefit, and dividend bonus features, individuals can ensure that their beneficiaries receive a more substantial payout when the policy matures or upon the insured's death. Understanding these options and choosing the one that best aligns with financial goals is essential for maximizing the value of a life insurance policy.

Life Insurance Expiry: Understanding the Fine Print

You may want to see also

Dividend Payouts: Regular dividend payouts can provide financial security and increase the death benefit

Dividend Payouts: Regular dividend payouts can be a powerful feature of certain life insurance policies, offering both financial security and an opportunity to increase the death benefit. This option is particularly attractive to those seeking a more active approach to managing their insurance policy. When you opt for regular dividend payouts, a portion of the policy's earnings is distributed to the policyholder as dividends. These dividends can be used in various ways to enhance the policy's performance and provide additional financial benefits.

One of the key advantages of this option is the potential to increase the death benefit. Life insurance companies often reinvest the dividends into the policy, which can lead to a higher cash value accumulation over time. As the cash value grows, it can be used to increase the death benefit, providing a larger payout upon the insured's passing. This strategy is especially beneficial for those who want to ensure their loved ones receive a substantial financial cushion in the event of their untimely demise.

The process typically involves the insurance company crediting the policy's account with the accumulated dividends. These credits can then be used to purchase additional insurance coverage, effectively boosting the death benefit. Over time, this can result in a substantial increase in the policy's value, providing financial security for the policyholder and their beneficiaries. It's important to note that the frequency and amount of dividend payouts can vary depending on the insurance company and the specific policy terms.

Regular dividend payouts also offer a level of financial security and control. Policyholders can choose to reinvest the dividends to further grow the policy's value or opt to receive them as cash withdrawals. This flexibility allows individuals to tailor the policy to their financial goals and risk tolerance. Additionally, the dividends can be used to pay premiums, ensuring the policy remains in force and providing continuous financial protection.

In summary, the dividend payout option in life insurance provides a strategic way to enhance financial security and increase the death benefit. By regularly distributing a portion of the policy's earnings, this feature allows policyholders to actively manage and grow their insurance policy, offering peace of mind and a potential financial safety net for their loved ones. It is a valuable consideration for those seeking a more proactive approach to life insurance planning.

Who Owns MetLife Insurance Now? New Owner, Same Coverage?

You may want to see also

Frequently asked questions

A life insurance dividend option is a feature offered by some insurance companies that allows policyholders to participate in the company's profits. When the insurance company performs well financially, it may distribute a portion of its surplus to policyholders in the form of dividends. These dividends can be used to increase the death benefit of the policy, providing a higher payout to the beneficiary upon the insured individual's passing. This option is particularly attractive for those seeking additional financial security and the potential for higher returns.

The dividend option typically involves a policyholder choosing to allocate a portion of their premium payments into an investment account. This account is managed by the insurance company and can accumulate dividends over time. When the insured individual dies, the death benefit is calculated based on the total value of the policy, including any accumulated dividends. This means the death benefit can grow beyond the initial premium amount, offering a more substantial financial safety net for the beneficiary.

While the dividend option can provide potential benefits, it also carries certain risks. The insurance company's investment performance is not guaranteed, and there is a possibility that the accumulated dividends may decrease in value. Additionally, policyholders should be aware of any fees or charges associated with the dividend option, as these can impact the overall value of the policy. It is essential to carefully review the terms and conditions of the policy and consult with a financial advisor to understand the potential risks and benefits before making a decision.