SBI Life Insurance offers a comprehensive range of benefits that make it an attractive choice for individuals seeking financial security and peace of mind. With a strong reputation for reliability and customer satisfaction, SBI Life provides a wide array of insurance plans tailored to meet diverse needs. Whether you're looking to protect your loved ones, plan for the future, or build wealth, SBI Life offers competitive premiums, flexible payment options, and a variety of coverage choices. Their commitment to innovation ensures that policyholders can access digital tools and resources for easy management and quick claims processing. Additionally, SBI Life's extensive network of branches and customer service representatives ensures accessibility and personalized support, making it a reliable and trusted partner in your financial journey.

What You'll Learn

- Financial Security: SBI Life offers comprehensive coverage, ensuring financial stability for you and your loved ones

- Competitive Rates: Enjoy affordable premiums with competitive rates, making insurance accessible and affordable

- Customizable Plans: Tailor your policy to meet specific needs, offering flexibility and personalized protection

- Reliable Brand: SBI Life is a trusted name, providing peace of mind with a strong reputation

- Customer Support: Dedicated assistance and quick claim settlements ensure a smooth experience

Financial Security: SBI Life offers comprehensive coverage, ensuring financial stability for you and your loved ones

SBI Life Insurance is a reputable and trusted name in the insurance industry, and for good reason. When it comes to financial security, SBI Life offers comprehensive coverage that can provide peace of mind and ensure the financial stability of you and your loved ones. Here's why joining SBI Life is a wise decision:

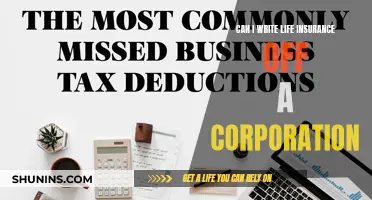

Financial security is a top priority for individuals and families, and SBI Life understands this need. They offer a wide range of insurance plans designed to protect your loved ones in various life stages. Whether you are a young professional building a career, a parent providing for a family, or an individual seeking long-term financial protection, SBI Life has tailored solutions. Their comprehensive coverage includes term life insurance, which provides a lump-sum payment to beneficiaries in the event of the insured's death, ensuring financial support during the breadwinner's absence. This coverage is particularly valuable for those with financial dependents, such as children or a spouse, as it guarantees their financial well-being.

The company's policies are structured to adapt to different life circumstances. For instance, term life insurance can be customized with various coverage periods, allowing you to choose the duration that best aligns with your financial goals and responsibilities. Additionally, SBI Life offers permanent life insurance, which provides lifelong coverage and a cash value accumulation, making it a valuable asset for long-term financial planning. With SBI Life, you can rest assured that your financial security is in capable hands.

One of the key advantages of SBI Life is its commitment to customer satisfaction and financial literacy. They provide comprehensive guidance and support to help policyholders understand their insurance policies and make informed decisions. Through educational resources and personalized advice, SBI Life empowers individuals to navigate the complexities of financial planning. This ensures that you can make the most of your insurance coverage and build a robust financial security framework.

Furthermore, SBI Life's financial stability and strong market presence offer an added layer of security. As a part of the State Bank of India (SBI) group, it benefits from the financial strength and reputation of one of India's leading banks. This stability is crucial when choosing an insurance provider, as it ensures that your policy is backed by a financially sound organization. With SBI Life, you can trust that your financial security is well-protected and that your loved ones will receive the intended benefits when needed.

In summary, SBI Life Insurance provides comprehensive coverage that addresses the financial security concerns of individuals and families. With their tailored insurance plans, customer-centric approach, and the backing of a financially strong organization, SBI Life is an excellent choice for those seeking reliable and comprehensive financial protection. By joining SBI Life, you can ensure that your loved ones are cared for, and your financial goals are met, even in the face of life's uncertainties.

Asset Modeling for Life Insurance: Understanding the Basics

You may want to see also

Competitive Rates: Enjoy affordable premiums with competitive rates, making insurance accessible and affordable

When considering life insurance, one of the most appealing aspects is the opportunity to secure your loved ones' financial future while also protecting your own. SBI Life Insurance offers a range of competitive rates that make this essential coverage more accessible and affordable for everyone.

Competitive rates are a cornerstone of SBI Life's commitment to providing value to its customers. By offering affordable premiums, the company ensures that insurance is not just a luxury but a necessity that can be within reach for all. This approach is particularly beneficial for individuals and families who may have been priced out of traditional insurance plans. With SBI Life, you can find a policy that suits your budget without compromising on the quality of coverage.

