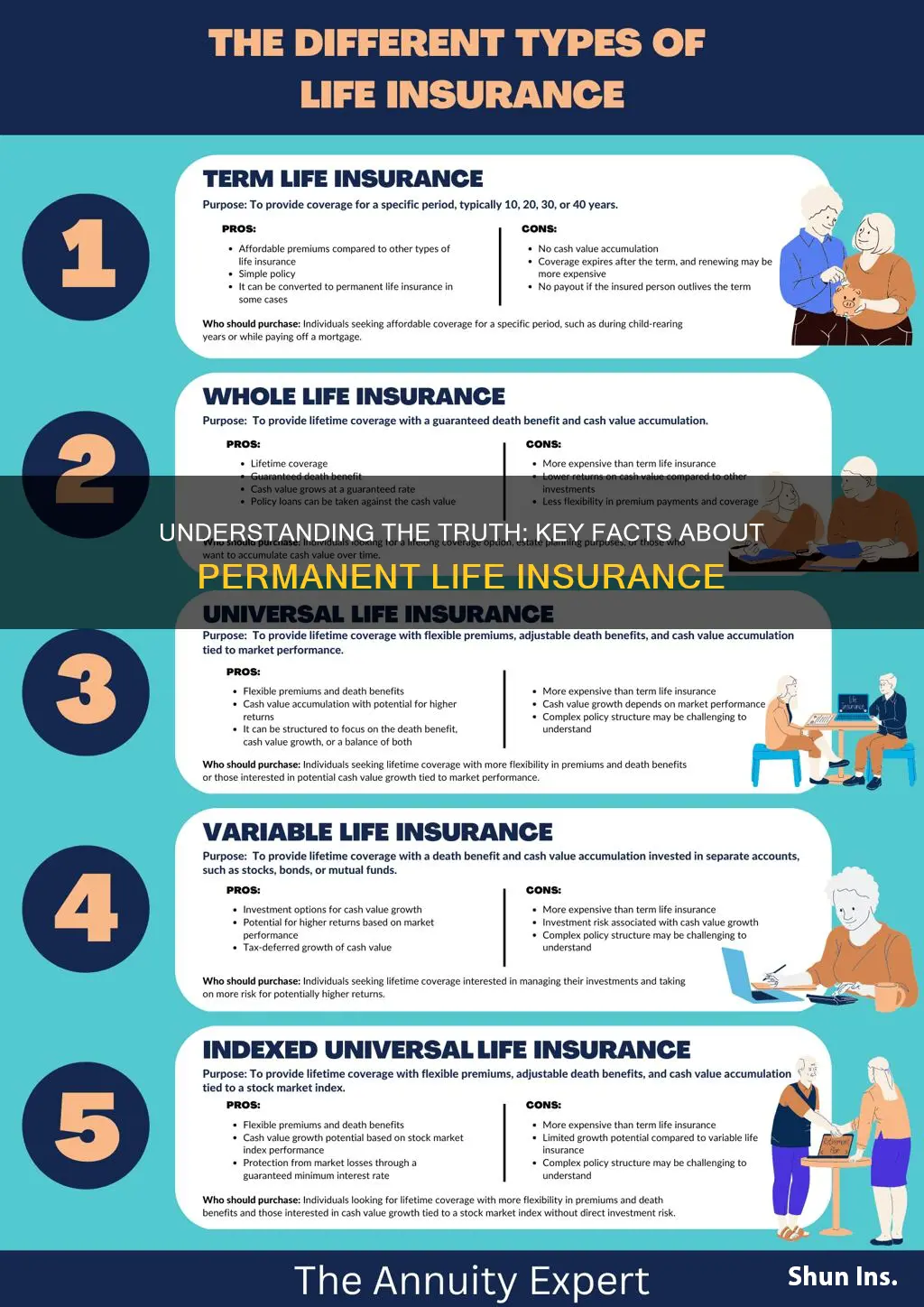

Permanent life insurance, also known as whole life insurance, is a long-term financial product that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specific period, permanent life insurance offers a combination of death benefit protection and a cash value component that grows over time. This type of insurance is designed to provide financial security and peace of mind, as it offers a guaranteed death benefit and a permanent investment component. The cash value in permanent life insurance can be borrowed against or withdrawn, providing flexibility and potential financial benefits for the policyholder. Understanding the features and benefits of permanent life insurance is essential for individuals seeking long-term financial protection and investment opportunities.

