Universal life insurance is a type of permanent life insurance that accrues cash value over time. It is similar to whole life insurance, but it usually offers more payment flexibility. You can convert term life insurance to universal life insurance, but not all term life insurance policies are convertible. If you are considering converting your term life insurance to universal life insurance, you should check your policy documents or consult your insurance provider.

| Characteristics | Values |

|---|---|

| Can universal life insurance be converted to term? | No, but universal life insurance is a type of permanent life insurance that term life insurance can be converted to. |

| Is there a cost to convert term life insurance to permanent life insurance? | There is no direct cost, but premium payments will be higher. |

| Is a medical exam required to convert term life insurance to permanent life insurance? | No, but this depends on the insurer. |

| Can you convert all or part of your term life insurance to permanent life insurance? | Yes, you can choose to do a partial or total conversion. |

| When can you convert term life insurance to permanent life insurance? | This depends on the insurer, but typically during the first few years of the policy. |

What You'll Learn

Converting to permanent life insurance offers lifelong coverage

Most whole life policies also have a cash value that builds very slowly and can be a source of financial help in emergencies. In addition, you may be able to use the IRS Section 1035 exchange to trade in a whole life policy for an annuity, which pays you a regular, fixed payment while you are still alive.

Converting to permanent life insurance is often possible even if your health has worsened. In some cases, converting your policy may mean you don't have to apply for a new policy or go through a medical exam or underwriting. This is particularly relevant if you are dealing with medical issues, as the insurance premiums for whole life coverage are typically on the higher end. Or you risk being rejected for coverage on the grounds of being uninsurable. But if you convert your term policy, you can skip the underwriting process, which generally includes a medical exam, and secure coverage without paying as steep a premium due to your health.

The thought of leaving your dependents behind without the financial support they need can be nerve-wracking, especially if you're the primary breadwinner. Converting to a whole life policy can give you peace of mind, knowing you can still provide for your loved ones when you pass away. But if you don't make the switch and pass away after the term ends, your family won't be protected.

Converting to permanent life insurance can also be a way to alleviate the stress of paying off debt, as your family can use the death benefit to take care of your outstanding obligations.

Unlike term policies, whole life insurance policies build cash value over time. Each time you make a premium payment, a portion of it is invested and grows tax-free. As the cash value on your policy accumulates, you can earn dividends and apply them to premium payments, use them to acquire more coverage, and access the funds if needed. Keep in mind that if you take money from your cash value account and do not replace it, your death benefit will be reduced. Conversely, the cash value will not be added to your death benefit and will revert to the insurance company upon your death. Still, cash value can add some financial flexibility for you.

Life Insurance: NRMA's Offerings and Your Options

You may want to see also

Converting may be the only option if your health has worsened

If your health has worsened, converting your term life insurance to a permanent life policy may be your best or only option. This is because, with a conversion, you can extend your coverage without going through the underwriting process again. This means that your current health won't affect the premium on a permanent policy or your insurability.

If you were to apply for a new term life policy, you would likely have to pay astronomical rates or could even be deemed uninsurable. However, with a conversion, you won't have to redo your medical exam, and your new policy will be priced in the same risk class as your term contract.

How to Convert from Term to Permanent Life Insurance

First, check the language of your policy to see if conversion is an option. Then, check the term conversion period—the timeframe during which you can convert. Some companies allow policyholders to convert at any point during the term of their policy, but many will limit the conversion period. For example, the conversion period on a 20-year term policy might be limited to the first 10 years the policy is in force.

Next, contact your insurance agent or company to ask to convert your policy. You will not have to take a life insurance medical exam or go through the underwriting process again. You will simply fill out a questionnaire, and your new permanent policy will be issued within a few days.

There are usually no fees to convert a term policy to a permanent policy, but your premium payments will likely increase. The amount by which your rate increases will depend on several factors, including your age when you convert and the amount you convert.

Types of Permanent Life Insurance

During a term-to-permanent conversion, your permanent life insurance choices will vary based on your insurer. Choices may include whole, universal, or variable universal life insurance.

Whole Life Insurance

Whole life insurance is the most common type of permanent life insurance. It offers longer-lasting coverage, consistent premiums, and a cash value component. However, it typically has a higher cost than term life insurance and premium payments might not have an end date.

Universal Life Insurance

Universal life insurance is similar to whole life insurance but usually offers more payment flexibility. It also has a higher cost than term life insurance and a lower cash value growth rate.

Variable Universal Life Insurance

Variable universal life insurance is similar to both whole life insurance and universal life insurance. It offers longer-lasting coverage, cash value with potential for greater gains or losses, and premium payment flexibility. However, it has a higher cost than term life insurance and is more complex than term insurance.