The competitive nature of these rates is designed to provide excellent value for money. This means that for every premium you pay, you receive a comprehensive level of protection. Whether it's term life insurance, whole life, or any other SBI Life product, the rates are structured to offer substantial coverage at a price that won't break the bank. This accessibility is a significant advantage, especially for those who might have been deterred by the perceived high costs of insurance in the past.

Furthermore, SBI Life's competitive rates are a testament to the company's understanding of the diverse financial needs of its customers. By keeping premiums competitive, SBI Life ensures that insurance is not a barrier but a solution. This accessibility allows individuals to make informed decisions about their future and that of their dependents, providing peace of mind and financial security.

In summary, SBI Life Insurance's focus on competitive rates is a strategic move to make insurance a viable option for a wide range of individuals and families. By offering affordable premiums, SBI Life ensures that financial protection is not just a dream but a reality. This approach not only benefits the company but also empowers individuals to take control of their financial future, knowing that they have a reliable and affordable insurance partner in SBI Life.

St Farm Life Insurance: What You Need to Know

You may want to see also

Customizable Plans: Tailor your policy to meet specific needs, offering flexibility and personalized protection

When considering SBI Life Insurance, one of the key advantages is the ability to customize your policy, ensuring it aligns perfectly with your unique financial goals and circumstances. This level of flexibility is a significant draw for those seeking tailored protection and a personalized approach to their insurance needs.

The customizable nature of SBI Life Insurance policies allows you to design a plan that suits your individual requirements. You can choose the coverage amount, select the duration of the policy, and even customize the benefits to include specific riders or add-ons. For instance, you might opt for additional coverage against critical illnesses or choose to increase the sum assured over time to accommodate changing financial obligations. This level of customization ensures that your policy is not a one-size-fits-all solution but rather a dynamic tool that evolves with your life.

Flexibility is a cornerstone of SBI Life's approach, allowing you to make adjustments as your life changes. Whether it's a career shift, a new family member, or a change in financial status, your policy can be adapted to reflect these changes. For example, if you start a new business, you might want to increase your coverage to protect your enterprise's financial stability. Similarly, becoming a parent could prompt a review to ensure adequate financial support for your growing family. The ability to customize and adjust your policy means you're always protected in a way that reflects your current situation.

Personalized protection is another benefit of these customizable plans. You can choose the specific areas of your life you want to protect. For instance, if you're a health enthusiast, you might opt for comprehensive coverage that includes benefits for routine health check-ups and preventive care. Alternatively, someone with a family history of certain medical conditions might want to include additional coverage for those specific ailments. This level of personalization ensures that your insurance policy is not just a financial product but a tool to safeguard your well-being and that of your loved ones.

In summary, SBI Life Insurance's customizable plans offer a unique advantage by providing tailored protection and flexibility. This approach allows individuals to create a policy that is not only financially sound but also deeply aligned with their personal circumstances and goals. With the ability to customize, you can ensure that your insurance is a powerful tool for securing your future and the future of your loved ones.

Understanding Excess Group Term Life Insurance: A Comprehensive Guide

You may want to see also

Reliable Brand: SBI Life is a trusted name, providing peace of mind with a strong reputation

SBI Life Insurance is a renowned and reliable brand in the insurance industry, offering a comprehensive range of life insurance products and services. With a strong reputation for trustworthiness and financial stability, SBI Life has become a preferred choice for individuals seeking secure and reliable insurance solutions. The company's commitment to customer satisfaction and its long-standing presence in the market make it a trusted name in the industry.

One of the key reasons to join SBI Life Insurance is the peace of mind it provides. Life insurance is an essential tool to protect your loved ones and ensure their financial well-being in your absence. SBI Life understands the importance of this and offers tailored plans to meet individual needs. Their comprehensive policies provide coverage for various life events, including death, disability, and critical illness, ensuring that your family is financially secure even in challenging times.

The reliability of SBI Life is evident in its strong financial position and ratings. As a subsidiary of State Bank of India, one of India's leading banks, SBI Life benefits from the parent company's financial stability and support. This strong backing allows SBI Life to offer competitive rates and a wide range of products, ensuring that customers can find suitable coverage for their specific requirements. Moreover, SBI Life's commitment to transparency and ethical practices has earned it a positive reputation among consumers and industry experts alike.

