When life insurance is paid in full, it signifies the completion of a financial commitment made by the policyholder to the insurance company. This milestone marks the end of regular premium payments, allowing the policyholder to enjoy the peace of mind that their loved ones will be financially protected in the event of their passing. It also signifies the successful fulfillment of the insurance contract, ensuring that the policyholder has fulfilled their obligations and can now reap the benefits of their investment.

What You'll Learn

- Premiums: Regular payments made to maintain coverage

- Benefits: Payouts to beneficiaries upon the insured's death

- Term Length: Duration of coverage, e.g., 10, 20, or 30 years

- Riders: Additional coverage options, like critical illness riders

- Conversion Options: Ability to convert term life to permanent life

Premiums: Regular payments made to maintain coverage

When it comes to life insurance, understanding the concept of premiums is crucial. Premiums are the regular payments made by policyholders to maintain their life insurance coverage. These payments ensure that the insurance company can fulfill its commitment to provide financial protection to the policyholder's beneficiaries in the event of their passing.

In simple terms, a premium is the cost of keeping your insurance policy active. It is typically paid at regular intervals, such as annually, semi-annually, quarterly, or monthly. The frequency of premium payments can vary depending on the insurance company and the policyholder's preferences. It is essential to set aside the necessary funds to make these payments on time to avoid any disruptions in coverage.

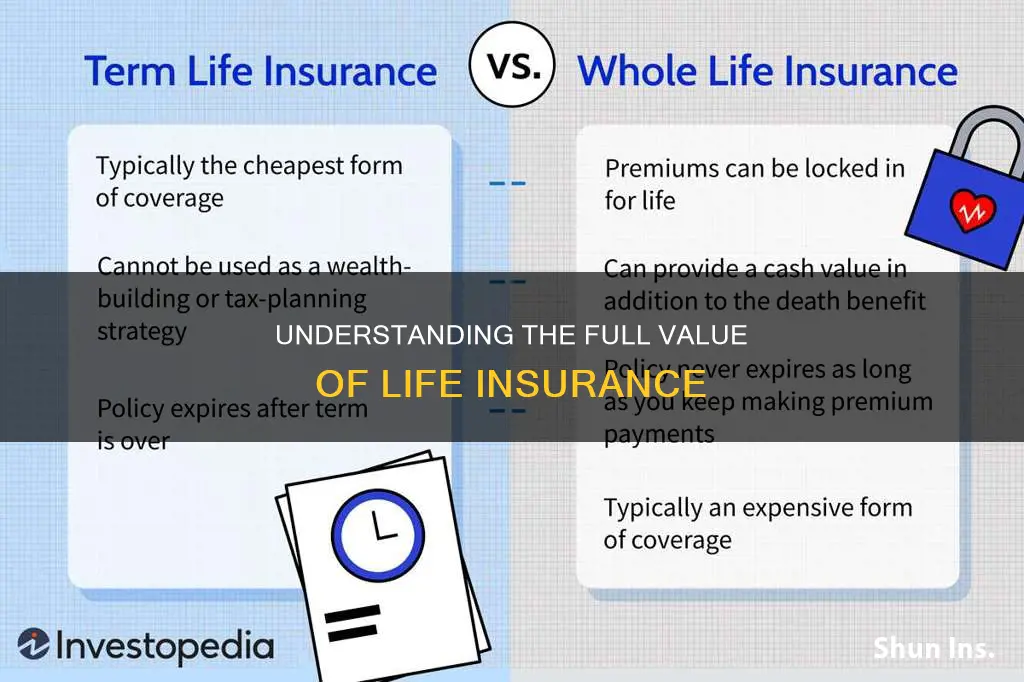

The amount of the premium is determined by several factors, including the type of life insurance policy, the coverage amount, the policyholder's age, health, and lifestyle. For instance, term life insurance, which provides coverage for a specified period, usually has lower premiums compared to permanent life insurance, which offers lifelong coverage. Additionally, a healthier lifestyle and lower risk factors can result in reduced premiums, as insurance companies consider these factors when assessing the likelihood of paying out a claim.

Paying premiums on time is vital to ensure that your life insurance policy remains in force. If a premium payment is missed, the policy may enter a grace period, typically 30 days, during which the policy remains active. However, if the premium is not paid within this grace period, the policy may lapse, and coverage could be terminated. It is the policyholder's responsibility to keep track of payment due dates to avoid any potential gaps in coverage.

In summary, premiums are the regular financial contributions made by individuals to sustain their life insurance coverage. Understanding the factors influencing premium amounts and ensuring timely payments are essential to maintaining the policy's validity. By staying informed and proactive, policyholders can ensure that their loved ones receive the financial protection they deserve when the need arises.