What You'll Learn

- Premiums: Permanent life insurance has fixed premiums, ensuring consistent costs over time

- Death Benefit: The death benefit is guaranteed and remains the same throughout the policy's duration

- Cash Value: It builds cash value, which can be borrowed or withdrawn tax-free

- Long-Term Coverage: Provides long-term financial security and coverage for a lifetime

- Tax Advantages: Permanent policies offer tax benefits, including tax-deferred growth and potential tax-free withdrawals

Premiums: Permanent life insurance has fixed premiums, ensuring consistent costs over time

When considering permanent life insurance, one of the key advantages is the stability and predictability it offers in terms of premium payments. Unlike term life insurance, which has variable premiums that can increase over time, permanent life insurance is designed with a fixed premium structure. This means that once you've chosen a policy and started making payments, the amount you pay each month, quarter, or year will remain consistent throughout the life of the policy.

For individuals and families, this predictability is a significant benefit. It allows for better financial planning, as you can budget and allocate funds more effectively knowing that your insurance premiums will not fluctuate. The fixed nature of these premiums also means that you won't face unexpected increases, which can be a common concern with other types of insurance. This consistency can provide peace of mind, especially for those who have already invested in a permanent life insurance policy and are comfortable with the long-term commitment it entails.

The fixed premium structure of permanent life insurance is often a result of the policy's dual purpose. It provides both death benefit coverage and a cash value component, which grows tax-deferred over time. The combination of these features allows the insurance company to offer a stable premium, as the cash value helps to offset the costs associated with providing the death benefit. This is in contrast to term life insurance, where the primary focus is on providing coverage for a specified period, often at a lower initial cost but with the potential for premium increases.

In summary, permanent life insurance's fixed premiums are a defining characteristic that sets it apart from other forms of life insurance. This feature ensures that policyholders can maintain consistent financial obligations, providing a sense of security and stability for the long term. Understanding this aspect is crucial for anyone considering permanent life insurance as a part of their financial strategy.

Tricare for Life: Primary Insurance with Medicare as Secondary

You may want to see also

Death Benefit: The death benefit is guaranteed and remains the same throughout the policy's duration

When considering permanent life insurance, it's important to understand the concept of the death benefit, which is a fundamental aspect of this type of insurance. The death benefit is a guaranteed amount that the insurance company will pay out to the policyholder's beneficiaries upon the insured individual's death. This guarantee is a key feature that sets permanent life insurance apart from other forms of life insurance.

In permanent life insurance, the death benefit is locked in and does not change over the life of the policy. This means that no matter how long the policy remains in force, the death benefit will remain the same. For example, if you purchase a $200,000 permanent life insurance policy at age 30, the death benefit will be $200,000 for the entire duration of the policy, even if you outlive the expected lifespan. This guarantee provides a sense of security and predictability, ensuring that your loved ones will receive the intended financial support when you pass away.

The consistency of the death benefit is a significant advantage of permanent life insurance. Unlike term life insurance, where the death benefit decreases over time, permanent policies offer long-term financial protection. This is particularly valuable for those who want to provide for their family's long-term needs, such as covering education expenses, mortgage payments, or other financial obligations that may extend beyond a fixed term.

Furthermore, the guaranteed death benefit allows policyholders to plan and budget with confidence. Knowing that the death benefit will remain constant enables individuals to make informed financial decisions and ensure that their loved ones are adequately protected. This predictability is especially important for those with complex financial situations or those who want to leave a substantial inheritance.

In summary, permanent life insurance offers a guaranteed death benefit that remains constant throughout the policy's duration. This feature provides long-term financial security and peace of mind, ensuring that your beneficiaries will receive the intended financial support when it matters most. Understanding this aspect of permanent life insurance is crucial for making informed decisions about your life coverage needs.

Black Americans and Life Insurance: Who Has Coverage?

You may want to see also

Cash Value: It builds cash value, which can be borrowed or withdrawn tax-free

Permanent life insurance, also known as whole life insurance, is a long-term financial product that offers a range of benefits, one of which is the accumulation of cash value. This feature is a significant advantage of permanent life insurance and sets it apart from other insurance types.

The cash value component in permanent life insurance is a unique aspect that allows policyholders to build a savings element within their insurance policy. Over time, a portion of the premiums paid goes into this cash value account, growing tax-deferred. This means that the cash value can accumulate and grow without being subject to income tax, providing a tax-efficient way to save and invest.

One of the key advantages of this cash value is the ability to borrow against it. Policyholders can take out a loan against the cash value, which can be a useful financial tool. These loans are typically interest-free, providing a source of funds that can be used for various purposes, such as home improvements, education expenses, or business ventures. The borrowed amount can be repaid, and the loan does not typically affect the death benefit or the overall policy coverage.

Additionally, the cash value can be withdrawn as needed. Policyholders have the flexibility to access their cash value by making a withdrawal, which can be particularly useful in emergencies or when financial needs arise. These withdrawals are also typically tax-free, allowing the policyholder to access their funds without incurring additional tax liabilities. This feature provides a level of financial security and flexibility that is not always present in other insurance or savings products.

In summary, the cash value aspect of permanent life insurance is a powerful feature that enables policyholders to build a savings component, borrow tax-free, and access funds when needed. This combination of savings, borrowing, and tax advantages makes permanent life insurance a comprehensive financial tool, offering both insurance protection and a means to grow wealth over time.

