Life insurance for daily pot smokers is a unique and often overlooked area of coverage. While traditional life insurance policies typically consider factors like age, health, and lifestyle, those who consume cannabis regularly may face specific challenges. This article explores the considerations and options available for individuals who smoke marijuana daily, including the impact on their health, the potential for drug testing, and how these factors can influence their life insurance premiums and coverage. Understanding these nuances is crucial for anyone seeking to secure their financial future while accounting for their cannabis use.

What You'll Learn

- Health Risks: Understand health impacts of smoking on life insurance eligibility and rates

- Smoking Cessation: Benefits of quitting smoking for better life insurance rates

- Policy Options: Explore different life insurance policies for smokers

- Medical History: Disclose smoking history to get accurate insurance quotes

- Alternative Coverage: Find alternatives for smokers with limited insurance options

Health Risks: Understand health impacts of smoking on life insurance eligibility and rates

Smoking, particularly daily smoking, can significantly impact an individual's health and, consequently, their life insurance eligibility and rates. The health risks associated with smoking are well-documented and can lead to various serious medical conditions, which in turn can affect the assessment of life insurance applications. Here's an overview of these health risks and their implications:

Cardiovascular Disease: Smoking is a major risk factor for cardiovascular issues. It damages the walls of blood vessels, leading to atherosclerosis, a condition where plaque builds up, narrowing the arteries. This increases the chances of heart attacks, strokes, and peripheral artery disease. Insurers often consider these conditions when evaluating life insurance applications, as they can significantly impact longevity and overall health.

Respiratory Problems: Daily smoking can cause chronic respiratory issues, including chronic obstructive pulmonary disease (COPD), emphysema, and bronchitis. These conditions can make breathing difficult and may require ongoing medical care. Insurers may view individuals with severe respiratory problems as high-risk candidates, potentially leading to higher premiums or even denial of coverage.

Cancer: The link between smoking and cancer is well-established. Smoking is a primary risk factor for various types of cancer, including lung, throat, bladder, and pancreatic cancer. The presence of cancer can make obtaining life insurance extremely challenging, and if discovered after the application process, it may result in a rejection or higher premiums.

Diabetes and Metabolic Disorders: Smoking can contribute to insulin resistance and an increased risk of type 2 diabetes. It also accelerates the aging process, which can lead to various metabolic disorders. Insurers may consider these factors when assessing an individual's overall health and life expectancy.

Long-term Health Complications: The cumulative effect of smoking can lead to a range of long-term health issues. These include chronic kidney disease, osteoporosis, and an increased risk of infections. Additionally, smoking can worsen existing health conditions, making it crucial for individuals to manage their health proactively.

When considering life insurance for daily pot smokers, it is essential to disclose all relevant health information accurately. Insurers will assess the individual's overall health, including smoking history and any associated medical conditions. Providing detailed medical records and undergoing a comprehensive health assessment can help ensure a more accurate evaluation and potentially lead to better coverage options.

Variable Life Insurance: Loan Provisions and Their Benefits

You may want to see also

Smoking Cessation: Benefits of quitting smoking for better life insurance rates

Quitting smoking is a significant step towards a healthier lifestyle and can have a substantial impact on your life insurance rates. For individuals who have been daily pot smokers, the benefits of giving up this habit can be life-changing, both in terms of personal health and financial savings. Here's an overview of the advantages of quitting smoking and how it can lead to better life insurance rates.

When you stop smoking, your body begins to heal and recover from the damage caused by nicotine and other chemicals in cigarettes. This process is a natural and gradual one, and it starts almost immediately after your last smoke. Within hours, your heart rate and blood pressure drop, and your circulation improves. Over time, you'll notice increased energy levels, better lung function, and a reduced risk of various smoking-related diseases. For those who have been smoking heavily, including daily pot use, the benefits can be even more pronounced. Quitting smoking can significantly lower the risk of lung cancer, heart disease, and other smoking-related illnesses, which are major factors considered by insurance companies when determining life insurance premiums.

The financial benefits of quitting smoking are also substantial. Life insurance companies often view smokers, especially heavy smokers, as high-risk individuals due to the increased likelihood of developing health issues. As a result, smokers may face higher life insurance premiums or even be denied coverage. By quitting smoking, you can improve your health status and potentially qualify for better insurance rates. Over time, as your body continues to heal, your life insurance premiums may decrease, reflecting the reduced risk to the insurance provider. This can lead to significant savings over the long term, allowing you to allocate those funds towards other financial goals or simply keeping more money in your pocket.