Group Term Life Insurance: Taxable in New Jersey?

You may want to see also

Benefits: Payouts to beneficiaries upon the insured's death

When life insurance is fully paid, it means the policyholder has completed all the necessary payments and the insurance policy is now in force. One of the primary benefits of having a fully paid life insurance policy is the peace of mind it provides. Policyholders can rest assured that their loved ones will be financially protected in the event of their passing. This benefit is especially crucial for those who have dependents, such as children or a spouse, as it ensures that their financial needs will be met even when they are no longer around.

The payout to beneficiaries is a significant advantage of life insurance. Upon the insured's death, the beneficiaries named in the policy will receive a lump sum payment, which can be a substantial financial support. This payout can help cover various expenses, including funeral costs, outstanding debts, mortgage payments, or even provide a financial cushion for the beneficiaries to maintain their standard of living. The amount paid out is typically tax-free, providing immediate financial relief to the beneficiaries during a difficult time.

Life insurance payouts can also be used to fulfill specific wishes or goals. For instance, it can be used to pay for a child's education, ensuring that their future is financially secure. Additionally, the money can be invested to grow over time, providing long-term financial benefits to the beneficiaries. This aspect of life insurance is particularly valuable for those who want to leave a lasting legacy or ensure their family's financial stability for generations to come.

Furthermore, the payout can be a powerful tool for estate planning. It can help settle estates, pay for probate fees, and ensure that the distribution of assets according to the policyholder's wishes is carried out efficiently. This benefit is especially important for those with complex financial situations or large estates, as it provides a structured way to manage and protect their assets.

In summary, having a fully paid life insurance policy offers a range of benefits, with the payout to beneficiaries being a key advantage. It provides financial security, peace of mind, and the ability to fulfill personal goals or estate planning objectives. By ensuring that the policy is in force, individuals can leave a lasting impact and provide for their loved ones even after their passing.

Trustee Sisters: Life Insurance and Family Dynamics

You may want to see also

Term Length: Duration of coverage, e.g., 10, 20, or 30 years

When considering life insurance, one of the most critical decisions you'll make is choosing the term length, which determines the duration of your coverage. This decision is crucial as it directly impacts the level of financial protection you and your loved ones will have during specific life stages. The term length options typically range from 10, 20, to 30 years, each offering unique advantages and considerations.

A 10-year term policy provides a relatively short-term safety net. This option is ideal for individuals who want immediate coverage for a specific period, such as those taking out a mortgage or those with a child's education fund to secure. It offers a straightforward and cost-effective solution, as premiums are generally lower compared to longer-term policies. However, it's important to note that a 10-year term will not provide coverage for an extended period, and you'll need to reconsider your insurance needs after this duration.

For a more comprehensive long-term solution, a 20-year term life insurance policy is a popular choice. This term length is often selected by those who want coverage to align with significant financial commitments, such as a mortgage or a child's college education, which typically last for two decades. By choosing 20 years, you ensure that your loved ones are protected during these critical periods, providing a sense of financial security. The premiums for a 20-year term are generally higher than a 10-year term but lower than a 30-year term, striking a balance between affordability and coverage duration.

The 30-year term life insurance policy offers the longest coverage period, providing financial protection for three decades. This option is suitable for individuals who want a more extended safety net, ensuring their loved ones are covered throughout their most dependent years. With a 30-year term, you can rest assured that your family will have the necessary financial support during significant life events, such as raising a family or supporting aging parents. While the premiums for this term length are the highest, it provides the most extended period of coverage, making it a comprehensive choice.

In summary, the term length of your life insurance policy is a critical factor in determining the level of protection you and your family will have. Whether you opt for a 10, 20, or 30-year term, each duration offers unique benefits. It's essential to assess your financial goals, commitments, and the level of coverage you require to make an informed decision. Consulting with a financial advisor can help you navigate these options and choose the term length that best suits your needs and provides the necessary peace of mind.

Life Insurance and Jeff Bezos: Does He Need It?

You may want to see also

Riders: Additional coverage options, like critical illness riders

When considering comprehensive life insurance coverage, it's essential to explore the various riders available to enhance your policy. One such valuable rider is the Critical Illness rider, which provides an additional layer of financial protection during challenging times. This rider is designed to offer financial support when you are diagnosed with a critical illness, ensuring that you and your loved ones are financially secure even when facing significant health challenges.

Critical Illness insurance riders typically cover a range of serious medical conditions, including heart attacks, strokes, cancer, and other critical illnesses. When activated, the rider pays out a lump sum benefit, which can be used to cover various expenses, such as medical bills, home modifications for accessibility, or even to replace lost income if you are unable to work. This financial support can significantly ease the financial burden associated with a critical illness, allowing you to focus on recovery and rehabilitation.

