Life insurance can be a complex financial product, and understanding its tax implications is essential for policyholders. When it comes to life insurance distribution, the tax reporting process can vary depending on the type of policy and the jurisdiction. In this paragraph, we will explore the various factors that determine where and how life insurance distribution is reported on taxes, ensuring that individuals are aware of their obligations and rights in this financial matter.

What You'll Learn

- Premiums Paid: Life insurance premiums paid are deductible and reported on tax returns

- Proceeds Received: Tax implications of life insurance proceeds received by beneficiaries

- Policy Loans: Interest on policy loans is taxable income and must be reported

- Surrenders: Surrenders of cash values from policies are taxable and reported as income

- Policy Sales: Selling a life insurance policy can trigger tax consequences and reporting requirements

Premiums Paid: Life insurance premiums paid are deductible and reported on tax returns

Life insurance is a financial product that provides financial security to individuals and their beneficiaries in the event of the insured's death. When it comes to taxes, understanding where life insurance distribution gets reported is essential for policyholders and tax professionals alike. One crucial aspect is the treatment of life insurance premiums paid, which can have significant implications for an individual's tax return.

Premiums paid for life insurance policies are generally considered a deductible expense. This means that the amount paid towards these premiums can be subtracted from an individual's taxable income, reducing their overall tax liability. This deduction is available to both individuals and businesses, providing a financial benefit to those who purchase life insurance. When filing a tax return, policyholders can claim the premiums paid as a deduction, ensuring that a portion of their insurance costs is not subject to taxation.

The process of reporting life insurance premiums on tax returns involves a few key steps. Firstly, individuals must ensure that they have the necessary documentation, including proof of premium payments. This documentation is typically provided by the insurance company and may include receipts or payment statements. It is essential to keep these records organized and readily available during the tax filing process.

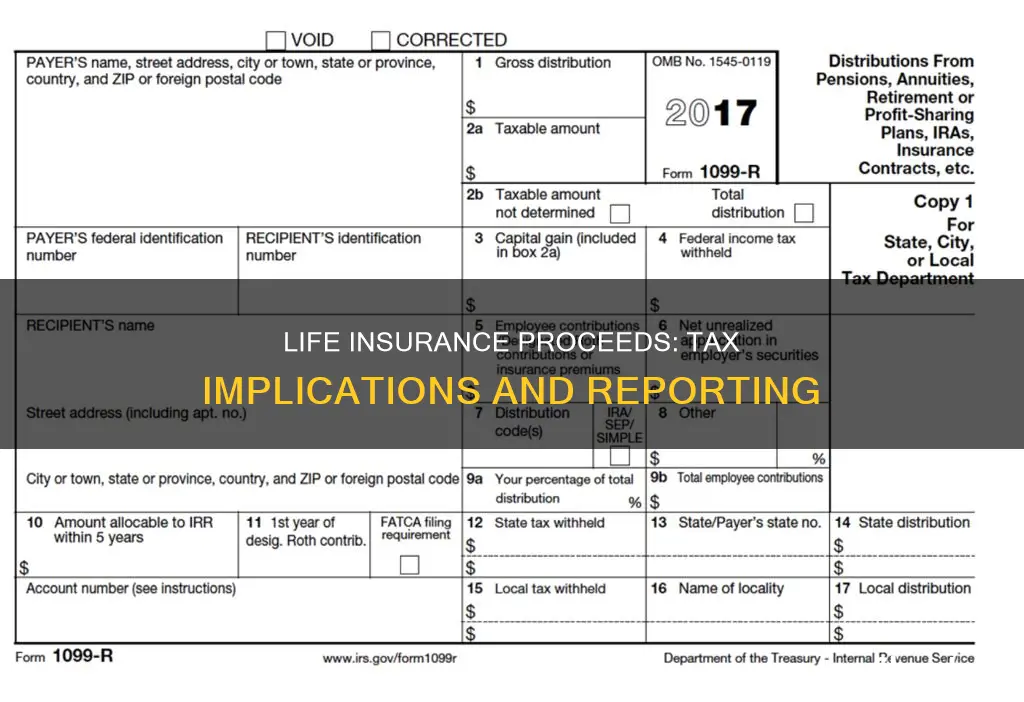

When preparing the tax return, policyholders should consult the relevant tax forms and instructions provided by the tax authorities in their jurisdiction. For example, in the United States, Form 1099-INT or Form 1040, Schedule A, may require information about life insurance premiums. Accurate reporting of these premiums is crucial to ensure compliance with tax laws and to take full advantage of the available deductions.