Strategies to Secure 100 Life Insurance Prospects

You may want to see also

You can convert all or part of your term life insurance

Understanding Term and Permanent Life Insurance

Term life insurance is a type of policy that provides coverage for a specific period, such as 10, 20, or 30 years. If the insured person dies within this time frame, their beneficiaries receive a payout. Whole life insurance, on the other hand, is a type of permanent life insurance that does not expire as long as premiums are paid. It combines life insurance with an investment component, allowing cash value to accrue over time. This cash value can be accessed by the policyholder and is tax-free.

Reasons for Converting to Permanent Life Insurance

There are several reasons why converting term life insurance to permanent life insurance can be beneficial:

- Changing Health Conditions: If your health has deteriorated, converting to permanent life insurance allows you to extend your coverage without undergoing a new medical exam or underwriting process. This option may be crucial if your health issues would make it challenging to qualify for a new term life insurance policy.

- Increased Budget: If your financial situation has improved, you may now be able to afford the higher premiums typically associated with permanent life insurance policies. Converting can provide you with lifelong coverage that better suits your long-term needs.

- Desire for a Cash Value Asset: Permanent life insurance offers a cash value component that grows with interest over time. This feature can be attractive if you want to access tax-free cash during your retirement or for other financial needs.

- Leaving a Legacy: Converting to permanent life insurance can help you leave an inheritance for your children or loved ones without compromising your retirement savings. It ensures that your beneficiaries receive a death benefit, no matter when you pass away.

- Final Expense Coverage: Even if you don't have dependents, converting a portion of your term life insurance to permanent coverage can help cover your final expenses, such as funeral costs. This can alleviate the financial burden on your family during a difficult time.

Factors to Consider

When deciding whether to convert all or part of your term life insurance, keep the following factors in mind:

- Conversion Clause: Check your term life insurance policy to see if it includes a conversion clause or rider that allows for conversion to permanent life insurance. Some policies include this option, while others may require the purchase of an additional rider.

- Conversion Deadline: Most term life insurance policies have a specified conversion period during which you can make the switch. This period is typically before the end of your term, and there may be age restrictions as well. Make sure you are aware of any deadlines to avoid missing the opportunity to convert.

- Types of Permanent Life Insurance: Different types of permanent life insurance policies are available, such as whole life, universal life, and variable life insurance. Each has its own pros and cons in terms of premiums, cash value growth, and flexibility. Understand the options offered by your insurer and choose the one that best aligns with your financial goals.

- Cost of Conversion: Converting to permanent life insurance will result in higher premiums. Consider your budget and determine if you can afford the increased cost, especially in retirement. You may also incur a one-time fee for the conversion, depending on your insurer.

- Partial Conversion: You have the option to convert only a portion of your term life insurance to permanent coverage. This can be a more affordable option, as it reduces the amount of coverage and, consequently, the premiums. You would then have both a term policy and a permanent policy active simultaneously.

Colonial Penn Life Insurance: Understanding the Unit System

You may want to see also

Converting allows you to build cash value over time

Converting universal life insurance to term life insurance allows you to build cash value over time. This is because, with permanent life insurance, a portion of your premium payments goes towards the policy's cash value. This cash value component of permanent life insurance grows with interest over time and can be used to borrow money or pay premiums.