The beauty of this rider lies in its ability to provide peace of mind. Knowing that you have this additional coverage can reduce the stress and anxiety associated with a serious health diagnosis. It empowers you to take control of your financial future and ensures that your loved ones are protected, even in the event of a critical illness. This rider is particularly valuable for individuals with pre-existing health conditions or those with a family history of critical illnesses, as it provides an extra layer of security.

When reviewing your life insurance policy, it's crucial to understand the specific terms and conditions of any riders included. Different insurance providers may offer variations in coverage, benefits, and eligibility criteria. Some riders might require a certain age or health status to be eligible, while others may have waiting periods before the coverage becomes active. It's advisable to consult with a financial advisor or insurance specialist to ensure you choose the right riders to complement your life insurance policy.

In summary, Critical Illness riders are an excellent way to customize your life insurance policy and provide comprehensive protection. By understanding the benefits and terms of these riders, you can make informed decisions to safeguard your financial well-being and that of your loved ones. Remember, when it comes to life insurance, exploring all available options, including riders, can lead to a more secure and personalized coverage plan.

Life Insurance for Seniors: Is It Possible?

You may want to see also

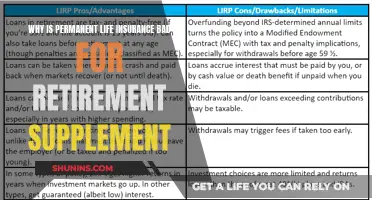

Conversion Options: Ability to convert term life to permanent life

When considering life insurance, one of the key decisions you'll make is the type of policy you choose. Term life insurance is a popular and affordable option, providing coverage for a specific period, typically 10, 20, or 30 years. It offers a straightforward way to protect your loved ones financially during that time. However, many individuals prefer the long-term security of permanent life insurance, which provides coverage for your entire life. One of the advantages of term life insurance is the flexibility it offers, especially when it comes to conversion options.

Conversion options allow policyholders to switch from term life to permanent life insurance without the need for a medical examination or additional underwriting. This feature is particularly beneficial for those who initially opt for term life but later realize the need for more permanent coverage. The process is often straightforward and can be done at any time during the term policy period. When you purchase a term life insurance policy, the insurer will typically offer a conversion privilege, allowing you to convert it to a permanent policy without any additional health questions or medical tests.

The conversion process is designed to be convenient and efficient. You can usually notify your insurer of your intention to convert, and they will guide you through the necessary steps. This option is especially valuable if you have a changing financial situation or if your family's needs evolve over time. For instance, you might start with a term policy when you're young and in good health, but as you age and your family's responsibilities grow, you may want to ensure that your loved ones are protected for the long term.

By converting to permanent life insurance, you gain the assurance of lifelong coverage without the need to reapply or undergo a new medical evaluation. This is in contrast to purchasing a permanent policy from scratch, which often requires a thorough medical assessment. The conversion option provides a seamless transition, ensuring that your coverage keeps up with your changing life circumstances. It's a strategic move that allows you to adapt your insurance plan as your life progresses.

In summary, the ability to convert term life to permanent life insurance is a valuable feature that provides policyholders with flexibility and long-term security. This option ensures that your insurance needs can be met as your life changes, offering peace of mind and financial protection for your loved ones. Understanding the conversion process and its benefits can help you make informed decisions about your life insurance coverage.

Life Insurance Rates: The 35-Year Spike Explained

You may want to see also

Frequently asked questions

When life insurance is paid in full, it refers to the state where the policyholder has fully paid the premiums for the insurance coverage. This means the policy is no longer in an active payment phase and is considered a mature or matured policy. The policyholder has fulfilled their financial obligation towards the insurance company, and the insurance coverage is now in effect for the entire term as per the policy's terms and conditions.

To determine if your life insurance policy is fully paid, you can review your policy documents or contact your insurance provider. They will have a record of your payment history and can provide information on the status of your premiums. Typically, a fully paid policy will have a 'matured' or 'paid-up' status indicated in the policy's documentation.

Yes, there are several advantages to having a fully paid-up life insurance policy. Firstly, you no longer have the financial burden of regular premium payments. Secondly, the policy provides guaranteed coverage for the entire term, ensuring that your beneficiaries receive the death benefit as per the policy's terms. Additionally, a fully paid policy can be a valuable asset, potentially providing tax benefits or being used as collateral for loans.

While a fully paid life insurance policy is no longer subject to regular premium payments, you may still have the option to make changes or adjustments to the policy. This could include modifying the coverage amount, changing beneficiaries, or adding riders or endorsements. However, these changes might be subject to certain conditions and may require additional fees or documentation. It's best to consult with your insurance provider to understand the specific options available to you.