By deducting life insurance premiums, individuals can effectively lower their taxable income, which can result in a reduced tax burden. This deduction is particularly beneficial for those with substantial insurance premiums, as it allows them to keep more of their income. Additionally, proper reporting of these premiums ensures transparency and helps individuals stay in compliance with tax regulations, avoiding any potential penalties or legal issues.

Credit Union Members: Life Insurance Coverage and Benefits

You may want to see also

Proceeds Received: Tax implications of life insurance proceeds received by beneficiaries

When a life insurance policyholder passes away, the beneficiaries receive a payout, known as life insurance proceeds. These proceeds are generally tax-free and can provide a significant financial benefit to the recipients. However, understanding the tax implications is crucial for beneficiaries to ensure compliance with the law and avoid any potential issues.

The tax treatment of life insurance proceeds varies depending on the jurisdiction and the specific circumstances. In many countries, including the United States, life insurance payments made to beneficiaries are typically exempt from income tax. This means that the beneficiaries do not have to report the proceeds as income on their tax returns. The insurance company is responsible for reporting the payment to the tax authorities, and the beneficiaries are not required to take any action regarding this reporting.

However, there are a few important points to consider. Firstly, if the deceased had any outstanding loans or debts secured by the life insurance policy, the proceeds may be used to repay these obligations. In such cases, the beneficiaries might be responsible for any remaining debt, and the tax treatment could be different. Secondly, if the policy was a modified endowment contract (MEC) in the US, the proceeds may be subject to income tax. MECs are typically those with a guaranteed death benefit and certain other features. It is essential to review the policy details to determine its classification.

Additionally, beneficiaries should be aware of the potential impact on their estate tax obligations. In some jurisdictions, life insurance proceeds may be considered part of the deceased's estate and could be subject to estate tax. This is especially relevant if the policy was owned by the deceased and not in a trust or another tax-efficient structure. Consulting with a tax professional or financial advisor is advisable to navigate these complexities and ensure proper reporting.

In summary, life insurance proceeds received by beneficiaries are generally tax-free, but beneficiaries should be cautious of potential exceptions and seek professional advice to ensure compliance with tax laws. Understanding the tax implications is essential to make informed financial decisions and avoid any legal consequences.

Employee Life Insurance: Voluntary Benefits Worth the Cost?

You may want to see also

Policy Loans: Interest on policy loans is taxable income and must be reported

When it comes to life insurance, one of the lesser-known aspects is the taxation of policy loans. If you have a life insurance policy with a cash value component and you take out a loan against that policy, the interest you pay on that loan is considered taxable income. This is an important consideration for policyholders, as it can impact their overall tax liability.

The process begins with understanding the nature of policy loans. These loans are typically secured by the cash value of the life insurance policy. When you borrow money from your policy, the insurance company acts as the lender. The loan is repaid with interest, and this interest is what needs to be reported as taxable income. It's crucial to recognize that this interest is not just a standard loan repayment but a distribution from the policy's cash value.

Taxpayers must report the interest on policy loans as taxable income on their annual tax returns. This is because the interest earned is considered a distribution from the policy's cash value, which is subject to taxation. The amount reported will depend on the loan's principal and the interest accrued during the tax year. Policyholders should carefully track these details to ensure accurate reporting.

To calculate the taxable amount, one needs to determine the interest earned on the loan. This can be done by multiplying the loan's principal by the interest rate and then considering any interest accrued over the tax year. Once the interest is calculated, it becomes a part of the policyholder's taxable income for that year. It is essential to report this accurately to avoid any penalties or issues with the tax authorities.

In summary, policyholders should be aware that interest on policy loans is taxable income and must be reported. This is a specific aspect of life insurance taxation that can significantly impact an individual's financial obligations. Staying informed about such details ensures compliance with tax regulations and helps individuals manage their overall tax liability effectively.

Child Life Insurance: Rollover Options for Parents

You may want to see also

Surrenders: Surrenders of cash values from policies are taxable and reported as income

When it comes to life insurance, understanding the tax implications of policy surrenders is crucial for policyholders. Surrenders, which refer to the withdrawal of cash values from life insurance policies, can have significant tax consequences. Here's a detailed explanation of how surrenders are taxed and reported:

Surrenders of cash values from life insurance policies are generally taxable events. When a policyholder surrenders a portion of the cash value, it is considered a distribution from the policy, similar to taking a loan or making a withdrawal from a retirement account. This distribution is taxable income for the policyholder, meaning it is subject to income tax. The amount surrendered is typically reported on the policyholder's tax return, specifically on Form 1099-R, which is a form used to report distributions from retirement plans and insurance contracts. This form provides details about the distribution, including the amount, the tax-free portion (if any), and the taxable amount.