Usaa Life Insurance Discounts in Virginia: What to Know?

You may want to see also

Long-Term Coverage: Provides long-term financial security and coverage for a lifetime

Permanent life insurance is a type of insurance that offers long-term financial security and coverage for the entire life of the insured individual. Unlike term life insurance, which provides coverage for a specified period, permanent life insurance is designed to remain in force for the rest of the insured's life, providing a sense of stability and peace of mind. This feature makes it an attractive option for those seeking long-term financial protection.

One of the key advantages of permanent life insurance is its ability to provide a guaranteed death benefit, ensuring that the insured's beneficiaries receive a specified amount upon their passing. This guarantee is particularly valuable as it offers financial security to the family or beneficiaries, especially during challenging times. Additionally, permanent life insurance policies often accumulate cash value over time, which can be borrowed against or withdrawn, providing an additional layer of financial flexibility.

The long-term nature of permanent life insurance allows for various investment opportunities. Policyholders can utilize the cash value to invest in various options, such as stocks, bonds, or mutual funds, potentially growing their money over time. This investment aspect can be advantageous for those seeking to build wealth and achieve financial goals alongside insurance coverage.

Furthermore, permanent life insurance can serve as a valuable estate-planning tool. It provides a means to ensure that assets are distributed according to the insured's wishes, offering a sense of control and customization. The policy can also be used to secure loans or provide funding for various financial endeavors, making it a versatile financial instrument.

In summary, permanent life insurance is a powerful tool for long-term financial security. Its permanence, guaranteed death benefit, and potential investment opportunities make it an attractive choice for individuals seeking comprehensive coverage and financial protection throughout their lives. By providing a sense of stability and control, permanent life insurance empowers individuals to make informed decisions about their financial future.

Group Life Insurance: Payout Frequency and What to Expect

You may want to see also

Tax Advantages: Permanent policies offer tax benefits, including tax-deferred growth and potential tax-free withdrawals

When it comes to permanent life insurance, one of the key advantages is the tax benefits it provides. Permanent policies, also known as whole life insurance, offer a range of tax advantages that can be highly beneficial for policyholders.

One of the primary tax benefits is tax-deferred growth. Unlike term life insurance, where premiums are typically paid for a specified period, permanent life insurance policies accumulate cash value over time. This cash value grows tax-deferred, meaning it can increase without being subject to annual income tax. As the policyholder, you can enjoy the benefits of compound interest without incurring additional tax liabilities on the growth of the policy's value. This tax-deferred growth can be particularly advantageous for long-term financial planning, allowing your money to grow and accumulate tax-free until it's needed.

Additionally, permanent life insurance policies often provide the potential for tax-free withdrawals. Policyholders can typically take out loans or make withdrawals from the cash value of the policy without incurring taxes on those amounts. This flexibility allows individuals to access their funds when needed, such as for education expenses, business investments, or other financial goals, without triggering a tax event. Withdrawals can be made as long as the policy remains in force, providing a reliable source of funds that can be utilized for various purposes while maintaining tax efficiency.

The tax advantages of permanent life insurance can be especially valuable for high-income earners or those with substantial assets. By utilizing these tax benefits, individuals can optimize their financial strategies, potentially reduce their taxable income, and build a more secure financial future. It's important to consult with a financial advisor or tax professional to understand how these tax advantages can be tailored to an individual's specific needs and circumstances.

In summary, permanent life insurance offers significant tax benefits, including tax-deferred growth and the potential for tax-free withdrawals. These advantages contribute to the overall value and attractiveness of permanent policies, making them a valuable tool for long-term financial planning and wealth management.

How to Adjust Your Life Insurance Payout

You may want to see also

Frequently asked questions

Permanent life insurance, also known as whole life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit protection and a cash value component that grows over time.

The cash value in permanent life insurance accumulates over time and can be borrowed against or withdrawn as a loan. It is an investment component that allows policyholders to build equity. This feature can be useful for various financial needs, such as funding education, starting a business, or supplementing retirement income.

Yes, permanent life insurance offers several guarantees. The death benefit is guaranteed to be paid out to the policyholder's beneficiaries upon the insured's death. Additionally, the cash value growth is guaranteed, ensuring that the policyholder's investment grows according to the policy's terms.

Yes, permanent life insurance policies typically offer flexibility. Policyholders can make changes to their coverage, such as increasing or decreasing the death benefit, or adjusting the premium payments. However, any changes may require medical underwriting and could impact the policy's overall cost and benefits.

Permanent life insurance provides tax-deferred growth of the cash value. This means that the earnings on the cash value accumulate without being taxed as income. Additionally, policyholders can make tax-deductible premium payments, and upon death, the death benefit is generally tax-free for the beneficiaries.