Additionally, quitting smoking can have a positive impact on your overall well-being and quality of life. It can improve your sense of taste and smell, enhance your physical appearance, and boost your confidence. You'll also be setting a positive example for those around you, especially if you have children or family members who may be influenced by your lifestyle choices. The benefits of quitting extend far beyond just your life insurance rates; they contribute to a healthier, happier, and more fulfilling life.

In summary, for daily pot smokers considering life insurance, quitting smoking is a crucial step. It not only improves your health and reduces the risk of smoking-related diseases but also has the potential to lower your life insurance premiums significantly. The process of quitting may be challenging, but the long-term benefits are well worth the effort. With improved health and financial savings, you can enjoy a better quality of life and secure your future with more affordable and accessible life insurance coverage.

Life Insurance and CSS Profile: What's Included?

You may want to see also

Policy Options: Explore different life insurance policies for smokers

When it comes to finding life insurance as a daily pot smoker, you'll discover that the options can vary significantly depending on the insurance company's policies and your individual health status. Here's an overview of the policy options available:

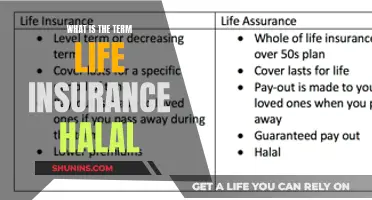

Term Life Insurance: This is often the most straightforward and affordable option for smokers. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit if the insured individual passes away during the term. The key advantage is that rates are generally lower compared to permanent life insurance, making it more accessible for smokers. However, it's important to note that if you stop smoking, you might be able to convert your term policy to a permanent one, ensuring long-term coverage.

Whole Life Insurance: Permanent life insurance, such as whole life, offers lifelong coverage and a cash value component. While it can be more expensive, it provides a sense of security knowing that your beneficiaries will receive a death benefit regardless of when you pass away. For smokers, the rates might be higher, but the long-term benefits can be appealing. Some insurers may also offer a non-smoker's rate if you can quit smoking for a certain period before applying.

Universal Life Insurance: This type of permanent insurance allows you to adjust your premiums and death benefit over time. It provides flexibility and the potential for cash value accumulation. For smokers, the rates might be higher initially, but you can potentially lower them by maintaining a healthy lifestyle and quitting smoking. Universal life insurance offers a customizable approach, making it a popular choice for those seeking long-term coverage.

Review Your Health and Lifestyle: Insurance companies will consider your overall health, including any pre-existing conditions and lifestyle factors. Quitting smoking for an extended period can significantly improve your chances of getting approved for better rates. Additionally, maintaining a healthy weight, managing stress, and avoiding other harmful habits can positively impact your insurance application.

Remember, it's crucial to disclose your smoking status accurately when applying for life insurance. Misrepresentation can lead to invalidation of the policy or future claims issues. Always consult with insurance professionals who can provide tailored advice based on your specific circumstances and help you navigate the various policy options available for smokers.

Qualifying Life Events: Health Insurance Changes and You

You may want to see also

Medical History: Disclose smoking history to get accurate insurance quotes

When it comes to obtaining life insurance as a daily pot smoker, it's crucial to be transparent about your medical history, especially your smoking habits. Insurance companies use this information to assess your risk profile and determine the terms and rates of your policy. Here's a detailed guide on why and how to disclose your smoking history for accurate insurance quotes:

Understanding the Impact of Smoking:

Smoking, particularly daily smoking of any substance, is a significant health risk factor. It can lead to various health issues, including lung cancer, heart disease, and respiratory problems. Insurance providers are well-aware of the increased mortality and morbidity rates associated with smoking. They use this knowledge to calculate the likelihood of an insured individual making claims, which directly influences the premium rates.

Medical History Disclosure:

When applying for life insurance, you will typically be asked to provide a comprehensive medical history. This includes details about your smoking habits. Be honest and accurate in your responses. Here's what you should consider:

- Duration and Frequency: Disclose how long you've been a daily smoker and the number of cigarettes or joints you consume daily. This information helps insurers understand the extent of your smoking habit.

- Age of Initiation: If you started smoking at a younger age, it may impact the assessment of your overall health. Younger smokers often face different health risks compared to older individuals.