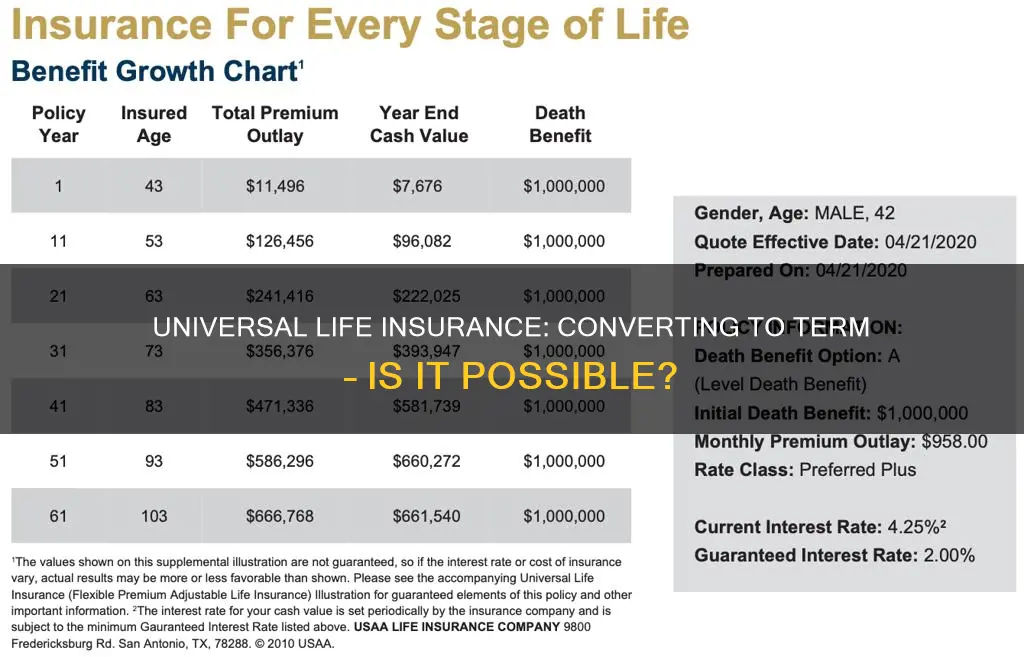

The cash value of permanent life insurance policies grows in different ways depending on the type of policy. Whole life insurance policies provide a "guaranteed" fixed cash value account that grows according to a formula determined by the insurance company. Universal life insurance policies, on the other hand, accumulate cash value based on current interest rates and investments, with many insurers offering consistent growth on the cash value of the policy. Variable universal life insurance policies are similar but offer subaccount investment options, which operate like mutual funds, meaning the cash value can grow or fall depending on the performance of these subaccounts.

It is important to note that the funds allotted to the cash value of permanent life insurance policies decrease as you age, as the cost of insuring your life gets more expensive for the insurance company. Therefore, the cash value accumulation tends to slow down as the policyholder gets older.

When deciding whether to convert universal life insurance to term life insurance, it is crucial to consider the different types of permanent life insurance policies available and how their cash value accumulation works. Additionally, consulting an insurance advisor can help determine the potential cash value accumulation of a specific permanent life insurance policy.

Life Insurance Loans: Are They Truly Amortized?

You may want to see also

Converting may be cheaper than buying a new whole life policy

Converting universal life insurance to a term policy may be cheaper than buying a new whole life policy. This is because when you convert a term life insurance policy to a permanent policy, there are usually no direct costs. However, your premium payments will likely be higher. The exact amount by which your premium will increase depends on several factors.

Firstly, your age when you convert will affect your rate. The older you are, the higher your premium will be. Secondly, the amount you convert will also impact your premium. You have the option to convert the full value of a term policy or just a portion of it. For example, if you have a $500,000 death benefit policy, you could choose to convert only $250,000 of it to a permanent policy. This will result in a lower premium than if you had converted the full amount. Additionally, the premium on the remaining term life policy will drop because the benefit has been reduced.

Another factor that will affect your rate is the timing of the conversion. For instance, some insurance companies like State Farm give term life policyholders a credit for the amount they've paid toward their policy that can be applied to the cost of a permanent policy if they convert within the first few years of getting the policy. Therefore, it is worth checking with your insurer to see if you can benefit from such an offer.

Finally, the type of permanent policy you choose to convert your term policy to will also impact your premium. For example, the premium for a whole life insurance policy will be higher than the premium for a universal life insurance policy.

Sildenafil: Impact on Life Insurance Coverage and Costs

You may want to see also

Frequently asked questions

No, universal life insurance is a type of permanent life insurance policy. You can convert a term life insurance policy into a universal life insurance policy, but not the other way around.

First, check your term life insurance policy to see if it includes the option to convert. If it does, contact your insurance company to discuss the types of permanent life insurance available and the conversion cost. Then, fill out a life insurance conversion application and choose the amount of life insurance you’d like in the conversion.

Converting your term life insurance policy to a universal life insurance policy can give you the ability to obtain permanent coverage, often at a cheaper rate than if you purchased a new universal life insurance policy when you’re older. Medical exams aren’t generally required when you convert term life insurance to universal life insurance, and you may be able to obtain permanent coverage if you’ve developed a new health issue that could prevent you from qualifying in a standard underwriting process. However, converting your term life insurance policy to a universal life insurance policy will result in higher premiums, and you may be limited in the types of policies you can convert to.

You should consider converting your term life insurance policy to a universal life insurance policy if you can afford the premiums, your health is declining, you want to cover final expenses, or you want to build cash value.

Term life insurance is an insurance policy that is good for a specific term of time, usually somewhere between 10 and 30 years. Universal life insurance is a type of permanent life insurance policy that does not expire as long as you pay your premiums.