The tax treatment of surrenders can vary depending on the type of life insurance policy and the policyholder's situation. For instance, in some cases, a portion of the cash value may be considered tax-free if it is taken as a loan or a withdrawal of earnings. However, if the surrender amount exceeds the policy's cash value minus any outstanding loan balances, the entire amount surrendered will be taxable. It is essential to consult with a tax professional or financial advisor to understand the specific tax rules applicable to your policy and to ensure compliance with tax regulations.

Reporting surrenders on taxes is an important aspect of managing your finances and ensuring that you are aware of your taxable income. By understanding the tax implications, policyholders can make informed decisions about surrenders and plan their financial strategies accordingly. Remember, proper tax reporting is essential to avoid any potential penalties or legal issues associated with non-compliance.

In summary, surrenders of cash values from life insurance policies are taxable events, and the amount surrendered is reported as income on the policyholder's tax return. It is crucial to be aware of these tax implications and seek professional advice to navigate the complexities of tax reporting for life insurance distributions.

Primerica Life Insurance: Payout Process and Benefits Explained

You may want to see also

Policy Sales: Selling a life insurance policy can trigger tax consequences and reporting requirements

Selling a life insurance policy can have significant tax implications, and understanding these consequences is crucial for both the seller and the buyer. When an individual decides to sell their life insurance policy, it is essential to be aware of the reporting requirements and potential tax liabilities. The process involves a complex interplay of tax laws and regulations, which can vary depending on the jurisdiction and the specific circumstances of the sale.

In many countries, the sale of a life insurance policy is considered a taxable event. This means that the proceeds from the sale, often referred to as the "policy cash value" or "surrender value," may be subject to taxation. The tax authorities typically treat the sale as a taxable income event, similar to the sale of other assets. The seller must report the amount received from the policy sale on their tax return, which could result in capital gains tax obligations. The tax rate applied will depend on the seller's income, the holding period of the policy, and the tax laws in their country of residence.

Reporting requirements can vary, but often, the seller is required to provide detailed information to the tax authorities. This includes the original cost of the policy, any premiums paid, the sale price, and the date of the sale. In some cases, the seller might need to obtain a valuation of the policy from an independent appraiser to ensure accurate reporting. It is essential to keep thorough records of these transactions to comply with tax regulations.

Additionally, the tax consequences can be further complicated if the policy has been owned for an extended period, allowing for potential tax advantages like tax-deferred growth. Selling such a policy may trigger a higher tax rate, especially if the seller has held the policy for more than a year. Tax laws often differentiate between short-term and long-term capital gains, with the latter typically being taxed at a lower rate.

To navigate these tax implications, individuals should consult with tax professionals or financial advisors who specialize in insurance-related matters. They can provide guidance on the best course of action, including the potential benefits of keeping the policy or exploring alternative options that may offer more favorable tax treatment. Understanding the tax rules and seeking professional advice can help individuals make informed decisions when selling their life insurance policies.

Term vs Life Insurance: Is It Worth the Switch?

You may want to see also

Frequently asked questions

Life insurance distributions are typically reported on Form 1099-R, which is a form that financial institutions use to report distributions from retirement plans, including life insurance policies. This form will show the total amount distributed and the tax implications, such as the taxable amount and any applicable tax credits or deductions. You will need to include this information on your annual tax return, usually Form 1040, to accurately report your income and any associated taxes.

The taxable amount of a life insurance distribution is generally the amount received minus any qualified death proceeds. Qualified death proceeds are typically tax-free payments made to beneficiaries upon the insured individual's death. To calculate the taxable amount, subtract the qualified death proceeds from the total distribution received. Any remaining amount will be subject to income tax.

In some cases, you may be eligible for certain tax deductions or credits related to life insurance distributions. For example, if you use the death proceeds to pay for qualified medical expenses or funeral costs, you may be able to deduct those expenses from your taxable income. Additionally, if you receive a life insurance distribution as a beneficiary, you might qualify for a tax credit for the amount received, depending on the jurisdiction and specific tax laws. It's important to consult with a tax professional to understand your eligibility for these benefits.