- Previous Health Issues: If you've experienced any smoking-related health problems, such as chronic bronchitis, emphysema, or heart attacks, disclose these details. Insurance companies will consider the severity and frequency of these conditions.

Benefits of Transparency:

Disclosing your smoking history accurately is essential for several reasons:

- Accurate Risk Assessment: Insurance companies use this information to calculate the risk of insuring you. By providing a detailed smoking history, you help them make an informed decision, ensuring the policy terms and rates are fair and appropriate.

- Avoid Misrepresentation: Omitting or misrepresenting your smoking history can lead to serious consequences. If you're found to have misled the insurer, it may result in policy rejection or increased premiums in the future.

- Long-Term Benefits: Being honest from the start can lead to better coverage options and lower premiums over time. As you age and your health improves, insurers may offer more favorable policy terms.

Getting Accurate Quotes:

Once you've disclosed your smoking history, insurance providers will use this information to generate quotes. These quotes will outline the policy options available to you, including different coverage amounts and premium rates. It's essential to compare multiple quotes to find the best deal that suits your needs and budget.

In summary, when considering life insurance as a daily pot smoker, remember that transparency about your smoking history is vital. It ensures accurate risk assessment, helps you secure the right coverage, and provides a solid foundation for a long-term insurance relationship. Always consult with insurance professionals who can guide you through the process and answer any questions you may have regarding your specific situation.

Understanding the AAA Life Insurance Suicide Clause: What You Need to Know

You may want to see also

Alternative Coverage: Find alternatives for smokers with limited insurance options

For individuals who smoke marijuana daily, finding suitable life insurance can be challenging due to the potential health risks associated with cannabis use. Traditional insurance providers often view frequent marijuana consumption as a risk factor, which may lead to higher premiums or even denial of coverage. However, there are alternative coverage options available for smokers who want to secure their loved ones' financial future.

One approach is to explore specialized insurance companies that cater to high-risk individuals or those with unique health conditions. These companies may offer tailored policies designed to accommodate specific lifestyles or habits. When researching, it's essential to compare quotes and coverage details from multiple providers to ensure you find the best deal. Some insurers might consider factors like the frequency and method of cannabis consumption, overall health, and lifestyle choices when determining premiums.

Another strategy is to consider term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. This type of policy can be an excellent option for smokers who want temporary coverage without the long-term commitment. Term life insurance is generally more affordable than permanent life insurance and can be renewed or converted to a permanent policy if needed. It's crucial to disclose your cannabis use to the insurer to ensure accurate premium calculations and avoid any surprises during the claims process.

Additionally, some insurers offer non-medical or 'lifestyle' insurance, which focuses on providing coverage based on an individual's lifestyle choices rather than medical history. These policies may consider factors like smoking habits, alcohol consumption, and even recreational drug use. While the coverage might not be as comprehensive as traditional life insurance, it can still offer financial protection for specific scenarios.

Lastly, it's worth considering the role of family and friends in providing financial support. Some smokers may opt for a 'pay-what-you-can' insurance plan, where they contribute a portion of the premium, and the rest is covered by a trusted individual or group. This approach can be particularly useful for those with limited financial resources but still want to secure their family's future.

Whole Life Insurance: Age-Related Purchase Options Explained

You may want to see also

Frequently asked questions

Daily pot smoking can potentially affect life insurance eligibility and premiums. Insurance companies often consider lifestyle factors, including drug use, when assessing risk. While the impact may vary, it's advisable to disclose regular cannabis use to the insurance provider to ensure accurate coverage and avoid any complications during the claims process.

Life insurance rates can be influenced by the frequency and amount of cannabis consumption. Regular and heavy use may lead to higher premiums due to the potential health risks associated with smoking. Insurance companies might view frequent cannabis use as a factor that could impact longevity and overall health, which are crucial considerations for life insurance underwriters.

Yes, it is possible to obtain life insurance even if you smoke pot daily. However, the process might be more complex, and the terms and conditions could vary. Insurance providers will assess your overall health, including any potential risks related to cannabis use, before offering a policy. It's essential to be transparent about your lifestyle choices to ensure you receive appropriate coverage.

There are no specific life insurance policies exclusively designed for cannabis users. However, some insurance companies offer customizable plans that can accommodate various lifestyle factors. These policies may provide tailored coverage based on individual health and lifestyle assessments. It's best to consult with an insurance advisor to explore options that suit your needs and ensure you have adequate protection.