SBI Life's reputation as a trusted brand is further solidified by its customer-centric approach. The company prioritizes customer satisfaction and provides excellent service throughout the policy journey. From the initial consultation to claim settlements, SBI Life ensures a smooth and efficient experience. Their dedicated team of professionals is readily available to assist policyholders, offering guidance and support whenever needed. This level of customer care contributes to a positive perception of the brand and fosters long-term relationships with clients.

Additionally, SBI Life's product portfolio is designed to cater to diverse needs. They offer a range of life insurance plans, including term life, whole life, and unit-linked plans, allowing customers to choose the coverage that best suits their goals. Whether it's providing financial security for a family or planning for retirement, SBI Life's products offer flexibility and customization. The company's ability to adapt to individual requirements makes it an attractive choice for those seeking personalized insurance solutions.

In summary, joining SBI Life Insurance means associating yourself with a reliable and trusted brand. The company's strong financial position, customer-centric approach, and comprehensive product range make it an excellent choice for individuals seeking secure and tailored life insurance solutions. With SBI Life, you can have peace of mind, knowing that your loved ones are protected, and your financial goals are met.

Unlocking Savings: When to Transition from Term to Whole Life Insurance

You may want to see also

Customer Support: Dedicated assistance and quick claim settlements ensure a smooth experience

When it comes to choosing a life insurance provider, having a reliable and responsive customer support system is crucial for a positive and stress-free experience. SBI Life Insurance understands the importance of this aspect and has designed its customer support to be dedicated, efficient, and customer-centric. Here's how they ensure a smooth journey for their policyholders:

Dedicated Assistance: SBI Life Insurance offers a dedicated customer support team that is trained to handle a wide range of inquiries and concerns. Whether you need help understanding your policy, have questions about premium payments, or require assistance with policy changes, their team is readily available. The support team is easily accessible through multiple channels, including phone, email, and live chat, ensuring that you can reach out whenever needed. They strive to provide prompt responses and personalized solutions, making sure that your experience is as smooth as possible.

Quick Claim Settlements: One of the most critical aspects of life insurance is the timely settlement of claims. SBI Life Insurance excels in this area by streamlining the claim process and ensuring quick settlements. When a policyholder or their beneficiary files a claim, the company has a dedicated team that efficiently processes the documentation and verifies the details. This quick response time can provide much-needed financial support during challenging times, ensuring that the policyholder's family or beneficiaries receive the benefits they are entitled to. The company's commitment to swift claim settlements is a testament to its dedication to customer satisfaction.

The dedicated customer support and efficient claim settlement process are designed to provide peace of mind to policyholders. By offering multiple support channels, SBI Life Insurance ensures that customers can easily access assistance whenever required. Additionally, the quick claim settlements demonstrate the company's commitment to honoring its promises and providing financial security to its customers when it matters the most. This level of customer support is a significant factor in choosing SBI Life Insurance, as it ensures a positive and reliable experience throughout the policy tenure.

Life Insurance: Impact on Net Worth Calculations

You may want to see also

Frequently asked questions

SBI Life Insurance offers a range of benefits, including comprehensive coverage, competitive premiums, and a variety of plans to suit different needs. They provide financial security and peace of mind, ensuring your loved ones are protected in your absence. The company also offers additional perks like critical illness coverage, accident insurance, and income replacement benefits.

SBI Life Insurance is a valuable tool for long-term financial planning. It helps build a secure future by providing financial support to your family in case of your untimely demise. The policy ensures that your dependents receive a lump sum amount or regular income, allowing them to maintain their standard of living and achieve their financial goals.

Absolutely! SBI Life Insurance offers various add-ons and riders to customize your policy. These may include accidental death benefit riders, critical illness riders, disability income riders, and more. These add-ons provide enhanced coverage and can be tailored to your specific requirements, ensuring comprehensive protection.

SBI Life Insurance is a reputable and trusted brand with a strong market presence. They have a large network of agents and customer service representatives who provide personalized assistance. The company's financial stability, backed by the State Bank of India, ensures that policyholders' interests are protected. SBI Life Insurance also offers a seamless digital experience, making policy management and claims processing convenient.

Yes, SBI Life Insurance policies qualify for tax benefits under the Indian Income Tax Act. Premiums paid for life insurance can be claimed as a deduction under Section 80C, reducing your taxable income. Additionally, the death benefit received by the nominee is tax-free, providing further financial advantages.